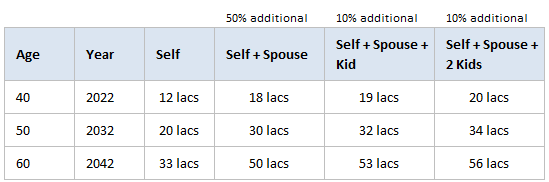

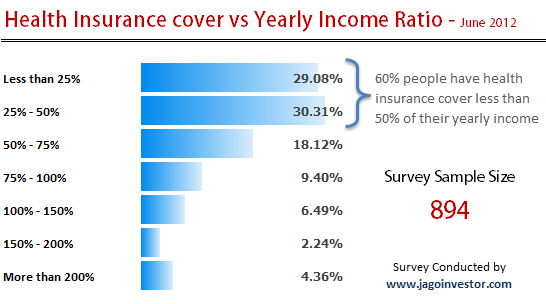

Is your health insurance cover enough at the moment? May be No! And you might want to increase it now. But if you feel that your health insurance coverage is sufficient right now, even then, it will need an upgrade after another 5-10 yrs.

Healthcare inflation is on rise in India and there is no way you can live with the tiny health insurance cover for rest of your life.

So let’s check 8 ways you can upgrade your health insurance cover.

If you have bought your own personal health insurance before 2010, in all probability, you have sum insured coverage of less than Rs.4-5 Lakhs.

While it’s great to hear that you at least have your own independent health insurance, and are not dependent on your employer health cover, it’s high time you realize that with the skyrocketing healthcare inflation, the sum insured you have is too low to even cover one hospital bill, leave alone cover you for your hospitalization expenses in your retirement years.

The amount of health insurance coverage you need has already been addressed in one of my earlier posts. What we are going to discuss here are the options available when one is looking for upgrading his/her coverage

8 ways to upgrade your Health Insurance Policy

There are various ways you can increase your health insurance cover. Below are some of them mentioned.

#1. Upgrade later, when needed

Though this may look like the most cost effective, ‘smart’ thing to do, mind you, this is the diciest options of all. Health Insurance companies will accept your upgrade request till you are young and healthy. No one wants you to enter their portfolio or books, once you are old, grumpy or dying.

Jokes apart, even if one of your family members suffer a chronic ailment like Diabetes, Thyroid etc. or worse make a claim in the health insurance policy, your chances of upgrade in the policy are almost zero.

If you are not aware, let me clarify – whenever you apply for an upgrade, you will have to make a fresh application to the Insurance Company for the upgrades giving declaration of any new diseases contracted etc. The insurance company will then evaluate the upgrade request similar to a new application and decide.

All said and done, even if the upgrade is approved, all waiting periods are applied to the upgrade part of the policy, from the year of upgrade, and not retrospectively.

#2. No procrastination. Upgrade your cover now

This is by far, the most ideal option if you have a lifetime health insurance plan and your family is reasonably healthy. Just apply for an upgrade to the highest coverage available first, before you try anything else, including a Top-up plan.

Yes, you will have to request for the upgrade at the time of renewal by filling an application, which will be subject to approval of the Insurance Company. If you one of you family members have had a claim for a chronic disease, you must explore upgrade for all the other members. If you are all covered under a floater, you can apply for a separate plan (explained in point 4).

If you are covered under individual plans, ask for upgrade for the remaining members in the same plan.

#3. Port your health insurance cover + upgrade

If the sum insured you have is the highest available with the current Insurer, you can explore the option of porting your policy to another product within the same insurance company, or another insurance company, which has higher coverage plans.

Note, for portability, in most cases, you need to apply to the new insurance company, 45 days in advance. While applying for portability you need to request for your preferred sum insured in the proposal form. Of course, you will get portability only for the existing sum insured and not for the upgraded sum insured. The waiting periods will start again for the upgraded part of the coverage.

#4. Buy second Health Insurance policy

If the sum insured you have availed is the maximum sum insured offered by the Insurance Company, and portability is not possible as explained above, another option is taking a second health insurance policy from another Insurance Company.

If you ever claim above the sum insured of Policy 1 you can always claim from Policy 2 for the rest of the claim. Ensure you inform about the existing policy in your proposal form for the new policy.

