The world of banking has evolved too much in last 10 yrs and the way banking happens now is totally different from past. Millions of people across the world still do not take simple precautions while they should ideally take or they are too casual about things and later regret when they lose money in some kind of fraud.

Today I want to talk about simple tips and precautions which you should take in your banking and while transacting with debit and credit cards online. It’s up to you to see which of the suggestions and tips suggested applies to you and how deeper you want to be secured. Here are those tips

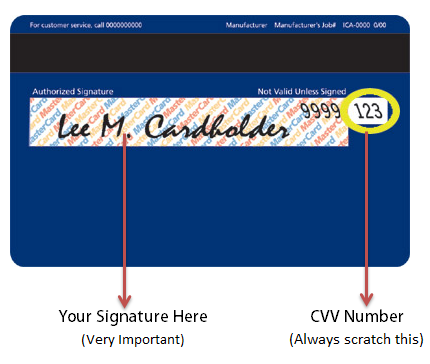

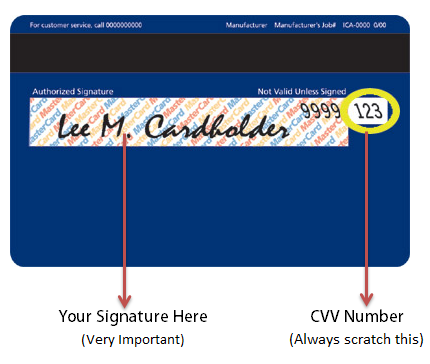

1. Scratch your CVV number

It’s one of the most common mistakes almost every credit card and debit card holder does. On the back of your card, there is a 3 digit CVV number, which is very critical information and only you should be aware about it. The first thing you should do after getting the card is that you should memorize and write it down somewhere and then scratch it, so that someone else can’t have a look at it. Note that this step will secure your CVV, but then you have to remember it, you can’t retrieve it back if you forget it yourself!

2. Make sure your internet banking password is very strong

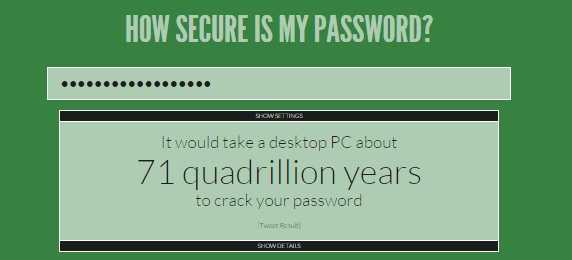

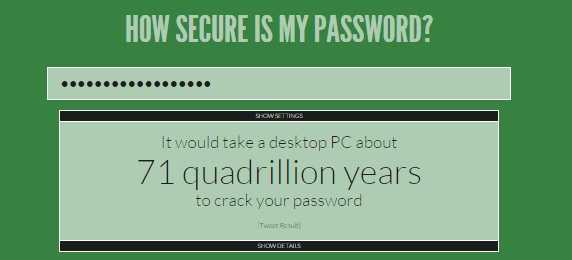

Your password for internet banking is probably the most important thing you have to take care of. Make sure you keep it very strong. Do not use your date of birth, name, etc in password, so that one can’t guess it and it’s only known to you. Make sure you have Capital Letters, Numbers, special characters in the password (anyway it’s mandatory in most of the banks portals).

And if possible keep a long password, which makes it tougher to crack and even if someone is watching your fingers typing movement, it becomes extremely tough for them to remember. It’s a good idea to check your password strength on this password strength calculator

3. Make sure have sms alerts enabled for any amount

Make sure you have SMS alerts for all the debit and credit transactions. A lot of online frauds are series of transactions like buying 10 times on a similar site or couple of recharges to various mobile phones. If you get notifications on your phone even for small amounts, it will help you identify the start of a fraudulent activity.

4. Make sure you buy insurance for your wallet and its contents

Companies like OneAssist and CPPIndia have products like wallet insurance, which will cover you from theft and other frauds which are possible in day to day life. Not just that, they have much more than just insuring your credit and debit cards.

