Today I want to talk about MONEY

Yes, you heard it right!. I want to just explore the role of money in our life and how it changes our thought process. I want to know how we think about money. I will share some really interesting insights I got by surveying 2440 people on some creative questions related to money.

I am sure you are going to enjoy this article and also get some takeaways at the end on how others feel about money. Our financial lives are very private to us. Our income, our struggle with money, our desires in financial life. All this is very secret to us. You do not know how hundreds and thousands of other people like you think when its related to money.

Do they share the same feelings as you? Do they also feel scared about the future? Do they also have stress like you in their financial life?

I will show you 8 amazing insights I got from this survey

Role of Money is our life

Money has a very important role to play in our lives. In a way, it’s one of the most important ingredients you can say. We need money for almost everything today. What we will ear, how others will perceive us, how famous we might be in our friend’s circle and if a father will be interested to give us his daughter or not?

Money has a big role to play in all these points which I mentioned above.

Money has in a way controlled our lives these days. We start our day going to work for money, a lot of people are into jobs they don’t like, but the EMI’s are to be paid anyways, so we continue.

There are many examples in life, where a person is amazing at X, but they are doing a job in the Y domain. The reason being MONEY. Money turns wonderful people into a monster. Money is a wonderful thing, but at the same thing a very dangerous thing too.

Our interaction with money

When we were kids, we had very little interaction with money. We got it from our parents and used it, we didn’t earn it and our notion about money was different. But once we get into the role of a breadwinner, only then we realize the game and how money turns us into a completely different person.

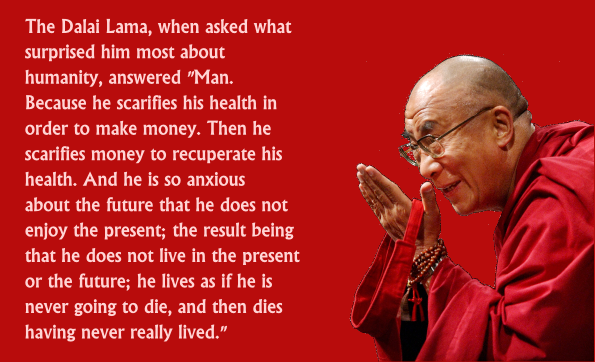

One of the best quotes to understand the effect of money in our lives is the below quote by Dalai Lama

Survey with 2440 people – Results

Let me not bore you too much with my views on money and rather look at how people think about money and what impact it has created at their thinking level. I will now take various things I asked in the survey and share the results with you

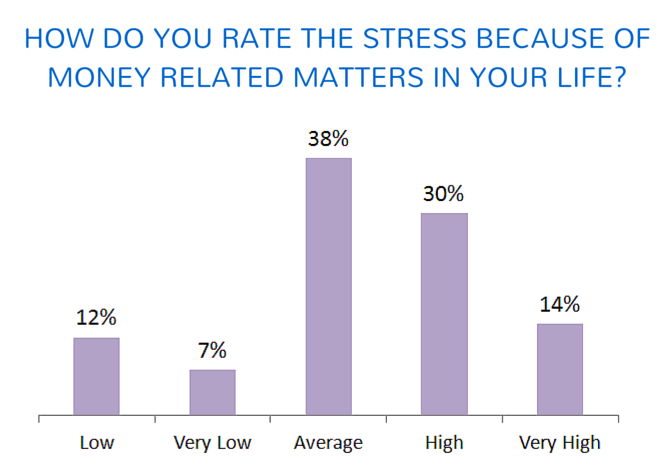

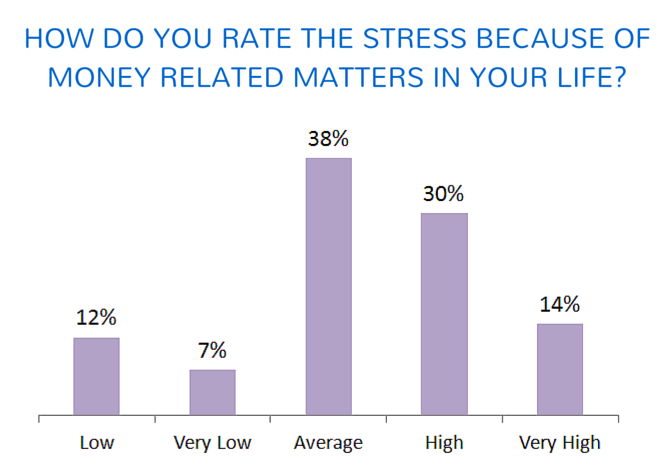

Insight #1 – How do you rate the stress level because of Money Issues?

