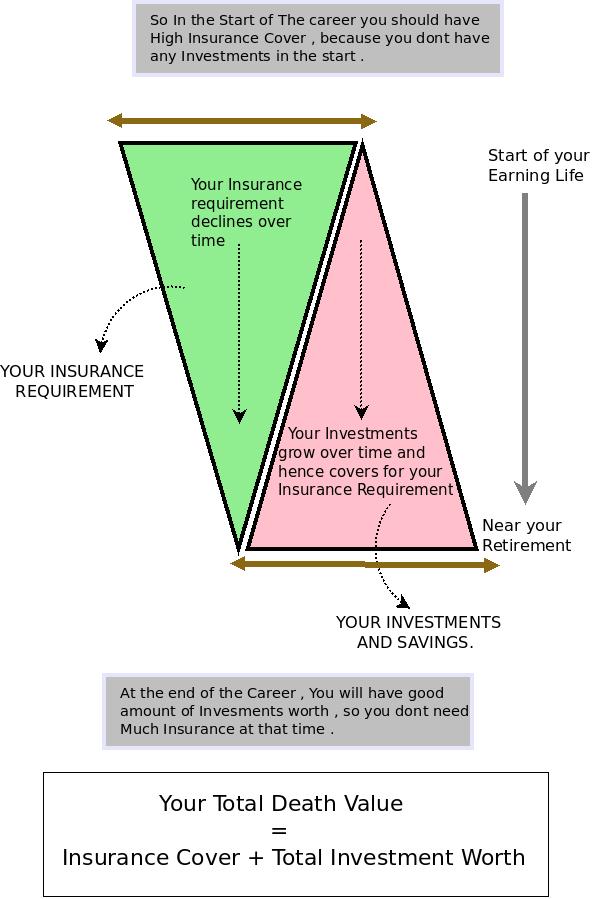

Imagine a scenario when you want to invest a big lump sum amount in stock market ? As markets are volatile and can go up or down very soon , there is always risk of loosing a big chunk of your investment (Learn about Stock Markets) . Take a case where you want to invest 10 lacs in Equity Mutual funds and suddenly market crashes for next 2 months, In this case a big chunk of your investment will be lost, on the other hand if market moves up pretty fast, you can make a good profit. Here you have to decide your main focus. If it’s minimizing risk and getting good decent returns in long-term, You should use something called Systematic Transfer Plan (STP) .

What is STP (Systematic Transfer Plan)

You should first understand SIP . SIP is way of investing in Mutual funds monthly, where a fixed amount of money goes from your Bank Account to Mutual funds, so if you do a SIP of 1,000 for 1 yr, it means that every month on a fixed date (chosen by you) 1,000 will be invested in a Fixed Mutual fund you choose. Lets understand STP now, In STP we invest a lump sum amount in some Mutual Fund and then a fixed sum is transferred from that mutual fund to another mutual fund .

%20works.png)

For Example : If you have Rs 6 lacs lump sum to invest and you want to invest in HDFC Top 200 , The steps you will have to follow are :

- Choose a good Debt fund or Floating Rate Mutual Fund from HDFC , which allows STP to HDFC Top 200 .

- Invest all the money in the Debt Fund .

- Now you can start a 10k/20k/30k per month STP from HDFC Debt fund to HDFC Top 200 .

Why and When to use STP

When will it work : STP will make sense from DEBT -> EQUITY when markets are mayvery volatile and you dont want to take risk with your money in a short span of time, If you invest through STP in markets and markets fall or have lots of volatile moves, then this situation will be better than the one time investment option. This is still better than putting money in Bank and doing a SIP, because at least you money is earning some returns on debt part in STP .

When will it not work : Incase markets are already at the end of a Bear market and markets can starts it upmove anytime, in that case STP will not deliver the best returns like SIP, one time investment is a good choice in that case. But then you never know that when will markets start go up. Given that a retail investor does not have all the tools and time to research the markets, it’s not advisable to invest lump sum in any case. It’s better to get 4-5% less returns than to see a huge downside of your money in short time, Smart investors think about returns, Smartest one’s take care of risk first .

