Today, a real-life architect is going to share with you some of the most essential things investors should check before buying property in India. Do you want to know what are the topmost things to look into the property before you take that big decision of booking the property?

Do you want to know what are some of the tricks builders employ and how they make decisions? Mr. Abhijeet Patki, a practicing architect, who is also a consultant to a reputed architecture firm in Mumbai has agreed to share his knowledge with all of us.

Mr. Abhijeet is one of the readers of this blog just like you and when I asked him to write an article about this area, he agreed instantly.

Mr. Patki has an experience of more than 11 years in the field of architecture and interior design and has worked on different kind of projects that includes IT Parks, Commercial Buildings, Residential Projects, Heritage Building, and many commercial interiors projects. So I hand over to Mr. Patki to share his wisdom and knowledge with you all.

8 important checklist points before buying property

Detailed descriptions of this checklist are done at a later stage.

[su_table responsive=”yes” alternate=”no”]

| Checklist #1

Project site or Land |

Checklist #2

Approvals from statutory bodies |

| Checklist #3

Flat Layout |

Checklist #4

The view outside your flat |

| Checklist #5

Specifications |

Checklist #6

Luxurious and Affordable homes |

| Checklist #7

Fire Safety (In tall buildings) |

Checklist #8

Big versus Small Developers |

[/su_table]

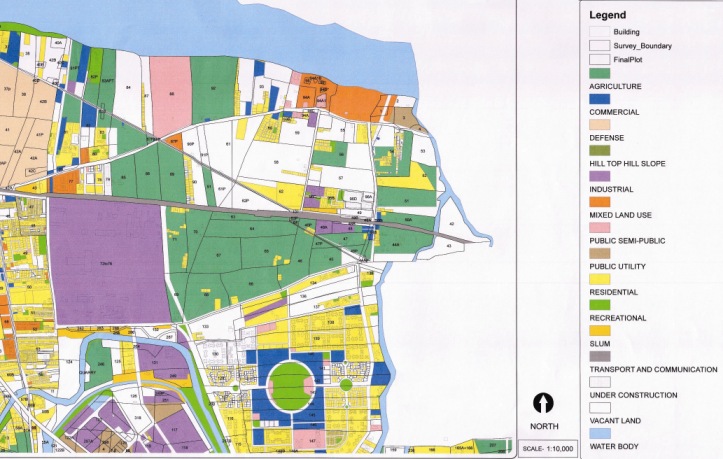

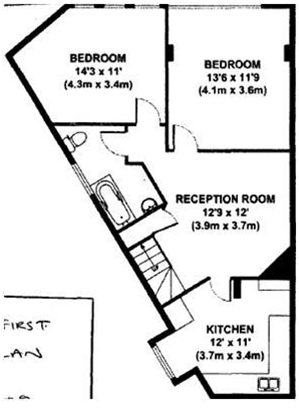

At some point in time in our life, everyone feels of owning a house. It may be for their own stay or as an investment. Depending on the stage of one’s life, buying a home is associated either with ambition or necessity or influence through various parameters.

It is taken for granted that it is THE ultimate investment to secure one’s future. Surprisingly, despite not having a regulatory body, an investment in real estate is assumed by many as a safe bet – safer than Equities, maybe because most of them are fortunate enough to not have faced any issues with their properties. However, the risk factor in this investment is equally grave like any other modes.

Without proper diligence, your dream investment certainly comes with a potential risk that can have lifelong repercussions on your livelihood. By no means I intend to say that all buyers are ignorant about the property survey before finalizing it; it is just that their analysis about their ‘to be’ property is limited to generic factors.

Usually, any Indian buyer looks broadly into the following parameters while selecting a property. Interestingly, a buyer buying property for his stay would look into the aspects in an order as mentioned below, while an investor will reverse the order except point #2 which will be on top of the list.

- Location & convenience factor.

- Rate of the property in comparison to the market trends in the vicinity.

- Surrounding neighborhood.

- Amenities offered by the builder.

- Building aesthetics.

- Expected rate of appreciation in the future.

What about Flat Layout?

You may be curious to know as to how I could not include an important factor – ‘Flat layout’.