One of the biggest problems in today’s times is STRESS. Stress at the office, the stress at the home and everywhere and a lot of times, you will realize that money has a big role to play there.

- Oh my god, How will I pay my EMI’s if I lose the job?

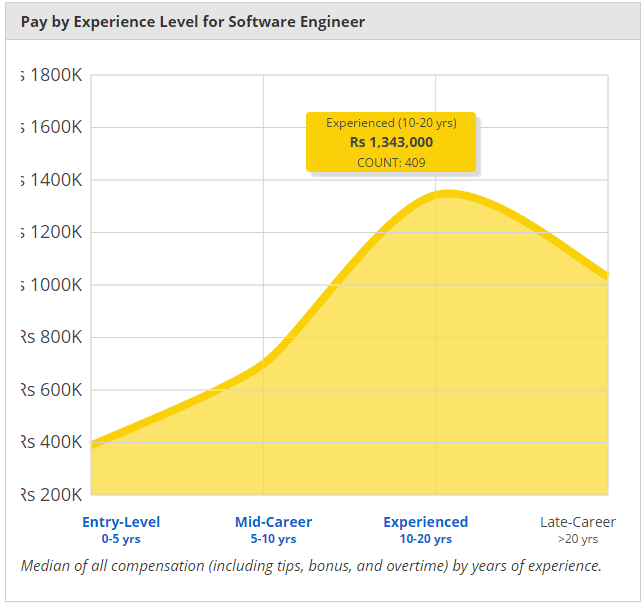

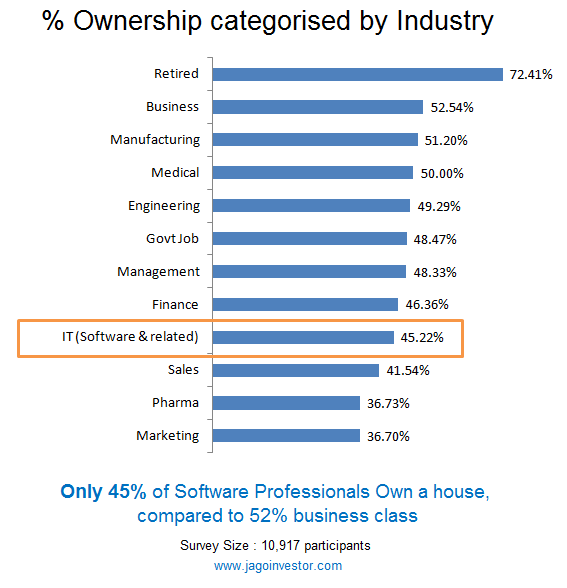

- Will I ever be able to buy a home with this salary?

- I am already 38 and have not saved a penny, How will my retirement look like?

Many such kinds of thoughts occupy the minds of today’s generation. When I asked this question – “How do you rate the stress because of money related matters in your life?” Here are the survey results