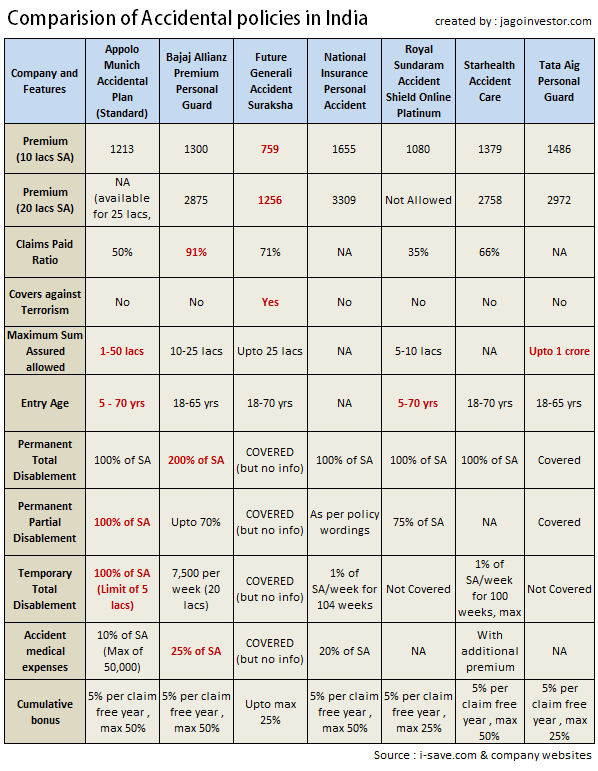

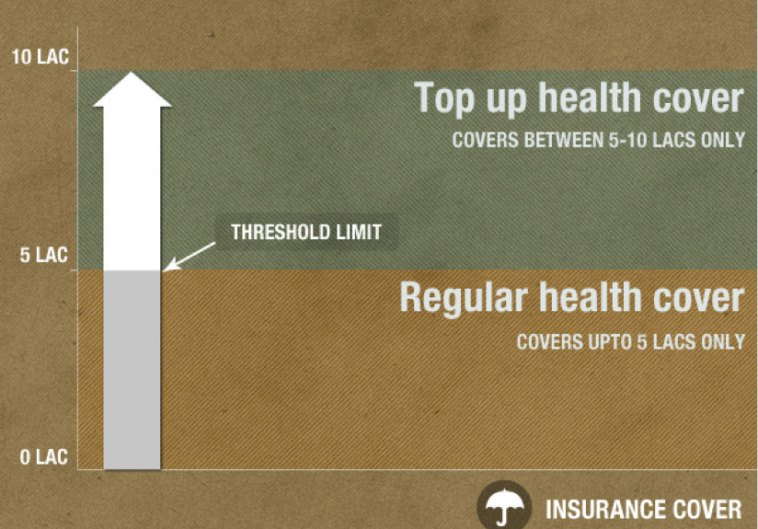

#5. Top-up Cover

Though Top-up plans are recently a popular option to increase your health insurance coverage, you need to understand how they work, before you sign-up for such plans. The policy provides a high coverage with a threshold amount upto which you cannot make any claims.

For instance, you buy a 10 Lakh cover with a 3 Lakh threshold (also called deductible) – you will be able to claim in this policy only when you have made claims of above Rs.3 Lakhs.

There are primarily two types of top-up health insurance plans :

1. Top-up health insurance:

Per claim deductible: Here the top-up coverage will trigger only when one hospitalization claim crosses the threshold sum insured.

For instance, if in the plan in the above example, there are 2 claims in a year of Rs.2 Lakhs and Rs.3 Lakhs each, the top-up coverage will not trigger since none of the 2 claims crossed the “per claim threshold” of Rs.3 Lakhs. On the other if there is one claim of Rs.4 Lakhs, then the top-up policy will pay the remainder Rs.1 Lakh, as per the terms and conditions.

2. Super Top-up health insurance:

As the name suggests, this is a better version of a top-up plan. Here the coverage will trigger even if the sum total of all claims made in a year cross the threshold sum insured. In the above example, where there are 2 claims made, both the claims will be paid, upto the sum insured of Rs.10 Lakhs.

Unfortunately, there is only United India which provides this plan (albeit, with a lot of reluctance) HDFC Ergo and Max Bupa are in the process of releasing such a plan, soon. Watch this space.