Indeed, it is one of the most important factors while buying the house, but the price of the property generally takes precedence above the layout. Here the typical Indian mentality comes into mind – “Our budget is Rs. X Lakhs & we shall buy the best (bargained) property within our limits”.

Thus, in order to stay within their planned budget, many people let go of a flat that has a good carpet area or a better layout.

While it is a debatable topic about increasing a budget for a better property or buying a suitable property within a planned budget, all that I want to say is that in most cases, the price of the property governs the selection of the flat and not the layout.

8 factors every investor should check before buying a property

Anyways, moving ahead, I am going to make you aware of some very important factors that should be considered while buying the flat which is usually overlooked or is unfamiliar to the common man.

1. Project site or Land

The very first check that one needs to do is about the land on which the project is planned. The land should be a Non Agricultural land (often called NA) and should be registered with the local municipal body.

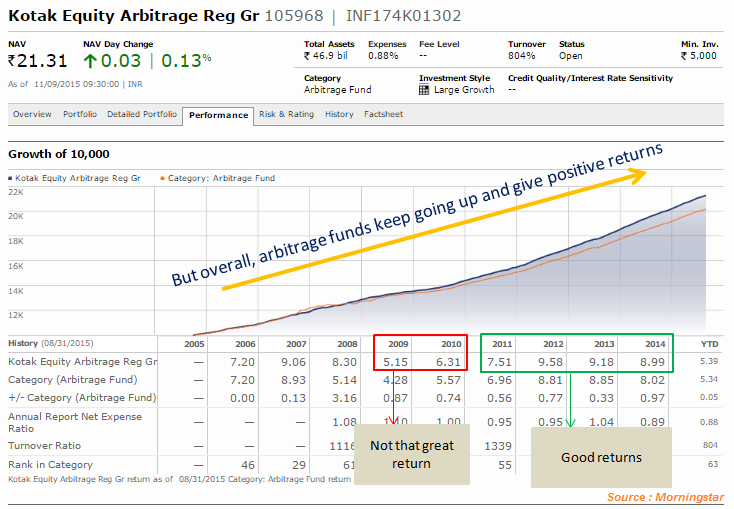

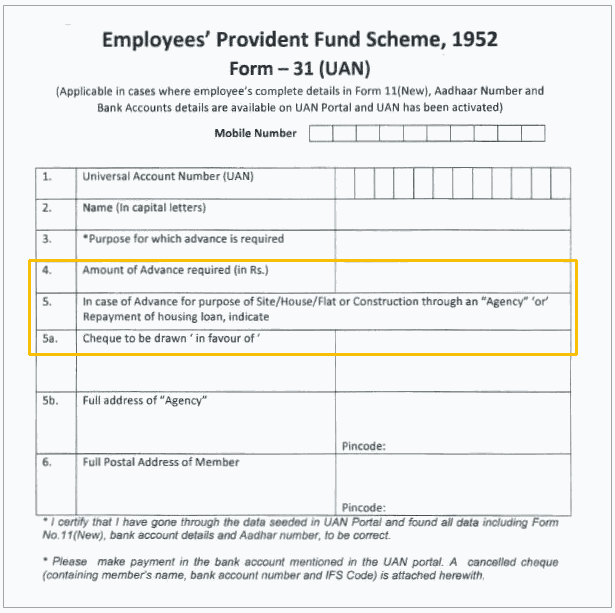

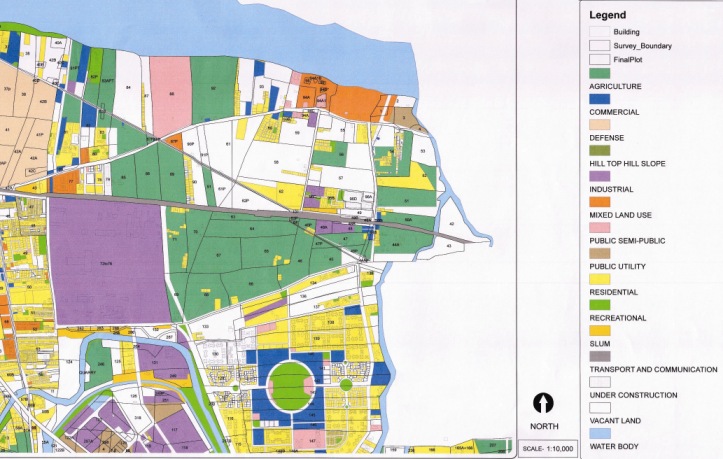

Each property comes with a ‘Property Card’ which mentions the details of the current owner of land and its status. Apart from the type of land, one should check in the city ‘Development’ Plan whether the land is earmarked for any reservations such as – playground, police station, public welfare amenities, religious structures, slum rehabilitation, etc.

