When a new kid is born, your entire life changes. You are excited to enjoy the new phase of your life. Today we are going to touch upon some basic things you should watch out for and focus on after your new kid is born.

These are few things which you will eventually complete, but if you are too late, you might end up waste your time and energy. So its better to learn from others mistake and take some actions before hand.

Note that we are going to look at only those things which are related to personal finance at some level. Also most of the things are generic in nature, so if you do not agree to some, just move on and do not implement them for yourself. Lets look at them one by one.

1. Review your Life Cover

Once your kid is born, a new life comes into existence. Its now an additional responsibility you and your spouse have on your shoulder. All the future and current expenses needs to be taken care.

Think about it, all the school expenses, future education expenses, providing for all the best things in life – This all is going to cost a lot of money and the breadwinner is going to provide for that. So, If something happens to breadwinner, your life insurance should provide all these expenses.

So make sure you increase your life cover after reviewing all the numbers. In case you have not yet taken any life insurance, I strongly recommend now get a life insurance plan. As a thumb rule, I think increasing your life cover by Rs 50 lacs is the minimum you can do.

2. Get the baby added into Health Cover

If you already have a health insurance plan (either bought yourself or through employer), make sure you add the kid to the policy the moment they are born. If you do not have the health insurance yet, you can now get the health insurance and make sure the kid is part of the policy.

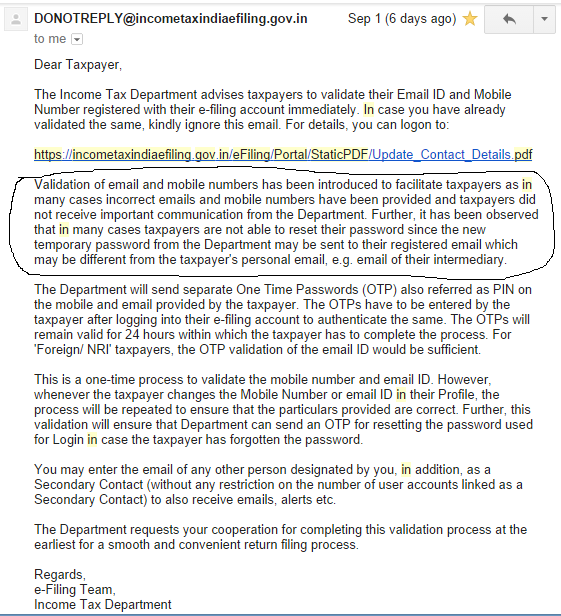

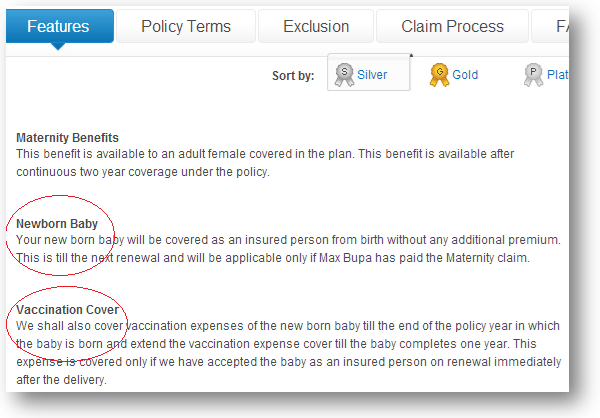

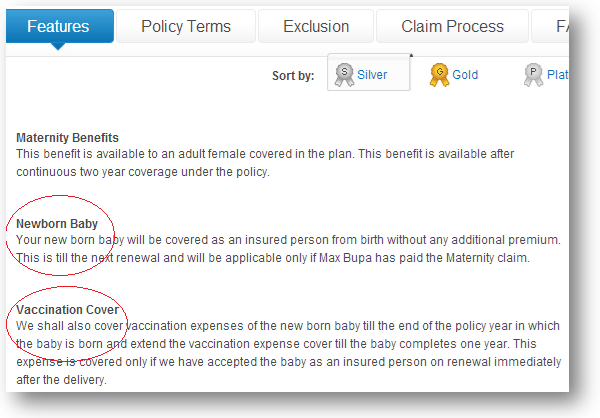

Some policies already cover your new born kid without any extra premium from the birth itself provided they have also paid for the maternity claim in the same policy.

