Most of the investors are not aware of how income tax is calculated and the basic understanding of tax related concepts when they start their career. In this guide, you will learn how to calculate income tax in a very simple and easy to understand way without involving any complicated jargons.

What is Income tax?

Income tax is a tax imposed by the government on the income of an individual in every financial year. To calculate your income, all the income sources like salary, business income, rent, dividends, etc are considered. Every citizen of the nation or even a non-residential individual also has to pay this tax to the government if he is earning any income in India.

The govt of any country has various kinds of expenses like paying pension to govt employees, building roads and infrastructure, start various schemes for the citizens benefit etc etc. For all this, they need money and income tax is one of the ways for the govt to earn the money.

The same money eventually is used to run the nation and its development. So when we pay the income tax, we get back various facilities like roads, public parks, and poor people also get various free services in health and education.

Every individual, who has yearly income more than a limit (current limit of 2018-19 is 2,50,000 per year) has to pay some part of their earning as tax to the Income-tax Department.

How to calculate income tax?

Calculating income tax is a little detailed, but simple procedure and it depends on 2 basic factors.

- Taxable income

- Age Slab

Let’s see the first factor i.e. taxable income.

What is taxable income?

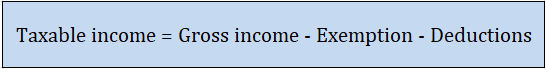

Tax is paid on “Taxable Income” and not your full income. There is something called “Exemptions” and “Deductions” which are reduced from your income to arrive at “Taxable Income”. Formula to calculate taxable income is given below:

#1: What is Gross income?

Gross income is your total earning. It is the entire amount of your income without any deduction or exemptions. Gross income is not only your salaried income. It is the income you earn from all your earning sources.

For example: In one month, If you earn Rs.50,000 as salary, Rs 25,000 from your house rent and Rs.20,000 from your other business.

Then your gross monthly income will be : 50,000 + 25,000 + 20,000 = Rs. 95,000

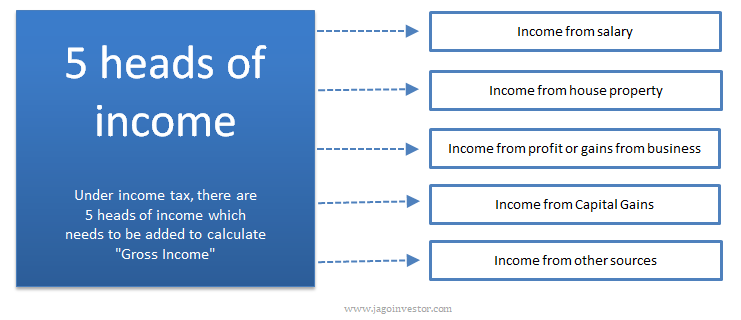

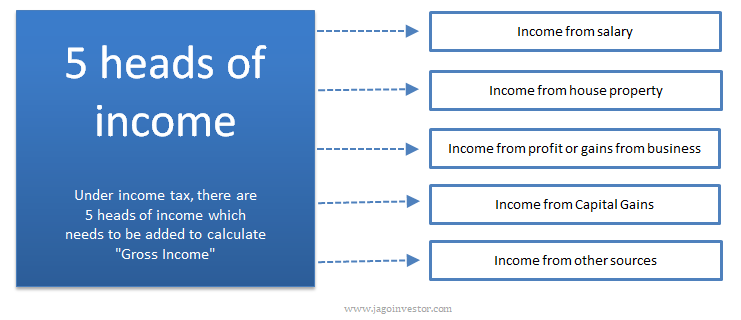

There are various sources of income which are classified into 5 categories. The categories are called 5 heads of income.

5 heads of Income:

Each and every source of earning from where you are getting money is considered as your income. There are 5 main sources which are also called as 5 heads of income which are considered as the main income sources. These 5 heads are as bellow:

Let me tell about these sources in detail.