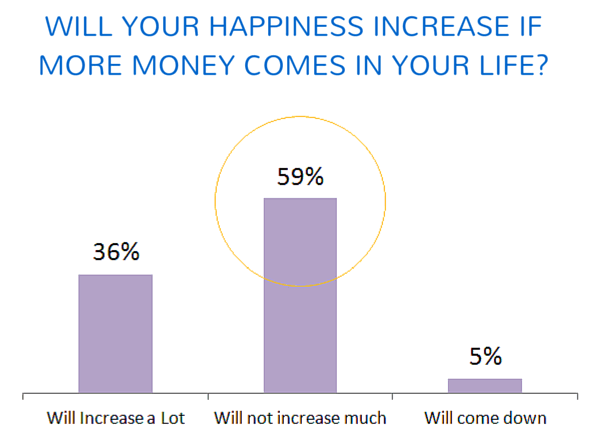

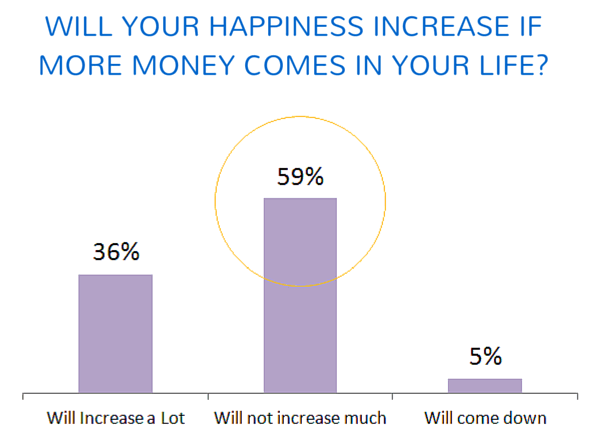

Insight #2 – Does more money means more happiness in life?

So we all are running after money day and night, thinking that money will solve all our worries and problems. However, those who have earned a good amount of money know that it’s true only to some extent. A rather correct statement would be “Absence of money leads to unhappiness”.

Yes, money is very very important and damn!, I also need tons of money and sure it can buy you all those things which can give you lot of happiness and make you feel like the king, but then beyond a point your happiness graph will start to appear flat even if more money comes into your life.

And this is confirmed by the survey results. 59% of people have said that more money will only lead to only a partial increase in their happiness and not beyond a point.

And trust me, if you have not earned a lot of money till now in your life, this statement will look like an idiotic one right now. If you are earning Rs 20,000 a month, surely Rs 2 lacs a month will mean 10X happiness, but will 20 lacs a month mean 10X more happiness from that point? I don’t think so? What about 2 crores a month? Salman also earns that !, Vijay Mallya also earns that as well. I am sure they have many issues in life!

This topic alone is worth a full book in itself, but we will keep it short as of now.

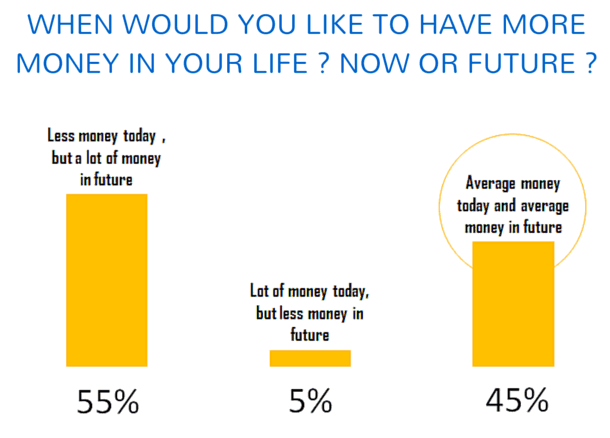

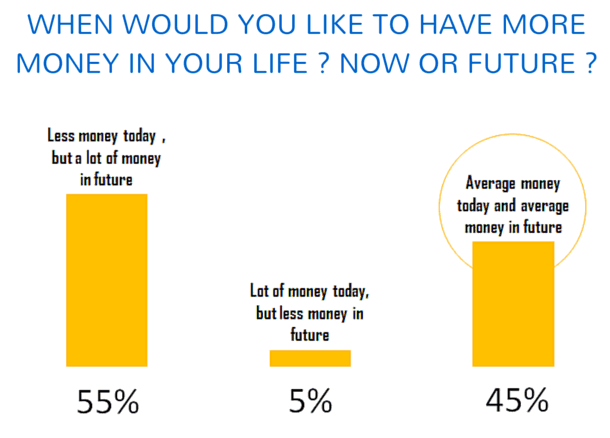

Insight #3 – Which option will you choose, More money Today or in the Future?

Most of us want a lot of money in our life. Surely more than what we have today. But we all know that it’s not going to happen suddenly? You either have to sacrifice your today to build wealth in the future, or you can enjoy all your money and retire poorer. Or there is a 3rd choice that you keep a balance between today and tomorrow. So given a choice between these 3 options, which one will you chose?

This was no brainer question in away. Around 55% of people chose that have a better future and are ready to compromise today, may be because they know that in the future they will have fewer means of earning and it looks natural. We all want an assured future.

