Tag: Beginner Level

Swing Trading Presentation by Sudarshan Sukhani

Swing Trading

This post is for people who are interested in Stock markets trading, Sudarshan Sukhani has posted an excellent presentation on Swing Trading here, please go through it and use it incase you want to do it.

Who should use this presentation for Trading ?

This presentation is only for people, who are already experienced with Trading, no matter they make Profit or Loss. You must have some level of knowledge and experience before.

Especially for people who are trading and are yet to succeed in Trading (Whether its Stocks , Futures or Options , it may be currency or Commodities also). I also come in this “overall loss making” category of traders till now. I am yet to break even and start making some profits in Trading.

Who should not start using this presentation just after seeing this presentation ?

Anyone who is not at all related to trading and just want to start Trading. If you have not done it before, Just look at it and stay away as of now. You are yet to gain more knowledge and then enter this world, You yet need to understand what is Money Management, Trading Psychology, Technical Analysis etc etc.

If you don’t listen to me and start using the techniques given in this presentation, there is extremely high possibility that you loose blow up your account at some point of time, Just see this presentation, get the feel and save it for future reference.

Investor alert – Beware of Mis-selling of financial products

From many years there has been a lot of mis-selling happening in some products and investors are getting trapped in it. In this article I’m going to tell you about mis-selling of financial products so that you avoid getting into this trap.

What is Mis-selling ?

Mis-selling means selling a product by giving a wrong picture of a product , it may include .

- Giving Wrong Information

- Giving Unrealistic Information (some times based on previous performance)

- Not giving full information about the product.

- Selling the product with proper information, even if it does not fit customers requirement.

Why is mis-selling happens?

Mis-selling happens because of following reasons

Low Awareness : Financial awareness is very low in our country and that’s the reason we do not understand products and how they can fit our requirement, Agents put a picture of a product in such a way that it looks the best product for us.

Competitive environment and Sales Targets : There is lot of pressure on agents and manager to show performance and sell products to meet there targets because of which mis-selling happens.

Last minute “Tax Rush” : People in India do not plan there Investments in Advance and hence at last moment they buy product just to save tax and which does not fit there requirement, and sellers take advantage of this.

Examples of Mis-sellings

ULIPS :

ULIPS are the classic example for mis-selling in this country, ULIPS are often projected as high growth, less risky products with “Insurance” in build. Ofter agents promise that ULIPS are risk free and it wont drop more than x% and return at least 10-15-20% in long run, which is nothing but marketing gimmick.

I have seen at least 100 people who have bought ULIPS and they don’t need it after 3rd year. They do not know why they bought it other than tax saving and when talked about how much Insurance cover they have, no one had more than 5 lacs.

One of my friend has ULIP for 50 yrs !!! not sure what he will do !! One of my friend has insurance of 1.25 lacs !! Insurance of 1.25 lacs !! Really, what does that mean … His/her life cover is just 1.25 lacs, he earns 5 lacs yearly !!

Mutual Funds

Even mutual funds are mis-sold, that happens when a agent recommends you a mutual fund which does not fit your requirement. Often agents recommend mutual funds which are too risky for customers without understanding there risk-appetite.

Read how to choose mutual fund ?

Insurance

One of the worst thing which has happened in India is that Agents never tell customers about Term-insurance, which is ultimate requirement for Indians, This happens because of penny like commission agents get on Term policies, that’s the reason they often lure customers with products like ULIPS and Endowment or Money back policies, which do not insure people to the extent they need it.

Agents don’t explain the importance of Insurance and only make them feel that they loose money in Term Insurance and we get lured by it, because we love “not loosing money” more than “little chances of dying and our families suffering”, this happens because people do not have enough foresight to look into future and question themselves about what will happen if they die without giving enough cover to there families.

Watch this video to know a horrific story of an insurance mis-selling:

Read why Life Insurance is so important

So like this Mis-selling happens in many products.

What can we do and should do?

“Prevention is better than cure”, this saying also applies in Investing, I know of people who took wrong products and then have to live with it for 10-20- years like Endowment plans. (Read why Endowment plans are not good)

So the only thing we can do is to educate our self to the level where no one can take advantage of our ignorance. Once you come to a level, where you understand importance of things in investing and managing you money, then no one can mis-sell you the products.

One of the recent product which i will categorise in Misold category is “Jeevan astha”, The reason I will say it was mis-sold is because it tried to put its picture in a very fuzzy way and tried to put things which were confusing to general public.