1. Income from salary

The first head is “Income from Salary”, so if you are a salaried employee, then your whole year salary has to be added, less exempt HRA and other perquisites (covered below in this article) which are allowed to be tax-exempt. So, this amount is to be shown under the head of the salary. It does not matter if you are a govt employee or work in the private sector.

2. Income from house property:

If you have a property and you have given it on rent, then all the rent earned in a year will be considered as your “Income from House Property”.

3. Income from profit or gains from business:

If you have your own business, then all the profits you generate from that business will be considered under this head. For example, if you have a shop, and your revenue is 5 lacs a year, but your expenses in shop is 3 lacs, then your profit is Rs 2 lacs. This 2 lacs will be considered as your income under this head.

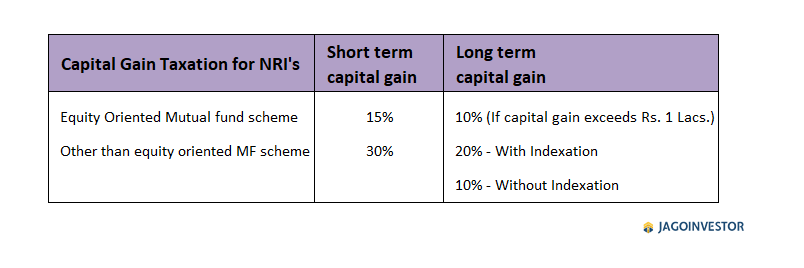

4. Income from Capital Gains:

Capital assets can be simply defined as the property you own, which includes Stocks, mutual funds, real estate, gold, etc. So the profit you earn through the sale of these assets is considered as a capital gain and it will be taxable depending upon the class of asset from which capital gain occurred. For example gain on capital assets like equity stocks or equity mutual funds is taxable at 10% above Rs 1 lacs profits in a financial year.

5. Income from other sources:

The sources of income other than the above-mentioned classes are considered under 5th head of income. For example – the money you receive from any relative or friend as a gift above Rs 50,000 or any award prize or lottery you won, etc will come under this head.

Most of the people who are salaried will not have to deal with the other 4 heads of income for many years.

#2: What are deductions and exemptions?

Now let’s understand the very important concept of “deductions” and “exemptions”. These two things can be reduced from your gross income and your taxable income can come down, which will result in lower taxes

In this article, we have covered exemption available to salaried employees on receipt of allowances and perquisites from employer. Let’s see the examples of Tax Exemptions and deduction:

Tax Exemptions

“Exemptions” are some of the defined benefits or heads which can be deducted from income. A person spends on some of the necessities in life like paying rent, spending money on children’s fees, and basic living expenses. So some of the exemptions allowed are

- HRA (house rent allowance)

- Standard Deduction of Rs 50,000 per year

- Children Education Allowance + Hostel Allowance

- LTA (Leave travel allowance)

Let’s understand these 3 things.

Exemption #1 – House Rent Allowance (HRA)

If you are receiving HRA as part of your salary and also pay rent for residential accommodation then you can claim the HRA paid to you as exempt from tax subject to certain limits and restrictions. These are as follows:

Minimum of the following HRA is exempt from tax –

(i) Actual HRA received

(ii) 50% of annual salary* if living in metro cities or else 40%

(iii) Actual Rent paid less 10% of Basic + DA

Exemption #2 – Standard Deduction of Rs 50,000

Once can directly deduct a standard deduction of Rs 50,000 and bring down their income by that margin. Before Financial Year 2018-19, there was a deduction available for Travel Allowance (Rs 19,200) and Medical expenses (Rs 15,000) when you produced the bills, but now there is no requirement of producing any proof of expenses. One can directly take the benefit of Rs 50,000 standard deduction (for FY 2018-19, this was Rs 40,000, but later it was increased to Rs 50,000)

Exemption #3 – Children Education Allowance + Hostel Allowance

If you are receiving children education allowance or hostel allowance from your employer then you are eligible to claim a tax exemption under the Income Tax Act. However, here are the limits for these two exemptions

- Children’s Education Allowance: INR 100 per month per child up to a maximum of 2 children.

