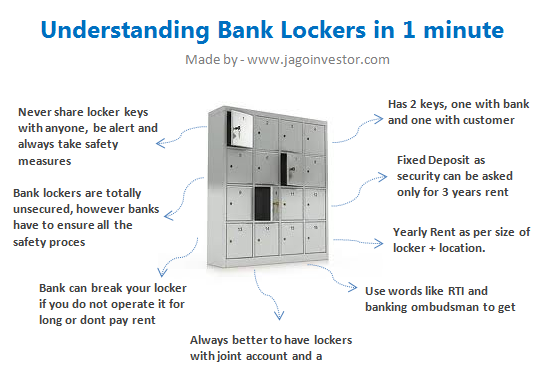

Today we are going to talk about “Bank Lockers” and how banks use unfair tactics by forcing customers to open a fixed deposit for a very large amount and that too for a long duration. It’s not uncommon to hear bank officials asking for fixed deposits of Rs 5-10 lacs in case you want to get a locker. That is just not allowed as per RBI and we will see what exactly the RBI guidelines say about it.

What is a Bank Locker and How does it work ?

Just like we have a saving bank account and fixed deposits to keep our money safely, we have “Safe Bank Lockers” to store our physical belongings like jewelry and various kind of important documents like WILL, Property Papers and other valuable items which you feel should not be kept at home.

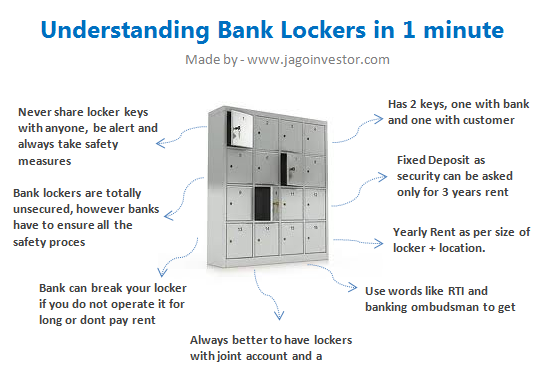

There are always 2 keys for the locker, one key is with Bank and the other with the locker holder. The locker can only be opened when both the keys are used at the same time. Generally bank official applies the key and then leaves the locker room and only after he/she leaves, you should open the locker door and do what you wanted to do. The banks use very high quality, strong lockers (generally Godrej). So overall, this all makes sure that your locker is very safe.

Lockers are to be allotted on first come, first serve basis (as per rules) and in-case the lockers are exhausted, the bank is suppose to keep a waiting list of customers who have applied for the lockers and have to inform them when the lockers are free in the same order of application. If bank says that they do not have any lockers left at the moment, you can ask them for the “Waiting Register.”

Annual Rent for Bank Lockers and Security Fixed Deposit

Bank lockers come in different shape and sizes, which can be taken by customers depending on their requirement. For using the facility of lockers, you have to pay an annual rent which will vary depending on the size of the locker, the city (metro, urban, or rural). For most banks, the locker rent starts from Rs 750-1,000 per year and can go up to 5,000-10,000 for PSU banks and even 40,000-50,000 in case of Private banks (see the locker rates for bank for Baroda here) .

Is opening a Fixed Deposit mandatory for getting a Locker ?

Now lets discuss the biggest pain point of customers. Almost all of you might have faced this. When you go to open a bank locker, you are asked to open a Fixed Deposit for a large sum like 2-5 lacs for a long duration or asked to buy some policy (ULIP or Traditional Plan) saying that this is the rule for assigning the locker. However it’s just a plain lie and an unfair practice followed by Banks. A common man has no idea if the bank is correct or not and where to get the right information? So, I looked at RBI regulations on Banking and found out the exact rules.

And this is what I found – YES ! , Banks can ask for Fixed Deposits as security !

But, here is the catch ! .

As per RBI regulations, the bank can ask for a fixed deposit only to cover 3 yrs of locker rent and the breaking charges, not a rupee more than that and that too only from the new locker applicants, not old one’s already having a locker. Here is the RBI wordings from their notification

1.2 Fixed Deposit as Security for Lockers

Banks may face situations where the locker-hirer neither operates the locker nor pays rent. To ensure prompt payment of locker rent, banks may at the time of allotment, obtain a Fixed Deposit which would cover 3 years rent and the charges for breaking open the locker in case of an eventuality. However, banks should not insist on such Fixed Deposit from the existing locker-hirers.

To give you the proof one of the PSU banks – Bank of Baroda clearly mentions this fact on its website here

At the time of hiring the locker, bank will obtain a minimum-security deposit in the form of FDR from the lessee for the amount which would cover 3 years rent and the charges for breaking open the locker in case of such eventualities.

