One of the most used financial products is the Credit card. We all spend so much time to get best credit card, but I have never seen someone, who has spend his time to fully understands the importance of the CVV number, One time password, Signatures on the back of credit card or how secure their credit card is overall ! .

There are so many credit card frauds going on, and yet each of us thinks, that our credit cards are fully secure and it cant happen with us. However, this is really far from the truth, because of the 4 big myths people have about their credit cards and we will bust them today for you, so that you become a more powerful and informed investor!

Myth 1 – My Credit Card is secure, because no one knows my PIN/Password

When you make a transaction through a credit card in India, at the end of the transaction, you are asked to enter one more final PIN number, which makes your transaction more secure and gives you an additional layer of security. RBI had come up with this additional password requirement just last year. While you needed credit card number, expiry date and your CVV number to make a transaction earlier, now as an extra security layer, you need this additional PIN too.

However note that this is limited to online transactions on Indian websites only. When you make a transaction outside India, this additional step is not compulsory. This means that someone having every other detail of your credit card other than your PIN can also do transactions even if he does not know your PIN . You must have realized this yourself, if you have done any transaction outside India.

Myth 2 – No one knows my CVV number, so I am secure

One of the biggest myths about credit card is that, if no one knows your CVV number, its impossible to do the transaction. Take a small breath, while I tell you this.

“CVV is not always mandatory on all websites to make an online transaction.”

Yes, you heard right!. You can make a online transaction on few websites out of India with only the Credit Card number, the expiry date and obviously the name of the credit card holder. If you don’t believe me, here’s a small example.

Try to book a domain name at godaddy.com. I was almost numb, when I booked a domain name some time back, only to realize that the domain name was booked, but the site never asked me my credit card CVV number and I was like – “What ?! Seriously ?!” . I then found out, that asking for CVV number is just optional for credit card merchants. While some countries make it mandatory, others don’t. It’s just a choice!

So make sure you are safe, do this

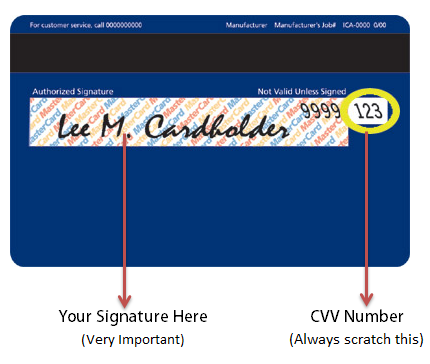

- Scratch your CVV number on the back of your credit/debit card

- Always make sure the swiping happens in front of your eyes! , I know, it can be a little embarrassing for you, but its just an extra mile security, see if its possible for you

- Better do not use Credit Card at all , use Debit card instead!

Myth 3 – My credit card can’ t be duplicated.

Yes, your credit card can be duplicated and it happens in India. A card (credit or debit) might be using something like EMV chips or Magnetic strips, and that’s where the problem is at. While EMV chips are more secure, the magnetic strips are not!. If your card has magnetic strips, it can be duplicated.

Here is how it works …

Your card has a lot of data inside it and it sits on the magnetic strip. When the card is swiped, all the data is extracted from it, for verification purposes. Now some expert hacker with bad intentions, can extract all this data from the swipe machine and make a new card using a technique called Cloning. There are machines called “skimmers” , which helps in extracting the data from the swiping machines to a new card. If you are still wondering if this all happens in India, here is a story excerpt from Hindu website

According to the police, the machines were used to swipe cloned cards by one Rahul. The cloned cards were arranged by Pankaj Deewan, Yogesh Mahajan and Yasin through their contacts. The amount transferred to Dheeraj alias Rohit’s account was shared by the machine holder and cloned cards holder at 40:60 ratio respectively.

Following this, the police launched a hunt and subsequently arrested Dheeraj, Pankaj, Yogesh and Yasin. They purportedly told the police that the domestic cards were cloned by one Kamal and international cards by Devender Chauhan of Agra with the help of a professional hacker. The cards were cloned by obtaining information of genuine customers and then copying the same on a plain card having a magnetic strip. According to the police, the accused used skimmer (a device used to copy data from credit/debit card) for the same.

And if you still don’t believe all this, here is a video you might want to spend time on

Myth 4 – The signature on the back on credit card does not matter much

One of the most misunderstood and unknown facts about credit cards is the signature on the back of the card. Let’s understand the rule today and lay this to matter to rest. If a credit card does not have a signature on the back, it’s an invalid card. As per the agreement between card issuer and merchant (the shops and hotels which give you the facility to swipe the cards), the merchant is supposed to check the signature on the back of card with the signature on the bill, and only if they match, the merchant should allow the card to be swiped.

