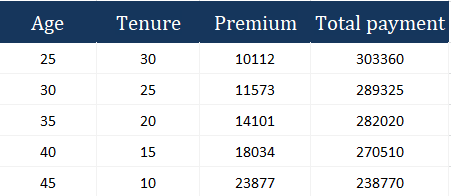

Imagine you are 25 years old earning 6 lacs/year, with a family to support financially. A Term insurance policy with some cover (may be 25 lacs) will have premium of 5k per year (for 25 years old) as the premium for this policy.

Almost 99% people need Term Insurance, But most of the people show good amount of reluctance, because they see “wastage of premium” incase nothing happens to them.

Let us try to see what are the reasons for this?

This happens because of some psychological reasons. Some of the reasons and counter arguments are :

1. People are not ready to accept subconsciously that they have equal probability of death like others; everyone assumes themselves to be little safer than others.

Counter Argument : A different case, someone tells this person that he has chances of dying within 20 years somehow explicitly, there are greater chances that his perspective about Term Insurance will change and he may go for a good amount of cover with this premium, the reason is that now he sees these [premiums as risk cover fees and not wastage.

Now he has convinced himself that there are good chances that his “death” is possible and his family needs some good cover, although there has not been any change in his lifestyle or life in general, all what matters is his attitude towards Risk coverage.

2. People do not concentrate on the value provided by Term Insurance and its cheapness, it is taken for granted.

Counter Argument : I did this very small survey where i asked my friends online. See one of them below

manish_chn: if your company says that it will cover your family for 25 lacs, but will cut your salary to some %

manish_chn:what will be the max % you are ok with

manish_chn:just the first number which comes to your mind

manish_chn:no calculation

manish_chn:please

rajagopal: hi

rajagopal: never thought about such things.

rajagopal: probably 5%?

rajagopal: without any calculations

This shows that a person somehow feels comfortable with 5% of his salary getting cut for just 25 lacs of cover for his family; it means that he can pay the price of 5% of his salary per year for 25 lacs cover.

Some people were even ok with 10% or 7%, on the average it was greater than 5%, whereas the real worth of cost is less than 1% of their salary (everyone’s salary is more than 6 lacs/year ). Cost of 25 lacs cover in market = 5k – 5.5k per year.

3. People pay money from their pocket after getting salary, so it feels that they are giving money unnecessarily.

Counter Argument:

If you make term insurance mandatory for everyone and cut 1% from their salary (6 lacs salary, and cut 500 per month for insurance premium of 25 lacs). In this case there are very high chances that almost everyone will feel that it’s a good thing. And they will even appreciate this move (there are always exceptions, but i can’t help those people).

What it shows is that people are lazy, when you do things purposefully; there are great chances that they will understand the importance of something.

So, if you give them 100% salary, they might not take the term insurance.

But if you give 99% salary and 1% is cut as insurance premium, many people will tell others how great there Company is !! (You can also just cut 1% and put it in your pocket and give them 99%, some people don’t even notice these things)

Summary

Understand that a lot depends upon yours perspective about something. When you see things in a different way, its meaning and importance chances totally for you.