Do you know, which is the one thing – which is responsible for making financial lives complex these days?

The answer is – LACK OF CLARITY!

Most of the investors take wrong decisions in their financial lives and regret later about it. However, I want to assure you that by the time you complete reading this article, you will learn how to take better financial decisions and lead a simpler financial life.

Each financial decision you take has some pros and cos and some advantage or disadvantage. Some decisions will put pressure on your cash flow and some will make you rich in eyes of society, while some will create assets for you and some will destroy your net worth.

And finally, decisions will give you peace of mind and some make your life hell.

Some examples of decisions which investors have to make !

- Should I prepay the home loan or invest it?

- Should I buy that plot or not?

- Should I take 2nd property or put the money in mutual funds?

- Should I buy the higher end model of the car or the lower one?

- Should I change my job for higher salary or be in my comfort zone?

- Should I give 1 lac to my friend as loan or make some excuse?

- Should I buy the 2 bhk or 3 bhk?

- Should I keep so much money in FD or invest in the 2nd house?

- Should I save for my kids education right now or leave it to fate?

- Is it fine to spend money on outings so much?

- Did I make a mistake by spending so much on myself? Am I selfish?

I must acknowledge that its always going to be tough, to take a decision. But can we do something which can simplify the process of decision making and give us a framework using which we can quickly decide and take things to next level.