Conclusion

Don’t Take any product just because it look good or is recommended by someone (not even me). Do your research and do some study, it does not take more than 1 hr to search the net and read about it, or ask some knowledgeable person whom you trust about the product.

1 or 2 hrs to study can save you pain of years, So don’t be lazy, when it comes to money no one is yours, its only you who can save you from mis-selling.

So wake up .. Jago Investor 🙂 Jago !!

Insurance Presentation

I have created a small and simple presentation for newbies regarding Life and Health Insurance . It will help new people to understand the importance of Insurance .

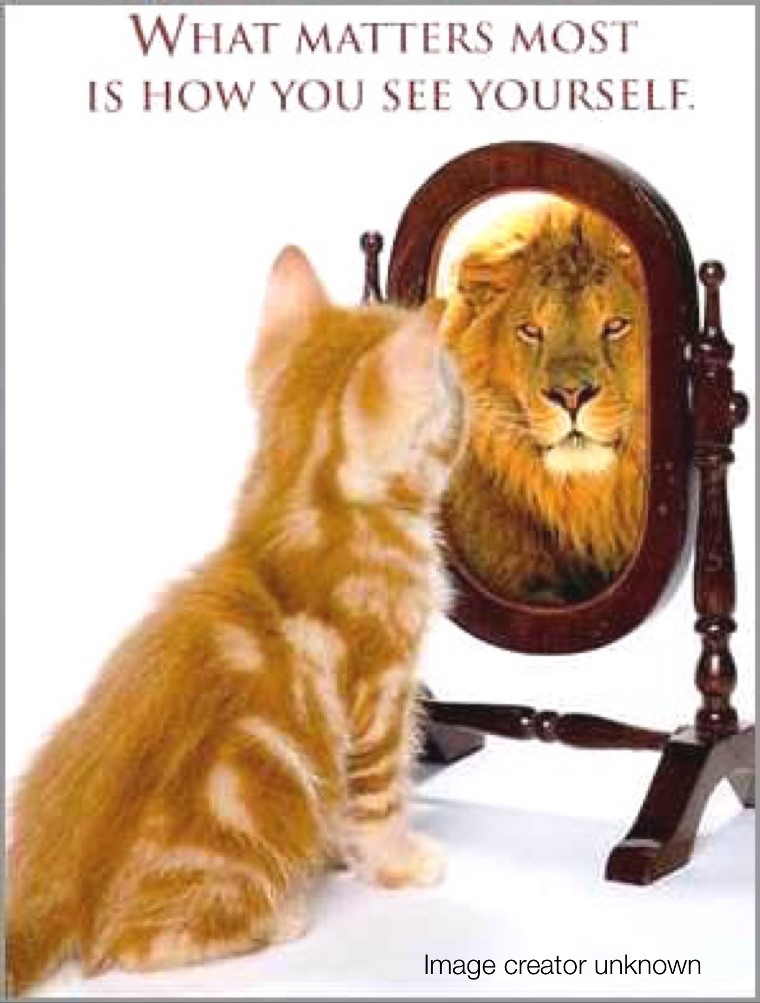

Search within You ..

I was watching a seminar video on my laptop today which was a trading seminar conducted in US, the speaker was an American.

In the middle of the seminar he presented a small story which was from Hindu Mythology which made me feel good, I am putting it here word by word after finding it from net (so that I don’t have to type all myself).

There was once a time when all human beings were gods, but they so abused their divinity that Brahma, the chief god, decided to take it away from them and hide it where it could never be found.

Where to hide their divinity was the question.So Brahma called a council of the gods to help him decide. “Let’s bury it deep in the earth,” said the gods. But Brahma answered, “No, that will not do because humans will dig into the earth and find it.”

Then the gods said, “Let’s sink it in the deepest ocean.” But Brahma said, “No, not there, for they will learn to dive into the ocean and will find it.” Then the gods said, “Let’s take it to the top of the highest mountain and hide it there.” But once again Brahma replied, “No, that will not do either, because they will eventually climb every mountain and once again take up their divinity.”

Then the gods gave up and said, “We do not know where to hide it, because it seems that there is no place on earth or in the sea that human beings will not eventually reach.”

Brahma thought for a long time and then said, “Here is what we will do. We will hide their divinity deep in the center of their own being, for humans will never think to look for it there.”

All the gods agreed that this was the perfect hiding place, and the deed was done. And since that time humans have been going up and down the earth, digging, diving, climbing, and exploring–searching for something already within themselves.

What does this teach us?

