This article is to be seen as Financial life – wake-up call. (Read it and share it with those whom you think needs a wake-up call)

When you are in your 20’s the areas that rules your mind are getting a good placement, partying, buying gadgets, finding right life partner or it can be setting-up your own business. There is very little space for money management (This is true for majority of people, there are always some exceptions).

I can say this because in my early 20’s, personal finance was an alien to me. In a way I was not ready to play role of an investor. I was totally casual and irresponsible with the money I had.

Now, when you step into your 30’s the entire scene changes. Some kind of short circuit happens in your head and you suddenly become serious about your hard earned MONEY. You start to gather personal finance knowledge from different sources, look for information, advice on internet and you start to read about personal finance (even if you struggle to understand it)

The Student in YOU is STILL alive

When you were a student I am sure you never started studying on the very first day of your college. Like majority of students you would have waited for the exam dates to get announced and when the exams get extremely close you would have purchased or opened your books (got notes photo copied) and started to prepare for your exams.

The last 7-10 days were the most crucial days for you. In such situation passing or scoring good marks turns into a mission.

Now, this is exactly what most people are still doing in their financial life; they are waiting for the last moment to arrive. They are waiting for the right amount of pressure to get build.

In your 20’s the pressure is least, in your 30’s it starts to build and in your 40’s or 50’s it turns into a do or die situation. Most of you don’t start your investments with the first salary you receive and so I made the statement that the student in you is still alive (If you are an exception I congratulate you)

Top 5 Moments of Transformation that makes you serious about your hard earned money

1. When you experience Ants in Your Pants

In your 30’s when you get face to0 face with your net worth the question that hits your mind is, where did it all go?

You realize that you have been slogging 13 hours a day from last 7-10 years and your net worth is not satisfactory at all. This moment is extremely confronting and it makes you feel uncomfortable but at the same time this is the moment of transformation.

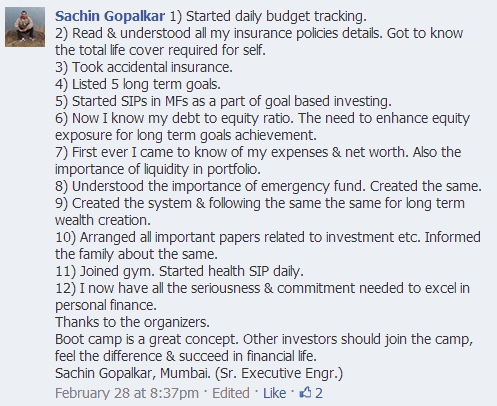

In such moment you become serious about your financial resources and your financial life. Some people start to write budget, some hire a financial planner and some write their situation to bloggers like Nandish and Manish. (Every day we get one such mail from some or the other investor and we start our rescue operation)

Hello Manish,

To start with I am one among very few people who practically is broke I must say. I took things for granted as most of us do and realized what deep shit I have got into. I am 31 years and believe me I don’t have savings worth my age as well.

Your blog woke me up from that undisturbed sleep that made me feel everything is okay. Swear to God it is not. Considering the things I have been to in the past. Lived the American way like there is no Tomorrow. Paid the biggest price ever Sir.

Not anymore, after reading you first book on personal finance I made a promise to myself that enough is enough. Not anymore and made couple of promises to myself that I am sure will keep.

Also would like to use your paid services sir, I never found a number that I can call on on the blog sir. Please provide with a number or advice how to start with considering I am in deep mess, I guess I need to recover all those years I’ve spent without savings.

Lost those early years sir and planning to recover them somehow.

Regards,

Stuck investor

Get this clear, it is not about this investor/person because many of you are sailing in the same boat in the area of personal finance

2. When Goals starts to Appear Scary

Most of the investors become serious about their finances when they do some calculations around their goals. Goals like buying house, children education, children marriage and retirement are considered to be the scariest amongst all other financial goals.

If you want you can test it, do some calculations and then look at your current savings and bank balance. The thought that will strike your mind will be “It’s high time I start doing something about my finances”. This particular moment is again moment of transformation.

In this very moment you start to become serious about wealth creation and you start taking actions in your financial life. By the way in reality no financial goal is scary, if you mismanage money the goals starts to appear scary. (You are one who makes them scary)

3. When you Experience Personal Earth Quake

Imagine a strange situation in which you experience personal earth quake right under your chair (Others are fine only your chair is shaking). We can say this from our experience of working and interacting with investors that such situations make’s a person serious about their financial future.