So, suppose you want to get a locker whose yearly rent is Rs 1,200 and the breaking charges for locker is say, Rs 100, then they can only insist on a Fixed deposit of Rs 3,700 (3 years rent + breaking charges); nothing more than that. Ergo, 3 years locker rent is going to be a very small amount, which almost anyone can afford, but banks lie to you and trick you by telling you to invest in a really large Fixed Deposit .You oblige for your own reasons. Banks do it to make sure they reach their monthly and yearly targets of acquiring new fixed deposits and selling useless policies like ULIPs and traditional plans (Note that banks are one of the channels for many companies to sell their products)

So next time you go to the bank for enquiring about lockers and bank officials don’t give you proper information, you can tell them about the rules and the notification from RBI. That should give some shock to the employees there and they might treat you a bit fairly. If still they do not budge, use the threat of RTI and banking ombudsman (and then actually use it)

Use RTI to resolve the Issue and Find Information

RTI is a powerful tool for a common man. We will see now, how you can use RTI against PSU banks. Next time when you go to a bank (I am referring to PSU banks here), tell them you want to have a locker (assuming you are having a saving bank account there already) .

When the bank staff tells you that they do not have any lockers available at the moment or try to impose some rules, you can tell them that you will find out things by filing an RTI application to the branch manager and also would quote his name in the RTI (stare on his name plate at the desk , he/she might be in horror). If they do not budge, then really go file a RTI after the incident. I would say better file a RTI before and once you get the reply from RTI, reach the bank with RTI reply letter itself.

When you file RTI letter, ask following things

- How many lockers are installed in the branch ?

- What is the size and volume of lockers and how many types ?

- Rental amount per year for the Lockers ?

- How many lockers are Unoccupied and available for allotment

- How many people have requested for it and are on “waiting list” ?

- What is your serial number in that waiting list (in-case you have applied for it) ?

- Is there any requirement to make a Fixed Deposit for getting the Locker (YES/NO) ?

- What is the amount of fixed deposit to be opened and what are the rules for it ?

- In how many days a bank locker is allotted ?

- Who is responsible to allot the bank locker in bank ? What is the name of the officer or designation ?

A weak person is always exploited in society, that’s the nature of life . When you appear as uninformed and too needy, anyone can take advantage of you, but when you appear as informed investor, who will not allow anyone to take advantage of his/her and who appears to be committed to be treated fairly, its tough for the other side to exploit then. Here is an instance on how Nikhil got the Locker facility with any FD at ING Vyasa Bank

I experienced a similar forced selling sometime back at ING bank. I wanted a locker and the Relationship manager said I need to make an FD of Rs. 100000/-. when I said NO. they said its a rule. I said there is no Rule book which mentions this. Rules are same for all banks and branches. the Relationship Manager stubbornly said ‘This is the rule of this branch’.

I just went to their website, found the no. of Chief compliance officer and spoke to the officer who helped me on this. After 2 hrs, I got a call from the same Branch of ING and they requested me to come to the branch and gave me a locker without any kind of FD!

Locker with Joint Accounts and Nomination

Just like saving bank accounts and fixed deposits, you can open a locker as joint account and with nomination facility, so that in case the demise or unavailability of the main locker holder, the joint holder can access the locker and operate it. Also in case the locker holders die (both joint holders), at-least there would be a nominee, who can get access to the locker by producing death certificate and filing up claim form.

There are tons of cases where locker was just owned by a single holder and when he died ,the family had to move mountains to finally get access to the locker. Worst, many families are not even aware about the existence of the locker and banks don’t take much interest in tracing down the locker family for many years (provided they have got the rent or have the fixed deposit linked to it).

Can bank open the Locker without your permission ?

In the worst case YES ! You need to operate your locker from time to time (at least 6 months to an year ideally.) Recently there have been cases when explosives and illegal things were found in lockers, which shows how lockers can be misused. When you are allotted a locker, there is proper KYC done by bank to make sure they know everything about you. They would place you in particular risk category like low, medium or high. If you are a high risk category person, you need to operate your locker at least once a year to make sure everything is fine. If you fail to operate your account for very long (depending on your risk profile), the bank will first remind you about the locker and will ask you reasons for not operating your locker. If you still do not take actions, the bank has all the rights to break your locker and give it to some one else, even if you are paying the yearly rent on time.

In case there is a genuine reason for not operating your locker for a very long time, you need to give it in writing to the bank mentioning the reason (like if you are now an NRI or if you are out of the city for a long time.) Also, if you fail to pay the yearly rent, they can break off the locker and re-allot it to someone else. Fair enough 🙂

Are bank lockers really safe ? Who is responsible if something goes wrong ?

Now this can be news to many, and a shocker, but in truth, Banks are not responsible for your bank lockers for any unforeseen events which is beyond the control of banks, provided they have done every due diligence from their side to protect it. You have to understand what exactly a locker facility is. The bank just gives out the space they have, on rent and make sure that its safe and secured professionally. They are suppose to make sure they have all the safety and security measures in place, to ensure that the lockers are safe and secure. So its more of a proprietor and a tenant relationship. In case there is a robbery (not in control of bank), Earthquake, Tsunami, Fire (which is not in control of bank) then bank is NOT responsible, or liable to compensate you.