However, 45% of people said that they just don’t want their future with lots of money but even their present. So they want average money today and average money in the future also, making sure that there is a good balance today and in the future.

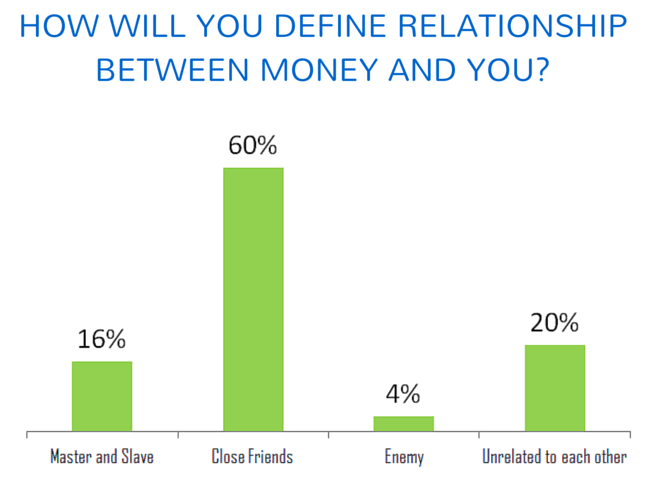

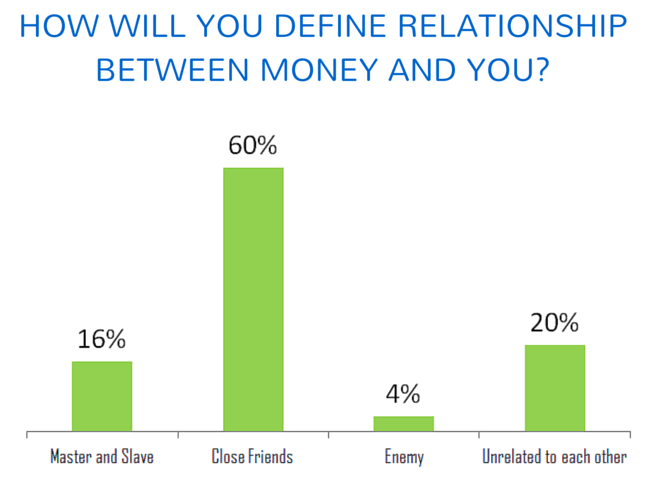

Insight #4 – What is your relationship with money?

Have you ever wondered what your relationship with money is? I first came across the term “Relationship with money” from my partner Nandish Desai, and I am thankful to him to share it with me. I added a new dimension to my thinking. He has also contributed a full chapter on this topic in my first book – “16 personal finance principles every investor should know”

Money or wealth is a non-living thing, but still, we have a certain kind of mindset towards it. We have some kind of “relation” with money. Imagine money as a human standing in front of you, do you see a friend or an enemy? Do you see it as a master and you as slave or you don’t feel any relation with each other.

I was happy and a bit surprised to find that around 60% of people who took the survey identified their relationship with money as “Close friends” . It’s a great thing that most people see a positive relationship with money. However, a lot of people who have messy financial lives don’t share very good relationship with money.