As an example – Family First Health Insurance from Max Bupa has provision for new born babies from the day they are born and even cover vaccination costs for the first year. Look at the snapshot below

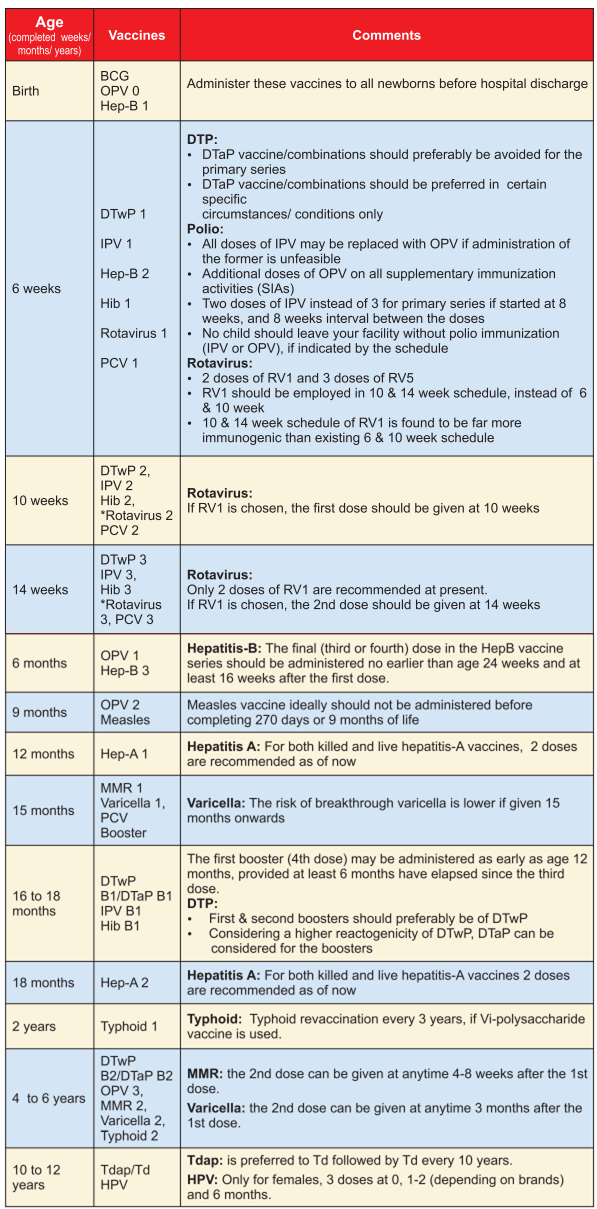

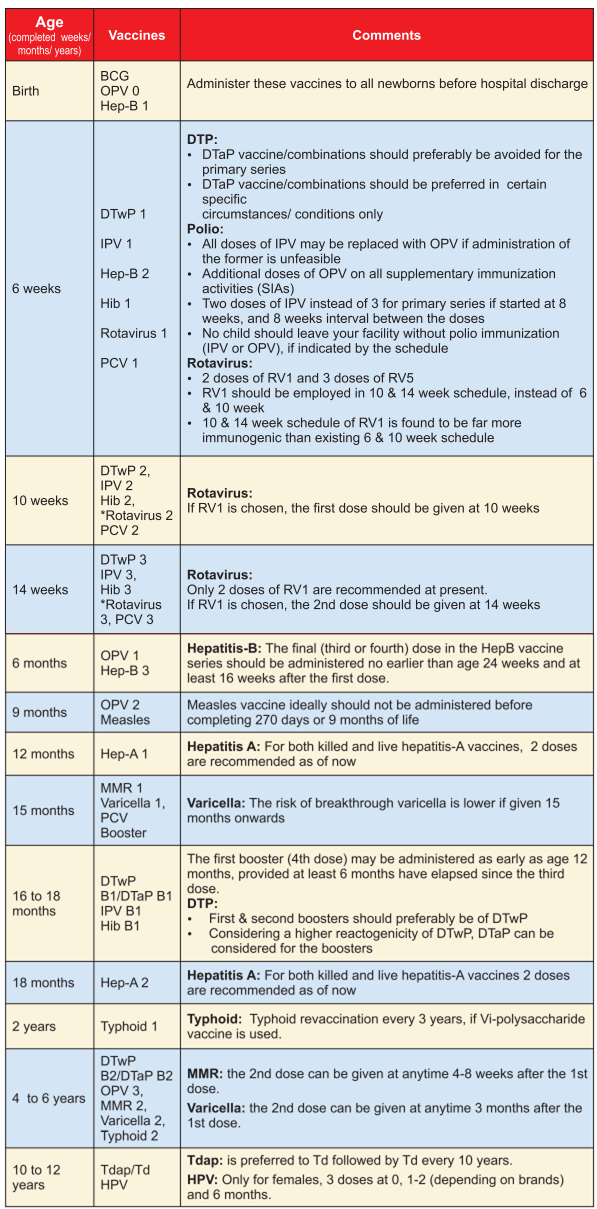

Below is the vaccination chart along with the age, vaccination name. It will help the new parents.