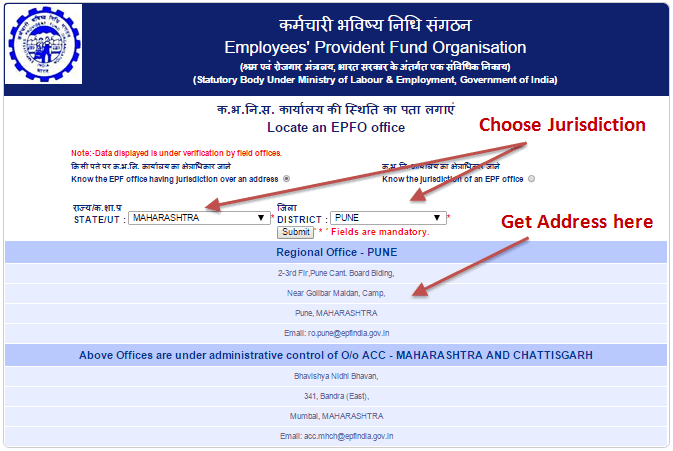

For any city development plan, you will generally get it from the website of the municipal corporation. For example, in the case of Pune, you can get it from here.

Below you can see a snapshot of how it looks like

No residential development can be allowed on lands that have reservations other than that for residential projects.

If the land had reservations & the developer claims that land usability has been changed with local authority permitting the same, then please ask for the proof for ‘Change in Land Use’ from the local body & State ministry of Urban Department, supported by valid approvals / NOCs covered in subsequent point.

Further, inquire if the land is a freehold land or leased one. If it is a leased land see the contractual documents relative to lease – lease tenure, usability, other conditions etc.

2. Approvals from statutory bodies

If there is any parameter that is of utmost importance while choosing a property, then it is this. Your property has no value if it has not got required approvals from the local authorities (municipal corporation or likewise).

Sellers advertise in a most generic manner in one line “All approvals in place” as they are aware that nobody will go deep into the investigation of the approvals.

I am located in Mumbai and I can tell you that any project that is planned to be executed in Mumbai requires more than 100 permissions / NOCs from various bodies and during different stages of the construction. This document gives you a good idea for these permissions and NOC required in various states

Ask for approvals form builder

As indicated earlier, the list of approvals / NOCs is not exhaustive and varies from cities to cities. It is recommended to investigate the status of the approvals with the builder, see the original documents before you make any monetary transaction. Yes, it is a bit complex to understand the approval process, inquire about the permissions, etc.

However, one can always appoint or seek advice from a local municipal leasing consultant at a nominal cost to carry out an assessment for you. It is a small price that you pay to safeguard your big investment and you can rest assured about the legal intricacies.

Many investors/buyers fall for the lucrative offers during ‘Pre Launch’ of the project. The attractive prices make the buyers hasty in buying the property. However, buyers should be aware that the Pre-Launch offers are marketing gimmicks and generally approvals are in the process during this stage, thus posing a risk to your investment.

3. Flat Layout

This is another important aspect to think about before you finalize the property. This becomes a family’s habitat for years to come. Regardless to say, the flat should provide you comfort, joy and a sense of complete satisfaction.

Taking all members of family in confidence, it should become a unanimous choice and one cannot leave a chance to regret the choice at a later date.

Important points one should remember

a) Your Life Style – First and the foremost thing you need to evaluate is whether your current lifestyle or routine would remain as it is or get better OR you would have to compromise on certain aspects.

If you anticipate a well-informed compromise & are still ready to buy it, then you may take that in your stride for a few days or even months. But deep inside, you would start regretting that compromise as the years go by and as you get used to it.

We buy a property for our betterment but if that is not happening then it becomes a liability. This point is more important for ladies in families because, in India, houses are run by our mothers and wives. If they are not happy, no member of the family can be.

