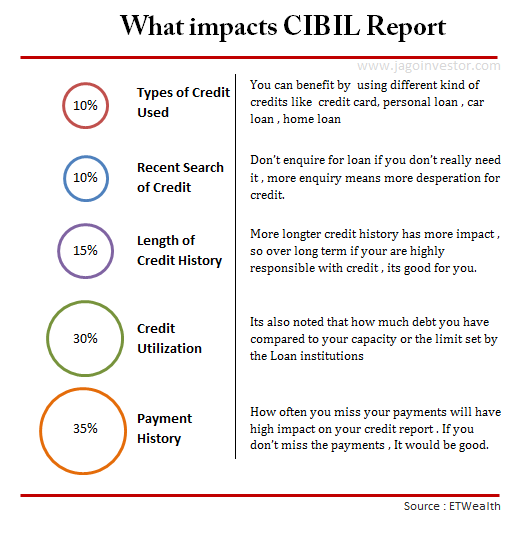

Did you do any loan settlement in past ? That will surely affect your CIBIL report and score ! . Before we look at that, look at this data – Over 88% of new home loan borrowers in 2011 had a CIBIL score of 750 and above. Do you have a score of 750+ or not ?

So now by default if your CIBIL Score is less than 750, you stand a very low chance of getting any kind of loan to be approved. Most probably your loan application will be rejected. However, today we are going to talk about “Loan Settlement” aspect of any Loan. Lets see more!

CIBIL has really made life worse for a lot of people. A lot of people have misused their credit cards or other kind of loans , on top of it outstanding loans piled up so much over time, that they could not pay it off completely. Banks suddenly told them- “Hey, Don’t worry if you can’t pay off your Rs 3 lac outstanding loan, just go for loan settlement and all you need to pay Rs 60,000. We will send you loan settlement letter or NOC letter after that”. Are you one of those who went for Loan settlement months or years back ?

Settlement of Loan is not a solution

A lot of people feel that Settlement of their loan outstanding in case they cant pay it off is a permanent solution to their worries? However, for one and the last time, understand that SETTLEMENT of Loan is just a temporary solution. It’s just a short cut way to get rid of constant reminders from banks and credit recovery agents. Banks do this because they know you are a waste and mostly you will never be able to pay back your 100% dues, so they settle for whatever you can pay! . Atleast they will get something back from you.

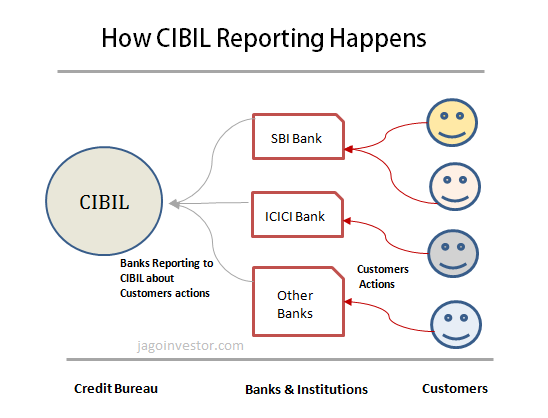

This settlement of loan will NOT clear your name in CIBIL report. In fact its a negative sign. It shows that you took loan, happily used it, ballooned it with late charges/interest by not paying on time and finally bank in frustration said – “Fine… Let’s take whatever we can get out of this guy, if we don’t get some part right now, we will not get even a penny later”.

Mak was worried why his name is appearing on CIBIL report as “settled” and his loan application was rejected.

I want to remove my name from Cibil report, I Used to have 2 CC, from HDFC & another from citi bank, I do had personal loan from citi finance, which I settled long 2yrs back for which I have settlement letter as well. Recently when I applied for a Bajaj finance loan for home electronic, It got declined, reason given to me was as my name reflected as a defaulter of Cibil. Please advice me to clear of my name from Cibil.

What Mak has to understand is that Loan settlement is a negative thing, and banks will report this incident to CIBIL and mind you, your status will be marked as “Settled” for next 7 yrs. So forget about getting any kind of loan from any bank for next 7 yrs at least. Once 7 years passes, then the SETTLED status will be removed , however your credit score by that time will be so low , that you will not get any loan even after that point, unless you work on improving your credit score. Now if your score is low at that point, it will again be very difficult for you to get any kind of loan (because of low score). So ultimately, the final conclusion here is that once you settle your loan, it becomes very very negative thing for you and your future and over the years it will not let you get any kind of loan unless you pay off each and every paisa of your loan.

