From last 8 yrs, I have been talking and dealing with investors & I can see some progress on how people see their retirement these days. They have got more “serious” about retirement planning.

Almost all the clients we have, for them retirement is a big goal and their focus on it is worth appreciation. But that’s a very small number, few hundred may be.

If we talk at the mass level (All India level), there is almost no seriousness for retirement planning. At the mass level, people are very short sighted and plan for their short term goals, but not “long term goals”

5 reasons why investors don’t plan for their retirement?

What about you?

Have you started your retirement planning?

Is some money being invested for retirement goal each month?

By “Retirement planning”, I mean a well thought investment plan (it might not be written) for your future. Are you consciously thinking about create a big enough corpus at your 60, which will support you for next 30-40 yrs?

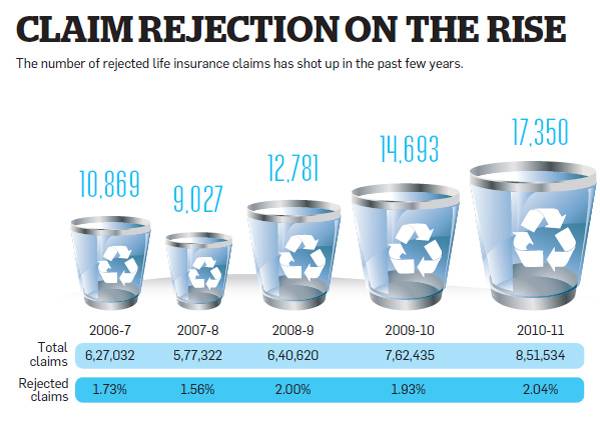

Please do not confuse “retirement planning” with buying some random policy for your 80C deduction, which had a word “retirement” in the name. It’s mostly a well marketed product sold to you on the name of retirement.

Now, let’s see some of the top most reasons why people don’t invest for their retirement seriously!

Reason #1 – It’s a “Selfish” Goal

I recently attended a session where the speaker asked this question – “Which is the most important financial goal of your life?”

To this, there were many answers like ..

- Retirement

- Children Education

- Buying a House

- Getting Debt free

- Stating own business

- Daughter Marriage

But the trend was clear… “Retirement” was not in majority.

The group age range was between 30 – 50 yrs. The speaker was silent for a moment, but then he said something which really hit me.

“Most of the people know deep down that Retirement is their biggest goal, but they refrain to accept it because it’s a SELFISH Goal”

Planning for Retirement is a “selfish goal”

Yes, retirement is about you and your requirement. Your retirement is the most costly financial goal and long duration goal, which will have to be provided for not just years, but DECADES.

It feels very odd to openly accept this and say this, especially in a society where we are always taught to first provide for others and think of others needs. We are taught from childhood that we should not think about yourself, we should not be self centered, we should think about others, we should think of others before thinking about yourself.

“Others” here can be our parents, children, friends, relatives, husband, wife or anyone else.

It’s a taboo to tell someone that “I want to first think about my own happiness and requirement at the cost of others”. You suddenly become “self-centered” and “rude”.

This is one major reason why a lot of people think of their own retirement at the end, only when other goals are planned for.

I think this is changing slowly and the way people are prioritizing things is slowly taking a new shape. I can now see a trend, where people have started giving importance to their own dreams and desires, compared to our parent’s generation.

While, you plan for important financial goals of your life, like buying a house, your kid’s education, children marriage etc, you need to give first priority to your own retirement.

It does not make sense to not plan for your own retirement, at the cost of other goals.

Reason #2 – Because it’s too early to plan

Imagine you are 30 yrs old.

It’s been just few years since you started your career. The top most thing in your mind right now is “how to buy the house?” and how to get the better pay package in the next job?

You are so engrossed into the hustles and bustles of life, and suddenly something says to you “Are you saving for your retirement?”

“Dude, I am just 30” – You feel !

Let’s be honest, it’s very tough to get serious about retirement at such a young age.

