Why do we invest ?

Answer : For ourself, for our Family, for there better future , for our kids , for there better life , for financial independence, at last the answer comes down to Our Family.

But, before investing, do we make sure that , do we secure our family at first place against any risk and problems which may arise. You can invest in great things, whatever it is like Mutual funds, ULIPS, direct shares, gold, blah blah blah …

But what if some bad things happens to you and your family is left behind with no money at present, what is your wife, kids or your parents meet some accident and go to hospital. Is that more important or creating your wealth for future.

What is more important is to first concentrate on “Now” and if everything is taken care of, only then think about the future. How do you secure your family.

There are two things :

1. Life Insurance for yourself (assuming you are the bread winner)

2. Health Insurance for your entire family, especially if your have old parents, or going to become old in some years 🙂 .

1. Life Insurance : Read https://finance-and-investing.blogspot.com/2008/06/life-insurance-revisited-one-of-my-good.html for understanding it better .

2. Health Insurance : Read https://finance-and-investing.blogspot.com/2008/07/health-insurance-what-is-health-or.html

Let me talk about a case study .

– Robert is in his 30’s earning 5,00,000/Annam. He is married and has 2 kids .

Robert needs life insurance of around 50 lacs to secure him Family . also he should take a health cover of 4-5 lacs each .

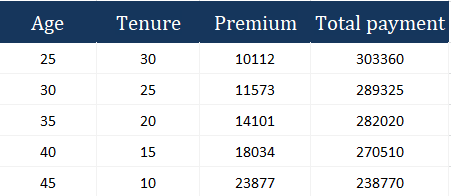

He can take a term cover of 50 lacs for 6367 . He can also take Health Insurance of Rs 4 lacs each for him , his wife and his 2 kids (family floater plan) @Rs 5000 (Check click2insure.in for these quotes) .

Means , he can take both of these things at 21,000 / year . It comes out to be 4.2% of his yearly Income.

Now think , can you spend 5% of your yearly salary for safety and coverage of your Family ? I thing YES !!

Once you do this , you are free of any tension , and now you can use your 95% money to generate long term wealth for your family and there security . You can effectively use your 95% , only if you use your 5% for your risk management .

There can be many cases when you dont cover your family and things can go wrong, like

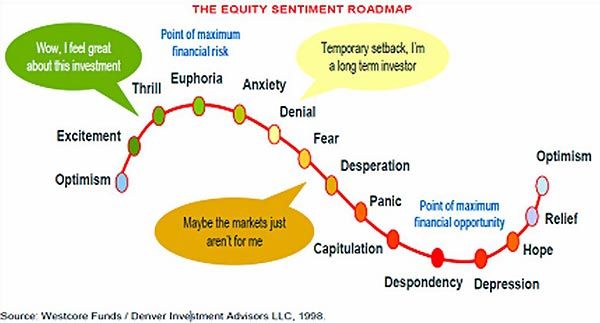

1. You invest heavily in Mutual funds or ULIP’s or what ever and in 2 years you die in an accident, what will happen then …

2. You invest your money in ELSS (tax saving mutual funds) for last 2 yrs and have life insurance also , but suddenly you wife meets an accident and you require 5 lacs for an operation , but you never took Health Insurance .

Investing your money is important, Covering your risks are Vital !!

Live in the moment, “now” is the truth … Keep you family happy with covering then and yourself now .

Some tips :

– Take a life cover ASAP if you have not taken it yet.

– Buy a family floater plan if your family has spouse and kids, for Parents you need to take a separate individual policy, as parents are not covered in Family floater plans.

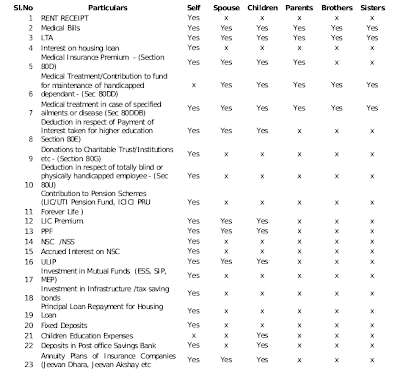

– You can also claim tax benefit for this under section 80D.

– Don’t feel that life insurance from other companies (other than LIC) are very risky and anything like that . Insurance sector is now getting mature enough and govt is taking all measures to confirm that the companies which enter Insurance Industry are from great Business families and conform with the guidelines . But its true that LIC will always be the safest (100%) .. but 99.999% is also safe …

Summary

Its more important to cover your Life risk and family Health risks first before any investments for future , when you put your money in Insurance and Health Insurance you are already taking steps for strong invesments for future which is safety of your family , which is of supreme importance . Dont ignore it … Take appropriate cover .