The taxation becomes more complicated when you moved out of one country to another for earning. A lot of times, an NRI will be earning in India as well as abroad, and pay the income tax in India and abroad both at the same time, because of many country levy tax on global income. This leads to double taxation for NRI’s.

We will talk about Double Taxation Avoidance Agreement (DTAA) today and understand how NRI’s can take benefit from it while they are planning their investments

Many NRIs earn various types of income from India eg. rental income, interest on FD or NRE/NRO savings account or even capital gain on sale of asset, etc. However, due to DTAA (Double taxation avoidance act), An NRI can save himself from getting taxed twice.

What is DTAA?

DTAA is a tax treaty signed between India and various other countries because of which investors does not have to pay taxes twice in both the countries. Hence DTAA mainly have following benefits

- Helps NRI’s in lowering their taxes

- Helps NRI’s in avoiding paying dual taxation

- Makes a country attractive for NRI’s because of such a treaty

- Helps in curbing the tax evasion by NRI’s

The benefit of DTAA is extended every year to NRI. Which means that NRI’s who want to keep availing the DTAA benefits have to furnish the required documents at the start of every financial year to the tax authorities.

Here is an example

An NRI can avail tax benefits with the help of DTAA, as his earnings in India are taxed as per the rates decided in agreement. This prevents the NRI from paying 30.9% as TDS (Tax Deduction at Source), instead, he could pay tax at 10-25% rate depending upon the country he currently resides in.

Example of DTAA with USA

There is a DTAA between India and USA also, and the TDS rate is only 10%, which means that an NRI who has income in India and who falls in 30% tax bracket will only be paying a TDS of 10%, and not 30% if he does all the documentation. Note that there are different tax rates for various kinds of income like interest, dividends, royalty etc.

Following are the types of income’s which fall under DTAA

- Salary that is received in India

- Income from services that are provided in India

- Fixed deposits & saving bank account held in India

- House property situated in India

- Capital gains arising out of transfer of assets in India

I think it will also be applicable on NRI’s investments in Mutual funds investments in India

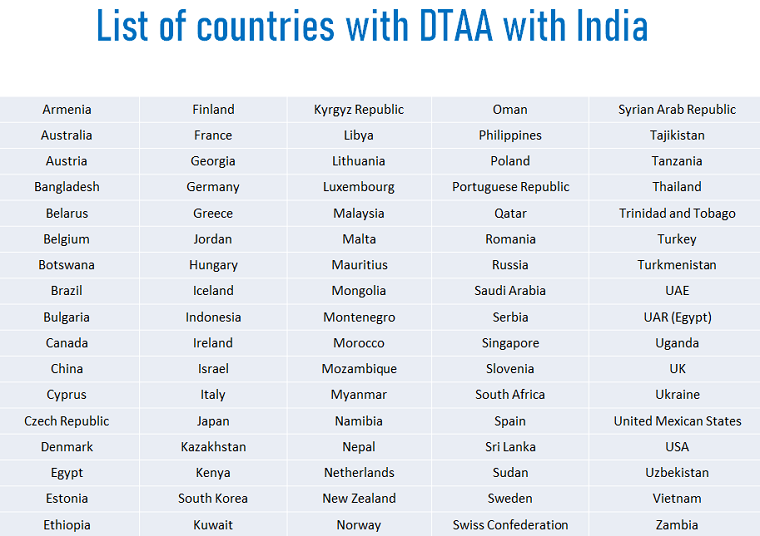

DTAA with 89 countries

Right now, India has double tax avoidance treaties (DTAA) with more than 89 countries around the world, whose details can be accessed here and a simple tabular list can be found here

Below is a TDS rate list with all 89 countries (out of which some 85 are in force)

[su_table responsive=”yes”]