3. Start a Recurring deposit for upcoming school expenses

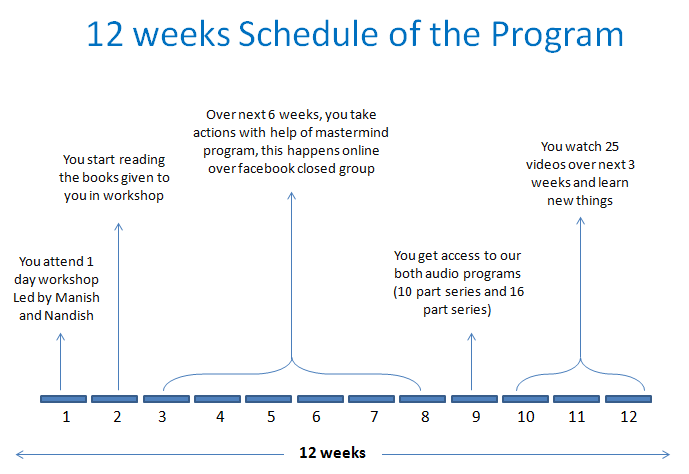

We conducted our workshops in 3 cities in India and one of the common point most of the participants agreed on is that school expenses on a yearly basis are in the range of Rs 50,000 to Rs 1 lac per year. Even the pre-schools are costing a bomb now, which can range anywhere from Rs 25,000 to 2 lacs per year.

Below is a report on pre-school charges in Bangalore from Times of India

Some pre-schools also double as creches providing day care, and charge astonishing rates. One such school in HSR Layout charges Rs 1.38lakh per year for day care of kids up to two years old. Timings are 8.30am to 6.30pm — one hour less costs Rs 1.25lakh, and till 3pm, it’s Rs 96,000.

There are some pre-schools that charge up to Rs 1.5lakh. A prominent national chain, with a branch in Indiranagar, charges around Rs 80,000. On an average, Rs 30,000-35,000 is what you will need to give your child a headstart in life. Most schools have also started their own pre-schools, from where the children automatically move on to nursery.

As these expenses will arrive in next 2-3 yrs, its important to make sure you are ready to arrange the money for this. The most simple way to plan for this short term goal is to either open a Recurring deposit in your bank or start an SIP in a debt fund.

If you want to plan investments for your children education or overall financial planning, you can leave your details on our services page and we will get back to you.

Coming back to the point, As an example, suppose the expenses are going to be Rs 45,000 and if you have 30 months in hand. You can just open a Rs 1,500 RD and when it matures after 30 months, you will have that money with you.

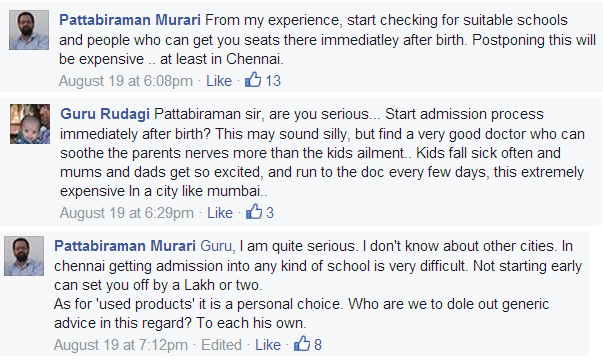

When I asked for some suggestions on this topic one one of the facebook groups run by Ashal Jauhari. Pattu gave an interesting point regarding School Expenses in the start. Have a look at the conversations below which was part of the long discussion in the thread there

4. Update your Nomination’s in various financial products

You might want to have your baby nominated in some of the financial products you own. It can be your bank accounts, fixed deposits, mutual funds or even some property. You might want to add your newborn as one of the nominee in the assets you own. Read more about nominations in this article if you do not understand what exactly nomination is.

Also, if you have written your WILL, then you might want to update it soon after the baby is born. If you miss this, and if you old WILL didnt have the right kind of wordings, then your baby might loose his/her share in your wealth in worst case.