Understand How to time markets using Nifty PE analysis

Difference between SIP, STP and SWP

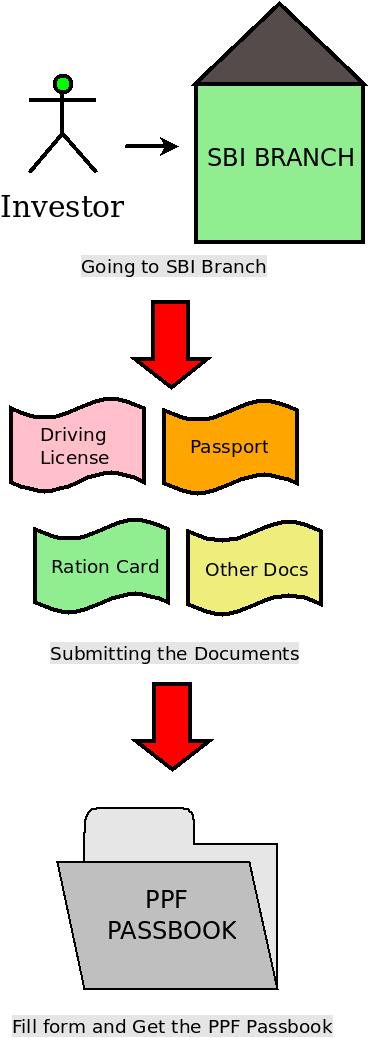

- SIP : The way SIP works that your money is in your Bank Account and every month a fixed sum is taken away from your Bank and invested in a Mutual fund .

- STP : The way STP works is, all your money is actually invested in a Mutual funds itself (probably Debt) and units are sold every month and its invested in another Mutual fund (probably Equity) or vice versa .

- SWP : However If you redeem your units in mutual funds every month and get it deposited in your Bank accounts , it’s called SWP (systematic Withdrawal Plan) , which is recommended to liquidate your mutual funds corpus after you see a good bull market to protect your investment .

.png)

4 advantages of STP

STP has 4 advantages and works in 4 ways for you . They are :

Works as SIP : You can invest in a Debt funds and from there you can start a STP to an Equity Fund , so it works like a systematic Investment Plan (SIP) .

Works as SWP : So STP can also work like SWP, because with some funds you can do transfer from Equity funds to Debt Funds, so when markets look risky to you, you can start a STP from Equity -> Debt funds, which will act like SWP .

Liquidity : Generally one does STP from Debt -> Equity funds, so your money is invested in Debt fund. This means you can sell it anytime if you want. Hence it works like a Emergency Fund also. Incase you need money urgently, it can act like a liquid asset (at least for the time being in the start when you have more money in Debt fund)

Growth in Money : Not to forget that your money is invested in Debt funds, so your money is also growing at debt returns , at least the part which is lying in the debt funds .

Some Helpful Tips

- Invest in ELSS , If you want to invest in ELSS schemes and have lump sum money , better put it in a debt funds and do a STP .

- Rebalance your portfolio, Use STP as a tool to rebalance your asset allocation, when your equity part goes up , start STP from Equity-Debt for 6 months or 1 yr, and bump up your debt part and if your Debt part goes up, do Debt -> Equity STP . Power of Asset Allocation and Portfolio Rebalancing

- Take advantage of market condition , If markets have gone too high now and every other person on the road is talking about Stock and stock markets are more famous than “Saas Bahu” Serials, immediately start your STP from Equity to Debt (literally Rush) . On the other hand when markets are deep down and “Why don’t you buy stocks” is feels abusive and everyone face looks like some body has died at home when you mentions stock markets, know that it’s a time to start a STP from your Debt – > Equity (Literally rush again) . You don’t need to see any indicators to predict the markets, the two real life scenarios I have described here are enough, try to remember markets around 2007 End(bull market) and Jan 2009 (markets lowest point) . STP can be used as switching mechanism in ULIP , though it’s very restrictive and with less choices .

- Using STP when an important goal is near, If you are saving for some important goal like Child Education , Buying Home or Retirement and your goal is approaching near by , don’t wait till target date , you don’t want to see your Money dip by 40-50% within 6 months or so if markets suddenly crash , start moving your money out of equity and transfer it to Debt now through STP .

Two types of STP

There are two types of STP plans , Fixed and Capital Appreciation. In Fixed Plan means a fixed sum will be transfered to the target mutual funds , on the other hand in Capital Appreciation , only the amount of capital which is appreciated gets transferred , that was the original lumpsum amount invested in the start is protected . Capital Appreciation choice is only with Growth Plan and not dividend plan . Here is the list of all the STP Plans as of now .

Important Points

- Typically, a minimum of six such transfers are to be agreed on by investors in STP , just like SIP

- Generally most of the mutual funds allow Debt -> Equity STP and not reverse , Only handful of Mutual Funds like Kotak allows it .

- STP is a facility for convenience , when the transfer happens from one mutual funds to another its still considered as selling of mutual funds and then buying another one , so tax rules applies in the same way .

- Most of the funds allow only Monthly and Quarterly STP , some allow weekly and fortnightly also .

- There can be some minimum amount requirement for starting an STP like say at least 1,00,000 needs to be invested in Debt funds to start a STP to Equity . Some restriction like this will be there .

- There can be additional Switching Charges for availing STP facility

- Entry load and Entry load may still apply while buying and selling of mutual funds through STP.

- Securities Transaction Tax @ 0.25% will be deducted on equity oriented funds at the time of redemption or switch to another scheme in STP .