#6. Critical Illness Plans

In most cases, a high coverage of health insurance is required due to contraction of a critical illness like Cancer, Paralysis, Heart Attack, Kidney Failure, Bypass Surgery etc.

A Critical Illness Plan provides a lump sum benefit irrespective of the actual expenses incurred provided the insured person is diagnosed for a listed ailment and survives for 30 days. Taking coverage of around Rs.5-10 Lakhs for critical illness is a good option. The only flipside of this plan is risk of suffering an ailment not listed in the policy.

Ensure you take a policy which covers an extensive list of illnesses, at least till the age of 70. There are plans which provide coverage for a list of 20 ailments.

#7. Defined Benefit Plans

Defined Benefit Plans provide fixed compensations against list of surgeries, irrespective of the actual costs incurred. For instance one plan pays a fixed benefit of Rs.1.00 Lakh for Angioplasty, Rs.2 Lakhs for a Bypass Surgery. These plans pay such claims based on minimal photocopied hospitalization papers.

Additionally these plans provide a host of other fixed benefits including fixed amounts per day of hospitalization etc. These plans are different from Critical Illnesses which are based on diagnosis, while these plans are based on actual hospitalization and surgeries.

#8. No Claim Bonus Plans

Given a choice, if you are going for a fresh cover, go for plans which provide No Claim Bonus (Increase of sum insured every year) rather than No Claim Discount (decrease of premium). This helps an assured increase of your coverage every year till you don’t make a claim.

Most good plans provide a bonus of at least 50% of the base cover. Of course, this is not a long term as one claim completely wipes out this bonus at the time of renewal of the policy.

Note – In my 2nd book – “How to be your own Financial Planner in 10 steps” , you can read about Health Insurance in the 3rd chapter

Watch this video to know 9 rules to keep in mind while buying a health insurance:

Top-up Vs. Super Top-up Vs. Upgrade Existing Policy Vs. Buying additional Policy

Most Insurance advisers recommend a top-up plan to increase your health insurance cover. In terms of convenience of purchase and claims, we would recommend upgrade of the same health insurance policy, as the best option. This is ofcourse, provided you are happy with the policy terms and services.

The second best option would be to compare available options of Super Top-up with option of Additional Mediclaim Policy. If the premium is more or less the same, we would recommend additional policy more than a Super Top-up.

After all the above options, look for the option of a simple top-up to increase your cover. Be sure you are aware of the fact, that this option is more useful in the very long term (6-10 years), since it will trigger only when your one claim goes above the threshold/deductible mentioned in the policy.

Other Important points when you plan for upgrading health insurance

1. Upgrade deadline

If you observe around you, lifestyle ailments are spreading like an epidemic across India, thanks to the sedentary lifestyle we live.

You will observe that most of the ailments start cropping up in the late 30’s or early 40’s. If you/your family are in your early 30’s and already have health issues (overweight, underweight, breathlessness, borderline high cholesterol etc.) it is recommended that you go for the highest coverage on mediclaim immediately, rather than get a restricted cover in case you suffer from a chronic ailment in the interim of your plan to increase coverage.

In any case, ensure you upgrade to desired coverage by the time you reach the age of 40 years.

2. Option of stepping up your upgrade plan

If you are in your early 30s, and you cannot afford a one-shot upgrade is too heavy on your current financial budget, create an upgrade plan. Spread the desired upgrade amount across your age upto 40 and upgrade the amount in a manner that you reach the upgraded amount by 40 years. For instance, increase your sum insured every year by say Rs.1 Lakh.

3. Upgrading Features of your plan

Moving to a plan with better features. If you are happy with the sum insured, but not with the features (limitations like room rent limits or co-pays etc. or maybe the network of hospitals) and you are looking at an upgrade, you need to first look at the same insurance company, and check whether they have an advanced plan you are looking for.

In case you like a plan from another Insurance company, you would have to opt for portability with this new Insurance Company 45 days before renewal of your existing policy. Do remember, in the real world (outside the IRDA guidelines) there are limitations on who can get portability, especially if your family is older than 45 years, has a claim history, or a chronic disease.

Go for any options you like above, the bottom line remains – TAKE ACTION. TAKE ACTION NOW. You have too many priorities in your life at home and work, to really be able to remember and act on this even tomorrow.

This article is from Mahavir Chopra of Medimanage. This article first appeared on medimanage blog