A lot of people have no idea on how their credit card works and what is the exact interest applications. Credit cards are in the market mainly to make money from customers by charging them huge interest because they overuse their credit limit or just fall for the minimum balance option and get into a debt trap. Let’s first understand a few concepts like billing cycle and grace period to start with

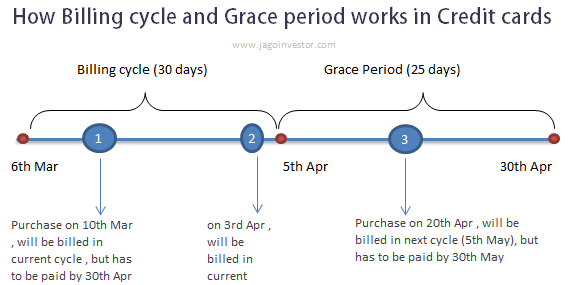

How Billing Cycle in Credit Card works?

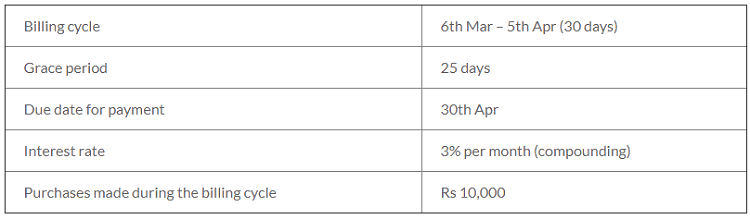

The billing cycle is the duration for which you are liable to pay the due amount. e.g. from the period 6th Mar- 5th Apr. It means that your bill gets generated on the 5th of every month. This bill includes all the transactions done in the last 30 days. If you buy something on 7th Mar, that transaction will appear on the bill generated on 5th Apr and if you buy something on 4th Apr, still it appears on the bill generated on 5th Apr.

What is the meaning of the Grace period?

A grace period is a number of days up to when you have the liberty to pay off your last bill. For example, if the grace period is of 25 days, in that case, you will enjoy no interest for the next 25 days from the recent billing date. In our example, as the billing happens on the 5th of every month. You can pay off the bill till the 30th of that month, but after that you start paying the interest if you don’t pay the bill in full.

A maximum number of days without interest?

So now based on this info, what is the maximum number of days for which you can enjoy interest-free credit?? The answer is the maximum 55 days! It’s because your billing cycle length is 30 days and grace period is 25 days, so if you purchase anything on the first day of your billing cycle, in this example say 6th Mar, then it will actually appear on your bill of 5th Apr (30 days are gone) and you still get 25 days to pay off this loan, so total 30+25 days = 55 days of interest free credit. However, if you buy anything near the end of your billing cycle, like 4th Apr, then that will appear on the 5th Apr and you can pay off that in the next 25 days, so in this case total 26 days of interest-free credit.

Now this means that if you have any large purchase or any big-ticket size purchase to be made, it’s always better to make sure you do it exactly at the start of the billing cycle to get maximum out of your credit card.

The myth of Minimum Balance

Do you know that you start paying interest on your balance outstanding even if you have Rs 1 in outstanding? Yes, if you don’t pay off your full balance by the end of the grace period, you will be charged with the interest from that point of time. Even if you pay off the minimum balance, still you pay the interest on the rest of the outstanding balance. A lot of people live in this myth that just because they have paid the minimum balance, they will not pay the interest and can pay off the rest of the balance next time without any interest. This is totally wrong!

Paying the minimum balance is just going to make sure that you are not charged any penalty for late fees. That’s the reason “minimum balance” is there. The worst part of this whole minimum balance thing is that once you have any outstanding balance in your credit card, the concept of the grace period is lost. You keep on paying the interest on your outstanding balance at the end of your billing cycle. The grace period concept will only return once the 100% dues are cleared.

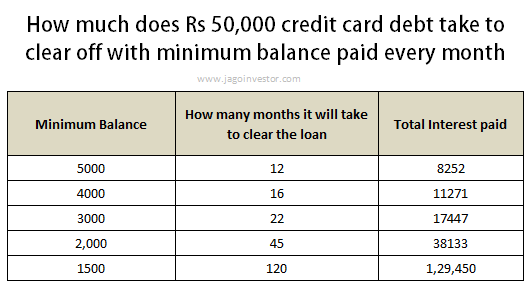

This is one big reason why the credit card outstanding balance ballons to such a big amount once a person starts paying the only minimum balance. Let’s understand this with a picture.