- Hostel Expenditure Allowance: INR 300 per month per child up to a maximum of 2 children.

Exemption #4 – LTA (Leave Travel Allowance)

A lot of employers give an allowance to employees for traveling on leave dates. An employee may travel for his holidays or vacations (alone or family) and will incur some expenses related to that. So this allowance is given for that on producing the bills and on doing the actual travel by taking leaves.

The actual rules for LTA are quite detailed, hence we are not covering it here in this article. Right now you just need to know that the employer can define the LTA allowance limit like Rs 50,000 (for example), so that employee can do travel expenses upto that limit twice in a block of 4 yrs and claim this exemption.

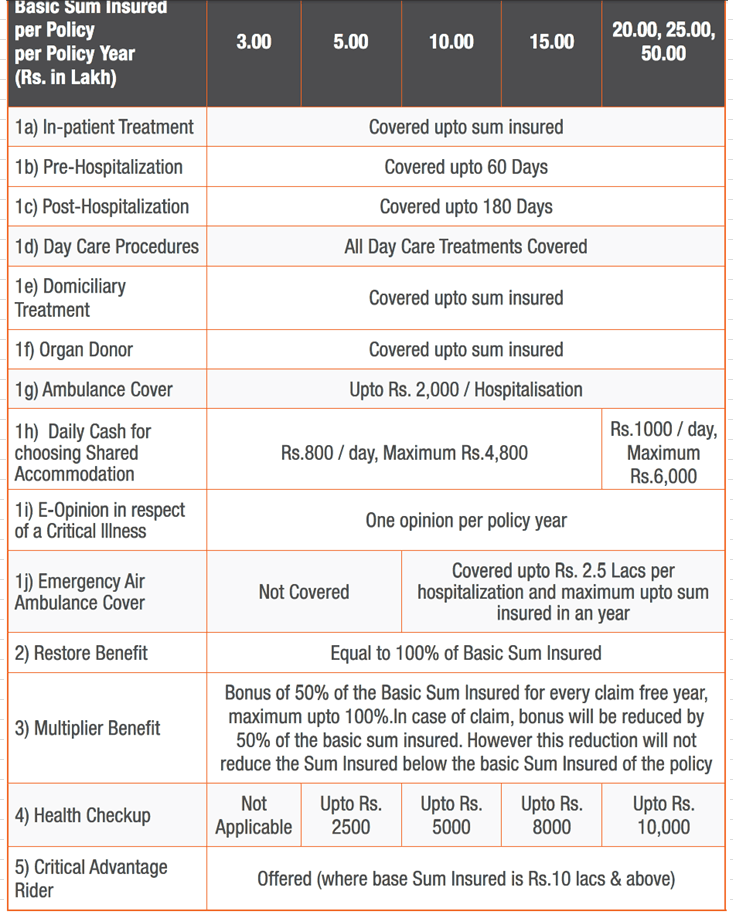

Tax Deductions

There are various deductions that are available under different sections of the income tax act. This deduction is against amounts that you have invested in some specific products like Insurance, ELSS, or ULIP and it also considers specific types of expenses that you incurred during a financial year like Principal repayment of loan, donations or health insurance premiums, etc.

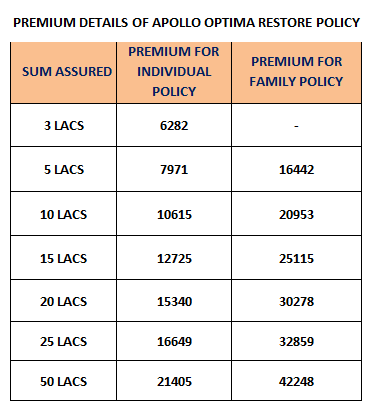

Here is the table given below in which you can see various sections covered under section 80 (from 80C, 80D up to 80U), their meaning, maximum limit of deductions and who can avail the benefit of these deductions.