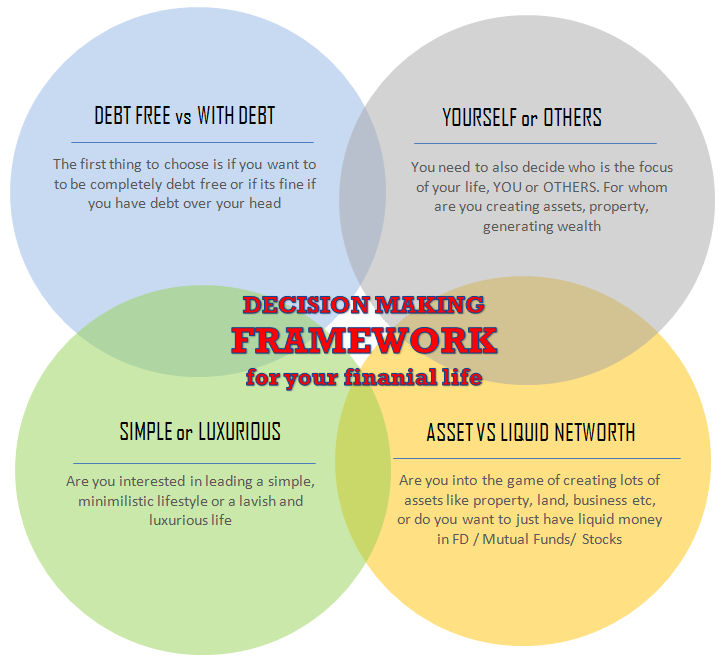

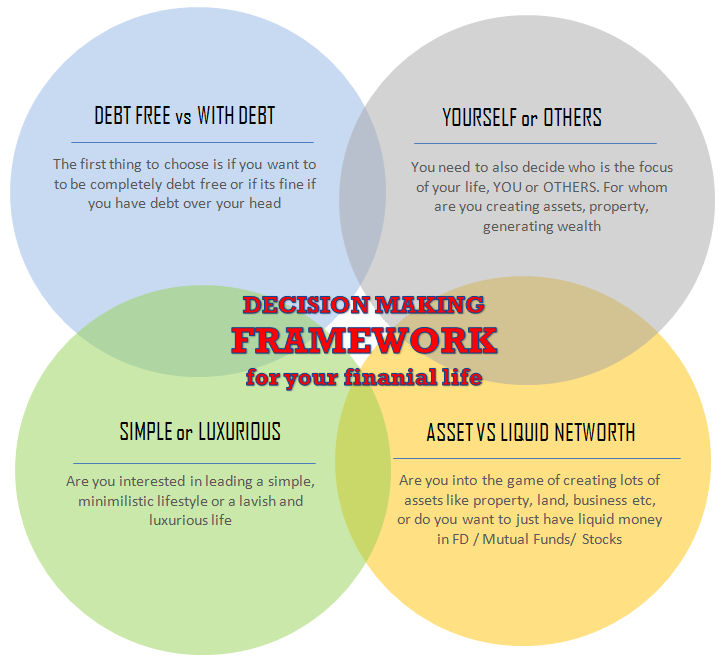

4 point Decision Making Framework

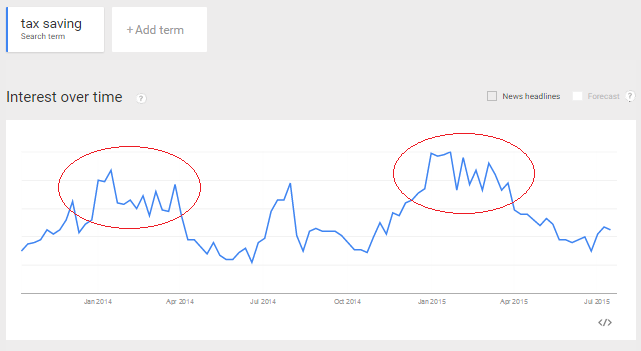

Let me introduce you to the concept of “decision-making framework”, which I recently invented and to test its effectiveness, I ran a survey which was taken by around 132+ people online. I will share the results with you below shortly.

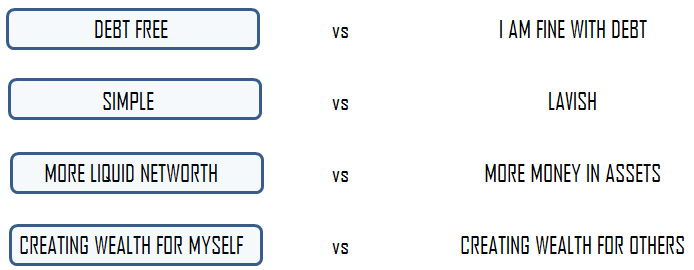

Below are the 4 points which I have included in the decision-making framework.

What is decision-making framework?

Like you saw above, a decision-making framework is nothing but few choices which you make before hand. So whenever you need to take some major financial decision involving money, you can check if it’s aligned with your overall decision-making framework and vision for yourself. You can check if the decision will take you closer to your goals in life or take you farther!

So now, let’s dive deeper into each point and you decide for yourself which side you fall into.

1. Debt Free or With Debt – What is your priority ?

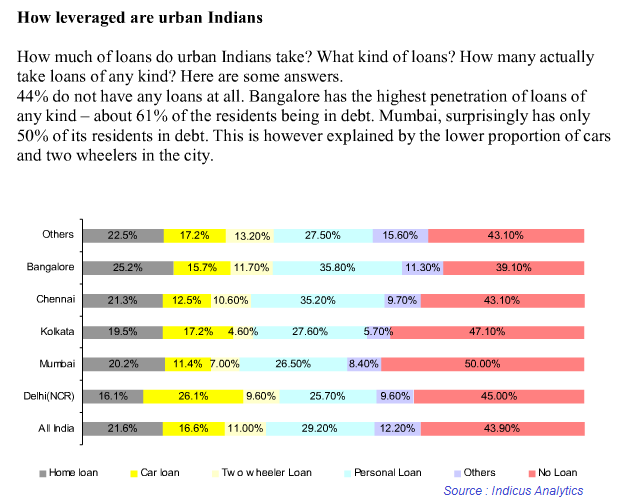

The first point in your decision-making framework is if you want to lead a debt free life or if you are comfortable with debt and side by side you are creating your wealth.

This question is very important to answer because debt trap has destroyed many lives and made some really amazing people slaves in today’s world. So a person wanting to be debt free asap, keeps getting into debt because each opportunity looks so promising that they are attracted towards it and even though it does match with his vision in life, they still fall in.

Its happens because of instant gratification problem !

The first home loan is allowed!

Note that I am not taking about the first home loan you take in your life. No matter how much logic I put in, I think in today’s times, there is a very high chance that most of the people will end up with a home loan at least even if they want to be debt free. So for the sake of this 1st point in the framework, we will allow one home loan and nothing more than that.

So if you look at the other side, a lot of people after they have taken the first home loan, keep taking additional loans for 2nd house, 2nd car, plot loan, loan against property or topup loan and keep giving away their salary in EMI and keep making assets on the side.

While this is not an issue as such, but the problem happens when you realise that you wanted to debt free long back, but have spent all your life living in the pressure of EMI’s and never felt that independence of not having debt on your head.

