In this post I will teach on how to plan for retirement. We will use simple tools like Mutual Funds and PPF for building Retirement Corpus.

We will also see what factors you should take into account when you plan for retirement. There can be other ways of doing this and it can be very complex with very advanced calculation. But in this post we will look at it in a very simple way which a common man can understand.

So you are finally deciding to plan for your Retirement. You need to understand following steps:

- How much is your Current Yearly Expenses

- How much will be average Inflation figure for the coming years

- How much would you need at your Retirement

- Finally coming up with the corpus you would need at the retirement

- Calculating how much you should save per month

- Understanding where to invest the money

We will see all the above points in detail and go through some examples side by side to understand the process in well. Let say we are taking an example of Ajay who is married and has 2 kids below the age of 6 yrs. He has a monthly salary of Rs 40,000 per month. His age is 32 yrs and he wants to retire at age 60.

Step 1: Calculating you Current Yearly Expenses

Take a piece of paper (do it now as you read this) and make a note of your expenses, things like Rent, House hold expenses, Children fees etc etc. You should have a rough idea of what is the minimum amount you require per month for living a good life. You should also try to save a part of your salary every month, Ask your self Can you live with 90% of your Salary ?

Ajay calculates his expenses:

Rent – Rs.10,000

House hold expenses – Rs.11,000

Medical Expenses : Rs.1,000

Entertainment and outing : Rs.3,000Total Monthly Expenses : Rs.25,000

Yearly living Expenses : Rs.3,00,000 (12 * 25,000)Other Expenses like Vacations and Surprise Expenses : Rs.50,000

Total Yearly Expenses : Rs.3,50,000

Step 2 : Understanding how much Inflation would be there in coming years

This is the inflation you expect in coming years till your retirement. I calculated the average inflation from last 28 yrs (1990-2008). The CAGR inflation was 7.3% Source.

Considering a better economy in future I expect the inflation over next 20-30 years to be 6-6.5%. Lets take 6.5% for our calculations here. However you can assume your own rate as it depends on your understanding.

Step 3 : How much amount would you require in your Retirement

By this we mean how much money will provide you same standard of living as of today. This will depend on the Current Yearly Expenses, inflation expected over the years and years left for retirement. Just like we require Rs 105 to buy something of cost Rs.100 in 1 yr at 5% inflation. The same way we can cost how much is is needed after X yrs.

So formula would be

Retirement yearly Expenses = Current Yearly Expenses * (1 + inflation)^(number of years left)

Ajay has already calculated his yearly expenses as Rs 3,50,000. He has 28 more years at hand. He calculates his retirement yearly expenses.

Retirement Expenses = 3,50,000 * (1+ .065)^28

= 20,40,000 (20.4 lacs approx)

Now one can tweak this figure depending on whether you want to have higher standard of lifestyle than now (earning years) or more simpler life. You can decrease it or increase it to the quantum of your compromise. You won’t have to compromise on your Retirement if you are a Early Investor.

Step 4 : Finally coming up with the corpus you would need at the retirement

Here you may want to receive the monthly income for whole of your life and preserve the capital for your Children or any nominee. So you need a corpus which if you put in Bank or invest in some “guaranteed return fund”, you should get an amount per year which is equal to your Expected Expenses per year.

So suppose you expect to get a return of 7% per year. Then you need X amount at the end where 7% of X is = your yearly expenses.

Corpus needed = (Monthly Expenses)/(interest expected )

So in the case of Ajay the yearly expenses expected was Rs.20,40,000 and return expected is 7%. So we calculated the amount required for Retirement that is 20,40,000 / .07 = 2,91,00,000 (2.91 crores).

Note:

You can also buy an Annuity for a fixed number of years till when you want to receive the income (which also means you should have an idea of when will you die, which is not easy). So for example if you want to receive the the monthly Income till you are Age 80 (for 20 yrs).

The following formula will be used. See this Video or this article on Net Present Value to understand the calculations and Concept.

PVA = A * [ {(1+r)^n -1} / { r * (1+r)^n } ]

Where

PVA = Present value of Annuity (Amount you need to have at your retirement)

r= Rate of interest you expect to get

n = Number of years you want the Yearly Income .

So at the end of this, you will have the Amount you need for your Retirement.

Do you calculations online just now Here OR download the excel sheet Here.

Watch this video to learn how to do your own retirement planning :

Step 5: Calculating how much you should save per month

Here comes the interesting part, here there are two things

- How much Return you expect to earn in long term

- How much you can afford to invest per month

Both are related to each other. If you expect more return, then you need to invest less every month and if you can afford to invest more every month, you need to generate less returns for your investments.

So which is the better way? What should you decide first? The returns expected or monthly contribution you can make? I would recommend the other way, better we first decide how much we can invest per month, because that is what we can control better way. We cant control returns !!

I have this monthly contribution calculator to calculate how much you need to put every month to generate Rs X after Y years if you expect R returns, please feed these inputs there and get your numbers. To understand how its calculated you can see this video which explains some important formula’s in Financial Planning.

So here is the process

- You figure out how much you can save

- Then you find out how much return you need to generate

- Then you decide where to invest to generate that return

You can also go the other way deciding how much return you can generate and based on that how much you need to save. But I prefer the first way because then you control things in your hand but you can go the other way too.

So our friend Ajay has a saving of Rs 15,000 at the moment (40,000 – 25,000) And he thinks that he can easily invest 10,000 per month at least over a long term. So the return he needs to generate per year CAGR for 28 yrs to generate his retirement corpus of 2,91,000,00 comes out to be 12.25%, see the calculator mentioned above.

So now you got to know how much you need to get per year in returns.

Step 6 : Understanding Where to invest it

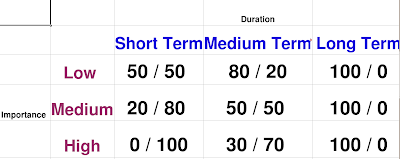

This is the last step as per our article. So you got the CAGR return number which you need to generate over a long term. This number will decide how much risk can you take and where can you invest depending on your time frame. See below to understand which are the suitable products you can invest to get your returns.

Understand the ground Rules

- Higher the return expected, higher the risk you need to take

- More the Tenure, Lower the risk

Above 15% : Direct Stocks, Sectoral Mutual Funds, Equity Diversified Mutual Funds

10-15% : Equity Diversified Mutual funds, Balanced Funds

8-10% : Mix of Balanced Funds Debt Funds

Less than 8% : FDs, PPF, Debt Funds, Balanced Funds [ find out which FD is best ]

However, if the tenure is more than 10 yrs you should always go for Equity Funds. Never go for FDs or Debt funds if your tenure is long enough. Understand the Chemistry of Equity and Debt please.

So in our Example of Ajay, he requires a return of 12.3% CAGR in 28 yrs, so for this, he can invest in Equity Mutual funds through SIP he has different ways to achieve this like Doing a SIP in 3 Equity mutual funds OR combination of PPF (25%) and SIP in mutual funds (75%) OR Direct Equity (5-10%) + PPF + Some Balanced Funds. You got to be creative in this :), there are endless ways of doing it.

Conclusion :

Here you go!!, you just did your Retirement Planning 🙂 . You can do your retirement planning yourself easily. A financial planner will look into more details and will do perfect planning for you which would be best but this is pretty much great way you can adopt your self.

Involve yourself in this journey of Financial planning and you will be amazed to find how much Fun it is.