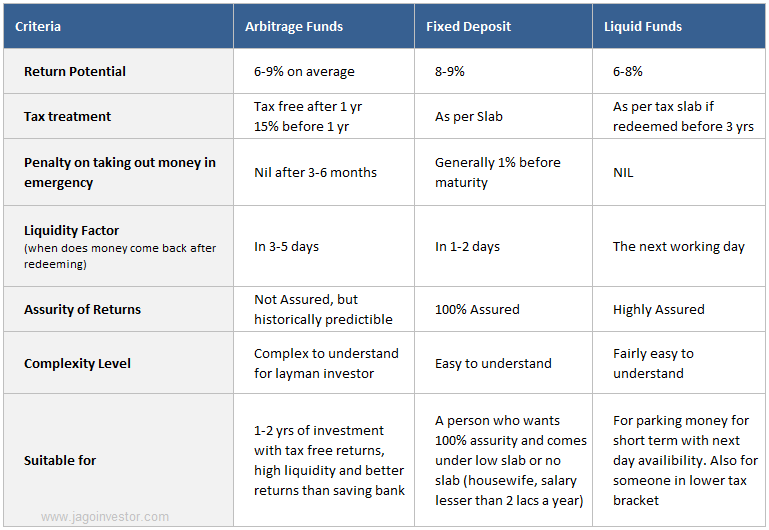

b) Do not fall for the saleable area figures – Saleable area includes the common areas of the buildings in addition to the carpet area of the flat. Generally, the saleable area is additionally 35% to 60% over the carpet area.

For example: If you are planning to buy a flat with a carpet area of 700 sq ft, then the saleable area is generally between 1000 – 1300 sq.ft. which includes the common areas like – lift lobbies, terraces, clubhouses etc which is proportionately divided among all flat owners.

The cost of the flat is generally projected in a saleable area which is actually wrong. Carpet area should be of primary importance to you as you are going to use this area for your habitat, hence try to do dealings on carpet areas instead of saleable areas.

c) Carpet area is important – Check the room sizes and the carpet area of the flat you are choosing. A carpet area is a usable area measured from wall to wall. In a layman’s language, it is that area where you can lay your flooring or carpet.

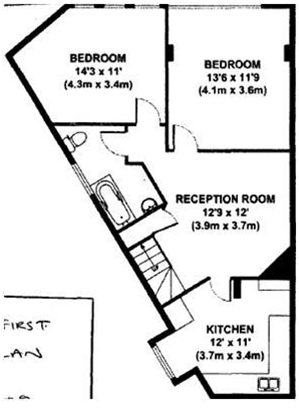

Room sizes should be adequate for us to maneuver comfortably after all the furniture is placed. Room shapes should be ideally rectangle or square.

At times developers concentrate more on building elevation/form to make it prominent in the locality but that can result in odd shape rooms or acutely angled corners were placing furniture is not possible. It just becomes a waste of space; yet paying for that area is inevitable since it gets counted in the carpet area.

In the adjacent image, you may note how tricky or difficult it would be to plan furniture in the odd shape bedroom and the living room. Also, the toilet is of a funny shape. To ensure that room sizes and shapes entail you to use each and every inch of the space.

d) Vaastu compliance – Many buyers are stringent about Vaastu compliance of the flat – whether it is east facing or west facing, whether or not the entry is in south etc. This is again a subjective factor with opinions varying from buyers to buyers.

d) Vaastu compliance – Many buyers are stringent about Vaastu compliance of the flat – whether it is east facing or west facing, whether or not the entry is in south etc. This is again a subjective factor with opinions varying from buyers to buyers.

Although being an architect, I am not an avid follower of Vaastu principles for an apartment flat, just because I am not convinced with the principles of Vaastu in a mass housing scheme. Vaastu was applicable then when people had their own dwelling unit on their own land.

So, if you are buying a plot or a bungalow, applying Vaastu principles can be convincing, but applying to an individual flat just doesn’t look convincing. Imagine for a moment, that you find a Vaastu compliant flat and choose to stay in it.

However, you later come to know that the plot, on which your building is built, is not Vaastu compliant. Further, in such mass housing schemes, it is extremely difficult to apply and comply with Vaastu principles.

