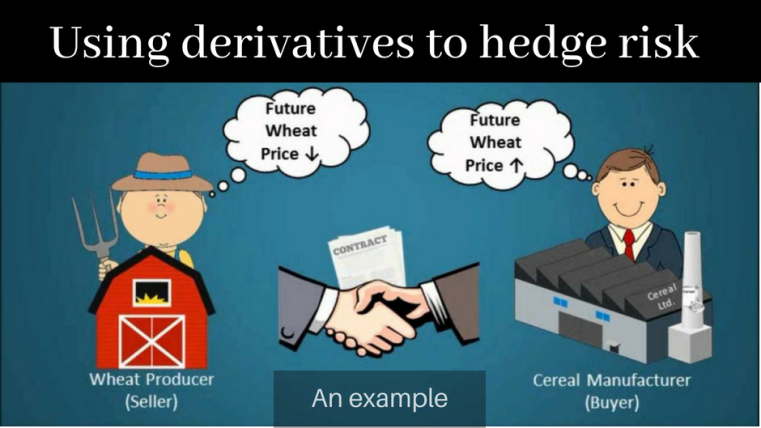

When it comes to invest in equities or mutual funds lots of people becomes concern about their investments. This article is surely for you if you invest in Equities (Direct shares or Equity Mutual funds). In this article I’m going to tell you how to hedge your portfolio using Derivatives.

Risk Management of Portfolio using Derivatives

Many people might have seen their investments go down to anywhere between 20-50%, if they invested in Indian Stock markets around Dec 2007 or Jan 2008, and they might be wondering if it will go more down in value .

Just like we know take life Insurance to cover the risk of Life, Home insurance or car insurance to cover the risk if anything goes wrong, Can we also take Portfolio insurance?

What does insuring the portfolio means?

What does insurance means? It means securing something from some event which can cause loss or damage. We ensure our Lives, our homes, our Car. What happens when nothing happens to our lives, Home or Car.? We pay a small price for it and that is a kind of fees, which we pay for the security.

In the same way, we can also insure our portfolio, we can make sure that our loss is limited, the loss is always limited. If you are one of those who invested in Equity mutual funds or Shares during 2007 or Jan 2008, and you are sitting on a loss of 30-60%, you will understand this very well.

Anyone who invested Rs.1,00,000 in stocks or mutual funds has loss of anything from 30,000 to 60,000 (depending on his investments). Just wonder if they could insure their portfolio and make sure that there loss cannot go beyond a certain limit. That would be wonderful. We are going to discuss this today.

How to insure your portfolio?

There is no specific product or service for this , you have to manage it using Options (Derivative Products). ( Read it in Detail)

I assume that you now understand what are Options and how do they work , what are call and put options and what is expiry date, in case you have not read about it, please read it at above links (try first link to get basic info).

If you have invested in Mutual Funds

Ajay has invested Rs.2,00,000 In Equity mutual funds in Aug 2008, Nifty is around 4,200. He has invested his money for 4 months and would like to withdraw his investments in Jan 2009. He is a smart investor and knows that markets can crash and there is no limit to how much down it can go, so he decides to minimize his risk.

For this he has bought Nifty 4200 PA DEC-2008 trading at 200, for which he spent Rs.10,000 (Rs.200 * 50 lot size).

Now let’s see 3 different cases and what happens to his portfolio

1. Markets boom and goes up to 5,000 : Nifty has gone up by 20%

I am assuming that his investments followed and his Rs.2,00,000 has grown to Rs.2,50,000

Value of his Nifty PUTS : 0

Profit from investments : 50,000

Loss in Puts : 10,000

Total Profit : 50,000 – 10,000 = Rs.40,000

2. Markets Crash by 25% and nifty goes down to 3,100.

His investments follow and now its value is around 1,40,000, but his PUTS will be valued at 1,100 (4200-3100). So its value at the end would be 1,100 * 50 = 55,000.

Loss in investments : 60,000

Profit in PUTS = 45,000 (55,000 – 10,000 investment)

Loss = Rs.15,000

Here you can see that Out of his loss of 60,000, 45,000 is covered from PUTS.

3. Nothing happens and markets are still at 4,200.

His investments will be almost same, and his PUTS will expire with value 0.

Profit from investments : 0

Loss from Options : 10,000

Total loss : Rs.10,000

In all the 3 cases, we should note that in all the cases his Losses are minimized.

Let us also take an example of Shares.

Ajay bought 300 shares of Reliance @2,000 on 1st Jun 2008. He wants to sell these shares around Dec 2008.

He senses that markets are uncertain, so he buys 4 lots of RELIANCE 2,000 PUTS DEC 2008 @100. One lot of Reliance options has 75 shares, that’s the reason he buys 4 lots, so that he has total 300 shares control.

What does it mean? It means that on Dec 2008, he has the right to see 300 shares of reliance @2,000 and for this right he has paid Rs.100 for each share.

The maximum loss for him is now Rs.100 per share.

Let us see the 3 cases.

1. Shares price has gone up to 2,500.

Profit in shares = 500 * 300 = 1,50,000

Loss in Puts = 100 * 300 = 30,000Total profit : 1,20,000

2. Shares price remain same at 2,000

Profit in shares : 0

Loss in Puts : 100 * 300 = Rs.30,000Total Loss = 30,000

3. Shares price go down to 1,500

Loss in shares = 500 * 300 = 1,50,000

Profit in Puts = 500 * 300 = 1,50,000 – (30,000 investments)Total Loss = 30,000

Again, we can see that in any case his loss is capped by 30,000 (5% of his investments of 6,00,000)

So options can be used to hedge or security. Watch this Youtube video to understand.

Summary

So the main idea of options is to use them to minimize the losses. If there is loss in investments, the puts will end up in profit and we will have very less loss or maybe we can get some profits only. The same way, if people do short selling they can use calls to minimize their losses.

So if you have invested in Shares or mutual funds and want to minimize your losses, use options or Futures as Hedging tools.