Some days back, we did a small survey with 379 people where we asked them what was the biggest reason why they did not consider retirement planning as their #1 goal in life, and the top most reason they choose was “It’s too early to plan for it”, the average age of this group was 30.4 yrs.

Which clearly shows that people are 30 are avoiding retirement planning because they feel it’s too far in future to even think about it.

But there is a problem…

Most of the youngsters never get out of that “I am still young” mode for decades. And one day when they hit 40-45, they feel they made a mistake of not starting early. Some people realize this at 50.

And then by that time, it’s very late.

So even though your retirement is very far away, you need to get this once and for all that you would need a big sum of money at the end, and early you start, better it is. You might not give high priority to retirement saving in the start, but start with something at least and increase the allocation later in life as you move from 30 to 40 .. and so on.

Reason #3 – They are not able to visualize the “Retirement” goal

We all are very bad at predicting how our lives will turn out to be after 10 or 20 yrs old. Just think about your past for a moment. 10 yrs back, did you have even a slight idea of how your life would have been today?

Not at all!

So it’s tough to predict how good or bad the future will be.

This is the reason, why most of the people do not plan for retirement. They are not able to visualize how serious it is to plan for retirement and how tough it will get if they do not have enough retirement corpus.

Most of the people who earn sufficient money right now never realize that one day the SMS – “Your salary XXXX amount has been credited in your account” will permanently stop and they will be left with another approx 40 yrs to be alive.

Your health will not be at the best level and your kids may not be in position to take care of you in the same way you imagine them to take care of you. They will be busy and struggling with their own life issues.

It’s not easy to look far ahead in future and visualize it especially when you have a very active income right now. Just like its very tough to image how it feels to be hungry, when you are easily getting 3 meals each day.

There are various examples of successful people who died poor and struggled in their retirement life. If you do not have enough money in your retirement, you do not have power with you. People do not treat you well, and that’s the harsh reality of life.

Don’t be that guy !

Subra has written a great piece called “Retirement Failure”, where he talks about how a retirement life looks like, if you do not have enough money at retirement. He is one of the best authors and writers on the topic of retirement, so you can trust him 🙂

So start getting serious about future and plan for the D-Day !