So it all boils down to your ultimate choice – whether you want an apartment flat that is very good in layout but not Vaastu compliant or whether you are okay to compromise on layout and be satisfied with Vaastu compliance.

e) Deviation of room size – Further, it is very necessary to check the actual sizes of the rooms that are constructed. Brochures indicate room sizes uniform for all the units. However, they vary a bit as per the construction. A deviation of 1-2% is accepted as a standard norm because construction is never 100% accurate.

There is always a construction tolerance of 15-20 mm applicable. So ensure that you pay for the carpet area that you get.

4. The view outside your flat

This is a selling point that is hot favorite by the builders. “Sea facing flats”, “Flats overlooking the green fields/hills” and similar panoramic views become a USP of any project.

With the help of advanced software’s & computer-aided renderings, developers even showcase you during the sale inquiry, the view that you would get once you occupy the premises. We all become excited and we get emotionally attached to the property. While a good view enabling adequate daylight & ventilation is absolutely necessary, one has to be very careful of the ‘view’ aspect.

While you would be certainly happy with the view that you may get, you just need to ensure that you would enjoy it permanently or at least for the long term.

There have been instances where the customers have paid a premium price to achieve a great view from their windows but within couple of years, their view got obstructed permanently because of a new building getting constructed on the land adjacent to their building/premises. Here you can’t blame the builder too because things outside his plot, is not under his control.

So, if you are vouching for that great view at a premium price, ensure that there are no chances of development that could obstruct the view and even if there are any in the future, see that the daylight, ventilation & privacy will not get compromised.

In the image below, you can see how the new building on the right has blocked the view of the building on the left. Fortunately, the natural daylight & ventilation for the older building is still intact.

5. Specifications

When we intend to buy an electronic gadget, say a mobile phone, we tend to go deep into its specification – Operating system, processor, storage capacity, battery life, etc. All this study is carried out for a gadget that costs mere thousands of rupees and is with us for a couple of years.

Contradictory to it, a purchase like a property, which runs into lakhs and crores of rupees & which could be with us for decades, is finalized on the aesthetics and other generic factors mentioned earlier. Little do we get into the details of the specifications.

We seem to be satisfied with just the high-level things which are provided to us – wooden flooring, granite kitchen platform, wooden doors, vitrified tiles so on and so forth. But we ignore the specification of those materials.

For example, what type of wooden flooring, can it remain durable with daily floor mopping, what type of wood is used for wooden doors & frame, what brand of vitrified tiles is used, how the waterproofing is done & what is the technique used. All such questions need to be asked to the developer.

Yes, one has to first get appraised with the knowledge in some way, but that shall do a world of good to you. With Google providing answers to any question, it does not seem impossible for you to get into details of materials.

Developers generally limit their capital costs incurring on the interior finishes or items that become a part of the customer’s possession. They simply ignore the aspect of operational costs as the money goes out of the resident’s pocket.

Real-life example – My personal experience

Let me give an example of this. I was involved in a design scheme of bungalow projects in the city of Pune. The bungalows were meant to be of high-end finishes providing luxury to the owners.

All interior finishes were selected accordingly to meet the expectations of a luxury villa. Buyers went crazy over the finishes and it became a strong selling point. However, there were few other items which were equally important but went unnoticed – one of those was the glasses that were used for windows & facades. Everyone knows that Pune has a hot climate and the summers are extreme.

Needless to say that people do require ACs in their rooms. Now the tonnage of an AC depends on the size of the room and size of the window openings. Bigger the window opening more is the tonnage required as there is a considerable heat transfer.

There are glasses available in the market which cut down the solar heat getting transferred through it, without affecting the vision. If such glasses are installed, then there is a significant saving in the AC tonnage requirement which eventually saves the electricity.

But these glasses are a bit expensive compared to standard glasses. Needless to say, that builder chose standard glasses as his capital cost was involved and he was least bothered about the AC requirement and its consumption. You must have now got an idea of how important it is to have materials with appropriate specifications.

To conclude, the materials that are used as finishing items of the flat costs are always bargained to fit in the budget and hence may not be of the highest quality or the one that cut downs its maintenance.

They are all standard products that the developers get at a very low rate due to bulk ordering. Assess the items that have been proposed and if that would require frequent maintenance / periodic replacement etc.