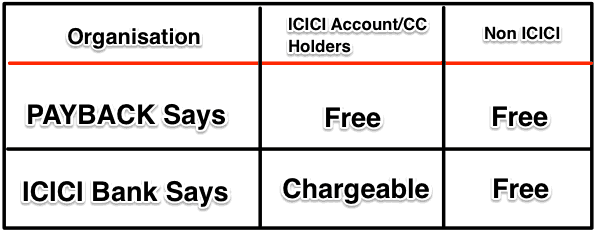

If you have ICICI bank Account, you can upgrade your debit card to RubyX and you will get One Assist complimentary benefits for your wallet insurance. Read more on this topic here

5. Do not save your banking passwords in Phone or Email in plain English

It’s a human tendency to take the shortcut route all the times, but when there is your money involved, it’s better not to ! . Do not store your banking passwords etc (I would say any password) in plain English in your emails or drafts or phone. Always make sure it’s in some format which only you understand, like interchange the alphabets one after another (e.g. – 12A47* becomes 214A*7) , so that you know what is the password, but even if someone gets access to it, has to spend some time to crack it. If you can avoid that also, it’s much better.

The other thing you can do is, you can just store start, middle and end 1-2 characters, because most of the times, we just need the start (most of us have multiple passwords). So if your password is MANISH987_FAKEpassw0rd , then you can store it as MA…98…FA…rd , and that’s all . You will most probably be able to recall it considering you are using it from long time, but someone else will not.

6. Never share your CVV / Expiry date to anyone on Telephone or email ever

Being financial literacy at low levels, millions of people are not aware which information is critical and which is not when it comes to credit cards, debit cards and online banking. Things like CVV , your Expiry dates etc are never ever asked by any bank customer care. They ask things like card number, start date, date of birth etc for verification purpose. But there are scams going on internationally where scamsters pose as actual customer care and in name of verification call, they ask for CVV number and Expiry Date, which is extremely confidential information and no one other than the cardholder should know.

7. Don’t let others punch your PIN at restaurants or Petrol Pump

I have seen tons of people who share their debit card CVV number at hotels while dining or even at petrol pumps just because its shortcut, and in 99% cases, nothing happens too and you are safe. But that 1% case is dangerous where someone looks at your expiry and CVV number, and then do the online transaction without requiring your OTP password (6 digit) on international websites (that last level authentication is just applicable for Indian websites)

I personally think you should punch your PIN yourself and not share it with others. Most of the time some restaurants even carry the EDC machine and bring it to you. If you are sharing your PIN with others and handing over cards at hotels, don’t be surprised if someday you get a sms saying – “You just purchased …. worth $340 at amazon.com” , it happens and very much can happen with you too! . Read the incident below

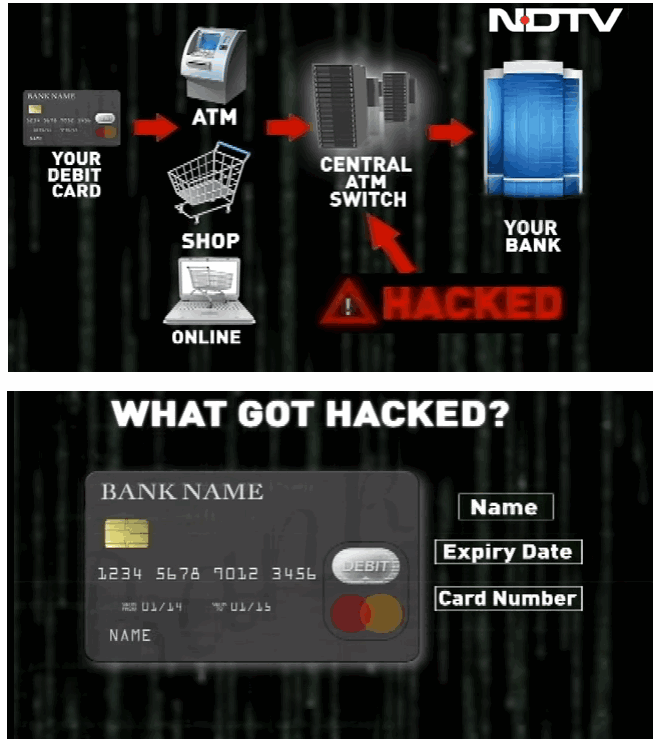

Four unauthorized transactions happened to my ICICI credit card on 27 Jan 2014 in USA in a Grocery Shop amount $1200 (Rs 70000) approx. The Credit card was with me all the times at Bangalore and I never shared my credit card or personal info to anyone. I was using the ICICI credit card from last 6 years. The transactions happened in night and in the morning I show the sms alerts and called customer care about that. (Source)

8. Have the customer care numbers in your mobile for emergency purpose

You should make sure that you have your credit card company customer care stored in your mobile to inform them as soon as possible in case there is some fraud transaction with your account or card. At times, we come to know about the fraud and we feel that we will inform the customer care as soon we reach home/office. But that can actually turn against you because of delay.