Loan Settlement is Tempting

Loan Settlement gives you instant gratification. It’s something you really want to go for? Obviously, it gives an impression that all your worries will be taken off by the bank, its shown to people as an “opportunity” by banks. And most of the people fall for it. Swetha is one of those people who is confused about the Settlement of her loan

I have a personal loan and i have defaulted , my loan completes in the month of april the collection guys asked me to settle the loan for half the price of the remaining loan amount which is rs 44000 and he said the NOC will be mailed to within 15-20 days and also can i get a loan again . Please guide should i go for the settlement or payoff the whole amount.

No doubt, once you settle the loan and pay the settlement amount, the banks will not bother you anymore by calling and asking you to pay. They will also send you an NOC that this guy has settled his loan of X amount by paying Y amount (Y<X). But please don’t be mistaken that bank will forget you and is so generous that it will show any mercy on you. Bank will make sure your life is hell after that point. You will not get any kind of loan from that bank plus, they will send this information to CIBIL that this guy was not capable of paying off his full amount and hence we showed mercy on him by settling his loan. Please mark him/her as “SETTLED”.

Unless you pay off each and every penny/paisa of your original loan outstanding, your CIBIL report will show status “Settled” and it’s a very bad sign. Finally let me tell you what CIBIL website has to say about “Written Off” or “Settled” status in CIBIL report.

Given that a CIBIL credit report helps a loan provider ascertain your ability to pay additional debt based on your past performance, a ‘’written off’ or ‘’settled’’ account implies that you have not been able to pay your past dues. Hence, Loan providers may view accounts that are reported as ”written off” or “settled” negatively and this may affect your chances of a future loan approvals. – from cibil website

Conclusion

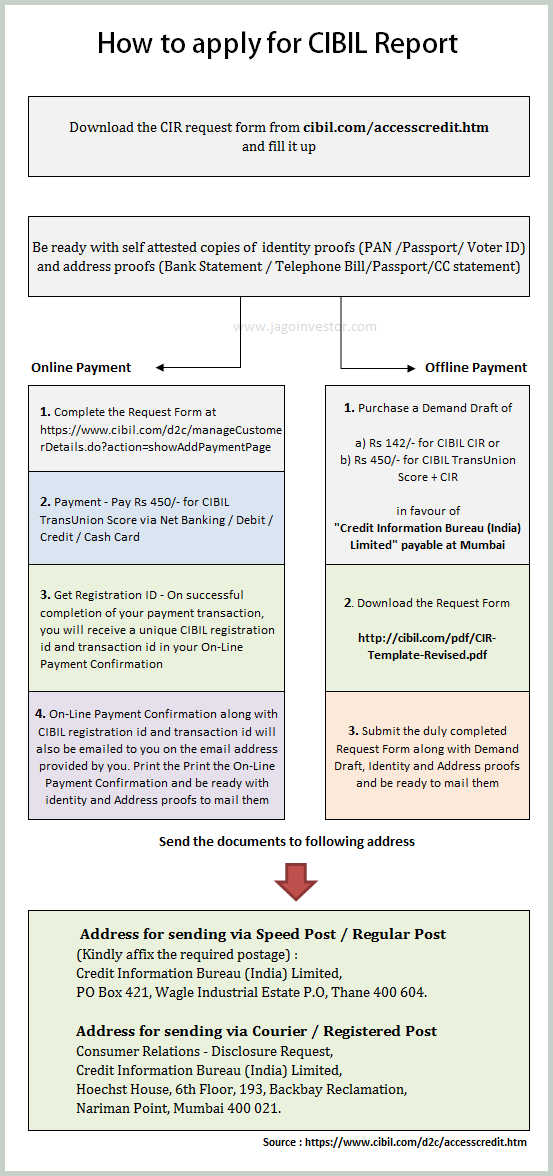

If you have done any kind of loan settlement in past, first check your credit report and see what is your score. If its low (lower than 750) , you will seriously face getting any kind of loan in future, So the only solution is to pay off the loan outstanding. Talk to your bank and pay it off. This will still not improve your score immediately, over next 1-2 yrs , make sure you pay your existing loan/credit card on time and dont misuse your credit capability. Your score will improve over time. Can you share your Loan settlement Story with us ?