[su_table responsive=”yes”]

SECTIONS

|

MEANING

|

MAXIMUM LIMIT

(IN RS.)

|

Who can claim?

|

| 80C |

Deduction on investment made in LIC, PPF, ELSS, ULIP, Payment towards Loan principal, tuition fee, etc. |

1.5 Lac (for 80C, 80CCC, 80CCD) |

HUF & Individual |

| 80CCC |

Deductions for premium paid for annuity |

1.5 Lac aggregate |

Individual |

| 80CCD |

Contribution to National pension scheme |

50,000 above Rs. 1.5 Lac limit |

Individual |

| 80CCF |

Deduction on investments in infrastructure and other tax-saving bonds |

20000 |

Individual & HUF |

| 80CCG |

Rajiv Gandhi equity savings scheme (RGESS) |

25000 |

Individual & HUF |

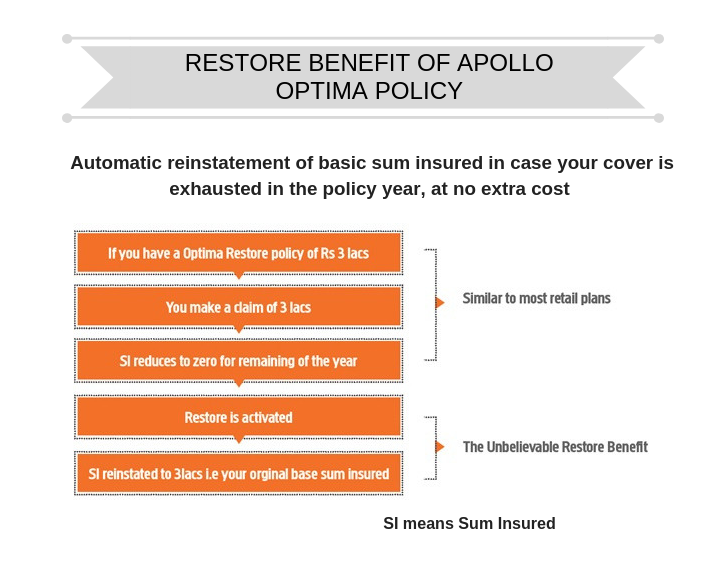

| 80D |

Deduction on premium paid for Medical insurance |

25000 (50,000 in case of senior citizen) |

Individual & HUF |

| 80DD |

Deduction on medical expenses of dependent handicapped relatives |

75,000 in case of general disability (1.25 Lac in case of severe disability |

Resident Individual & HUF |

| 80DDB |

Deduction on medical expenses of self or dependent relative |

40,000 ( 80,000 in case of senior citizen) |

Resident Individual & HUF |

| 80E |

Deduction for interest on education loan for higher studies |

There is no limit on the maximum amount that is allowed as deduction. |

Individual |

| 80EE |

Deduction on interest paid for home loan only for first-time homeowners |

Up to 3 Lac |

Individual |

| 80G |

Deduction on donations for social causes |

Limits are based on donations |

All assesses |

| 80GG |

Deduction on House Rent when HRA is not paid |

2,000 per month |

Person who is not getting HRA |

| 80GGA |

Deductions for donations made towards scientific research or rural development. |

Limits are based on donations |

Taxpayers who have income from salary or property or capital gains and not from business |

| 80GGB |

Deduction on the amount paid to any political parties by companies |

Limits are based on donations |

Indian companies |

| 80GGC |

Deduction on the amount paid to any political parties by an individual |

Limits are based on donations |

Non-corporate assesses or taxpayers |

| 80IA |

Deductions in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development |

NA |

All assesses |

| 80IAB |

Deductions in respect of profits and gains by an undertaking or enterprise engaged in the development of Special Economic Zone. |

