Do you know that, when someone deposits some money in your bank account, what is its taxation angle ? A lot of people take some loan from their friends for few months and then return it back, but never think twice about it from taxation angle? Your parents deposit some money to your bank account because you want to pay the down payment of your house. While it’s a help from your parents, have you ever thought if you have to pay tax on that amount or not?

In this article lets see all the aspects about these kind of transactions, when money comes and goes out of your bank account and what are the rules for income tax on gifts received from relatives or other people in India .

Let us first see what kind of situations we are talking about ?

- You swiped your credit card for your friend Rs 20,000 purchase and then your friend paid back money to you by transferring it to your bank account.

- You asked Rs 50,000 from your friend as loan and paid him back after 1 month.

- You got Rs 50,000 cheque from your relative on your wedding.

- Your father transferred some money you your bank account as help for some purpose.

These are few instances, which happens in our lives. But its very important for you to understand the tax implications in various scenarios and the possible issues which can come up in the future, if income tax department decides to scrutinize your income tax returns for example. By understanding the gift tax rules and precautions to take, you will be safe. So now, let’s look at 5 points which will help you understand rules about incomes tax on gifts in a better way.

By virtue of Section 56(2), any sum of money exceeding Rs. 50000 received without consideration by an individual or an HUF from any person is chargeable to tax as income under “other sources” subject to some exclusions . Below we are going to see all those exclusions and gift tax rules.

1. Upto Rs 50,000/year is not taxable

The first major rule which every person should know is that there is no tax to be paid on gifts received (cash or kind), if the amount of the gift is upto Rs 50,000 in a year. However if the total amount crosses Rs 50,000 . Then you will have to pay the tax on the total amount received (not additional). For example – If a friend of yours gifts you Rs 30,000 in a given year, you don’t have to pay any tax on that amount, as its below the limit of Rs 50,000 .

Now suppose you also get Rs 20,000 after that, still you don’t have to pay the tax as the total worth of the gift you got in the year was Rs 50,000 till now (less than the limit of Rs 50,000) . But now, if someone gifts you another Rs 10,000 . Your total gifts in a year is Rs 60,000, so you will have to pay tax on the total amount of Rs 60,000 , not just on additional Rs 10,000 . This Rs 60,000 will be included in your income and you will have to pay tax on this Rs 60,000, as per your tax slab. Note that this is exactly how the written law is.

Since 1/10/2009, Section 56(2) has been amended and the scope of ‘’gifts’’ will include even immovable properties or any other property besides sums of money under its ambit.

2. Any amount received by relatives is not taxable at all

Another rule for income tax on gifts, is that any amount received from specified relatives is totally tax free in the hands of recipient. So if a relative gives you gift in form of cash/cheque or in consideration, you will not have to pay any tax on the amount received.

Following is the list of relations which are considered as “relatives” for this

- Your spouse

- Your brother or sister

- Brother or sister of your spouse

- Brother or sister of either of your parents

- Any of your lineal ascendants or descendants

- Any lineal ascendant or descendant of your spouse

- Spouse of the persons referred in above points

Example – So if you want to buy a house and your father/mother/sister/brother etc transfer Rs 20 lacs to your bank account. You don’t need to worry about the taxation part, because its a gift from your relatives and you will not have to pay any tax on this amount. However its a good practice to do the documentation for this, if the amount if pretty big like in this example. All you need to do is document this transaction on a paper which clearly states that who transferred the money and the reason for it, along with the signatures of both parties. In future, if there is any income tax scrutiny, this small piece of proof will be handy and will help you a lot.

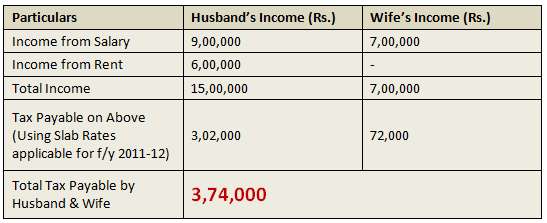

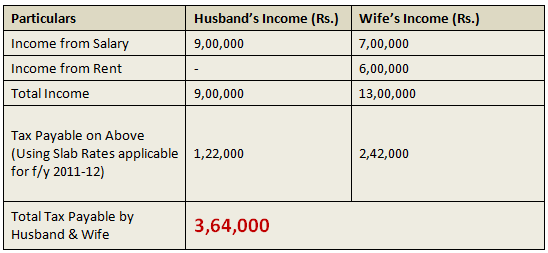

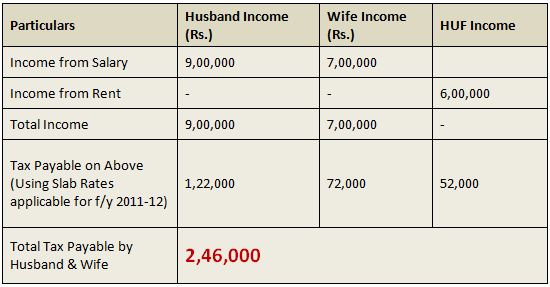

Important – Note that, there is no income tax to be paid on the money received from relatives, however at times income clubbing provisions may apply, for example, if a husband gifts Rs 10,00,000 to wife, there is no ta to be paid by wife on Rs 10 lacs received, however when she invests that money and if any interest income is generated, it will be clubbed with husband income. Read all about income tax clubbing rules here.