6. ‘Luxurious’ and ‘Affordable’ homes

Developers have started a new trend of marketing their schemes like the one that provides ‘Luxurious flats’, ‘Ultra-Modern flats’ and even ‘Affordable homes’. While it is an individual’s choice of deciding how should be his lifestyle and gaining luxury with hard-earned money is no wrong.

But buyers have to be prudent in knowing what ‘Luxury’ is being offered. Understand whether the luxury is being offered as a spacious flat with a large carpet area or a standard / compact size flat with finishing items with high-end specifications.

If you ask me, luxury is having a spacious flat which will satisfy your needs & also give you good resale value. The other aspects included in luxurious schemes are amenities, spas, concierge services and many more.

While this can be a treat for people who really desire such facilities, for middle-class buyers it can become a big liability because once the builder hands over the scheme to become a society, then the overheads in maintenance can shoot up much folds.

So luxury will always come at a high cost and one has to decide about it with a long-term financial implication.

On the other hand, affordable homes are marketed with a certain attractive price tags. But they are located far from the city center. So the purpose itself gets defeated. Flats can be termed ‘Affordable’ if they are within the municipal limit of that city with good public transport & convenience factors.

But that is generally not the case. It is located far away in areas that have good low rates if you buy resale flats. Further, the specifications used for building materials can be substandard to reduce the overall construction cost. So it is better to check the specifications of all the materials.

7. Fire Safety (In tall buildings)

Tall buildings are sprouting up because of a lack of space in the city. It is also an economically viable option for a developer to go for tall buildings within a city where the development charges are high. Buyers too are excited to live in a tall building where they can enjoy great views, daylight & ventilation.

But what one doesn’t take seriously is the fire safety measures or evacuation strategy in case of emergency.

Below is a nice presentation giving the full specification of how a high rise building should handle various things at the time of construction to combat the fire safety issue. If you live in a high building, please check if your building has things mentioned in the presentation or not.

Builders do provide the fire fighting equipment & fire egress stairs since they are to be provided as per the building codes. However, one should ask the developer, the evacuation strategy envisaged in case of an emergency.

Ask them the fire rating of the walls and concrete structure. Fire rating means the time taken by materials to succumb under the event of a fire. Ideally, it should be rated at 1-2 hours.

Check the refuge area, where in case of emergency, residents are supposed to gather and stay safe till the fire personnel come and evacuate them.

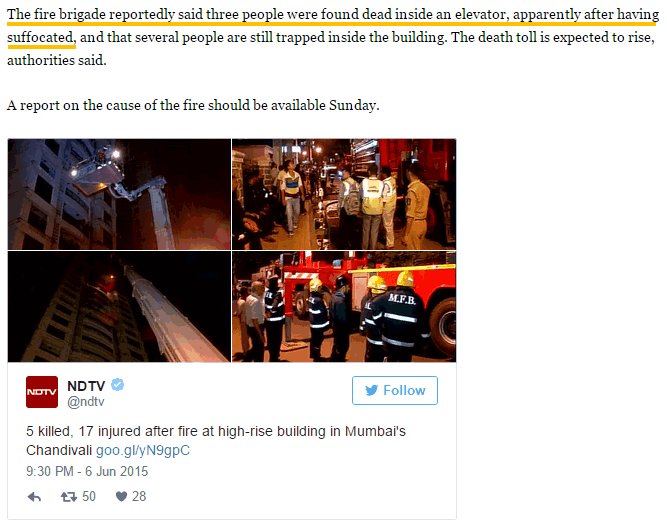

Do take a look at the fire staircase & if possible, do descend by it. This is because, in case of fire, you are supposed to use the staircase & not lifts. A few months back only, there was a case of fire in a high rise building in Mumbai, where people died because they were stuck in an elevator

So you should feel comfortable while getting down. Ideally, the builders should provide the fire fighting gadget – water sprinklers in individuals flat too so that in case there is fire, it is arrested by sprinkler burst.

But very few builders are committed to such precautionary measures as they understand the importance of safety. Others limit their scope only in common areas like lift lobbies and foyers.

If you are opting for a resale flat in such a building, ensure that fire fighting equipment is operational & that the society is committed to maintaining it. Also, ensure that all egress paths are free from any obstructions enabling comfortable progress.

