Do you take all your decisions based on facts or emotions? Be it personal or financial life, it’s a well-known fact that 95% of our decision are based on emotions.

Today we are going to look at various kinds of behavioral biases in the area of money and in general. For this, I got in touch with Mr. Siddhartha K Garg who is an expert on this topic.

We had an hour-long conversation on various things and how investors make mistakes in their financial life because of various emotions. You can listen to a 1-hour long audio podcast below. Just make sure you listen to the full conversation as there are various points discussed.

If you do not want to listen to the audio podcast, you can go through the summary point of our talk below.

What are biases?

Simply put our brains give more attention to something but less attention to something else, despite there being no actual inherent reason to make such a distinction.

And hence it is a bias – that is making a distinction without any reason. A simplest example which you yourself can notice right now – how many positive stories from today’s news do you remember v how many negative stories? I am certain many more negative stories than positive ones.

This is because our brains are hardwired to pay more attention to negative stores than positive ones as the negative ones are more likely to harm us. Or why that pollution in Delhi only becomes an issue every winter, but not so much in summers. Because we are biased to give more attention to an issue when it is right in front of us as opposed to something in the future (this is called proximity bias and we will shortly discuss it).

Now, apart from small purchases like everyday items, these biases can wreak havoc on your long term wealth if you don’t take steps to check them! Want to know more? Let’s read on and think which ones of the following have you already fallen prey to?

Bias #1 – Anchoring effect

Definition – Rather than explaining what this bias is, allow me to illustrate how it originated – once a shopkeeper was trying to sell a mixer grinder and was having a very hard time trying to do so. He had priced it at 25US$ and was aggressively marketing it, yet the customers just wouldn’t buy it.

But one day suddenly his sales started shooting up. Perplexed as to what is the cause of this upward selling, he went to the aisle where the mixer-grinder was stocked and noticed that a shop employee had put another similar company mixer-grinder next to it and accidentally put a tag of $100 US on this 2nd model, despite there being barely any difference in the 2 models.

What the shopkeeper noticed was that the customers would anchor the price at the heaviest figure and then judge the models based on such price and not go into the features etc of the models at the display. As a result no one even touched the 100$ mixer-grinder but the sales of the 25$ shot up.

- Example – Another similar example would be that of a famous café in Italy, that apart from the usual coffee and food items in the menu also have available for purchase a Vespa! (one of those hipster scooters) Now they obviously don’t expect anyone to buy it, but just by seeing that price tag of 800 Euros on the menu card makes the 30 Euro coffee seem not that expensive.

- Solution – Now that you know about this bias, you will automatically notice yourself gravitating towards such an item, whose actual value is not worth the price or maybe you just don’t need it. Point being – decide on the purchase on the cost of the item relative to its own quality and your need and not to some item thrown in the menu to throw you off track

Bias #2 – Sunk-Cost Fallacy

Definition – Divestiture aversion or in simple we are averse to letting anything go which we already possess. In more common terms this is when we throw good money after bad.

- Example – keep sticking with some stock despite consistent under-performance because we think it may improve

- Solution – cut your losses – yes, a little bit of loss is better than huge loss and what you get back can be re-invested and earn to counter the loss made

Bias #3 – Confirmation Bias

Definition – we look for sources of information that confirm our beliefs rather than oppose our beliefs

- Example – people who have a right-wing philosophy prefer Facebook pages that cater to that view or with left-wing philosophy will only follow pages that talk about their beliefs. Or in investment parlance – those who believe that FD is safest and surest will try and avoid news outlets or people who say that you must have equity exposure also.

- Solution – get a mix of information sources and don’t just limit to one side. Hear everyone and have contrast exposure to all investment strategies.

Bias #4 – Halo effect

Definition – Halo is the golden circle you see above the heads of angels. Like in Tom and Jerry, whenever one died they showed the character in white robes in heaven with a golden circle above their head.

So in this bias, we get a halo above our head after we do something good (like not over-spending throughout the week or doing a financial review of all your insurances and investment on a weekend), that now you think that you are good boy and can get away with a little bit of unexpected spending.

- Example – Sometimes people work out a lot in a gym and think that now they deserve it and come home and order Dominoes. Similarly, people can do in financial life, like for example after spending a weekend going through your finances, documents and portfolio status people think that they have done all the right financial habits that they go and splurge in the mall on Sunday evening.

- Solution – notice that this is a common behavioral trap when you see yourself falling for it, back off and stick to your investment or budgetary plans.