3. Any amount received as Wedding Gift is not taxable

One of the few advantages of getting married is that any amount you get, as wedding gift is not taxable in your hands, either from relative or non-relative 🙂 . So even if you get Rs 1 crore as wedding gift from someone in your wedding, it’s not taxable in your hands.

Lets see some examples –

Suppose if your spouse parents give you some gift worth Rs 10 lacs on marriage, it will be treated as a wedding gift and will not be taxed. However, it is not clear by provision, whether the gifts should have been on the exact date of marriage, or a few days before or later. Normally, it should be sufficient if the gift is given just on the occasion of the marriage, means either on the day of the marriage itself or a day or two before or after. Practical common sense view would prevail in such cases.

4. Gift Tax on Movable/ Immovable properties

There is a valuation aspect involved in gifting of immovable properties

- If the property is gifted without any consideration then if the stamp duty value exceeds Rs. 50000/-, stamp duty value will be taken

- If the property is gifted for a consideration, then the actual value of the property will be taken

In case of other properties:

- If gifted without consideration and fair market value exceeds 50,000, then the fair market value will be taken as the final value

- If gifted for a consideration and the Fair Market Value (FMV) less consideration is greater than 50000, then the FMV less consideration amount will be taken as the value of the gift.

5. No tax on the amount received through WILL or Inheritance

When any sum of money or any property is received under a will or by way of inheritance, it is totally exempt from Gift Tax. So if you get a real estate worth Rs 50,00,000 and some other things worth Rs 30,00,000 through inheritance , you will not have to pay any tax on that amount received.

Be cautious about the take and give transactions

At times, we ask for money from our friends for some purpose and then give it back. One of the examples I can give is what I heard from one of the readers in comments section. He swiped his credit card for a friend for Rs 50,000 and then asked his friend to pay him back through online banking. Here if you see, the amount came to his account, however it was a reverse transaction and not actually a gift, so ideally this transaction should not be considered at all.

If its a small amount and can be justified with proofs, there is not much to worry about this. But in this case, lets say there is a income tax scrutiny, and tax inspector asks you about this “Rs 50,000” coming to your account. Now – You can clearly say that the money you got from your friend was a amount which you got back because you paid Rs 50,000 to him through your credit card. But just saying this will not be enough, He will ask you to prove it. Then you will have to bring your credit card statement, and prove to him that this was done by you for your friend and no one else.

The point here is – no matters how truthful you are, there should be something you can show to income tax officers in case this is questioned. So for any transaction like this, which involves a big amount, its always a good idea to have a proof, like in the example I just gave, the credit card statement will be handy along with a small note, where you friend signs saying that you swiped your credit card for him and he will pay back the money through netbanking.

In this same case, If you ccan’tprove that this money was just a “reverse entry” , you can imagine the situation. Even if you were clean, the whole amount would be added to your income and you need to pay income tax based on your tax slabs on the ground of unaccounted income.

Another point, worth noting is that just because you have a reverse transaction, the other party can get into trouble. For example, suppose you give Rs 20 lacs to your friend, who wanted the money for buying a house and then your friend gives back those Rs 20 lacs in 3 months. Note that now there is a clear entry that you gave your friend Rs 20 lacs, so in future income tax department can reach you through your friend and ask you about this Rs 20 lacs and from where you got so much of money. They can ask you to justify the source of this money. So always keep these points in your mind.

How to document Gift transactions, Registered Deed or plain paper?

A gift deed is a deed, that is executed and delivered in which the donor transfers title to the receiver without any payment or considerations. It a document which transfer the legal title of the property to the donor, where the consideration is not monetary but is made in return for love and affection. There is indistinctness with respect to compliance of the gift deed at times, Whether a gift deed is required to be made in every circumstance

When it is required to be stamped OR get registered?

Gift made by way of cash or cheque does not mandatory requires to be executed through a gift deed. Writing a plain typed note on a paper will generally suffice. It is not required to be stamped and registration is also not needed. You may simply mention the names of persons, their relation and that the gift is being given out of love and affection.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court, and registration of gift deed is not required in this case. For the purpose of making a gift of immovable property, the transfer must be effected by a registered instrument signed by or on behalf of the donor. Gift of immovable property which is not registered is not valid as per law and cannot pass any title to the receiver.

Conclusion on Income Tax on Gifts received

As far as you make the transactions which can be justified, there is not much to worry, however its always a good and safe practice to document things on a paper with proper signatures. This will help you because income tax scrutiny can go back to many years of your life. The stronger your documentation and proof, the smoother will the situation be.

Thanks to Rishabh Parakh (www.rishabhparakh.com), a chartered accountant who helped me while this post and gave his inputs. He is founder director of Money Plant Consulting (www.moneyplantconsulting.net ) a leading Tax & Investment Advisory service provider in Pune.