Let’s see what most of the people choose out of the two choices.

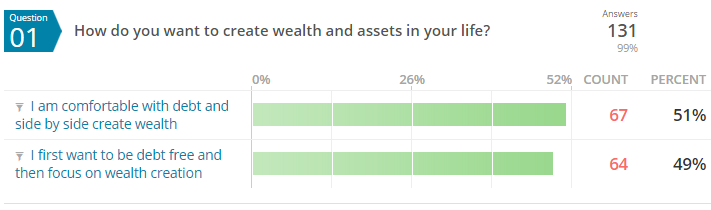

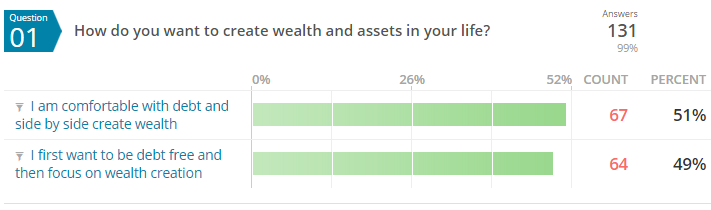

As per the survey, it was a big tie between the two choices and almost 50% people said that they want to take the route of debt free life asap, but the other half were fine with the debt in their life while they create the wealth on the side. I am sure these are the investors who have a strong predictable income structures and safe job which gives them the confidence to say that. Below are the results

Real life example when it becomes tough to choose

Imagine you have taken a home loan which is 50% complete. You are regularly taking all the efforts to prepay your loan and because of your extreme focus, the loan will soon complete (in few years). You also have few lacs in your bank account accumulated from last few years which you wanted to keep as surplus funds and are now planning to repay the home loan further and that will almost make you debt free.

BANG!

Now suddenly you come across an amazing flat/plot which sounds like an amazing opportunity and you start visualizing how this can be an amazing addition to your portfolio. How after few years you will make 100% profit on it. You visit the site, the sales guy tells you about the amenities, location, the future prospects of the property and now you don’t want to miss the offer.

Your spouse is already happy and proud of you making further real estate investment.

You were closer to get debt free, but you again get into that debt trap, because this offer comes and now you are on the way to take another loan to fund the purchase of a new property. On one side, you are so happy, but on the back of your mind, you are worried if something happens to your job, will you be able to handle the EMI for another so many years? You are worried if the new property didn’t turn out to be that great, then what?

You are worried, if it really really makes sense to buy something which you will use after many years? What if it didn’t fetch you good rent?

Truly speaking, there is no right or wrong decision of the above problem, but your decision has to align with what you wanted in your life and hence you should before hand if leading a debt free life is bigger priority or not.

2. Simple or Luxurious – What will be theme of your lifestyle?

The next thing which I feel should be part of your decision-making framework is a clear choice between what kind of lifestyle do you want to lead? Will it be simple, plain, minimilistic or a lavish and luxurious one?

I know some people will say, they want a balanced life which has a mix of simplicity and luxury both? I get that !. But there is always one of these dominating one, which will be the major part, we are talking about that here. Its totally ok to choose to live a simple life, which occasionally has luxury in it or vice versa. But the theme has to be clearly defined for you and your family.

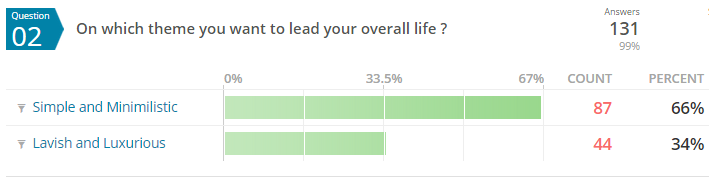

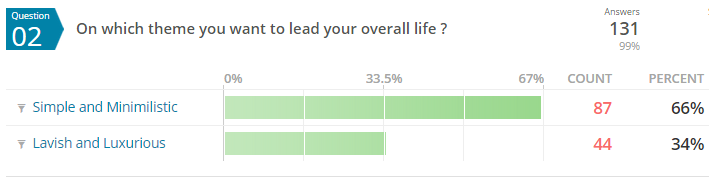

When I asked this same question in our survey, around 66% people said that their life theme has to be simple and minimalistic and 34% said they wanted it to be lavish and luxurious.

Let’s not judge people on this parameter. I am sure a lot of people who want to choose luxury theme deserve it and are working hard for it. It’s a choice of leading a life, after all it’s one life and when will you not live like a king if not right now at this moment.