| Sr. No | Country with whom India has TDAA treaty | TDS Rate |

| 1 | Albania | 15.0% |

| 2 | Armenia | 10.0% |

| 3 | Australia | 10.0% |

| 4 | Austria | 10.0% |

| 5 | Bangladesh | 15.0% |

| 6 | Belarus | 10.0% |

| 7 | Belgium | 10.0% |

| 8 | Bhutan | 15.0% |

| 9 | Botswana | 15.0% |

| 10 | Brazil | 15.0% |

| 11 | Bulgaria | 10.0% |

| 12 | Canada | 10.0% |

| 13 | China | 10.0% |

| 14 | Columbia | 10.0% |

| 15 | Croatia | 10.0% |

| 16 | Cyprus | 15.0% |

| 17 | Czech Republic | 10.0% |

| 18 | Denmark | 10.0% |

| 19 | Estonia | 10.0% |

| 20 | Ethiopia | 10.0% |

| 21 | Finland | 10.0% |

| 22 | Fiji | 10.0% |

| 23 | France | 10.0% |

| 24 | Georgia | 10.0% |

| 25 | Germany | 10.0% |

| 26 | Hongkong | 10.0% |

| 27 | Hungary | 10.0% |

| 28 | Indonesia | 10.0% |

| 29 | Iceland | 10.0% |

| 30 | Ireland | 15.0% |

| 31 | Israel | 10.0% |

| 32 | Italy | 10.0% |

| 33 | Japan | 10.0% |

| 34 | Jordan | 10.0% |

| 35 | Kazakhstan | 10.0% |

| 36 | Kenya | 10.0% |

| 37 | Korea | 10.0% |

| 38 | Kuwait | 10.0% |

| 39 | Kyrgyz Republic | 10.0% |

| 40 | Latvia | 10.0% |

| 41 | Lithuania | 10.0% |

| 42 | Luxembourg | 10.0% |

| 43 | Malaysia | 15.0% |

| 44 | Malta | 7.5% |

| 45 | Mongolia | 10.0% |

| 46 | Mauritius | 10.0% |

| 47 | Montenegro | 10.0% |

| 48 | Myanmar | 10.0% |

| 49 | Morocco | 10.0% |

| 50 | Mozambique | 10.0% |

| 51 | Macedonia | 10.0% |

| 52 | Namibia | 10.0% |

| 53 | Nepal | 10.0% |

| 54 | Netherlands | 10.0% |

| 55 | New Zealand | 10.0% |

| 56 | Norway | 15.0% |

| 57 | Oman | 10.0% |

| 58 | Philippines | 10.0% |

| 59 | Poland | 10.0% |

| 60 | Portuguese Republic | 10.0% |

| 61 | Qatar | 10.0% |

| 62 | Romania | 10.0% |

| 63 | Russian Federation | 10.0% |

| 64 | Saudi Arabia | 15.0% |

| 65 | Serbia | 10.0% |

| 66 | Singapore | 10.0% |

| 67 | Slovenia | 15.0% |

| 68 | South Africa | 10.0% |

| 69 | Spain | 10.0% |

| 70 | Sri Lanka | 10.0% |

| 71 | Sudan | 10.0% |

| 72 | Sweden | 10.0% |

| 73 | Swiss | 10.0% |

| 74 | Syrian Arab Republic | 10.0% |

| 75 | Tajikistan | 10.0% |

| 76 | Tanzania | 10.0% |

| 77 | Thailand | 15.0% |

| 78 | Trinidad and Tobago | 10.0% |

| 79 | Turkey | 10.0% |

| 80 | Turkmenistan | 12.5% |

| 81 | Uganda | 10.0% |

| 82 | Ukraine | 15.0% |

| 83 | United Mexican States | 15.0% |

| 84 | United Kingdom | 10.0% |

| 85 | United States (USA) | 10.0% |

| 86 | Uruguay | 10.0% |

| 87 | Uzbekistan | 10.0% |

| 88 | Vietnam | 10.0% |

| 89 | Zambia | 10.0% |

[/su_table]

What sections under IT Act provide relief from paying double tax?

Section 90, Section 90A and Section 91 of the Income Tax Act, 1961, provides for DTAA relief.

Section 90 – Reads as “Agreement with foreign countries or specified territories”. It applies to the cases where India has a bilateral agreement with another nation like Canada, UK, Singapore, etc.

Section 90A – When a specified association in India enters into an agreement with a specified association abroad, the Central Government, may by notification adopt such agreement and provide relief under section 90A of the Income Tax Act, 1961.

Section 91 – Applies to cases where India does not have any bilateral agreement, rather it has unilateral agreement. It states how tax relief can be availed in case of “Countries with which no agreement exists.”

How to claim DTAA benefits?

To benefits from the provisions laid under DTAA, an NRI individual will have to provide the following documents in a timely fashion to the concerned deductor eg. bank in case of tax on interest income earned.

- Self-declaration cum indemnity format

- Self-attested PAN card copy

- Self-attested visa and passport copy

- PIO proof copy (if applicable)

- Tax Residency Certificate (TRC)

According to the Finance Act 2013, an individual will not be entitled to claim any benefit of relief under the Double Taxation Avoidance Agreement unless he or she provides a Tax Residency Certificate to the deductor.

To receive a Tax Residency Certificate, an application has to be made in Form 10FA (Application for Certificate of residence for the purposes of an agreement under section 90 and 90A of the Income-tax Act, 1961) to the income tax authorities of country of residence. Once the application is successfully processed, the certificate will be issued in Form 10FB.

DTAA methods

There are two ways NRI’s can claim the DTAA benefits, and let’s discuss it here

Tax Credit Method

This is the most popular method of taking DTAA benefits. Under tax credit method, the person first has to take into consideration all his income into consideration (foreign country + home country income) and calculate the taxes applicable. Then they will calculate the taxes as per home country and take that much credit while paying for taxes.

For example, if someone has a bank interest in India for 20 lacs and the tax rates applicable to them is 30%, and if in the foreign country they live right now taxes is at 40%, then the person will be able to take back the credit of 30% and only pay additional 10% taxes. This method makes sure that there are almost no way a person pays dual taxes.

Exemption Method

This is another way, in which you don’t have to consider your home country income at all and just have to pay the taxes on the income which you have earned in the foreign country. So it does not matter what are the tax rates in different countries. As per the DTAA treaty, you just skip the home country income altogether, so you just end up paying taxes in home country only.

Take Professional Help with it comes to DTAA

Once you have become an NRI, and you have multiple income sources in different countries and when you also have spent different times in India and abroad, it becomes quite complicated to take benefit of DTAA rules. You also have a chance of making a mistake and pay less tax (or to pay more) if you try to do it yourself.

Hence I strongly suggest that you hire a professional CA who has expertise in DTAA matters and pay the fees to them to do the calculations and tax filing.

I hope this article was able to help you understand various rules related to DTAA.

If you are an NRI, we also invite you to explore our NRI financial planning services