Do you want to open PPF account in ICICI Bank ? Yes It’s possible now. Few months back, ICICI started the facility of PPF account. The way it was advertised was “Online PPF” , but it mainly meant that you can deposit and maintain your account online. While you can also apply for the PPF account online, still you need to provide them the documents physically. In this article we will look at how to open Public Provident Fund account in ICICI Bank.

Can you open PPF account in any ICICI Branch ?

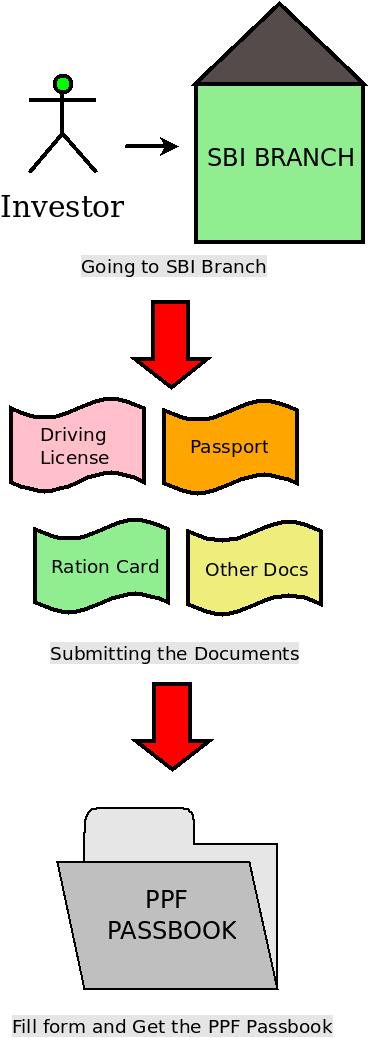

No , you can not open PPF account in any ICICI Branch . For each city, there are special designated branches for opening PPF account. You will have to open the PPF account there, here is the list of those designated braches . Note that you need to have a ICICI Bank account before you open the PPF account in ICICI, however the account can be in any branch of ICICI .

Documents required for opening the PPF account in ICICI Bank ?

Case 1 : For customers who have a relationship with ICICI Bank that is < 5 years.

- Form A

- Passport size photograph

- Copy of PAN card

Case 2 : For customers who have a relationship with ICICI Bank that is > 5 years

- Form A

- Passport size photograph

- Copy of PAN card

- Residence proof – Passport/ Electricity Bill

In case 2 , the additional Residence Proof must be required mostly because if the customer is quite old, his address must have got changed. Note that if you do not have a ICICI Bank account already, you will have to first open an account , in which case you will fall into case 1

How to transfer your existing PPF account to ICICI Bank account ?

As per the PPF scheme of the Government, subscribers can transfer their PPF account from one authorised bank or Post office to another (Check detailed article on how to transfer a PPF account from Post Office to SBI bank) . In such a case, the PPF account will be considered as a continuing account. To enable customers to transfer their existing PPF accounts to ICICI Bank, the following process must be followed.

- The customer approaches the bank or the Post office where his current PPF account is held and makes an application for transfer of PPF account to ICICI Bank’s branch.

- Once the application is processed, the existing bank/Post office arrange to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. to ICICI Bank branch address provided by the customer, along with a cheque/DD for the outstanding balance in the PPF account.

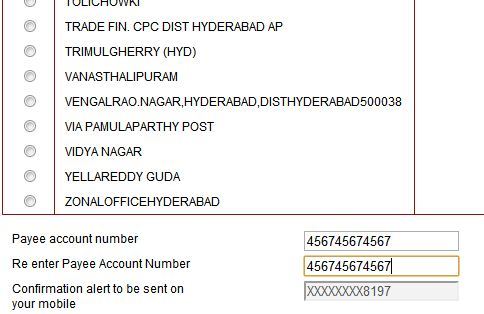

Once transfer in documents are received at ICICI Bank branch, customers are required to submit fresh PPF account opening form (Form A) and Nomination form (Form E/ Form F in case of change of nomination), along with their original passbook . Also customer is required to submit a fresh set of KYC documents.

You will not get PPF passbook in ICICI bank by default

This is something interesting I found which was getting discussed on our jagoinvestor forum . Looks like by default ICICI bank does not provide a PPF passbook when you open it. If you really need it, you will have to give a written request and only after its processed it will be given. Under its PPF terms and conditions its mentioned that

3.3. Passbook shall not be made available to the Customer/s for PPF Account/s which are applied for and operated through ICICI Bank Internet Banking Services. However, the Customer shall be able to view his/her transactions through his/her statement of accounts available online on the Website. In the event, i Customer wishes to have a passbook for the PPF Account applied for through ICICI Bank Internet Banking Services, he/she shall be required to put in a written request for the same at the designated base branch where PPF Account is/has been opened as per ICICI Bank’s policy / process/Primary Terms.

However, if you mostly do all the transactions online, the Passbook point is not that big thing to reject the idea of opening PPF account in ICICI bank.

Conclusion

PPF account was always opened at SBI bank or Post Office by maximum people and ICICI bank is the new player in this field. Only time will tell about their services and how they handle this PPF service. However overall for netsavvy investors who already have a ICICI bank account, seems like its a good option and which can be acted upon faster. Now you need to take your decision. Let us know if you will open a PPF account in ICICI bank or not ?