8. Big versus Small Developers

It is a general opinion that one should buy property from big, reputed developers as their schemes & construction quality is superior. Someway, buyers feel more reliable on them and are willing to pay more expecting superiority, timely possession, transparency etc.

Let me be very clear that – this is a myth.

There are many small developers too who give equally good service. In fact, prices of the reputed developers are high to cover their marketing cost & branding. You are certain to get equivalent quality of flats from small or medium-sized developers.

The most essential thing is to check their past records irrespective of their stature. So before investing in their property check out the projects they have completed. Get in touch with the residents living in their old schemes.

Inquire with them if they got possession & occupancy certificate on time. Ask whether the process of builder handing over the conveyance deed for society formation was smooth or rough. See how the buildings are looking after a few years – whether they still look decent or have deteriorated rapidly.

Check the monthly outgoing of those societies and if it is high what are the reasons for it. After this survey, you will surely get an answer as to how good the builder is.

I believe with all the points that I described above, you must have got a fair idea about how complex it is to choose the right property and how one needs to be cautious, appraised of all the intricacies involved for selection. The above list is certainly not exhaustive and can be extended further but till then, this should hold good.

By no means am I discouraging anybody from getting into the real estate investment, but it is just a word of caution for buyers & investors.

Quick Checklist while buying the flat

- Information about the Land – to confirm if it is NA plot, non–reserved plot, freehold / leased, etc.

- Approvals for the projects (Varies from cities to cities)

- Infrastructure around the project/building – electricity, water line, telecommunication line, sewerage disposal line, stormwater drain line, etc.

- Potential development around the project.

- Facilities around the project – Public transport, hospitals, schools & colleges, markets, police station, etc.

- Track record of the builder – visit past completed projects

- Availability of funds for the builder to complete the project – whether it is a self-funded or bank-funded project.

- The overall scheme of the project

- Evaluate the probable outgoings once society is formed. More the facilities, the higher the outgoings.

- Carpet to Saleable area ratio – Prefer to carry out a transaction on the carpet area.

- Flat carpet area

- Flat Layout, Room sizes, and shapes

- Availability of adequate daylight & ventilation.

- Does the planning of the building/project provide comfortable access to senior citizens & handicap people?

- Good quality of finishing materials – flooring, kitchen platform, bathroom fixtures, windows, doors, paints, etc.

- Guarantee on waterproofing for bathrooms & flats below the terrace.

- Fire fighting systems and evacuation strategies.

- View from the building / flat.

- Do periodic site visits to check the progress and workmanship quality.

- Ensure a safe handover of the project from a builder to make a cooperative society.

- While buying a resale flat, ensure that the property is a freehold property & that the seller provides access to NOC from the society, Chain of all old registered agreements, Occupancy certificate, share certificate, Maintenance Bill, Electricity or Telephone bill, Property Tax receipt and Registered Sale & development agreement of Builder, Conveyance Deed.

- While buying a resale flat, ensure that the water supply is provided by the corporation / local authorities and not by tanker water. If that is the case, then either OC is not available or the water supply line to the area is not available. That will shoot up your monthly outgoings.

Hope you enjoyed reading it and let me know if you liked it. Thank you.

Disclaimer – The information and views expressed in this article are those of the author to create awareness and does not necessarily reflect the official opinion or guarantees the accuracy, completeness, currentness, validity in any way.

Neither the author nor any person acting on their behalf may be held responsible for any errors, omissions & delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

|

About the Author

Architect Abhijeet Patki is a practicing architect and a consultant to a reputed architecture firm in Mumbai. Graduated from the University of Mumbai, Ar. Patki has experience of more than 11 years in the field of architecture and interior design. Ar. Patki has worked on different kind of projects that includes IT Parks, Commercial Buildings, Residential Projects, Heritage Building, and many commercial interiors projects. |

d) Vaastu compliance – Many buyers are stringent about Vaastu compliance of the flat – whether it is east facing or west facing, whether or not the entry is in south etc. This is again a subjective factor with opinions varying from buyers to buyers.

d) Vaastu compliance – Many buyers are stringent about Vaastu compliance of the flat – whether it is east facing or west facing, whether or not the entry is in south etc. This is again a subjective factor with opinions varying from buyers to buyers.