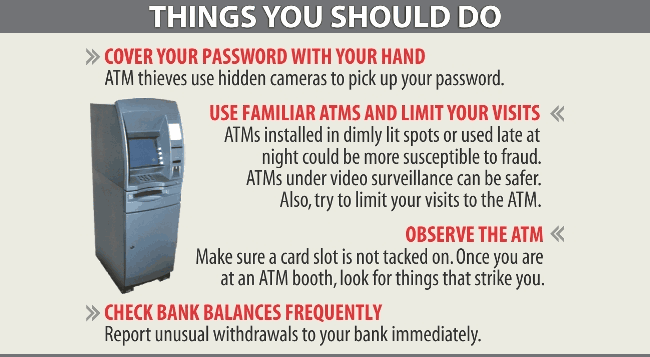

9. While using your ATM card, make sure you block the view of others

Looks are deceptive . You never know who is watching you and your activity and what’s their plan? It’s always a good idea to cover your hand while punching the PIN and make sure no one is looking at you. If its ATM, make sure no one is around you. I know many must be thinking that they should probably skip this point, but only when some fraud happens, you realize how important it is.

It’s like people start wearing helmets only after an accident and buy health insurance only when someone in relatives had paid a big bill at hospital.

10. Avoid ATM transactions very late at night or at lonely places

If possible, it’s better to avoid ATM transactions at lonely places or at nighttime especially after 10-11 pm . If you are using ATM’s at remote locations, you have to be extra cautious. There are numerous cases where someone entered the ATM while someone was using it and they at gunpoint looted them or because it was lonely and dark, someone tried to rob someone coming out of ATM.

11. If you don’t swipe your cards regularly, keep it at home

I do this myself. I generally use only credit card when I am transacting offline, and use credit card only for online transactions, so I don’t not carry my credit card at all (haven’t seen it from last one year actually). So if you do not use it on a very regular basis or only in some pre-know situations , then it’s better to carry them only when you require them. Else just keep it at home.

I know this does not apply for many people, but you can still learn from this point .

12. Do not put much info on Social Media

I have seen numerous cases of people sharing their bank account details, phone number, email id, PAN and even date of birth online one various portals online (even on this blog) especially on consumer complaint websites. Note that you can write your entire story without your critical details too. Never share your personal details with anyone stranger or on public forum

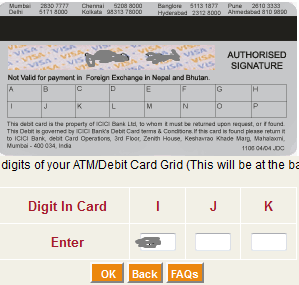

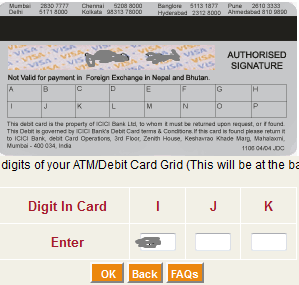

13. Enable Two Factor Authentication for your transactions

Enabling two factor authentications means that you will be asked to enter your transaction password and then either an OTP (which comes on SMS) or your card grid values. So there is security at two levels.

e

Most of the banks now have this by default, but if your bank has a choice of it, then you should enable it and if your email accounts are too precious, then even they have two factor authentications now (Gmail)