On the other hand, there are people who are very uncomfortable with lavishness and want their life to be simple and plain. These people also spend a lot of money on few things they love and they become spendthrift at various points of their life. I am on of them.

Both the themes discussed above are RIGHT, and we never know why people choose the theme they are choosing. It all depends on how they have lived their lives till date, what is their outlook towards life, their past experience with money, the struggles they have seen in their life and what kind of people they associate with. There are too many dimensions to it

Why choosing your theme is important?

So that when a big purchase comes, you can see if it fits your theme or not?

- So that you can choose which car to buy?

- So that you can choose how much furnishing to do at your newly bought home?

- So that you can decide if you want to buy a premium villa or a normal 2 bhk house.

- So that you can decide where you want to give the kids birthday party.

I am associated with both type of people in my life. One of my friends bought 70 lacs home and did a 25 lacs of interior (his house is awesome), while the other friend bought a 35 lacs home and bought minimal furniture and setup, but he has bought a high-end camera which is very very expensive.

Its not about show-off

A lot of people might feel that those who want to lead a life of luxury want to impress others and show off, but let me make it clear that it’s not like that. It is how those people want to spend their life on this planet which is anyways limited and its very natural. Just because you are not like that, does not make the other person wrong.

So, if you have made the choice of lavish living as your theme, then “to hell” with those friends who keep saying why you should save for future. Spend yourself like a king, earn more and spend more on yourself, buy awesome clothes, go on exotic tours, travel like there is no tomorrow. But be clear that you wanted it 🙂 and the best part is that you will not be guilty about it. After all, you have chosen your life to be that way.

3. Blocked Assets vs Liquid Networth – What excites you?

For those who think a lot of money will solve their struggles, you will be amazed to hear that there are many investors with net worth of 2-3 crores depend on a personal loan if they suddenly need 8 lacs of money and if they suddenly loose their job, they will panic like anyone else, because they are not sure from where the next month EMI is coming up.

Why is it so when their networth is 2-3 crores?

Because, its all blocked and locked in assets which is highly illiquid. If they want to take out the money, it will take many months and years to get the best deal. These investors choose to spread their money across various assets (especially real estate like plot and houses) and anytime they have some cash in their FD or mutual funds, they feel it should be diverted to something concrete which they can touch and feel (even gold is one asset class).

So they keep increasing their networth, but are always low on liquidity. The biggest problem which I feel with these investors is that if some great opportunity comes and knocks their doors, they are so low on liquid money that they cant take advantage of the opportunity and have to take help of loans.

The worst part is that a lot of these investors never wanted things to be like that. But because they never slowed down in their financial lives to think of how it should eventually look like, their financial life took the shape on their own based on circumstances.

Some investors like Liquid money !

Liquid money means the money which can be redeemed very soon, but with fair and decent returns. So A lot of money in mutual funds, fixed deposits and limited money in real estate is what I call as “liquid networth”. In our financial planning terms, Me and Nandish think that having 1 crore in liquid networth has to be one of the primary milestone of every investor.

You will find many investors who are having networth of a crore, but all of it will go away if you take out real estate out of the equation.

So the main question comes – “What excites you more?”

Do you want to create high networth comprising of liquid networth (stocks, mutual funds, FD,Cash + 1 real estate for living purpose) OR you want to be high on real estate, various properties, plots, businesses etc and lower on the liquid networth?

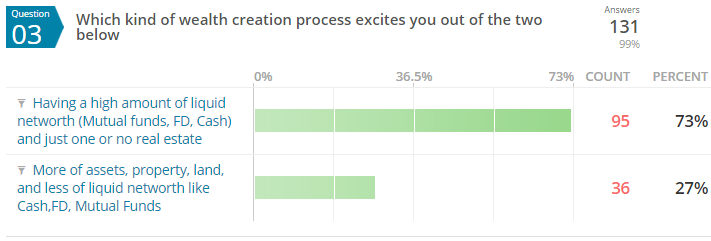

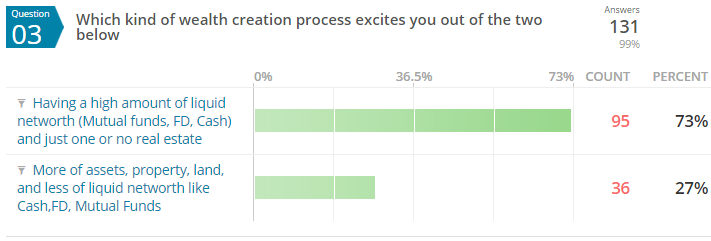

Whatever choice you make, it will help you to take further decision in life which you have to decide where should that Rs 5 lac go which you got as bonus!. I was surprised that 73% people in our survey said that they want high liquid networth (not sure if its because real estate is not doing so well from last 1-2 yrs). Below are the results.