Minimum balance is to make sure you don’t pay full?

Minimum balance is a trick, pure trick to make sure you pay less and get into a debt trap. Credit card companies know very well, that if they do not give any option to pay the minimum balance, people will have no other option than to think “let’s pay off my bill in full”. But they know that if they put an option saying “minimum balance”, most of the people will then think – “Ok! this month let me pay this small amount and next month I will settle the full amount.” Sadly this is the first step for most people to get into the debt trap, and this cycle never ends. As this strategy is a lifeline of credit card companies, they make sure they take full advantage of this.

How Psychology Affects Your Payment Behavior

A recent research study concluded that when a person looks at the amount of “minimum payment”, it can influence how much of his balance he decides to pay off each month. The study looked at how people’s behavior changed when they saw a specific number as “minimum balance” and when they did not see anything as “minimum balance”.

A random sample of 481 Americans was taken and divided into 2 groups . One group saw a mock credit-card statement showing a balance of $1,937, and an annual interest rate of 14%, but they didn’t saw any “minimum payment” option. However one the other hand, the other group also saw that the minimum payment of 2% of the balance was mandatory.

What they found is that people who did not see any minimum payment number desired to pay a higher amount of their balance — significantly more than 2% . Whereas people who were shown the minimum payment number were inclined to pay closer to 2% (meaning they’d be in debt longer)

Example of Ajay paying Minimum Balance

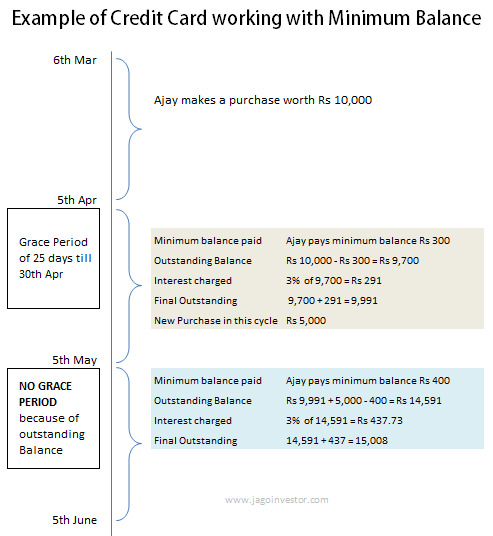

Let us see an example to understand all the concepts and working of credit cards. Let’s take an example of Ajay

Suppose Ajay pays a minimum balance of Rs 300 and carries forward the outstanding balance for next month and also spends Rs 5,000 more in the next billing cycle.

In this case, as Ajay makes the minimum balance of Rs 300, then his outstanding balance would be Rs 9,700 as on due date (30th Apr). Now his total interest will be charged on this Rs 9,700 and that would be 3% of Rs 9,700 = Rs 291, which will be added to his outstanding amount and his final outstanding amount would be Rs 9,991 (just Rs 9 less than his original outstanding amount). Now as he carried forward an outstanding amount on his credit card, there is no concept of grace period. Now in this billing cycle as he has spent another Rs 5,000. That will be added to his old outstanding and the total would now be Rs 9,991 + 5,000 = Rs 14,991

Now this time, suppose his minimum balance is Rs 400 (just for example), and he pays it, then his outstanding balance will come down by Rs 400 and his final outstanding balance would be Rs 14,991 – 400 = 14,591. Now as there will be no grace period, he will be charged the interest of 3% on his outstanding balance of Rs 14,591, that’s 3% of 14,591 = 437.73 and will be added back to his outstanding, 14571 + 437.73 = 15,008 (approx)

You can see that even after making the minimum balance he is actually having more than his previous outstanding amount because of interest paid. In case he does not pay the minimum balance also, in that case, he will also be charged a heavy penalty for late payment and that will be added back to his credit card debt. You can see how the minimum balance gets one into a debt trap.

Making Minimum payment affects your Credit Score

Do I need to give any other reason why one should stay away from minimum balance whenever possible? Making a minimum payment means not making full payment on time and the more number of times you do it, the worse your credit score gets each time. Read more on Improving your credit score here

Conclusion

Now you know all the terminologies in credit cards and how it works exactly. You also came to know about how minimum payments work and how it gets you into a debt trap. Try to make sure you become more responsible for your credit card payments. What do you think about it ? Give your views about this