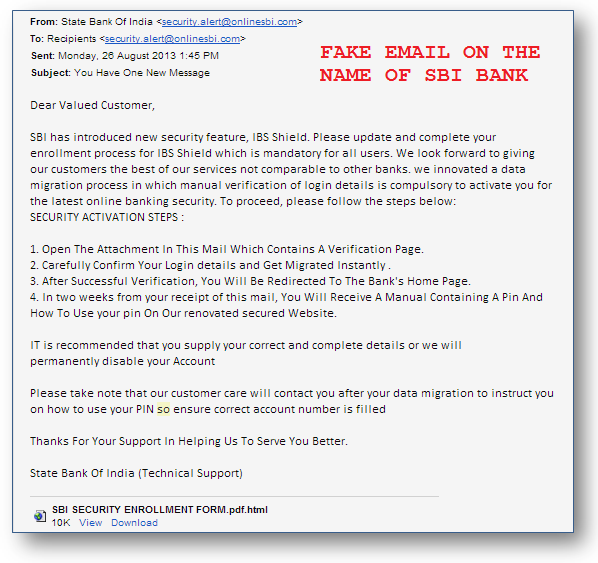

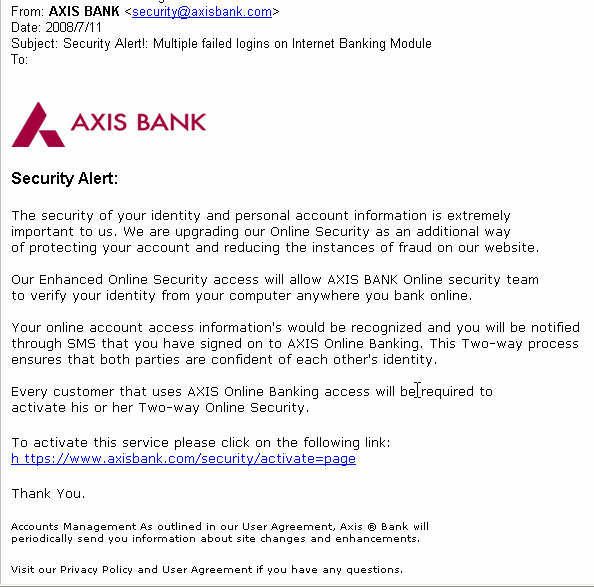

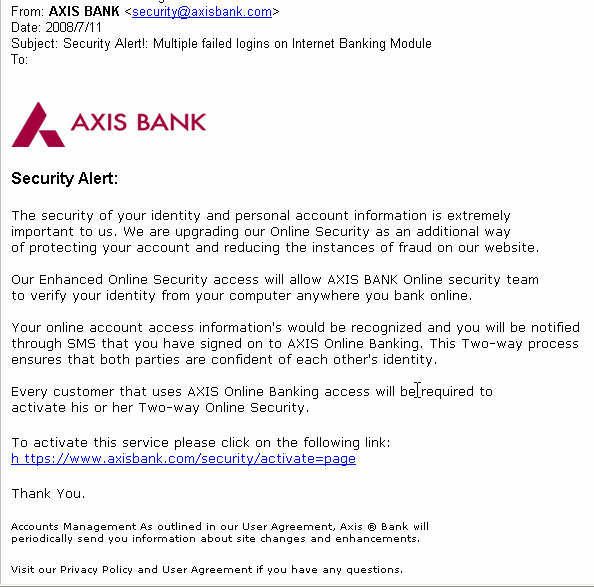

14. Never click on links on email to go to sites

You should never click on the links which come on your email and visit the website of a bank or credit card company. That might be a fraud email, which is taking you to a similar looking website. As far as possible, always make sure you only open the website either by clicking on a pre-stored web address or book marked one by you or type it yourself and always make sure it starts with https://

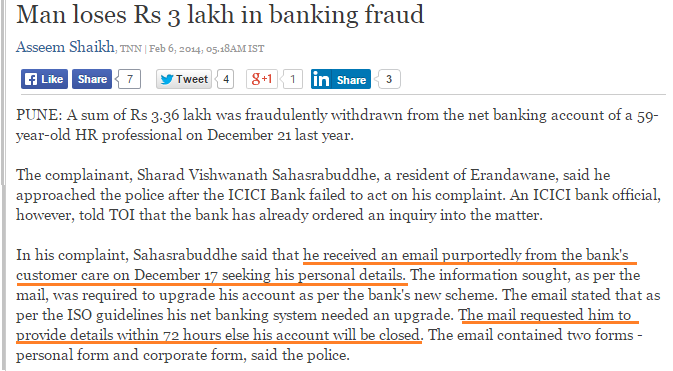

Below is an example of one such email which was sent by a fraudster on the name of Axis Bank Security update, which was taking the person to some other website on clicking the link mentioned in the email.