NA |

All assesses |

| 80IB |

Deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development undertakings |

NA |

All assesses |

| 80IC |

Special provisions in respect of certain undertakings or enterprises in certain special category States |

NA |

All assesses |

| 80ID |

Deduction in respect of profits and gains from business of hotels and convention centers in specified area |

NA |

All assesses |

| 80IE |

Special provisions in respect of certain undertakings in North-Eastern States |

NA |

All assesses |

| 80JJA |

Deduction in respect of profit and gains from business of collecting and processing of bio-degradable waste |

100% of profit for 5 successive assessment years |

All assesses |

| 80JJAA |

Deduction in respect of employment of new workmen. |

30% salary of full-time employees for 3 years |

Indian companies |

| 80LA |

Deduction in respect of certain incomes of Offshore Banking Units |

Rs.12000 (plus additional 3000) |

scheduled banks, IFSC and banks established outside India |

| 80P |

Deductions in respect of income of co-operative societies |

NA |

Co-operative Societies

|

| 80QQB |

Deduction in respect of royalty income, etc., of authors of certain books other than text-books. |

3,00,000 |

Resident Indian authors |

| 80RRB |

Deduction on the income of Royalty of a Patent |

3,00,000 |

Resident individuals |

| 80TTA |

Deduction from gross income for interest on savings accounts |

10,000 per year |

HUF and Individual taxpayer |

| 80U |

Deduction in case of physical disability |

75,000 in case of general disability (1.25 Lac in case of severe disability |

Resident individuals |

| 24 |

Home Loan Interest |

Rs.2 lakh (for self-occupied house) No limit (for let-out property) |

Individuals |

[/su_table]

Let me show you an example of calculation of taxable income of a person who’s total earning is Rs.12,60,000. See the table given below.

**Examples in this article are mainly for salaried class of individuals having no other source of income like house property or capital gains.

[su_table responsive=”yes”]

| Person ‘A’s gross salary |

Rs. 12,60,000 |

| His deduction under 80(C) act |

Rs.1,50,000 |

| HRA benefit |

Rs.60,000 |

| Standard Deduction |

Rs.50,000 |

| Taxable income formula |

Gross income – exemption – deduction |

|

12,60,000 (Gross income) – 1,50,000 (Deduction) -[60,000 – 50,000 (Exemption)] |

| Total taxable income |

10,00,000 |

[/su_table]

So from this example we got Rs.10,00,000 as a taxable income of that person.

You must have got an idea of calculating taxable income. So now let’s move toward calculating income tax applied on that taxable income.