In life we have all the power to achieve something we want, we cant get help from some one, we can get tools, we can get support or for that matter any damn thing, but what is needed for success lies with us only, So don’t hunt for things outside, first know yourself.

“Its only you who can change things.”

How do I relate this to Investing and Money Management?

Whatever it takes to grow your money, do better investments or take informed decisions, Its within you, you just need to explore it, You can read stuff on this blog or anywhere else, but the real wisdom lies within you, you have to work hard on it.

I know nothing spacial or advanced things, I know things which any one can learn, The only difference can be my willingness to learn and make the difference and confidence. You can do it to. Just make sure you have the fire to learn and see within you and have confidence.

Just like a good cook doesn’t need great ingredients to make good food, he can make great things out of simple and basic stuff, the same way, we don’t need fancy products for our investments, Even if we have basic products we can utilize them well and create wonders, Only the knowledge and willing to do is required. Its within you, search for it ..

Please leave your comments on the blog, on your view and whether you liked the articles or not. That way I can know atleast that people like my articles or not.

Leave Travel Allowances and medial Reimbursements – The tax free allowances

As we are in mid Feb of the year and its tax time, I thought to talk a bit on LTA and Medical reimbursement benefits. Though many of you might already know about it, let me go over it in brief for readers who have less knowledge about it.

What is LTA ?

As the name suggests, LTA i.e Leave Travel Allowance is an allowance that an employee receives form his employer for his traveling expenses while he/she is on leave. This allowance is given only for the domestic traveling, international traveling is not covered in this allowance.

There are normally two situations when employee gets this allowance :

#1. Employee receives this allowance while traveling alone or with family or dependents from his current employer.

#2. Employee receives this allowance while traveling alone or with family or dependents from his former employer after retirement or termination of job.

It is the benefit given to a salaried employee and you can claim travel expenses from any one journey in a year. Lets see some important features of this allowance:

Features of LTA

- There is a block of 4 yrs decided by govt ( current block is 2006-2009). In a block you can claim LTA for any two years. For other 2 yrs you cant claim it, so total 50,000 will be taxable in those 2 yrs.

- These blocks are not financial years (April 1 to March 31); they are calendar years (January 1 to December 31).

- If your LTA is not utilized, it gets added to your salary and you will be taxed on it.

- LTA covers travel for yourself and your family. Family, in this case, includes yourself, parents, siblings dependent on you, spouse (even if your spouse is working) and children.

- The entire cost of the holiday is not covered. Only the travel costs are covered. So, whether you fly, hop on to a train or take public transport, you will have to show the ticket to claim your LTA. This means you will need to keep your air, rail or public transport ticket.

- If an employee doesn’t claim once or twice in a block year, he/she can carry forward one claim to the next block year. But the condition is he/she has to claim for that allowance in the first year only of that particular block year.

- If husband and wife both are receiving LTA then they can claim for the allowance in the same year but for different destinations.

Restrictions on claiming LTA

- You can claim on only twice in a block year

- Only actual cost of traveling is covered in this allowance

- You cannot claim LTA 2 times in a year.

- If the children are born after 1 October 1998 then you can claim for only 2 children’s traveling expenses. There are no restrictions for the children born before 1 October 1998.

Watch this video of rules and exemptions of LTA:

How much amount can claim under this allowance to get tax benefit?

You have a limit up to which you can claim your spent amount on LTA and medical bills and save tax on that part. If you didn’t claim it, for that much amount you will be taxed .

Limit for LTA : 50,000 per year

Limit for Medical Bills : Rs 15,000 per year

So from your total salary, you can save tax on this 65000 if you want, if you don’t claim it, you will have to pay tax on this part .

Medical Reimbursement

You can also claim deductions on the medical bills for medicines and doctor visits. You just have to get the bills and submit a proofs .

The bills can be in the name of you or your dependents .

Final Note : Utilizing this benefit just requires you to keep the documents ready. many people do not claim this benefit because they are too lazy of keep the documents safe. Don’t be lazy …

The basics of Trading with example of Reliance – For beginners

What is Trading?

I see many people who want to try there hands in trading .

Trading means buying and selling something with a short tenure in mind. Short tenure can be day, week or months. You can trade Stocks, Derivatives like Futures or Options or you can try out Commodities or currencies too.

The sad part is that many people just enter this trading business without much preparation and knowledge and burn there hands like anything. they continue loosing money every day, week, month and cant figure out why they are loosing.

