An Agent comes to your home or office and tells you about an Insurance plan. It can be a traditional insurance plan or term insurance. Being an agent, he wants to make sure, you do less work. Anyway most people feel bored or find it tedious to fill out a long form by themselves. After all, the agent is there to do it. It’s an amusing situation, that in today’s generation, we run around all day to different places to buy our TV, Fridge, Washing Machines. We inquire from a million places, read the reviews etc., and make sure you we find out each and every little detail when we buy such products for our home or our convenience, but sadly we don’t care enough to read financial documents or fill them ourselves; documents which will help take care of our little children or family when we are not around; documents that don’t even take few minutes or an hour to look at.

Coming back to the story, this Insurance agent treats the customer as King and customer also feels great about it. The maximum he will do is sign the document (after having a super quick look at the pages, making agent feel that he actually cares about it !) The customer is a smoker, but agent doesn’t even bother to ask. Even if customer tells him about it, the agent does not put “Smoker” in the form as it might reduce the chances of getting the policy and hence no commission 🙂

Why Mistakes Happen in Life Insurance details ?

Now tax saving is coming for the year (not the protection of family, mind you !), and the customer is ready to raise his hands for questions like “Who all have Insurance?” or “Who is adequately covered through life insurance” ? The agent get his commission and mostly disappears, and customer is happily living his life under a happy impression that he has life insurance; until one day, he dies…

The family is devastated, but time goes on and once things settle down, they go to the insurance company and ask them for the Insurance Money… and Pow! The family gets sucker-punched! . The insurance company happily tells them that the customer was a smoker, but has given false information in the documents at the time of taking the policy hence by law, they are will not honour the claim! They are correct . Read a case between LIC and one customer on claim rejection.

This happens with a lot of insurance customers. They tend to give wrong information in the documents; as giving correct information increases the premium. (This happens a lot with smokers.) What’s so wrong if company asks for a higher premium for smokers? If you are a smoker, definitely from a business standpoint (and even logically) you have higher chances of dying than a non smoker. So, it’s natural to charge you a higher premium. But, if you give wrong information in the documents or try to misrepresent anything, it means company is covering a higher risk person for a a normal premium and they are very correct to reject the claim. Read this article to understand more on giving wrong or incomplete information in insurance documents.

Comment from Insurance Company Official

Sourav Shah, a senior Manager at Aegon Religare, shares some of his thoughts for claim rejection in comments section.

Hi Manish, To give you a detailed explanation of why the plan ‘iTerm’ is cheap.

The simple reason is ‘There are no middlemen – Agent – involved in selling this product.’ Since this product is sold online there are no agents commission involved and hence the company is not paying anything to the Insurance agent and thus passing on the benefit of the low cost to the consumer. We all know that most insurance products have a commission of 30-40% in the first year premium that is paid to the agent. The reason this product is cheaper because there are no agents commission involved. Secondly, Aegon Religare is the only company that has sought IRDA approvals to sell the product online since we are very keen on providing the customers what a product that they need – a simple term plan – at a price that is affordable.

Regarding the claims ratio, Manish, the 3 customers whose claims were rejected were due to wrong declaration at the time of taking the policy. They had declared themselves as non smokers. I would request all customers who are buying a term plan or any insurance product from any Life insurer, to not hide any facts while taking a policy. The insurers build up the cost based on your declaration, so its always advisable to declare truely in order to ensure that all claims are met. And if any customer faces any issue with any isurer he can contact the insurance ombudsman and he will immediatley look into their issues. Happy buying. Manish this is a beautiful and unbiased platform that you have provided for customers to clarify their doubts. Please keep up the gr8 work.

Regards,

Sourav Shah

([email protected])(Link)

How to correct the false Information ?

In case, you have provided any wrong information in your policy document, it’s almost certain that your claim will be rejected. Don’t try to fool insurance companies. They are smarter than you at figuring it out. So contact your Insurance company and give them factual information . This may lead to increase in premium or rejection of policy, but it’s a better situation than getting rejected at the time when you are in the sky.

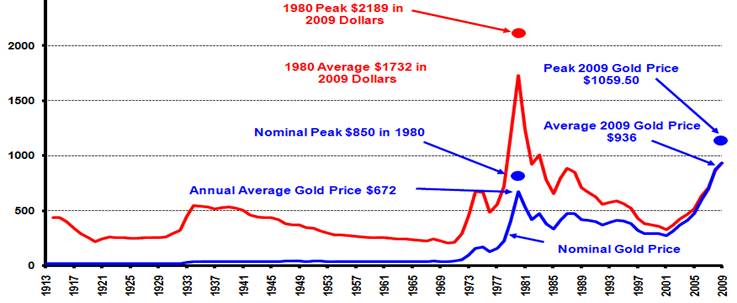

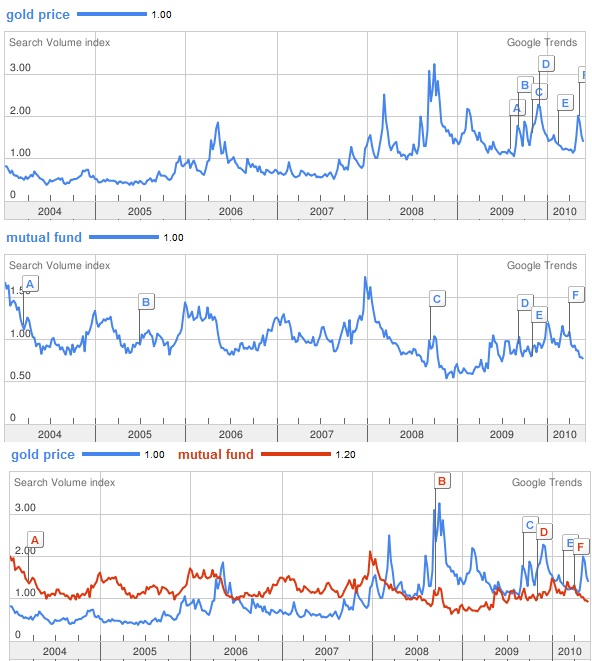

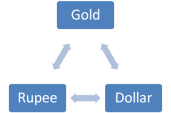

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.

Today also, each emperor (so called Government) produces and controls their own currency as DOLLOR, Rupee, Dinar etc. But internationally, gold still remains the purest form of currency as it cannot be manipulated. Now in paper currency world over, Dollar became the most acceptable currency as US economy is still the biggest and almost all countries trade with US. After US dollar, the most acceptable form of currency is GOLD. If you have gold and you are not carrying dollar, you can still buy items in any country of the world but you cannot do so with Indian Rupee. Hence, in economic terms, gold is a currency.