Small is Big? Are you worried, about how will your financial goals be achieved, because you are not able to save more? Do you feel that small savings will not help you much to reach your big goals in life? If that’s the case, you are mistaken!

While it’s true that small savings won’t be able to help you much in short run, they can impact your financial life in a really big way and contribute significantly in long run.

In the tribal villages of Cameroon, there is a community called “Mofu“, who grow and eat millet’s all year. They store their entire crop for the whole year in their store houses made of mud and wood. Unfortunately, in some bad years, termites attack these store houses and no matter what the villagers do, termites destroy just about all the crops in a short span of time.

The only creature which can now save these villagers, are driver ants which they call “Jaglavak” in their native language. They search the village and try to find those ants. Just a handful of driver ants, kill all the half-million termites in a few days!

How are these ants able to destroy a big army of termites? The answer lies in their strategy and their team work! If they are not disciplined in their approach, it would not be possible to defeat the big army of termites. It’s not the power of a single ant which makes them winners, its numerous ants working together and following a few simple rules.

Small Expenses can help us grow wealth

Just like the story above, we in our financial life have a lot of small/medium expenses which keep rotting and destroying our wealth and many a times, our health too.

Some of them are smoking, drinking, too much eating out without any reason or out of sheer laziness in cooking at home, spending on items which give us instant happiness, but in reality we don’t need them, buying things just for ego-satisfaction (My neighbors bought it, so we should also have it!).

Small pains taken today by saving money and investing properly will help you generate enough money in future (read this story). Most times, we keep thinking about bigger problems in life and do not value or think about taking care of small things. We ignore them because we see them in isolation a lot of time.

My friends case –

One of my really good friends works in a finance company and earns around Rs.25,000 a month. Just graduated from college and found a decent job in Delhi. He lives a great life! Movies with friends, eating out, smoking and drinking.

His credit card bill keeps piling up month after month, but the instant gratification of paying “Minimum due amount” is much higher than the pains which will follow years later when banks will deny or ask for a very high interest rate when we will need a Home Loan or a Car loan.

I asked him his financial goals in life, and got this answer –

1. Retirement corpus of more than a crore by the age of 60

2. 40-50 lacs to open a restaurant once he retires

3. 6-7 Lacs for a vacation in Europe after 10 years with his wife.

How cutting some bad habits helps in long term

He was expecting a big laugh from me. He expected me to tell him, that he is living in fantasy world. With a salary of Rs.25,000 per month how is it possible to achieve these financial dreams in a situation where he was not able to save even Rs.1,500/month?

To his surprise I told him that if he is ready to compromise on bad habits and have discipline in investing from today, it might just be possible to get closer to his dreams! He thought that my advice and plan for him would be tough, complex, and full of jargon and he will have to spare next some days to understand what I was going to show him.

Here was my plan for him.

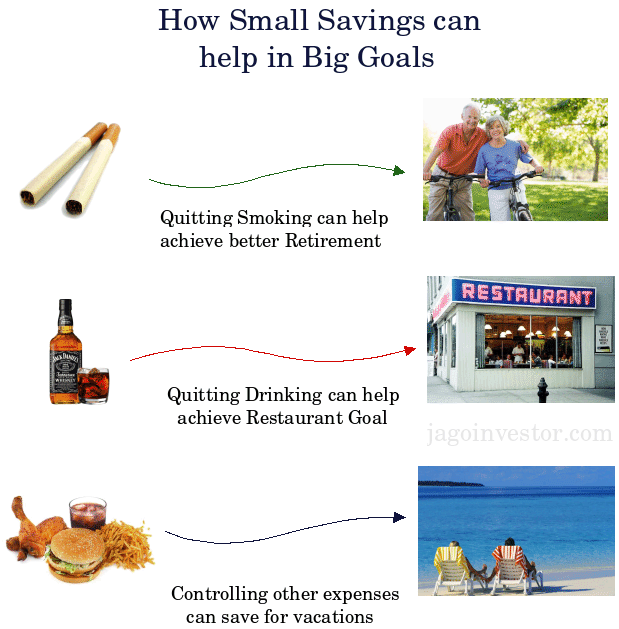

Goal 1: Retirement

His retirement can be taken care of, by just investing the money which will be saved by quitting smoking. I don’t know how much a quality smoker spends on his daily quota of smoking, but I guess I can safely assume Rs.50/day which turns out to be Rs.1500/month.

Instead of using this money to deteriorate his health every month for next 35 years, if he invests it in equity mutual funds regularly through SIP. Assuming a 12% return, he can make around 97 lacs (calculate). Note that this amount is without taking into consideration any inflation, if we incorporate inflation of 5% (in cigarette price); it would turn out to be 1.2 crores in 35 yrs.

Equities in long run might give excellent returns and a 15-18% return can be expected from equities if the time horizon is 30-35 years, especially from Indian Markets (Read why)

Goal 2: Restaurant

My friend’s plan for opening a restaurant in retirement can easily be achieved if he controls his drinking and starts investing that money. I have some idea on how much it costs to booze per week (no, I don’t drink, I actually thank my friends in college), I assume it to be around Rs.200/week. Let’s consider Rs.800 for a month.

If he invests part of this in PPF and rest in balanced funds, he might be able to generate 10% returns , and with 35 years in hand, it would be Rs.48 lacs assuming that he also increases this investments by 6%/year (come on, alcohol prices also increase!)

Goal 3: International Vacation in 10 years

My friend spends a lot on phone with his 10 “best friends”, eating out, shopping gadgets and clothes every month/quarter. Not sure why he keeps flying from Delhi to Varanasi every quarter when he can take an overnight train! And save thousands.

Cutting a bit on all these habits I mentioned, it should not be a big deal and he should be able to save few hundreds from each of those and save another Rs.2,000 in total months.

If he saves this money in balanced funds, he should again be generating 3-4 lacs in next 10 years and if not Switzerland, he can go on a vacation to some near-by destination :).

Conclusion

A bit of restructuring and prioritization in your spending habits can give you a good idea on what all things can you saves on. If you are disciplined in your approach, over the time these small savings if invested with proper plan can help you in a big way in your financial life.

Just like my friend in above example, we have many areas in our life where we can cut our expenses or stop them. If we use it and invest systematically for some goals in our life, slowly it can turn out to be a very big amount. If you are still confused and can’t think of where to cut expenses, another alternative for you is to live on 90% of your salary. It works!

Assumptions : It’s assumed that all the spending might have continued for all life which are saved and diverted to investments. Also the investments are assumed in Equities.

Can you think of anything similar in your life and how it can help you in saving some money? It can be asking small as Rs.100 or Rs.200. Please share! Also share how it can help you in achieving something, use our calculators to find out.