Just in case you have not done your tax planning for this year and you are in a rush of doing it for providing documents proof to your employer, I will tell you how you can quickly do your tax planning at the last moment. First of all it’s not advised that you wait for last minute for your tax planning investments but now if you are late, let’s see how you should plan for your investments at the last minute to save your taxes. We will also discuss in this short article what are the things you should not do in hurry.

Don’t get mad about tax saving: If you have short term Commitments and can’t afford to lock your money for long term it’s better you do not put money in Tax saving Instruments. You should never do Investments just for tax savings. I have personally not invested for much tax saving this year apart from my company PF and Insurance. I have short term commitments and I cannot afford to lock my money for another 3 yrs. So I better pay tax on the part which I could have invested. There is no point in locking my money and then again running around for personal loan or credit from Friends and Family when need arises.

Life Insurance: Make sure you have adequate life insurance cover. If not, take a term insurance for amount of the cover your are short of. Protection is the first step of successful Financial planning. Take a Term Plan from two Insurers. Look at how to calculate your Insurance requirement. The cheapest Term plan at this moment in market is iTerm from Aegon Religare.

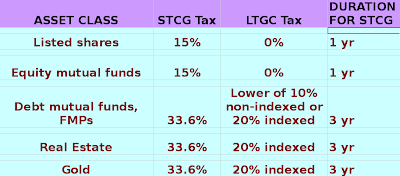

Planning for Long Term Goals: Make a list of goals for long term like Retirement, Child Education, Child Marriage etc (Anything thing with a target date of 5+ yrs). For these goals you can invest in Tax saving Instruments. If the goal is extremely critical and you are not a risk taker then the best thing would be Tax saving Fixed Deposits. If you can take some amount of risk, you can invest your money in ELSS Mutual funds (here is a list of good Equity Mutual funds). For goals which are 10+ yrs away, you can also put partial money in PPF. Investors who have sound knowledge of Markets movement and can spend time and efforts on switching can go for Low cost ULIP’s (see Wealthsurance and Aegon religare). Short term ULIP investing is a BIG and BOLD No No!!

Health Cover: The next thing you should target is your Health Insurance. Better take a Family Floater Plan for your Family and the premium will be exempted under Sec 80D up to max of 15,000.

Short Term Goals: If you have any short term goals then do not put money in any tax saving instrument, rather put money in non-tax saving instruments like Plain FD (See, how to find best FD), Debt Oriented Mutual funds, Avoid Equity as far as possible if you are not a risk taker.

[ad#big-banner]

So the hierarchy of your products should be like this

- Life Insurance

- Health Insurance

- Long Term Investment products like ELSS and PPF

- Medium term Investment Products like tax saving FD

What you should not Invest in?

Another Important Point is what no to do in Hurry? So here are some of the things you need to remember

- Do not invest in ULIPS in hurry, the last 3 months of financial year is the time when Agents will give their best performance in luring away investors. Don’t listen to their stories of India Shining and other bakwaas, if you don’t understand the product and you do not have skills to manage ULIP’s. Same applies to ULPP’s or any other market linked products.

- Do not invest in Endowment or Money back plans for tax savings. Your Father, your Grandfather or your Uncle might push for it but investing in those policies is a long term commitment and just for saving tax this year you cant invest in those policies.

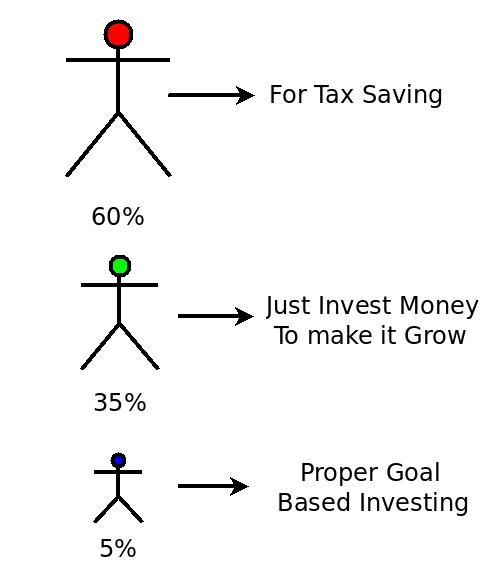

- Evaluate your risk appetite again and then take decision. Most of the people can take risk and their situation allows them but they don’t take risk. On the other hand there are people who’s situation does not allow taking risk, but still they take the risk. They confuse between Willingness to take risk Vs Ability to take risk.

Conclusion

Tax saving should be done at the start of year always so that we dont take wrong decisions in hurry. But if you are late you can take some logical decision and still do your tax planning.

Please share your ideas about what other instruments can be used for long term tax savings. Let other know how early tax saving decision has helped you.