Bias #5 – Bandwagon Effect

Definition – in simple words it is the herd mentality

- Example – in your office everyone decides to invest in gold because the market is low and do so you. Or your relatives and uncles decide that life insurance is the best way to save tax, you also decide to follow. When clearly they are the wrong choice. One person example – in the SCBA (Supreme Court Bar Association) there is a tie-up with a particular company’s life insurance. And I see many people just buying that insurance because most of the other lawyers are also buying it. Now I am not saying that this particular company’s offering is bad but only saying that just because everyone else is purchasing it, makes it the right option. One should always purchase, not blindly following the herd, but after carefully analyzing the options.

- Solution – Don’t just follow the crowd but analyze what are your requirements and then what are the best solutions based on your investment need. If you are a young salaried person then invest in equity and if about to retire and obviously can’t carry many risks then look for safer options – maybe debt funds. But don’t just follow the crowd and invest based on your requirements and financial situation.

Bias #6 – Proximity bias

Definition – we give more importance to things in our current than in the future.

- Example – The study of people under F-MRI shows that for future they viewed themselves with the same regard as a stranger. In fact, doctors in the US, show the pictures of people on a computer screen that if they don’t exercise or take their medicine then in the future they will look so and so and this caused more compliance to the diet plan.

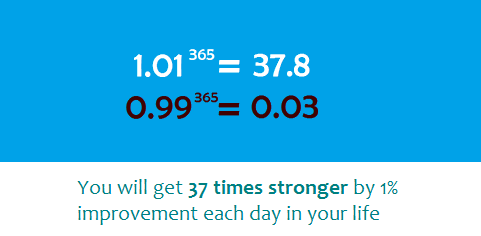

- Solution – it might not seem important now but your future will be present soon. Days are long but years are short – so, start saving for retirement from the very first cheque and start your SIPs early to take advantage of cumulative interest.

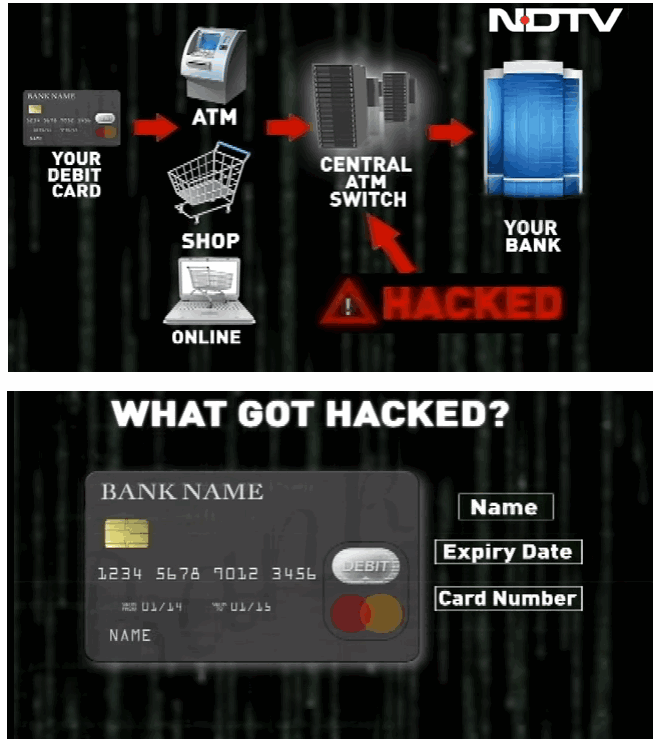

Bias #7 – Recency Bias + Negativity bias

Definition – we pay more attention to negative and recent things

- Example – stock market crashed – as opposed to a long string of bull runs or that many companies did farewell and decide to go for FD and not invest in mutual funds

- Solution – Stick to a chosen investment strategy based on goals and not let blips change your mind

Bias #8 – Status Quo Bias

Definition – that we prefer to let things stay as they are and not rock the boat – it’s going fine then why shake things up

- Example – simples would be not analyzing your portfolio – it’s going fine. Why apply mind and let it be

- Solution – No! Get over the laziness and devote some good time like Sunday afternoon after lunch one hour once a month without phone calls or emails or any distractions and get things done.

Bias #9 – Information Overload and attention deficit

Definition – you are overloaded with information and you just get paralyzed. You stop taking any actions because you are over-analyzing things and not able to arrive at decision.

- Example – let’s say you want to decide which mutual fund to invest in and get bombarded with options and decide that let’s just get the simple FD done. In fact, a study from the US shows that a company offered its mutual funds to invest in on the company’s expense. With 3 options, 75% of people selected a fund. But with 10 mutual funds options, the purchase rate dropped down to 25%.

- Solution – get basic research done and then keep cutting out irrelevant information, get the main data and then decide with the help of an expert – hired or a family or friend. But just because lots of work doesn’t mean you should not do it at all.