5. Register the birth Certificate

Make sure you apply for the birth certificate for the new born asap. It is a simple process if you complete it in the starting itself, else it will get complicated later. Most of the hospitals anyways has this as one of the mandatory things you need to do.

You can get the form from the hospital itself and then submit it to the local authorities within 21 days of birth. This page mentions the procedure in detail in-case you want to have a look.

6. Start a Saving Bank account for kid

One of the best things you can do for the kid from the start itself is open a saving bank account for the new born the moment they are born. Almost all the banks have facility for kids to open their bank account. For example – ICICI Bank clearly mentions that any kid starting age 1 day to 18 yr are eligible to open a bank account called “Young Stars” with them.

I would like to draw your attention on 3 reasons why you should open a bank account for your newborn kid.

Reason 1 – Put all the Cash Gift in the Kids Bank account

The moment your kid is born, for next many months and years – you will start getting lots of gifts in form of Cash. Often this money is not handled properly in families because of its small ticket size and it gets consumed here and there and finally evaporates.

You can always make a rule that all the small/big money coming in the baby name (on their birthday’s or baby shower functions etc) will be deposited in the saving bank account opened for the kid.

Reason 2 – You can open dedicated long term investments for your kid’s future

Another reason why you might want to open a saving bank account for the kid is that if you want to invest for your kid long term education or any other thing. You can make sure you start the investments from the kid account itself.

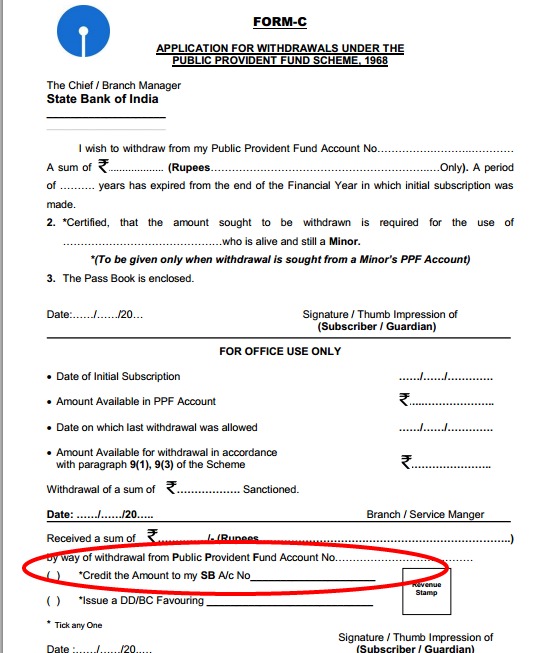

This way the account will be dedicated for that purpose and your volatile decision making will not impact the savings for kid. You can either invest in Kids PPF account through this account or do a SIP in equity mutual funds for long term investments needs.

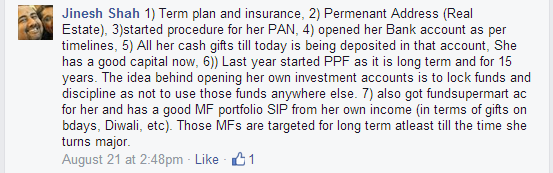

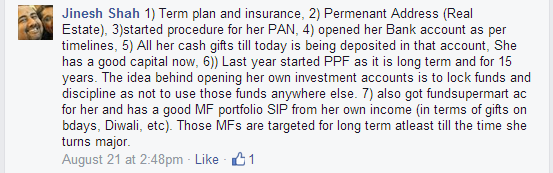

Mr. Jinesh Shah from in one of the facebook group shared what he does for her kid.

Reason 3 – Your kid will learn about banking and personal finance from very start of his life

Another good reason for opening the bank account for your new born kid is that once he/she turns upto 8-10 yrs, you can allow them to partially handle their own bank account and teach them banking aspects.

Learning that they have their own personal bank account will make them feel good and also they will take keen interest to learn these things, which most of the people learn very late in life.

Bonus Tip : You can also apply for your baby’s PAN card within few weeks/months of his/her birth. Anyways you have to make it later, so why not in the start itself. Its always a good practice to have a proof of identity in the start.

It will be handy if you want to apply for other kind of documents like Passport, bank account, etc . You can read this experience from Amit Gupta when he applied for PAN Card for her daughter.