Image Source (read the full story on this link) 15. Never access your internet banking passwords and accounts from cyber cafe and someone else PC

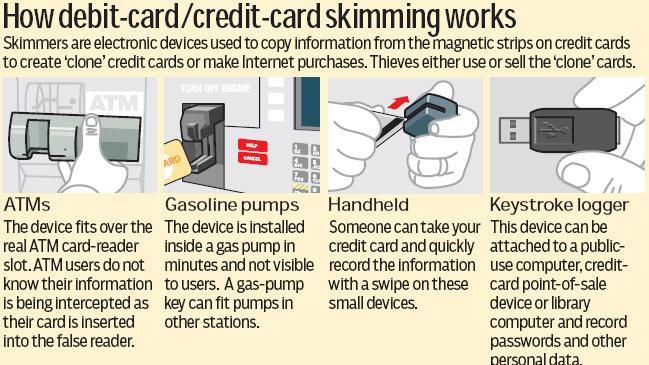

You should make sure you do not access your internet banking (and even your important mail accounts) from a public computer or unsecured networks. Places like cyber cafes are a NO NO .. I would even make sure that I do not operate my internet banking from someone else computer too. You never know what kind of softwares are stored on someone computer. There are programs called “Key loggers” which record your which keys are you typing and it keeps a note of it and can later be retrieved.

Even some viruses and Trojans might be stealing your important information on real time and you might be at risk

16. Make sure your computer firewall is turned on and are running antivirus software

A lot of people turn off their firewall to increase the speed of internet . Make sure you avoid keeping it off. The firewall of your computer is extremely important to protect you. Also, make sure you have a good antivirus installed in your computer and keep cleaning it from time to time. You never know what bad thing got installed while you were downloading something over the net (especially when you use torrents)

17. Use Mobile Antivirus in case you access banking from your phone

If you use your mobile frequently to access banking, then it’s a good idea to have even mobile antivirus installed . Most of the troubles come from the least expected people and place.

18. Do not choose to save your passwords in browser when it asks for it

When you login to any website with username and password, browsers often ask you if you want to save the password, so that you it auto populates it next time.

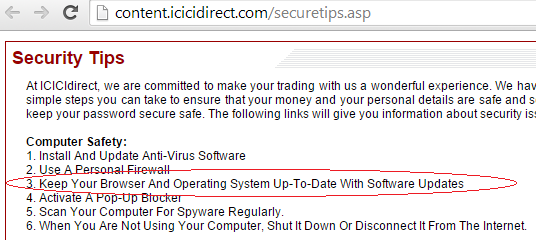

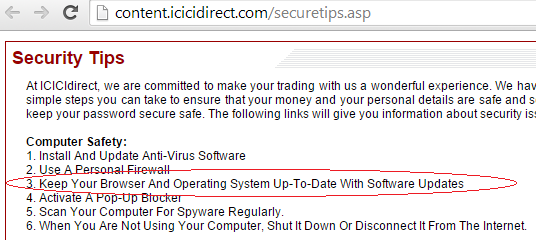

19. Keep your computer OS and browser up-to-date

Its highly recommended that you have an up-to-date browser and Operating system (I hope no one has Windows XP or Vista or old version of IE/Mozilla/Chrome) . There are several security updates which keep coming and many loopholes are detected and fixed from time to time. Almost all the banks suggest it clearly that users should keep their OS and Browsers updated. ICICI bank also mentions it on their security tips webpage ..

20. Use Virtual Keyboard if possible

You must have seen a keyboard kind of interface which can be used while typing password and username, you can use it to make sure you are safe. As I explained before, there are programs like ‘Spy Ware’, which can detect which keys are you hitting and can steal that data. But when you use the virtual keyboard, it can only record which keys you pressed because it’s not happening on your computer, but one the bank server (experts on this topic, please correct me if I am wrong)

You should read more on this topic here

21. Use a separate browser for banking purpose

I think it’s a great idea to use a separate browser itself for banking purpose. Like if you are using Chrome for your other browsing, you can keep Firefox reserved for the banking related activities. I know this might sound like it’s going to extreme level of security, but then it depends on how paranoid you are about this security thing. It’s a personal choice of yours. If you do this, you can choose to disable the cache at all and not save anything in browser at all by default, no plugins , no add ons .. just pure minimal level of browser.

Secure your Banking NOW!

I know that most of the people might be following a lot of things mentioned here. Now it’s time for you to follow the other things mentioned here. Banking is one of the core element of your financial life, which can be considered the central element I would say. It’s extremely important to take care of it with highest level of security.

I would love to hear your comments and any new tips if you want to give from your side?