Bias #10 – Snowflake fallacy

Definition – if you see snowflake under the microscope the you see that each snowflake is unique and so do we, think that we are special in the universe and that we know what we are doing is right or that our problem is unique and no solution to it out there, as result don’t look for the solution

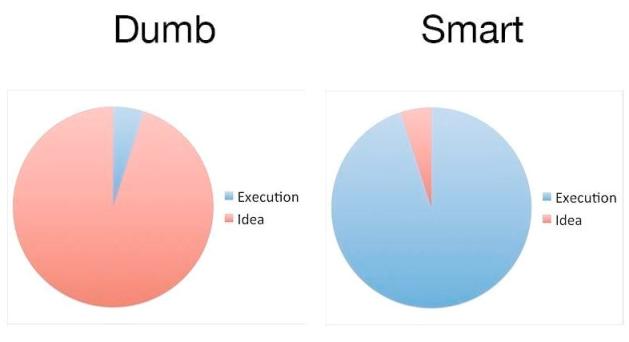

- Example – We think we know it all and can conquer the stock market. Stop – if you are an average person who wants full-time work in the field you are better with mutual funds. Which is basically a collection of stocks picked by experts.

- Solution – remember that you are not unique and get your major decisions reviewed by someone knowledgeable in the field and don’t just ignore the basic rules of investment.

- Main example – Even Sir Isaac Newton was not able to beat the stock market! In the 1720s had lost about 3 million US$ (in today’s term) when he tried to play the market on the stock of a company called “South Sea Company”.

Bias #11 – Lifestyle inflation

Definition – This is also called the “Hedonistic adaptation” – it basically means that once your salary etc starts increasing, subconsciously your spending also starts to increase. You won’t even notice it. And hedonism means the philosophy of seeking pleasure and when your salary increases you adapt your lifestyle for more pleasure, hence causing the hedonistic adaptation.

- Example – You have a nice 50 inch LED. Your salary increases and you start thinking why not a 60 inch LED TV. Then after some time, you decide why not a 4k LED. Then you decide why not an Android enabled LED. Now even with the 50 inches LED you were fine. But slowly and creepingly there was inflation in your lifestyle. And to afford the same TV on EMI, you have to work more, the same time you could have just spent with your family enjoying the latest movies on the 50 inch LED! The problem that I am highlighting here is that I am not at all saying that don’t buy more as your income increases. Obviously, with more income, you would want more things but don’t go overboard and stick to your needs. And make sure that as your income increases so do your savings for retirement etc also increase because otherwise with more income and also more expenditure your savings rate will remain the same and maybe, if you don’t notice, it might even decline – as you save less even though are earning more!

- Solution – be wary of your purchases. Keep strict logs and budget your discretionary spending. If you start going overboard then you know that you have become a victim of lifestyle inflation. In fact, a US study showed that people would be happiest at the income of 75,000 USD income and after that particular level of income, the happiness level remained the same and it meant only more stuff in the house.

Few general solutions to deal with biases

- Accept and acknowledge that you are not perfect and can make mistakes – Remember – that you are human and our minds are not in as much control as we think we are. Accept that our mind works in ways that we can’t even imagine and not all decisions are “rational” decisions. This acknowledgment and acceptance is important because then you will know that yes I can make mistakes and I must setup safeguards so that I do not commit these mistakes.

- Never buy major items on the spur of the moment

- Never make any investment decision when (a) sleepy, (b) hungry and (c) irritated

- Sleep over it! – Economists call this as a cool-off period – so you had the requirements with you and you got the various pitches. Now just take all the data and the pitches to your home, go through them once and just forget about it for one day. In a day or two automatically your brain will tell you which one to choose.

- Write it down and be accountable! – When going purchasing – be it a TV, or in the market for an equity mutual fund or new health insurance for greater coverage because you want separate insurance for your old parents away from your family floater policy – WRITE DOWN your requirements and your budget and give them to your partner/spouse/friend. And if you exceed or breach the budget then again write it down again and tell your partner/wife/friend to question such a breach. This will make you accountable for the decision you took. In fact, keep looking at your written note (paper, Google keep, iPhone notes whatever) when doing the purchasing so that any aggressive sales pitch doesn’t throw you off your goal.

We hope you liked this audio podcast and the article. Please share your personal experiences around this topic? Which bias do you feel you have gone through? Share in the comments section.

(This piece is authored by Siddhartha K Garg who is an Advocate in the Supreme Court of India and a former Junior Research Scholar in the Law and Economics Department of University of California, Berkeley. He also runs an NGO Angel Trust for Animal Care in Delhi and can be reached at [email protected])