7. Buy clothes and toys smartly – they’re often gifts

I know new parents are excited and want to give their best. They will buy lots of clothes and toys and no one has any authority to advice parents on what to do and what to not do. The emotional side of joy cant be suppressed. However Often new parents realized later that they have overspent too much on things which baby never needed.

In reality, for the first few months – the babies only sleep almost all the times and they grow so fast that things you had bought for them is now not needed by them. And when relatives and friends come for visits, they anyways bring lots of things you had already bought for kid.

So there are few tips which can optimize the expenses side and also help reduce the wastage done by many parents.

Rotate things among your group – There can be many things which can be rotated among parents for their new born kids. If you have some item which can be shared with some other new parents, then better share it with them and help them reuse things. There is nothing wrong in it.

Shop Slowly – Buy things one by one and not in a lot – If you want to buy something for your kid, start small – let the moment come and buy it. This way you will not buy things which are unwanted for kid.

Below is a survey done by Moneylife on the topic “The real cost of parenting” sometime back. It explains what kind of expenses families are doing on various stages for their kids. I am sharing the results for the age group 0-4 here. If you are interested to look at the full survey results, please read their full article here

8. Dont invest in CHILDREN PLAN

Yes, thats correct.

The moment you become parents, Apart from the joy and happiness, some part inside you will also be “very worried” about the kids future and how you will provide him/her best in life. This is the perfect mis-selling moment on the name of kid by various agents.

All the insurance agents (uncles and aunties) will come to you and try to sell you a CHILD PLAN. You will be sailing on the emotional boat at that moment and you will hear sentences like – “Gift you kid his bright future” and “This is the perfect thing you can buy for your kid in the start” .

While I am not against any policies and plans, but these Child Plans are often designed to exploit these kind of emotions and things are bundled in such a way that they look over attractive proposition to a new parents for their kid.

Inside the product its often the mix of insurance and investments with some kind of payout on regular basis. These are high on costs and a bit complex products. Its nothing but a slightly changed versions of ULIP’s or traditional insurance plans.

In case you are really impressed with those products, my suggestions is to wait for some months, and later study them properly and then buy them if you are fully convinced about them.

In general I would recommend any new parent to insure them with a simple Term plan and either open a Recurring Deposit or just invest in a simple mutual fund with SIP route to start with or you can follow this ready made calculator, I create sometime back for planning your kids investments

9. Have a 24/7 reachable Doctor nearby home

Medical expenses and Doctor visits are one of the top most expenses you will have to incur after the baby is born and for at-least first 1-2 yrs and you cant even avoid this issue.

You will have to travel many times to doctor. These visits are sometimes planned and often emergencies. You even might be in your office when you get a call from home that baby needs urgent attention and then you take a day off or leave early from office.

It helps a lot if the doctor is near you home or within few KM’s distance. At times people have their doctors as far as 15-20 km’s (for reasons like – “He/she is the best doctor I think”) and then in-case of emergencies it can take 2-3 hours to just travel.

So its always the best thing to have a good doctor nearby and try that they are reachable almost all the times. Ask their permission if you can call them anytime (day or night) and take consultation. Compensate them for their effort and they should agree.

10. Make a Baby Emergency Kit and save on Time+Money

This is a great tip shared by Nandish (He became father 1 yr back), while I was working on this article.

He shared that they have created an emergency kit for baby, which has medicines for the recurring issues and most common things which new parents will encounter all the times like stomach ache, teething issues, loose motions, fever etc. You can sit with your doctor and take consultations on what all to do in various situations without visiting them.

To show you importance of this emergency kit, I would like to share an incident which happened with Nandish. Her neighbor’s kid was having some issue around afternoon time, when her husband was in office and no one was there at home (I forgot the medicine name) .

She was trying to find out how she can get the medicine asap from somewhere. Because there was an emergency kit available at Nandish home, that common medicine was there and she could get it instantly. This is a small action, but it saved a visit to doctor and even a trip to market to just fetch the medicine.

This kit can also have wet wipes, extra nappies and every other thing you can imagine. Its even very handy if you suddenly have a travel plan (locally within city) and its going to take yours . Medimanage has put up a very nice starters guide for new parents, have a look at it.

Conclusion

The points if implemented will help you make your parenting journey more smoother and your financial life more better over long term. I know most of the people do not think about all the points mentioned above thinking they will handle things once they arrive, but then its your choice. Its a always a good idea to prepare for things well in advance and not wait for the last moment surprises.

Can you share some more tips which are not mentioned above. It will help people who are about to become parents or new-weds who will plan for their kids in next few years.