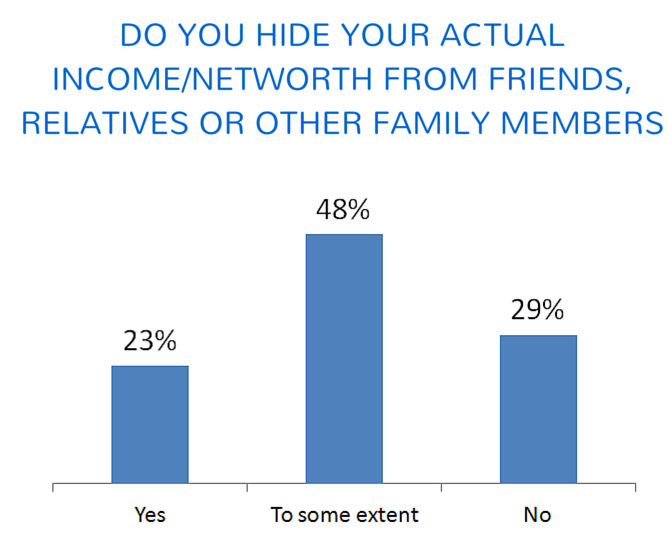

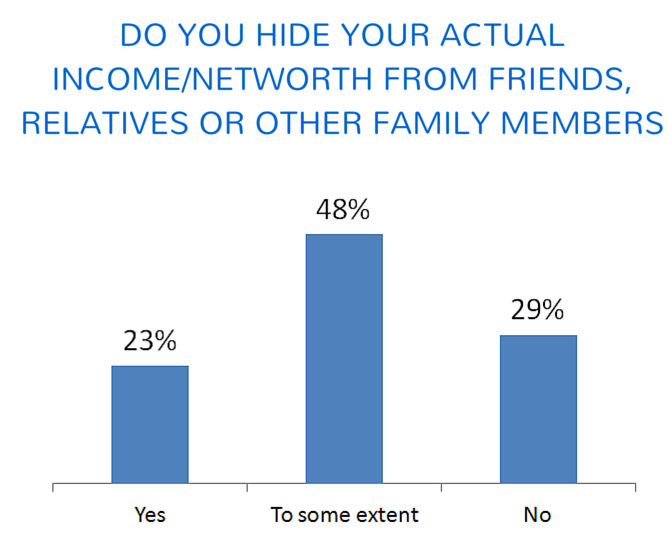

Insight #5 – Do you hide your wealth from others?

How many people know your exact salary? How many people know the exact net worth you have? How much you have in your bank account, or your mutual funds or other assets? Do you under-report it to your friends, relatives or even some close family members like your siblings and even parents? Spouse?

Seems like most of the people do. Only 29% of people said that they don’t hide it from others, but rest others hide it. while 23% said coldly YES to this question, around 48% said that they do it to some extent.

No wonder that this happens. There may be many issues which can happen if the world knows that you have a lot of money. Some might just expect “help” from you, some might ask it directly and unnecessary attention and expectations come across which most of the people want to avoid.

No wonder, most of the people want to keep a low profile when it comes to showcasing their wealth.

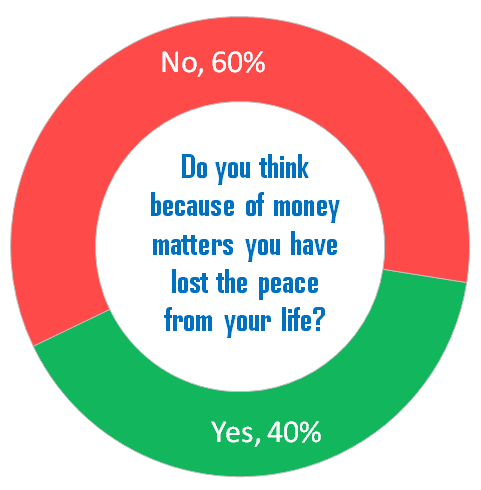

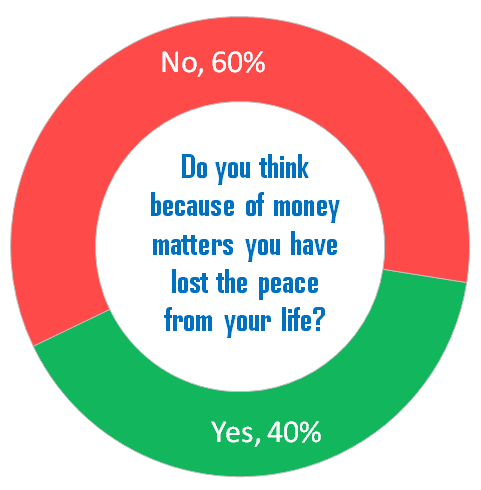

Insight #6 – Have you lost peace in life due to money issues?

A lot of people are very stressed because of money matters. Someone from low income and high expenses, while someone might be due to medical expenses while is costing them all their income each month. Someone might be under debt which was passed to them from their parents and they are paying for it. Someone might have lost money in some scam and someone might not be able to fulfill their loved one’s wishes due to money constraints.

Like I said earlier, lack of money might make the life hell in this competitive world. Around 40% of people say that they don’t find peace in their life due to money issues. They felt they have lost it. Think about it. It’s quite a big number, so every 4 out of 10 people is stressed out and does not feel relaxed.