Understand some things :

Trading is a profession, and its highly rewarding in every ways. BUT !! Trading is one of the hardest thing one can ever attempt, trading is simple but not easy. It takes years for one to master it and become successful as a trader.

If you are trying to learn trading and want to do this in your life. I can suggest somethings:

- Start Learning about markets and do it for at least 1 year (not 1 month)

- Learn Technical Analysis and try to do some analysis on your own.

- Read good books and make sure you have read it really well.

Once you have done this. Then you should paper trade for some time, may be 2 months. After you have paper traded and can see that you can trade well on paper, then start with small money (you must be ready to loose this money) … Do some real trading with this money and see how you perform.

Trading is a highly rewarding and satisfying profession. You can earn good money and you are your own boss. Trading can be fun and challenging. But Trading is the most challenging and highly risky profession one can attempt as I already said.

I have put up a simple Technical Analysis Example for Reliance, It discusses buying or selling Signal for Reliance in coming days. You can see it here

Why Technical Analysis?

Technical analysis helps in taking much better decisions for buying and selling. Its a must for short term traders, however it also helps people who have longer time horizon, With Technical Analysis you can make better entries, exits and manage your decisions well.

Some reading Material for people who want to learn technical Analysis is here

1. https://www.investorsintelligence.com/x/why_technical_analysis.html

Your investment must be the way you want your life to be – Simple and Easy.

Keep it Simple Please

Lot of people thinks that if they choose complex investment products then they can generate a good return. But then key to successful investment is make it as simple and easy as you want your life to be.

There are many products available in markets , Some are extremely easy to understand and strongest. While others are complex and on an average not very easy to understand by common public.

In Life, simple things works best. We all want our lives to be simple and easy, We don’t want lots of complications. In the same way we should use simple products while choosing our investments. Simple things works in the best manner.

There is a tendency of creating complex products because general public feels, that because they are complex and not easy to understand, they must be working very differently and in a smart way. This is far from truth.

Easy to understand products like Term Plans, PPF and Mutual funds works brilliantly. You don’t need ULIPS or product like Jeevan Astha and Endowment plans with lots of stupid clauses.

What happens when u choose simple products?

Your life is easy, you can understand them better, track them better and change it in a much better way.

Imagine a person A with ULIP or Endowment policy for Insurance needs and B with Term Insurance.

What are the benefits B enjoys?

– He understands every things about his products the reason being there is very less to understand. (If you die, your family gets money, if you don’t, you get nothing).

– He can choose to stop his stop his policy any time he wants (if he does not feel the requirement)

– He can change it to some other policy later in life if he wants.

There are many things like this, where as in ULIPS and Endowment policies , people are stuck with no mercy if they cant pay premiums some 2-3 yrs in a row. There are too many clauses and different types of sum assured, and things like those.

What is the Learning?

Take easy to understand and simple products which look Plain Vanilla, Complex products have nothing extra than complexity. Just make sure you understand easy products well and how to use them well. Your investing life would look much like your investments. Keep them Simple.

What can Repiblic Day teach us about Financial Planning

India gained its Independence in 1947 . At that time India was free , and ready to grow on its own , with its own decisions . But it was not possible without a set of guidelines to guide the decision making process .

Success comes when you are disciplined and have a decision making process. On Jan 26 , 1950 our Constitution came into effect and now we had laws for different things .

We knew exactly what we have to do when thing happens . We had a road map to follow. From there on we progressed and have came a long way . We can now say that we are much better than we were at that time and we continue to grow and make better decisions.

We need amendments from time to time and that helps us to change the bad laws and adapt to new situations.

How do we relate it to Investing?

We can learn from anything … really anything . Let us try to map each event discussed above and relate it to our Investing world .

1. Gaining Independence

When we get a job and start earning on our own, we are full of confidence. we are independent, We don’t need to ask for money from our parents. Rather we have to support them. We have responsibilities. There are many goals for us like buying house, car, saving for our retirement, Marriage etc etc.

2. Republic day

This is the day when we understand that we need to do our financial planning and have a set of guidelines to guide our decision making regarding our investments .When we know how exactly we are going to invest to achieve our goals, we have a clear road map and time duration .

We just need to follow it with discipline.

Example : If a young 25 yrs old want to retire at 55 with 2 crores at the end . He can take two approaches .

a) He can try to save money here and there, some month he can invest 10k, and some month he can skip it and down the line, he has a vague idea where is he going and how is he making progress. This kind of approach often leads to failure, because there is no road map and sometime will come when you will have no idea whats happening.

b) Second approach can be very easy . You have to make sure that you understand some thing very well and be clear about somethings. Those are

– Equity outperforms every other asset class in long term .