However almost all the merchants avoid checking it, as if it does not matter at all. This is violation of terms and conditions and if you have lost a credit card which was SIGNED, and some transaction takes place, you are not suppose to be charged, because the merchant should have checked the signatures on card with the signature on the bill. What this means is that if there has been ever a fraud on your credit card, and you are asked to pay the money (Like this Incident) , just ask your card issuer to check the signature on the bill with your specimen signatures with them and if they do not match, they are not suppose to pay the merchant at all and let merchant take the loss for not doing their duty of checking the signatures.

This explains why you should sign your cards on the back and not leave them blank, because if someone steals your card and puts his signature on the back, then the transaction can be done successfully even if the merchant does his duty of checking the bill signature with the signature on card and in that case you are bound to pay the money to card issuer.

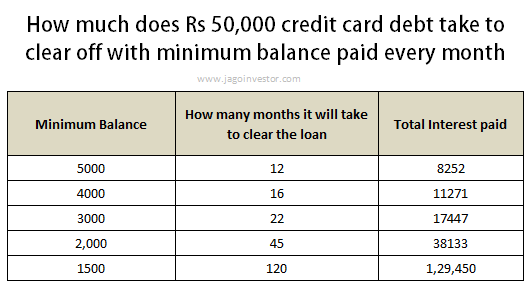

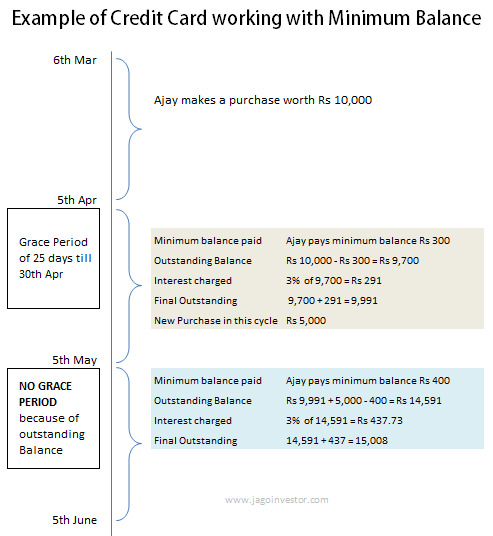

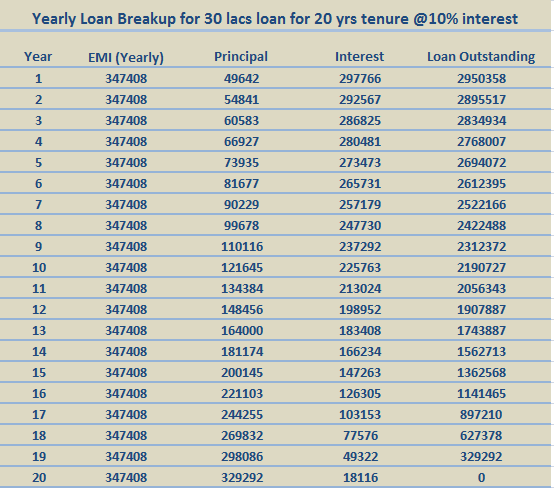

MYTH 5 – By paying minimum balance, I do not have to pay Interest

As you have used your credit card and now it’s time to pay your bills of Rs 15000. But you don’t have money to pay back the bill. You are in tension because if you don’t pay your bill you will be charged penalty. So to avoid penalty you pay minimum balance of Rs 3000 and now you will not be charged penalty. So now the left over bill amount is Rs 12000.

You must be happy that you will have to pay Rs 12000 only but let me tell you that you will have to pay Interest of 3 to 4% on this 12000. So even if you pay your minimum balance to avoid penalty but you cannot avoid the interest charged on the left over amount.

MYTH 6 – Too many credit card will improve my credit score

Many people think that if they opt for more than one credit card then there credit score will increase eventually. But this is other way round. If you opt for too many credit cards you won’t improve your credit score but you end up being more dependent on these credit cards, which is not a good sign. Managing too many credit card becomes burdensome.

Tips to Secure your Credit Card

I hope, now that these myths are busted, you are a more informed and powerful person who the rules of the game of credit cards . To summarize, lets put out some tips to secure your credit card

- Do not share your one time credit card password (IVR) with anyone ever

- Scratch your CVV number and remember it in your head !

- While making any online transaction, make sure the website starts with https://

- While making any transaction offline like on petrol pumps , hotels etc, make sure its swiped in front of you as far as possible.

- Make sure the card is swiped on a machine which is issued by authorized banks and not some machine which looks suspicious , it can be a “Skimmer” machine which steals your data.

- Put a signature on the back of your credit and debit card, so that unauthorized transactions are not done and you are protected a card holder

- If possible, better use a credit card which has a small limit like 10k or 20k for shopping.

- There are virtual credit cards these days, you can use them for online transactions

If you ever had any incident that was mentioned here, please share it with others and if you have some thing to teach others, please share it here with everyone.