Let me know what do you think about that?

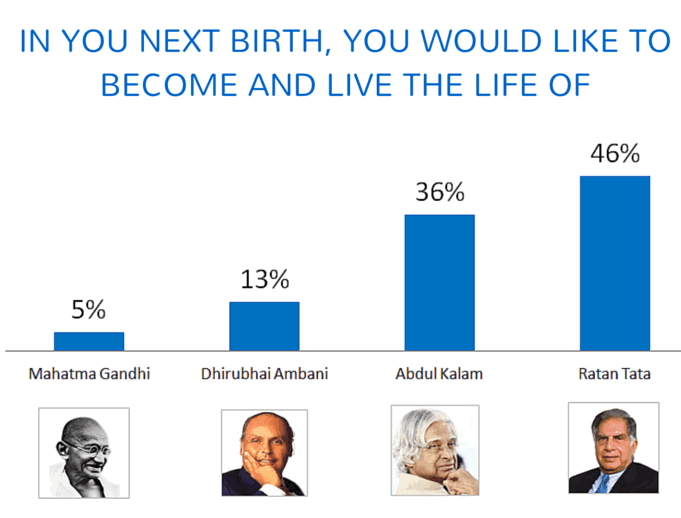

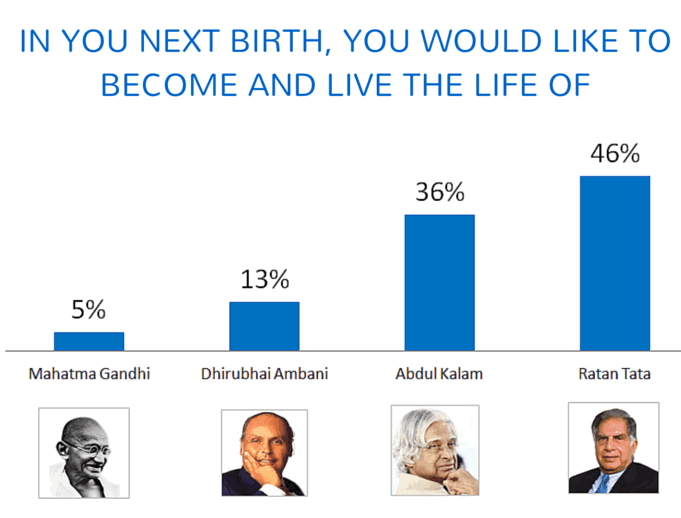

Insight #7 – In the next birth, who would you like to become?

I wanted to know what people aspire to be and what kind of life they want to live in reality. So I asked a very different kind of question, that if they got a chance, then in their next birth whose life they would like to live? I gave 4 options as below who are all very famous for whatever they have done in their life, some are respected because of what they have done for our country and some are known for wealth or both.

The options were

- Mahatma Gandhi

- Dhirubhai Ambani

- Abdul Kalam

- Ratan Tata

For a second, without looking at the results below, think for a moment about yourself. If you got a chance, whose life would you like to live in your next birth?

Here are the results and they might surprise a few of you.