It would be a good exercise to see if your current networth is aligned to your theme or not ?

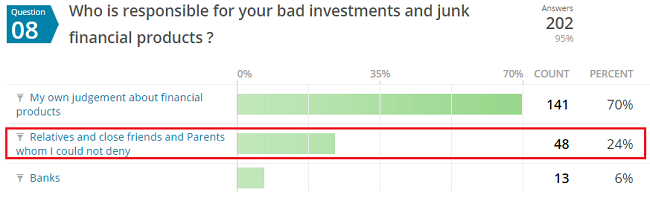

4. Yourself vs Others – For whom are you creating wealth for?

This point if the decision-making framework can be a bit uncomfortable for many investors, because now we are going to be a bit selfish in life here. And the tough question for you all is – “For whom are you earning this money?”

- Mainly Yourself + a bit for others in your life (kids, parents, others in life)

- OR Mainly Others + a bit for yourself

Our parents created wealth primarily for us – their kids. They earned all their live, but never enjoyed the fruits of their labour. They never gave priority to their desires in life. They never owned a car, so that we can have a bike. They never created their retirement fund, because they were busy funding our post-graduation. They never went for any lavish vacations despite having money because their daughter’s wedding had to be planned years before and the money was to be accumulated.

But this story is taking a new shape in last many years.

I am constantly seeing the shift in mindset. From last 10-15 yrs, the mindset has shifted on “them” to “Me”. from “their needs” to “my wants”. The aspirations have gone 10X high and we want to consume, spend, enjoy, live life in a very different way compared to our past generations.

We have seen many of our clients focusing more on their “Retirement goal” rather their “kids education” or “kids marriage” and to some level I think they are going right.

Kids Education and Retirement

In old days “Kids Education” means “Retirement goal”

You will find various parents today who have hit retirement, have nothing great in networth to talk about and don’t have a penny to feed themselves and there is no help coming from their kids as well for whom they spend all their wealth till date. A lot of parents secretly wonder, if they did the right thing to over think about their kids and others and never thought about their own retirement or aspirations.

But things are changing !

Today, you have to plan both the goals separately and for most of the people its not possible to reach both the goals easily. Kids today have many options like taking education loan (if they are highly smart and crack good institute) or first take a basic job go for higher education few years later using their own money. In fact, many parents are now taking the route of education loan (they help taking it), but finally ask the kids to repay it themselves.

Already a lot of kids are guilty these days that their parents have to spend on their weddings and they want to arrange it all themselves. I know this is a sensitive topic, but this always keeps hiding in every investors mind and no one talks about it.

Spending culture in increasing

These days more and more people are going on exotic vacations abroad and within India, spending more and more money on entertainment, eating out, having great experiences, and spending on possessions. But some people are not able to do that because they are not yet clear if its morally right to do it or not.

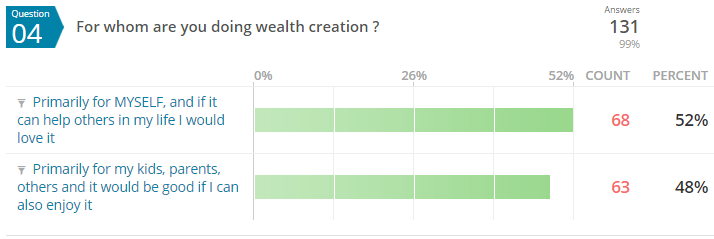

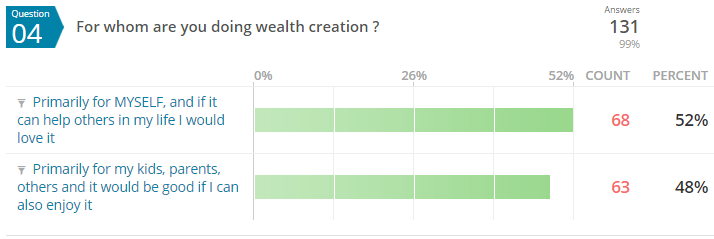

Here comes the biggest surprise. Almost half number of people who took the survey chose themselves over others and the other half choose others over themselves.