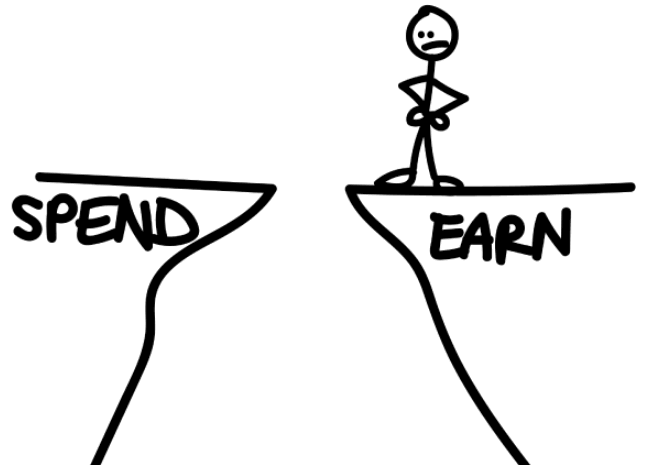

Reason #4 – Not able to save enough money

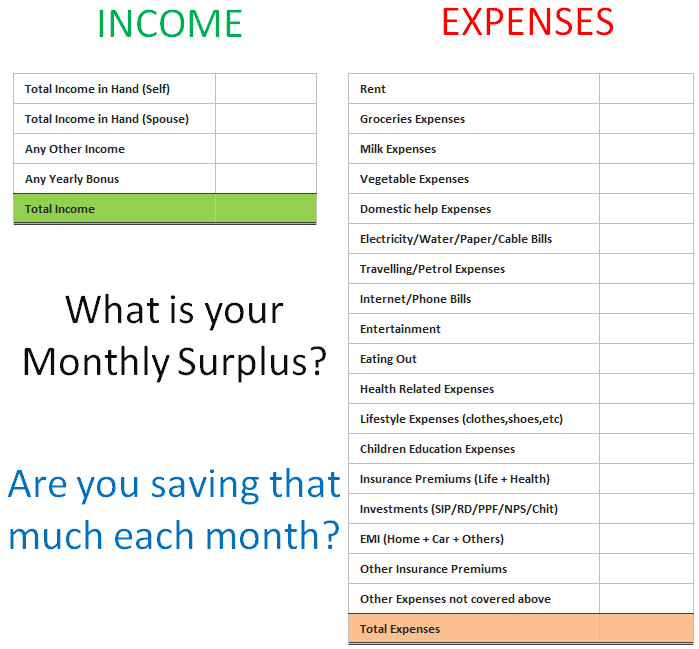

People also don’t save for retirement for the simple reason that they just don’t have any surplus left at the end of month. It’s fairly logical!

Incomes are not increasing, while expenses are growing like amoeba in all directions. It’s getting tough to save in today’s times especially if you are single earning member in family with 5-6 people in a big city.

It’s true that you are not able to save much, but that’s something to get altered to and act on it, rather than hide behind that fact and just let years pass by.

Just because you were not able to save enough for future, no one is going to give you money at your retirement.

So take charge of your future now, and act on it. Work on your income, work on your expenses and make a start. Start saving with Rs 1,000 a month first, then Rs 2,000 and eventually go up and up.

Even if you are able to save Rs 5,000 or Rs 10,000 a month at minimum, a good retirement corpus can be generated. You will not be a RICH guy, but you will have something to fall back on at least.

What can you do with Rs 10,000 per month?

Below is a graph which shows you the power of investing Rs 10,000 per month on a regular basis for next 30 yrs. You can create close to 4 crore at retirement if you are a 30 yr old person.

It can be a slow start, but that’s OK.

If you want to talk to our team for your retirement planning, just leave your details on this page and our team will call you to discuss about your retirement planning.

Reason #5 – They see their kids as retirement corpus

I am not giving my own comments on this point, it has to be written by you.

Yes, I do not want to give my comments on this point because it’s such a sensitive topic that various people will have very different style of thinking on this topic.

From my side, I can only say that I can see lots of people in big cities these days who are very clear that they do not want to depend on their children for anything. They want to give the best to their kids and raise them as amazing people, but then they do not expect anything back from them.

But from the small city I have come from (and many of you) , it’s almost a crime to think like that. Most of the people really see their children as “Budhape ka Sahara” and literally expect them to take care of them “because” they have also raised them and spend on them all their life, so it’s now their turn to return back.

How do you see the relationship with your kids?

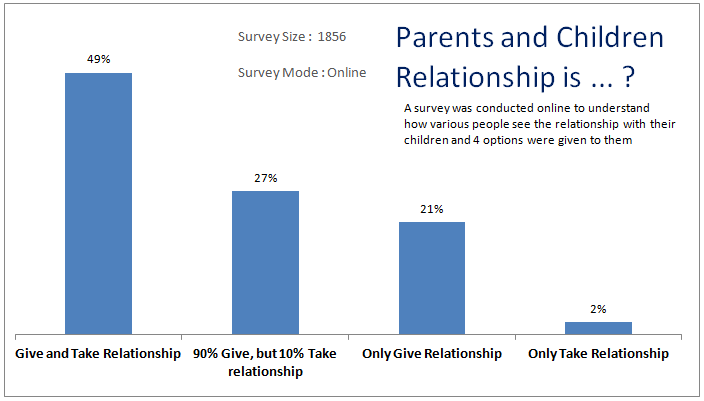

Few months back, we did one online survey on this website to understand how do people see their relationship with their children. 49% participants in that survey choose the option which said “Give and Take Relationship”, where as only 21% felt that it’s only a “Give Relationship”.

I can’t comment if it’s right or wrong, but would like to know from everyone, what they feel about this point? Please expand this 5th point in comment section and have some fruitful discussion.