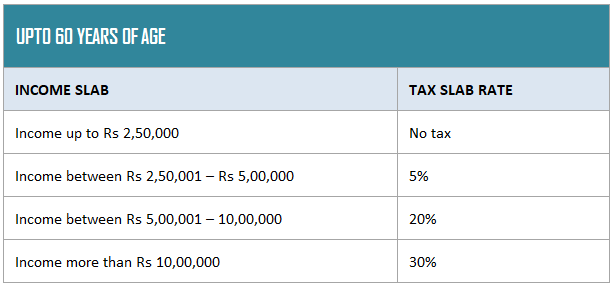

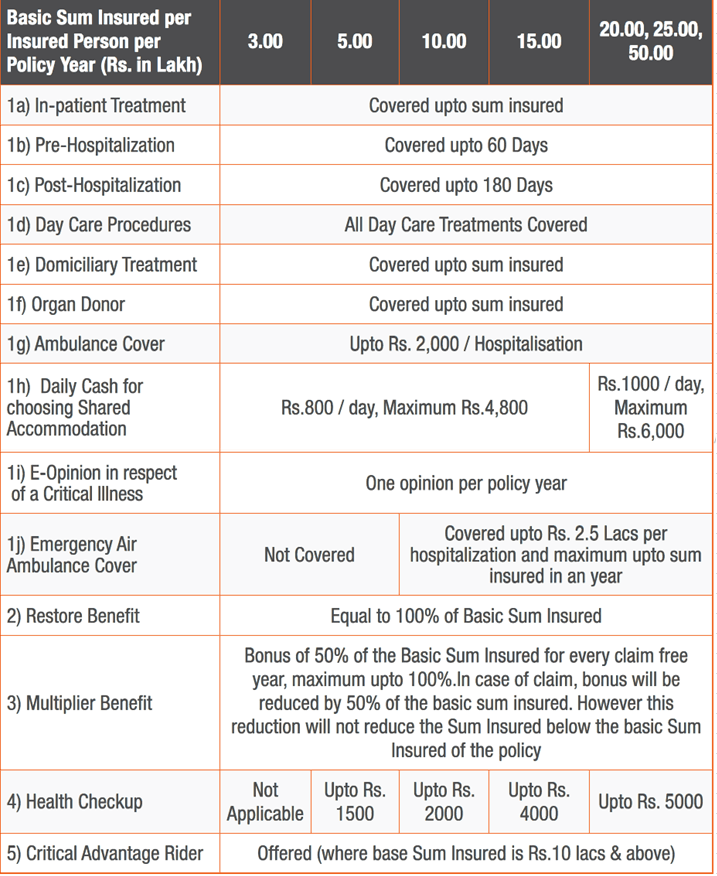

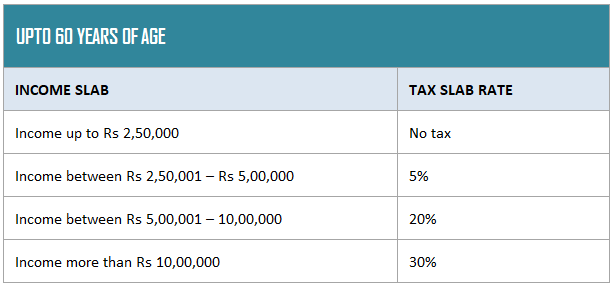

The second factor essential for income tax calculation is your age. According to the age groups, there are three tax slabs and each tax slab has different tax rates. See below these three tax slabs and yours.

1) Tax slab below 60 years of age group:

In this group comes the youngsters both men and women having age below 60 years. Individuals in this group have to pay more tax than the other groups. Here the tax rate is highest among all three groups. See the table below to understand the tax rate –

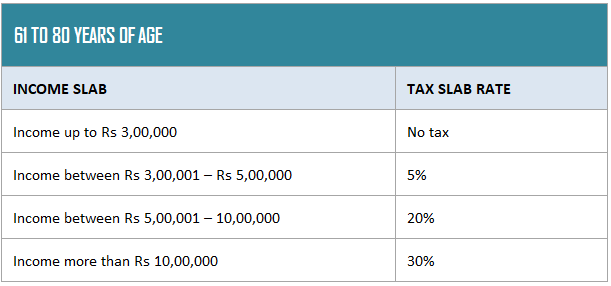

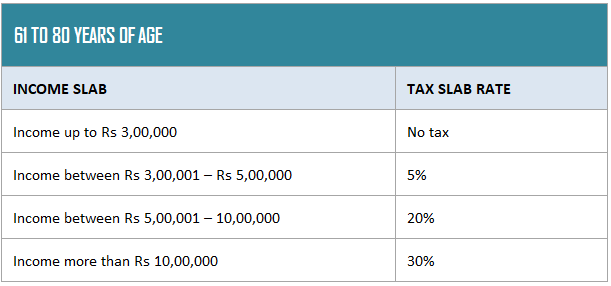

2) Tax slab between 60 to 80 years of age:

This is the group of individuals most of whom are already retired. In this group tax charges are different i.e. lower than the first group. The percentage of tax is given below.

