Taking a loan on EMI is a good option, but do you know how to calculate EMI? It’s not just about a Home loan, it can be any loan EMI.

In this post I will tell you how does the monthly EMI for Home Loan is calculated and how increasing Tenure does not help much after a certain point.

What is EMI?

EMI is an abbreviation of Equated Monthly Installments. The name itself explains what does it exactly means. It’s a monthly installment that a borrower has to pay to the bank or the financial institute from where he has taken the loan.

This EMI depends upon the principle amount of loan and tenure i.e. years for which the loan has been taken.

How to calculate EMI?

EMI can be calculated on the basis of 3 terms, which are as –

- Loan Amount

- Interest Rate

- Loan Period

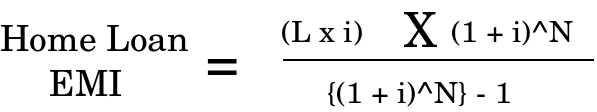

The formula for calculating EMI is given below.

Where,

L = Loan amount

i = Interest Rate (rate per annum divided by 12)

^ = to the power of

N = loan period in months

A lot of people do not know that increasing the tenure only leads to increase in Interest amount payable and nothing else . The decrease in EMI is not proportional to the increase in Loan tenure.

In Housing Finance, Equated Monthly Installments (EMI) refers to the monthly payment towards interest and principal made by a borrower to a lender. Have a look at the example given below to get a clear idea about it.

Example

Assuming a loan of Rs 1 Lakh at 11 percent per annum, repayable in 15 years, the EMI calculation using the formula will be :

[su_table]

| EMI = | (100000 x .00916) x ((1+.00916)^180 ) / ([(1+.00916)^180] – 1) |

| EMI = | 916 X (5.161846 / 4.161846) |

| EMI = | Rs 1,136 |

[/su_table]

Note at i = 11 percent / 12 = .11/12 = .00916

You must have got an idea about calculating EMI. Some people think that increasing the tenure of EMI is a good option because it will help to reduce the EMI.

EMI Calculator:

[CP_CALCULATED_FIELDS id=”9″]

Q. How much benefit we get by increasing the Tenure of the Loan. Considering a Loan of Rs 30 Lacs at 12% interest rate.

Ans: I did a bit of my so-called “mathematical skills” … and found out that EMI is of form

EMI(n) = C1 X C2^n / C2^n-1 , where

C1 = L * i

C2 = 1+i

So the difference in the EMI value for n+1 and n is nothing but

by a bit of calculation I got :

EMI(n) – EMI(n+1) = C1 x (C2^2n – C2^n) / (C2^2n – 1)

and when n becomes very large … and applying limit, we get

Lim C1 x (C2^2n – C2^n) / (C2^2n – 1)

-> Inf=>

Lim C1 / C2^n

n->Infand as C2 > 1 (C2 = 1+i)

=>

Lim C1/C2^n = 0

n->Inf

Or in other words, if we differentiate the EMI formula … we get a constant …

It shows and proves that the difference in EMI value is not very significant compared to the change in tenure and at one stage its almost of no gain to increase the tenure.

To show this argument: I would like to present an example, considering my old question:

Q. How much benefit we get by increasing the Tenure of the Loan. Considering a Loan of Rs 30 Lacs at 10% interest rate.

See the table given below. In this table, i have shown how EMI changes with increasing tenure, and also the difference in your old EMI and new EMI you will have to pay after increasing the tenure.

[su_table]

| Period | New EMI | Difference between old & new EMI |

| 10 | 39645 | |

| 15 | 32238 | 7407 |

| 20 | 28950 | 3288 |

| 25 | 27261 | 1689 |

| 30 | 26327 | 934 |

| 35 | 25790 | 537 |

| 40 | 25474 | 316 |

| 45 | 25286 | 188 |

| 50 | 25173 | 113 |

| 55 | 25104 | 69 |

| 60 | 25063 | 41 |

| 65 | 25038 | 25 |

| 70 | 25023 | 15 |

| 75 | 25014 | 9 |

| 80 | 25008 | 6 |

| 85 | 25005 | 3 |

| 90 | 25003 | 2 |

| 95 | 25001 | 2 |

| 100 | 25001 | 0 |

[/su_table]

From this table you must have realized that after a particular time there is no sense in increasing the tenure because the difference between your old EMI and new EMI will be in some rupees which is negligible.

So it is advisable not to extend your loan tenure to much just to reduce the EMI.

EMI calculators of different banks

Interest rate on loan is different for different banks. So the EMI you will have to pay is also different from bank to bank. In the table given below, I have enlisted some top banks and their EMI calculators link. Click on the links to check the EMI of different banks.

[su_table]

[/su_table]

Tips before taking loan on EMI

- Check the EMI’s of all banks before tanking loan

- Don’t extend your loan tenure just to reduce the EMI

- Negotiate with your agent or loan providing institute when you are planning to take a big amount of loan

- Pay your EMI on time

- Make sure you have a good credit history and you are eligible for home loan before applying.

- Do not expect from a sales person in a bank or the institute from where you are lending money to tech you how to use it. If you are taking a house loan then research for all the related expenses on your own and spend it accordingly.

- And finally, collect all the documents after repaying your loan.

Taking loan is not a bad thing and it doesn’t carry a risk with it, but its only then when you manage it properly. If you have any doubts regarding this information please leave your query in the comment section.