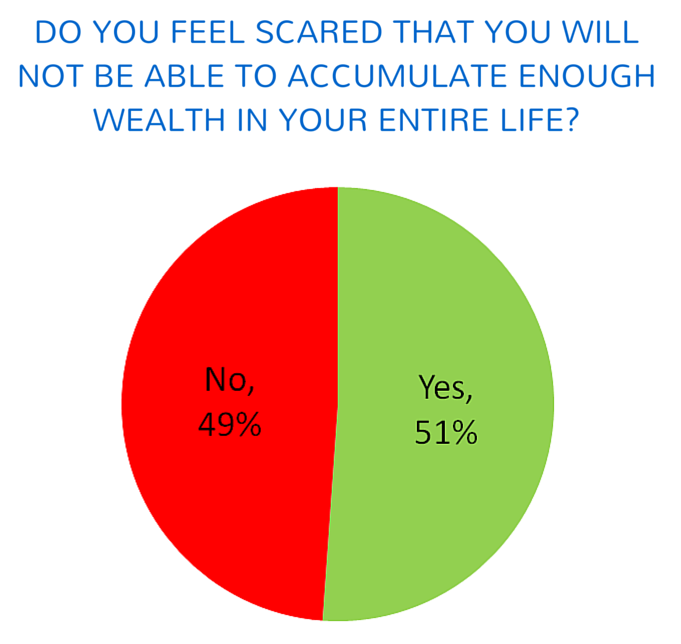

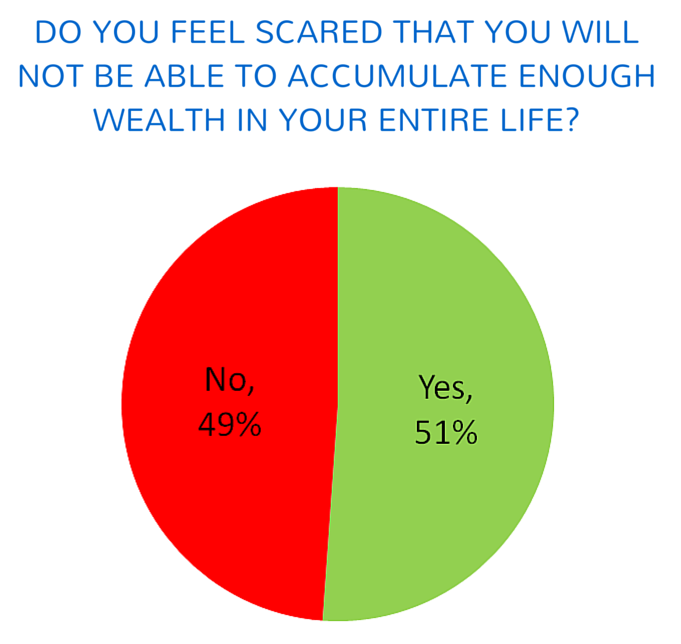

Insight #8 – Are you scared that you won’t be able to accumulate enough wealth in the future?

No matter how good your career is going or if you are earning decent enough right now, there is always a bit of anxiety about the future. We have no idea how things will turn out in the next 10/20 yrs. Because of rising inflation, and multiple expenses people do not save the amount which they deserve and they are always scared if things will continue this way ever?

So I wanted to know how many people are scared of future and they think that there are chances that they might not accumulate enough wealth in their lifetime which is required for leading a great life they desire. Here is what people say.

Around 51% of people said that they are scared of this.

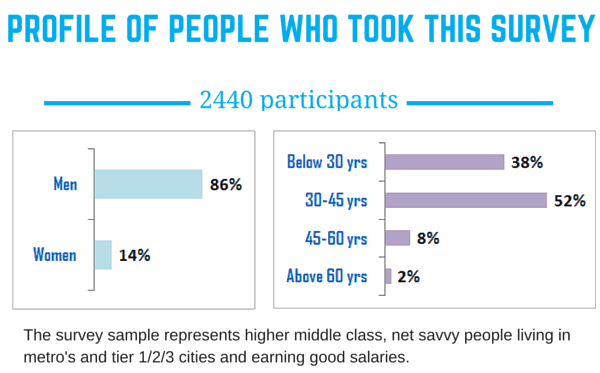

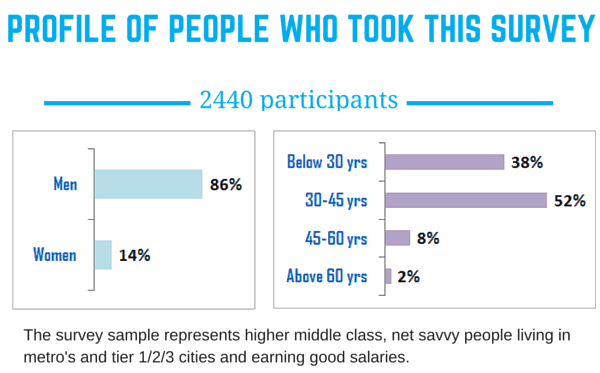

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.

With this, I would like to end this survey here. I would like to know what you feel about this survey and if you got any insights on how other people think in this country. I would like to mention very clearly that the survey size was 2440, which is surely not the representation of the entire country, but it’s a good enough sample size for the net-savvy higher middle-class people who live in big cities earning decent salaries.

What do you think about the survey?