You have to complete your responsibilities in life

In no way, I mean to say that someone who is choosing themselves as the primary beneficiary of their wealth are running away from their responsibility. You still have to pay your kids school fees, clothes, your parents health expenses. Do all that!, but when you have to choice do a SIP for your retirement and another option is to pay EMI of a second house which you think will help you kids in future, you have to make a clear choice on who will get a bigger pie.

Will this decision-making framework help you ?

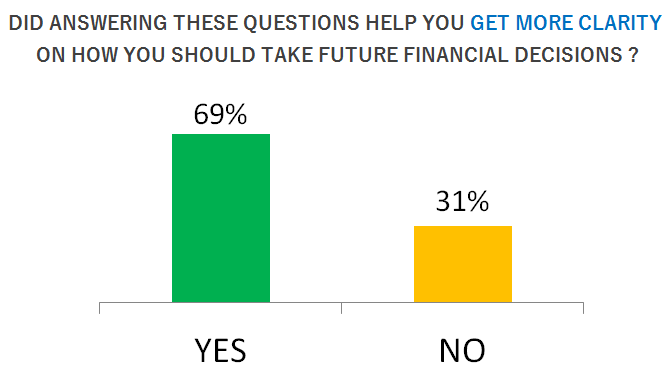

Truly speaking, YES and NO both are the answers. This whole exercise is nothing but bringing out your subconscious mindset on paper and make it clear to yourself on what you want your future to be like and how you would like to lead your financial life. You will not get robotic about your decisions, and obviously deviate from these points which you decide by yourself, but at least this will give you a structure to think and act.

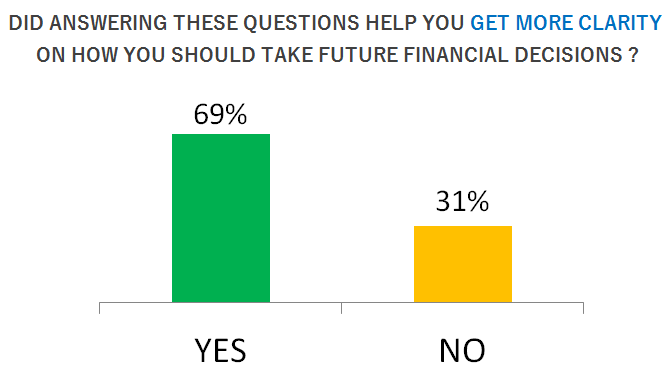

At least 69% people who took the survey said that just by answering these 4 questions and choosing their answers helped them realise what really they wanted in life and how they should take their future decisions.

I also now realize, that why we should not think why others don’t act like us and why some are materialistic and others don’t, why some people spend too much on their comfort and some live frugally. Why some people buy too much of real estate and others don’t. Why some people are in rush to close their loans while you might be thinking that they are not taking right decisions.

SO what works for you might not be others priority and does not fit others life. Its important to understand this point and brings maturity in your thinking.

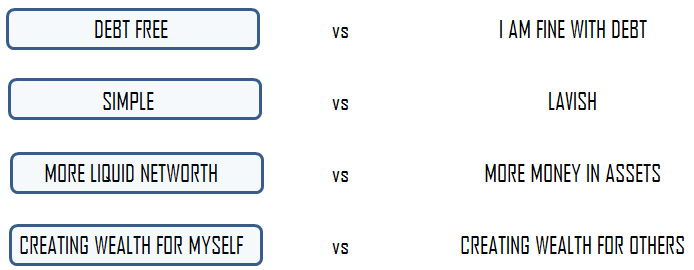

So what is my personal answers for my decision-making framework ?

I thought I will share with you all about my personal answers for these questions above and how I think about my own financial life. Below they are

Understand that the above points are my personal points based on my life experiences and my mindset, you should think that they are better than yours or anyone else. Because of my clarity on above 4 points, I will decide in following manner.

I would like to hear what do you think about this idea and does it make sense to you. Do you feel something like this simplifies the decision making or not? Also please share your personal decision-making framework. What are your answers on these 4 points?