– Equity in long term has given 15%+ returns and its possible in future too .

– You should have understanding about the power of compound interest.

Now when you are clear crisp about this idea , then you can use a simple compound interest formula to see , how much you need to invest every month for rest 30 years (55 – 25) , which can generate 2 crores at 15% annual return .

The formula is

Final_amount = monthly_contribution * (1+rate) * ((1+rate)^months – 1)/rate

where

rate = monthly rate = 15% / 12 = .15/12 = .0125

months = total number of months you will invest = 30 * 12 = 360Now you can calculate what monthly_contribution fits the values .

The amount comes to little below 3,000 per month .

Which means if you invest 3,000 per month for next 30 years , you can achieve your retirement target easily without fail. (Invest in Equity Diversified Mutual funds to target 15% returns for long tenure).

When you do this, you go with a plan (constitution) and dont have to doubt your self and you will not get lost. Just follow it with discipline without fail.

3. Amendments

Just like amendments are made in Law , because of change in environment and situations . You also may have to change you plans with market change and new products coming in (this happens rarely , because fundamental things remain same) .

Summary and Learning

What I want to point out here is that just earning money and being independent in not enough and cant make you successful with money , Discipline and proper understanding with good planning will help .

So if you are Independent but have not put your constitution in place , do it soon to really succeed . Make this day as your teacher and learn from it . Don’t be afraid of mistakes .

“Success is a ladder where every step is made up of Failure . If you cant fail !! , Winning will not be easy ” .

Manish

Do you have an insurance policy? -Read an amazing irony about Insurance

Imagine you are 25 years old earning 6 lacs/year, with a family to support financially. A Term insurance policy with some cover (may be 25 lacs) will have premium of 5k per year (for 25 years old) as the premium for this policy.

Almost 99% people need Term Insurance, But most of the people show good amount of reluctance, because they see “wastage of premium” incase nothing happens to them.

Let us try to see what are the reasons for this?

This happens because of some psychological reasons. Some of the reasons and counter arguments are :

1. People are not ready to accept subconsciously that they have equal probability of death like others; everyone assumes themselves to be little safer than others.

Counter Argument : A different case, someone tells this person that he has chances of dying within 20 years somehow explicitly, there are greater chances that his perspective about Term Insurance will change and he may go for a good amount of cover with this premium, the reason is that now he sees these [premiums as risk cover fees and not wastage.

Now he has convinced himself that there are good chances that his “death” is possible and his family needs some good cover, although there has not been any change in his lifestyle or life in general, all what matters is his attitude towards Risk coverage.

2. People do not concentrate on the value provided by Term Insurance and its cheapness, it is taken for granted.

Counter Argument : I did this very small survey where i asked my friends online. See one of them below

manish_chn: if your company says that it will cover your family for 25 lacs, but will cut your salary to some %

manish_chn:what will be the max % you are ok with

manish_chn:just the first number which comes to your mind

manish_chn:no calculation

manish_chn:please

rajagopal: hi

rajagopal: never thought about such things.

rajagopal: probably 5%?

rajagopal: without any calculations

This shows that a person somehow feels comfortable with 5% of his salary getting cut for just 25 lacs of cover for his family; it means that he can pay the price of 5% of his salary per year for 25 lacs cover.

Some people were even ok with 10% or 7%, on the average it was greater than 5%, whereas the real worth of cost is less than 1% of their salary (everyone’s salary is more than 6 lacs/year ). Cost of 25 lacs cover in market = 5k – 5.5k per year.

3. People pay money from their pocket after getting salary, so it feels that they are giving money unnecessarily.

Counter Argument:

If you make term insurance mandatory for everyone and cut 1% from their salary (6 lacs salary, and cut 500 per month for insurance premium of 25 lacs). In this case there are very high chances that almost everyone will feel that it’s a good thing. And they will even appreciate this move (there are always exceptions, but i can’t help those people).

What it shows is that people are lazy, when you do things purposefully; there are great chances that they will understand the importance of something.

So, if you give them 100% salary, they might not take the term insurance.

But if you give 99% salary and 1% is cut as insurance premium, many people will tell others how great there Company is !! (You can also just cut 1% and put it in your pocket and give them 99%, some people don’t even notice these things)

Summary

Understand that a lot depends upon yours perspective about something. When you see things in a different way, its meaning and importance chances totally for you.