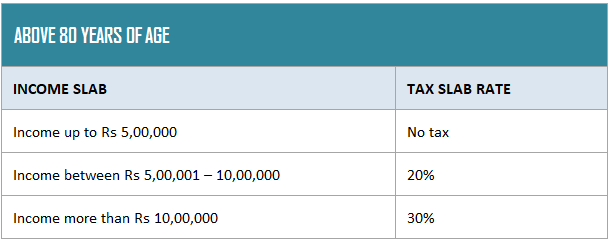

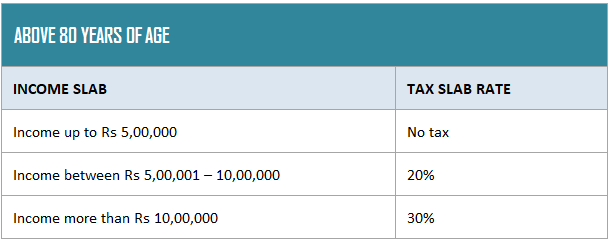

3) Tax slab above 80 years of age:

This is the last and most aged tax payer’s slab. The tax rates are lower here than the other two groups. The percentage of tax is given in the following table.

Income tax calculation

Let’s take the same above example of taxable income of Rs 10 lacs and considering this person in 1st tax slab, his income tax can be calculated as follows.

Income upto Rs.2,50,000 is tax free.

(between Rs. 2,50,001 to 5,00,000) 5% tax = 5% of Rs. 2,50,000 = Rs.12,500

(between Rs 5,00,001 to 10,00,000) 20% tax that means 10,00,000 – 500000 = 5,00,000

Tax at 20% on 5,00,000 will be = Rs. 1,00,000

So the total income tax of this person will be –

Rs. 12,500 + Rs. 1,00,000 = Rs. 1,12,500 (plus Education cess of 4%)

The GIF given below will explain you complete tax calculation:

If the person is earning more than 10 lacs, than on the amount above Rs 10,00,000, it will be taxed at 30%.

What is TDS?

When you earn an income beyond a specified limit, the govt has mandated the person paying you the income to deduct one part of it as your advance tax on your behalf is called TDS. If you look at its full form its Tax deducted at SOURCE (whoever is paying it).

If you want to find out all the TDS deducted for you at one place, there is a form called form 26AS which can be downloaded from TRACES website. You can claim the TDS amount against the total tax payable by you. Incase your TDS amount is more than the tax payable, you can apply for the tax refund when you file your ITR.

Various ITR forms

After paying the income tax, one also has to file the IT return which is to declare your income earned from various sources, tax paid in advance, your TDS deducted in the financial year. It is also useful for claiming income tax refund.

There are different ITR forms for each class of individual i.e. salaried, or business/professional individual. Following is a brief classification of ITR forms –

ITR 1 or Sahaj :

This form is for an individual (Resident) earning less than Rs. 50 Lakhs in a financial year under heads of Salary or pension, one house property, Other sources (excluding winning from Lottery and Income from Race Horses) and agricultural income less than Rs. 5000 in F.Y.

ITR 2 :

This form is for HUF and an individual (including non-resident/resident not ordinarily resident) who is earning more than Rs. 50 lakhs under head of Salary, House property, Other Sources (including Winning from Lottery and Income from Race Horses), agricultural income more than Rs. 5000 in F.Y. and also capital gains.

ITR 3 :

This form is used by HUF and resident individuals who have income under the head of Profit & Gains from business or profession. This return may also include income from house property, salary/pension and income from other sources.

ITR 4 :

This return form is to be used by an individual or HUF, who is resident other than not ordinarily resident, or a Firm (other than LLP) which is resident, whose total income for the assessment year 2019-20 does not exceed Rs.50 lakh and who has income computed on presumptive basis under section 44AD or 44AE or 44ADA.

Conclusion

In this article, we tried to cover various income tax-related concept in nutshell, I hope it was beneficial for those who had no idea about it. We will try to cover this information in detail in various other articles dedicated to individual topics. Please ask your questions in the comments section so that we can answer those.