Today I want to discuss a problem which is part of almost everyone’s life and creates some really big issues. I am talking about the problem of “Over Estimating your Future Income” . Yes – A lot of people take their current life decisions, based on what they feel about their future career and future income.

My Salary Hike

When I was working in Yahoo, Bangalore around 2008, I saw all the newcomers around me “expecting” their salary hike to be around 20% and 25%, and guess what – It actually happened.

Then in 2nd year, the same people “estimated” that they deserve a minimum 15-20% salary hike at any cost, because they have given their best. It happened again ! .

Then in the 3rd year, they got into the same – “I think my salary hike this year will be .. ” game and by then these people were using maxing out their credit card limits, had bought all the financial products for tax saving and committed to pay huge premium, at times as high as 80,000 per annum. They were all living a life which they deserved after 7-8 yrs of their career.

Then there was a layoff in Yahoo and some people got FIRED (some were my friends)

One guy had almost finalized a home loan, obviously based on his “future income”. Another guy could not pay his credit card bills for next 3 months, because there was no money (he eventually got another job in few months) . And most of them wished if they had saved a bit more, it would have been a better situation.

We focus on positive side, but not on negative’s

The incident I explained above looks fine at the start of career, there is less to loose. But just imagine the depth of this problem. This shapes our financial life.

If you have been working for many years now, you probably have lots of things to achieve in life and due to peer pressure, you can go overboard on your expenses, just by assuming that your future is too bright. The issue is not that we look at the brighter side, the issue is that we look “only” on the brighter side – the salary hike, the promotion, the better salary if we switch companies, the extra bonus which we will get, and then the side income which we can generate along with job .. etc

We do not look at the negative side seriously or just under rate them. We feel job loss is something which happens to others, not us! . The accidents can never happen to us. We cant loose our wealth due to some reason. What about a sudden medical emergency which can wipe out your wealth, what about “No Salary hike” this year , what about “bonus below the expectation” , what about a Fraud which creates a big hole in your pocket?

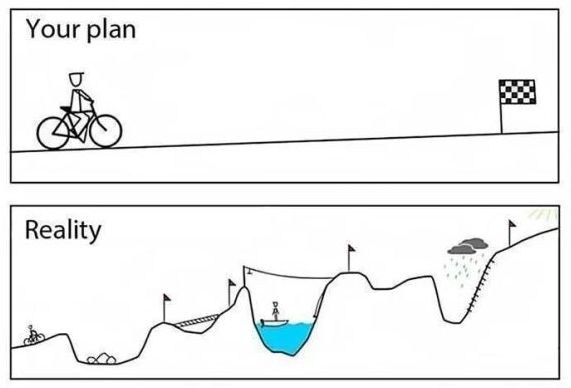

When we see our future from current situation, it looks like a straight line without any issue or problems, we extrapolate our smooth past into future and every thing looks promising. However the reality is full of surprises, and problems. Things can go terribly wrong and it can really damage your plans in life. How serious it will be depends on how much over estimation you have done for your future income. The image below clearly explains what I want to say here.

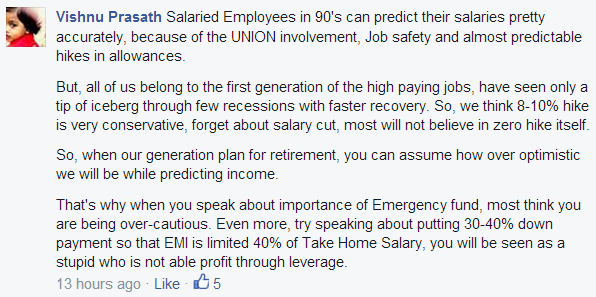

I posted this same point about “overestimation of future income” on my facebook wall, and I got a very good reply from Vishnu Prasath, which I feel everyone should read, below is that reply

In our 6 weeks online Investors Bootcamp, one of the weeks is about getting clarity of your current situation and where you stand in your financial life. With the help of an amazing excel sheet, participants are able to find out 12 insights which are related to their financial life, it tells them key hidden points about their financial life.

Yeah .. I am starting my business !

Let me also touch upon the point – “starting my own business”. When you do calculations and plan for your business potential, MS Excel makes you millionaire on paper and shows you all the rosy picture. However things are so different in real life. Assume a person, who is going to leave his job and going to start a business/startup . He forcasts the cashflows and profits and declares that in next 1 yr itself he will break even and start making money. Life will be on track again, but in reality – it can take 4-5 yrs. There can be losses, things can go totally wrong ..

