Budget 2012 was out yesterday and within minutes, it was clear that almost all the people were disappointed, but then Sachin’s century made sure that every one was back in mood and were able to sleep happily by the end of the day. I looked at various articles on budget which were flooding every minute. I didn’t hurry to post this article, because I wanted the dust to settle down and then come up with only those major points which you can consume, understand and which really matters to you. So I read this budget memorandum for some points which had confusion and came up with 13 points which really concerns most of you.

The budget did not live upto the expectations of many people because rising inflation had created an expectation among people that this time they will get some major relief from taxation and were expecting exemptions upto 3 lacs income and big raise in 80C limit. But Congress made sure that they lose and waste this last change which they had to give people a small reason to like them. What a waste of this golden opportunity they had. Anyways, lets keep aside things and get to the top most points I extracted for you from the budget 2012.

1. Change in Tax Slabs

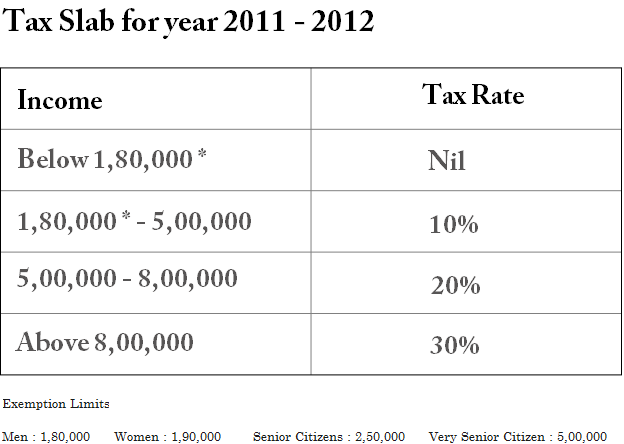

The minimum taxable income on which tax has to be paid was increased from 1.8 lacs to 2 lacs, so the new slab is as follows – Nil tax between 0-2 lacs income, 10% tax between 2-5 lacs, 20% tax between 5-10 lacs and 30% tax above 10 lacs income. The taxable limit for men and women is same, which is 2 lacs, but the limit for senior citizens (above 60 yrs) is 2.5 lacs and for very senior citizen (above 80 yrs) is 5 lacs. No change in that. This means that most of the people will save additional Rs 2,000 on tax outgo , thats all . Not a big deal ! .

2. DTC not coming this year, hence ELSS gets one more year

DTC (Direct tax code) will not be implemented this year, which was very obvious – thanks to Anna Hazare, Food security bill and other issues which made sure govt has no time for DTC . What this means is that Tax Saving Mutual funds (ELSS) are still a tax saving option for 2012-2013 and you can invest in them and claim tax benefit next year also.

3. EPF (Provided Fund) Interest cut from 9.5% to 8.25%

EPF interest rate cut was not part of this Budget 2012, but it happened just one day before Budget, and as this is an important update, you better know that EPF interest rate is reduced from 9.5% to 8.25% now and it will be applicable from next year. Last year itself the EPF interest rate was increased to 9.5% . This is a very steep cut and really wont make any salaried person happy. Not sure what is the reason to keep it below PPF interest rates. Anyways – you cant do anything about it – Bite the bullet ! .

4. Income tax exemption for health check-ups upto Rs 5,000 under section 80D

A new kind of deduction called “preventive health checkup” is included under section 80D . Till now you were able to claim Rs 15,000 for the medical insurance premium paid for self, spouse and dependent children, but now you can also include health checkup cost upto Rs 5,000. But note that this is included in Rs 15,000 limit and not additional one. You can make cash payments for these checkup’s.

5. Tax exemption for Direct Equity Investments if income is less than 10 lacs

Just like the above point a new tax deduction is introduced for direct equity investments, Its called as “Rajiv Gandhi Equity Saving Scheme” – under which a new equity investor will be able to claim 50% of his investments in direct equity upto the maximum investment limit of 50,000. This investment would be subject to 3 yrs lock in period (just like ELSS) . However this will be available to only those whose taxable income is below 10 lacs. There are 3 questions which I am not clear about and I want to know. a) Is it only for direct stocks or even equity mutual funds ? b) Is it only for those who will invest for the first time in equity because the rule mentions “new retail investor” . c) How will they make sure that a person does not sell his shares before 3 yrs, will this limit be from demat provider ? Will get more clarity on this in coming days ! . Read more on Rajiv Gandhi Equity Saving Scheme from Subra !

6. Tax exemptions on Saving bank interest upto Rs 10,000

Till now all the interest income earned from your saving bank was taxable. However now saving bank interest income upto Rs 10,000 will not be taxed. Not that it is applicable for Saving bank account, Post Office Saving account and all co-operative bank accounts. But I doubt how many people will really be able to take full benefit of it, because to earn 10,000 interest in saving bank, you need to keep anywhere close to 2 lacs or 2.5 lacs, which does not happen with most of the people. A lot of people anyways never paid any tax on the interest from saving bank and might be fearful if some one catches them, now law itself asks them now to pay upto 10,000 , I can see some witty smiling faces 🙂 . Also dont confuse this with interest earned on your Fixed Deposit, that is still taxable!