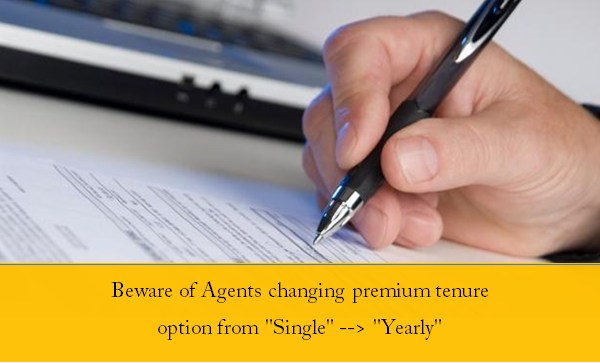

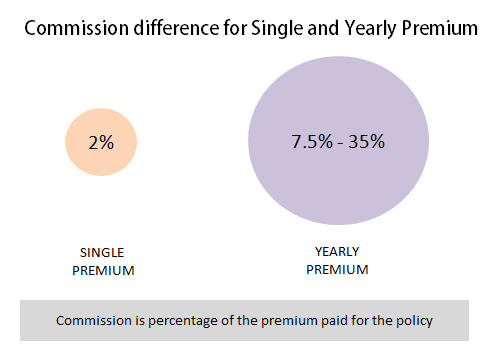

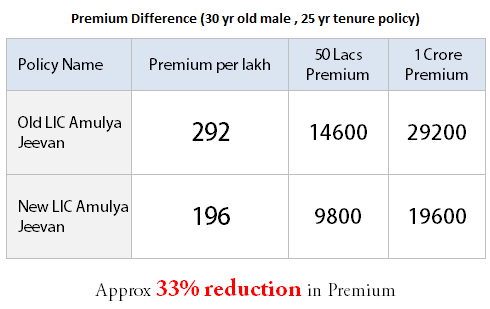

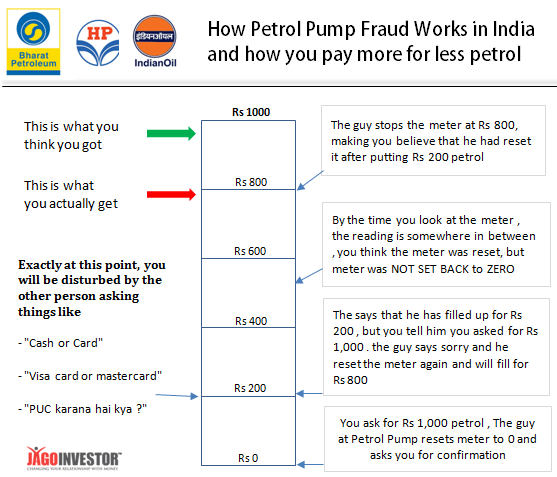

In your world you think you have made all the right investment choices but on one fine day you land on a blog like jagoinvestor and you discover that you have made all wrong choices and you are a victim of mis selling.

This personal earth quake moment shakes you, wakes you and in a way shatters your financial world. In this very moment you start doing required home work in your financial life, before putting blind signatures you will take out time to read the brochures of different financial products. From this very day you stop trusting all the uncles and relatives who supplied you free dose of advice.

4. Real life experiences causes transformation

Reality is the best teacher you will ever encounter in your life. We have come across numerous cases which brought drastic change into people’s overall attitude towards money management. One of our clients lost his elder brother at a very young age and this event made him very serious about life protection and how important it is to keep things organized.

A lot of people after one of their family member gets hospitalized they become serious about health cover. My invitation is do not wait to take actions in your financial life. You don’t have to wait for some accident to take place before you start wearing helmet.

Look around you and learn from some real life experiences as they are of the biggest source of transformation you will ever find.

5. Breakdown in Career

It is said that “Man proposes and god disposes”. In my book “11 principles to achieve financial freedom” we have a chapter called “Your plan vs. God’s plan for you”. It is a fun and insightful chapter that helps you to think beyond making plans in your mind.

We have coached many investors who had some kind of career breakdown and we could see how it made them extremely serious about their finances. Somewhere you start to value money most in your bad times.

Most of people in their 30’s take major career decisions, they are clear that their idea is going to get them all the success that they are looking for. I am not saying doing business is risky or one should not experiment. All I am saying is such situation leads to personal transformation into an investor’s financial journey.

Some final wake-up words to engage with

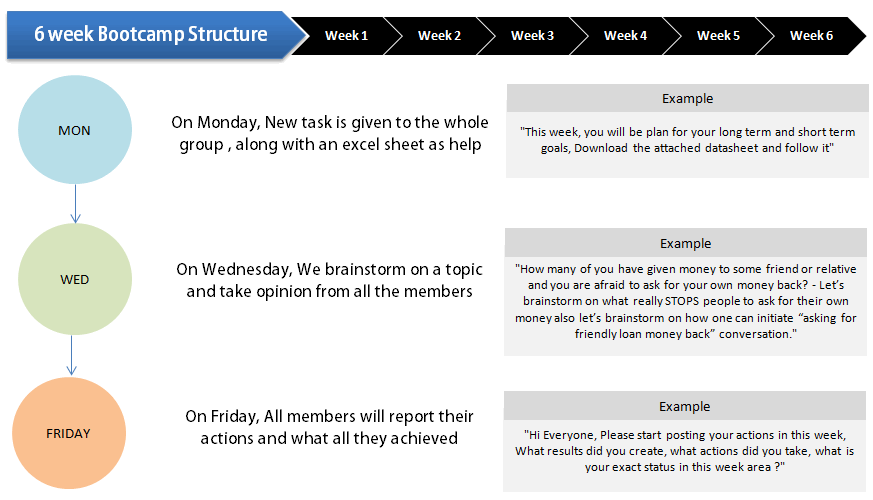

Do not wait for a kick on your ass or for some unpleasant situation to occur before you get serious about money management. We wrote this article because majority of our clients for financial planning and financial coaching are in their 30’s. Something happens when you step into your 30’s and you need to acknowledge the moment or event that got you serious as an investor.

Whatever is your age right now just start taking actions in your financial life. Also, in the comments section share the moment that made you serious as an investor and what would you say to those who are yet not serious when it comes to money management?

This article is contributed by Nandish Desai. Let us know your thoughts about this article.