In that case, imagine the situation, the stress the family will go through , the “I told you so … ” the person has to be hear every month. This is one real life example almost all the not-yet-successful entrepreneurs can relate to .

How we spend more and more Today

So because we over-estimate our future income, we buy bigger car, bigger Home, we go on more longer and premium vacations, and commit to higher EMI’s which looks possible considering our future income and cash flows. I do not want to sound like a pessimist here, I am not saying don’t be confident in life or career, one always have to do a calculative move and take decisions based on some assumptions, but some people go over board and damage their future at the cost of today. On that point I want to focus on two main points – which are

We are Consuming more today and not leaving much for future

The biggest problem I see today in most of the people financial life is that they are consuming a lot on the name of “Life is here to Enjoy” .. Yes – its a crime if you dont enjoy your life despite earning so much, but there is a limit to it. There is a always a cieling to your spending. If your yearly salary package is Rs 8 lacs, then you should NOT be spending all 8 lacs , because you “feel” , next year your package will rise to 10 lacs and “at that time” you will save more. If your salary is 8 lacs per year, you should start with Rs 5 lac car, and not Rs 16 lacs car, because your future looks bright. It just does not work that way in most of the cases.

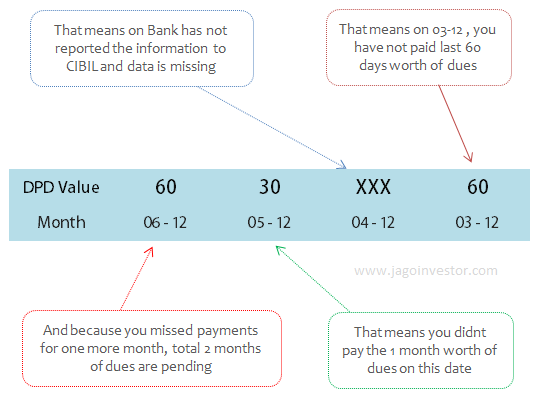

Getting into Debt Trap

Another issue is that, When things dont turn out as per your expectations, you also feel very disappointed and frustrated and start comparing your imagination with reality. Just because you assume future is too bright, you spend on those things, which you dont really need today, but have potential to pay. You also over spend and this is also a cause at times for Debt Trap, you get into a small debt first, you assume its normal and next month you will take care of it, and then it never happens and after 3 yrs, you feel you should have controlled yourself in the start itself.

One of the guys commented his real life experience on one of the facebook groups I am part of. Here is what he said

The biggest problem with our generation is that we overestimate our future cash flows,, think ourselves entitled to expensive lifestyle due to easy credit and fall prey to EMI trap rationalizing it with our increasing incomes every year. I represent this generation and have badly suffered the consequences of overestimating my future earnings.

I took personal loan for construction of my home, then took top up loan next year when my salary increase and put it in interior and then again took maximum personal loan that I was entitled to for my sister’s marriage next year rationalizing every time that my income will only increase every year in my job.

But then I left job to start a business with one of my friends and all hell broke loose. All my cash flows dried up, debts increased andI was reduced to begging for money. I had to live on borrowed money for more than a year. All my aggression,confidence,self image and big talks took a bad beating. It was hell of a time. Now I hate debt and credit of any kind. It is slavery, bondage and evil.

You never know when things can go wrong for no reason or for no mistake of yours. Think a hundred times before committing yourself for high EMI, high tenure loans.

(Source : Asan Ideas for Wealth Facebook Group)

How long can you survive financially if you loose your job ?

So you must be wondering about your own case right now. Let me ask a very simple question – “If you loose your job, how many months or year can you survive without working?” . This is a powerful and disturbing question at the same time. If you have been working for many years, and your answer to this question is in months, then there is some issue.

Whats the right way ?

There is no right or wrong way here, there is only logical way. You always have to keep a balance in your spending and saving. You can surely expect the future to be good and bright, but make sure you do not over leverage to a limit which turns out to be a disaster if things go wrong. Also think about situations which are negative and then take a balanced decision.

Let me know what are your comments on this topic ? Have you ever faced any issue because you over estimated things ?