7. Life Insurance deduction available only if premiums are below 10% of Sum Assured

This is a little hidden clause and not highlighted by media, but as per the budget 2012, any life insurance policy issued on or after 1st Apr 2012, will be eligible for “tax exemption each year [80C] and “no tax on maturity [section 10(10D) ]” only if the yearly premium in all the years are below 10% of Sum Assured. Currently this percentage is 20%. So for example if you buy a life insurance policy with premium of Rs 20,000 for a Sum Assured of Rs 1,00,000, then it will not qualify for tax exemptions because here premium is 20% of sum assured. However existing policy holders dont have to worry about this, their policies wont be affected.

8. Securities Transaction Tax (STT) reduced from 0.125% to 0.1%

Whenever an equity transaction is done, STT transaction tax is applicable and you have to pay it. It was 1.25% earliar, but now its reduced to 1%. So it means you will have to pay less for your equity transactions. Good for those who buy/sell stocks/mutual funds frequently or in big quantities.

9. Service Tax increased from 10% to 12%

This move should worry you, because with increase in service tax, your bills for telephone, internet, hotel stay, eating out at restaurants, flying by air and several other kind of services will cost a little more, because we all pay service tax on all these things. So as service tax is increased from 10% to 12%, we will pay 2% more on the bill amount. This will add up to a good enough amount in whole year even though it does not bite you in small installments. Surprise! – Be ready to pay more for your Life Insurance and Health insurance premiums also, because we pay service tax on the premiums too. As per a rough estimate for most of the urban class people like you and me, the additional service tax we will pay due to this will cancel out that Rs 2,000 additional tax saving which happened due to increase in tax limit.

10. TDS @1% at the time of real estate sale above 50 lacs

A lot of people will cry hearing this one and will not appreciate this move by govt, but it’s for good. As per this budget 2012, now whenever you sell your residential flat/house/plot (any kind of real estate) and the selling price is more than 50 lacs, you will have to compulsorily pay TDS @1% . This is actually a big problem, because it might happen that even though the sale value is above 50 lacs, but after indexation and your decision to use the funds in next house purchase, your overall tax out of the transaction might be Zero, but still you will have to pay 1% TDS. So in worst case you will have to claim that tax amount back by filing a return. Note that property registration will not be permitted without proof of deduction and payment of this TDS , so you cant escape it, incase you thought you thought you will escape somehow. All the registration offices across the country will be following this one.

11. Increase in Excise Duty from 10% to 12%

Excise duty is the tax paid by manufacturers on production of any kind of goods. So now that is increased from 10% to 12%. So it means that manufacturers pay more tax and recover that same additional burden from consumers, which in turn means that a lot of goods will get costlier, it would include daily use items and what we consume in day-to-day life. Anyways – you never realise this as consumer 🙂 because instead of increasing the price, they reduce the weight of the product, I hope you know that the Maggi packs which used to be 100 gms , are now 90 gm from many years and still costs Rs 10 and you were so happy all these days! .

12. For Medical Insurance – Senior citizen age reduced from 65 yrs to 60 yrs

In the last budget the age for senior citizen was reduced from 65 yrs to 60 yrs, but it was not applicable for sec 80D and 80DDB. Till now people above 65 yrs old were considered as senior citizens in case of medical insurance deduction, but in this budget, that rule is amended and anyone above 60 yrs will be considered as senior citizen. Infact now for all the taxation purposes, senior citizen age is above 60 yrs. In case of Sec 80DDB , the deduction up to Rs. 40,000/- for the medical treatment of a specified disease or ailment is allowed.

13. Tax Benefit on Infrastructure bonds removed

2 yrs back Tax Saving Infrastructure bonds were introduced and apart from 80C (1,00,000), additional 20,000 was eligible for tax exemption. However this year this benefit is not extended and now there is no tax exemption on Infrastructure bonds. However companies are allowed to issue 60,000 crore worth of bonds compared to 30,000 crore worth bond last year. However I doubt if the excitement this time will be very high as it was last year. (source)

Some Other Changes in Budget 2012

- No Advance Tax for Senior Citizens if no income under head “Income from Business” .

- The amount of goods you can bring from outside India increased to Rs. 35,000 from the earlier Rs. 25,000 .

- Tax filing compulsory for any resident who holds a property outside India even if the taxable income in India is below the limit.

- Under Section 80G, any donation made above 10,000 has to be done by any mode other than cash. Till now you could donate through cash by cash, but now that limit is there.

How do you rate this budget 2012 and are you happy with it ? What as per you was that one thing which budget should have this year ?