A lot of us do not have even an idea on how much money we have in our Employee Providend fund account (EPF) and how to check EPF Balance online or offline. So in this post we will see how one can check his EPF balance online and get the details back through sms . Earlier I used to search a lot on checking EPF balance online and I came across some links , but most of them never worked. But few months back I successfully got sms with my EPF balance status. Let me show you that.

How to check your EPF balance online ?

- Go to this EPFO website link

- There will be a link below the page to check your EPF account balance status online , click on that (direct link)

- You will see a drop down there to select the PF Office State ( like Maharashtra, Karnataka , Delhi etc) . Select your PF office .

- Once you select the State , you will see a list of different cities office, like for Karnataka , you can see one of the options as “Bangalore” along with the “data available upto” date , so you can get your PF balance till that date only .

- Choose the city office

- You will be taken to the page where you will have to fill in EPF account number , Your Name and mobile number and Submit.

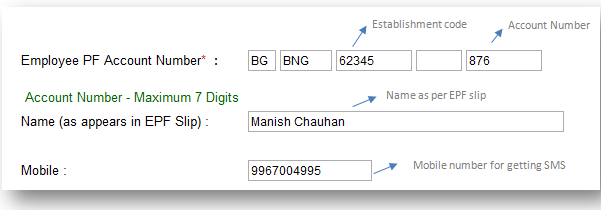

How to enter your EPF account detail ?

For an example lets say Manish Chauhan worked in Bangalore and had a Employee Providend Fund account with number KN/62345/876 . This name “Manish Chauhan” is the name appearing in EPF slip .

In that case 62345 will be the Establishment Code (which will be first blank column) and 876 will be the account number (third column) . The second column will be blank in most of the cases , it’s actually the sub code or extension of the establishment code.

Important Points

- Note that the name should be exactly same as it appears in EPF slip

- The office and state have to be selected properly , In a single start there can be many offices , make sure you choose the right one.

- The SMS can come a little late , so please be patient

- The amount can be only upto a certain date which will be mentioned in the SMS

Can you share if you have are waiting for your EPF money from long time ? Are you facing problem in getting right information on why your EPF money has not reached you ? Were you successful in the enquiry of EPF Balance online ?