Let me give you an example – If there is a robbery in the bank and your locker is one of the unlucky ones to get robbed, you lose it completely and the bank is not liable to compensate you for the reason that it wasn’t in their control to stop it, especially when they have all the security measures in place like a security guard, powerful lockers, CCTV cameras installed, and emergency alarms in place. The act of robbery is more of a unlucky event for them and you. (However there are some policies in market which insures the jewelery in your bank locker like this policy from Axis Bank). If you think that robberies in bank (with locker looted) do not happen in reality, I must tell you that it happens and has happened in past. Here is one such example.

Robbers recently broke into the strong room of a Punjab and Sind Bank branch in Jalandhar and emptied out 36 lockers in an incident that stands out as a grim reminder of the abysmally poor security infrastructure at financial facilities in the country. The incident is a reminder of a burglary at the Chirgaon branch of the Central Bank of India in Jhansi, Uttar Pradesh. As many as 45 lockers had been robbed in the November 2010 episode. (Link)

When you put your valuables in bank locker, the bank does not know what did you put in there, there is no record of it in writing with bank. That’s one reason, they can’t compensate you in case something happens to it (It could happen that you never had anything in locker and you can suddenly say that jewellery worth 10 lacs is missing! What’s the proof ?) However it does not entirely mean that banks are not liable to pay back or compensate the locker holders in every case!

Bank has to make sure they have done their side of safety measures and security

Bank is not responsible for your lockers only in case of those events which are totally not in control of bank and unavoidable, but only when they have done their share of work and security like I explained above. If banks fail to do their duty and then a robbery or some unforeseen event occurs, which results in your loss, then a customer can always claim that the bank is liable to compensate, because then the incident might have not happened or could have been avoided if banks did their part.

In another case, of Bank of India vs Kanak Choudhary, the customer had kept currency notes in locker which was eaten up by termites. Here the bank didn’t do their job of ensuring that the place is clean and safe. The customer was awarded the compensation.

Bank of India vs Kanak Choudhary

Here, the customer filed a case stating that termites had destroyed currency notes and important papers kept in her locker. The commission said that the bank “was bound to ensure that the respondents’ locker remained safe in all respects”, and awarded compensation to the customer.

Even in the robbery case shown above, the bank was found to be irresponsible and didn’t not do a lot of security measures, and definitively there was a chance of the robbery being unsuccessful if only bank had done their share of work, which means the locker holders would get compensation from bank, but then issue now is, how much compensation bank has to give and why when ? The matter would have gone to court and delays and frustration must have happened in that case.

But how much you can claim back from Bank ?

Not 100%, because you can never define how much you lost with 100% certainty. Banks themselves insure the lockers to deal with the loss in an extreme eventuality, so bank themselves get some compensation from wherever they have insured the lockers. So you can get some compensation from bank out the amount they themselves get, but to get back the compensation, you will have to show the receipts of the things which you claim was kept in the locker. Even in that case, you will not get 100% back, it will be some percentage, which can’t be defined. Also you can’t get back any compensation for the documents kept (as you cant define it’s value) and the currency notes if any. You can look at the youtube video above to see these points on claims you can get back.

While the risk is always there with bank lockers, note that this is an extreme eventuality. This information should be seen more of an awareness point, rather than a decision making criteria to choose or discard taking a bank locker. You don’t stop driving a car, just because there is a small chance of accident, right? In the same way, just because lockers are not 100% secured, does not mean you say that – “I will not go with bank lockers, because its not 100% safe.” Truly speaking it’s much safer than you bank almirah at least.

Some safety measures you should take for Bank Locker

You can never get rid of the complete risk, but you can ensure that you follow some best practices and common sense tips to make sure your bank locker is safe. Here are some good practice.

- Always open your locker after the bank employee who accompanies you to the vault leaves the place.

- Make sure your bank has all the necessary security measures, such as alarm system, iron-gated rooms, electronic surveillance via CCTV, etc.

- Visit your locker frequently and ensure your valuables are safe. The RBI and banks expect frequent locker visits from customers.

- Also, ensure the locker is properly locked before you leave the vault.

- If possible, better have 2 lockers to diversify the risk (like one locker for valuables, and another for Documents)

- If possible, always go with the bank where you have huge trust and comfort and its near your place, so that you can visit them often

- Keep laminated documents in the locker, so that they are not damaged if you keep them for a very long tenure.

- Always keep a record of what all you have in locker, so that in-case of eventuality, you can alteast find out what was lost and what was the worth

- Demand a copy of the hire-purchase agreement for the locker so that the bank cannot ask for a higher rent in future

- If a bank says the locker request is in the waiting list, ask for the waiting number

- Demand a copy of the bank’s internal guidelines regarding lockers (their guidelines never mention fixed deposit as a mandatory condition)

I hope this articles has helped you understand almost everything about the bank lockers and how they work and different rules and regulations. Do you also have a bank locker ? Generally what all you keep their and how much do you trust your bank for the locker safety ?