“Jo Cheez Free Mein Milti Hai Uska Paisa Kyon de Bhai?” said one person when his financial advisor asked him to pay a fee for advice, something which he has been giving free for the last 4 years. It may sound obvious that if you are getting something for free then why should one pay for it. But when it comes to financial advice, free can be very costly.

It is very common these days to hear about stories of investors losing money because of wrong financial advice. You can call it mis-buying of financial products or misselling or both. And while it is reasonable to expect every individual to gain enough knowledge before buying a financial product, I think a much bigger responsibility is upon the financial advisor to guide investors in selecting appropriate financial products. But many financial advisors have failed in protecting their client’s interest. Wonder why? Read on…

Conflict of interest

When financial advisors also sell financial products, it is a clear case for conflict of interest. The craving for misselling is higher when the advice is given for free and income is earned only from sales commissions. One important question for consumers of financial products would then be: “Will the financial advisor recommend me those products that are most appropriate for my needs or the ones that give him/her higher sales commission income?”

This conflict of interest, coupled with human greed has been cited as the main reason behind several global financial crises as well as the day-to-day mis-selling of financial products.

Separating advice from sales

Across the world, steps are being taken by financial regulators* to separate financial advisors and sellers. (*In India, RBI is a regulator for banking, SEBI for securities markets including the mutual fund industry, IRDA for insurance, PFRDA for pension products and FMC for commodities markets)

In healthcare, it is fairly clear that we go to a doctor for advice and then buy medicines from the chemist, so most people are accustomed to paying a fee to the doctor and then buying medicines from a medical store. It is also clear to us that if a doctor earns a commission from the sales of medicines or medical tests and surgeries etc, then the chances of getting biased advice are very high. The same logic applies to the financial services industry, however so far the distinction between financial advisor and seller has not been very clear. (Learn about our Financial Coaching Program)

In my opinion, the chances of an individual getting the wrong financial advice are several times more than getting wrong medical advice. Why? Because so far in India there is no regulation for financial advisors and that means that anyone can print a visiting card saying that I am a “Financial Advisor” or “Investment Advisor” or “Financial Planner” etc. There are no mandatory educational qualifications, experience or registration requirements. But things are about to change!

What the financial regulators in India are proposing

The financial regulators in India are working towards regulating financial advisors. Regulations will include a minimum educational qualification and registration to get a license for becoming a financial advisor. It will have a set of rules laid down for advisors and any misconduct can lead to a penalty or even revocation of their license.

SEBI, in its concept paper for the regulation of investment advisors, has proposed several steps to separate investment advisors from investment product sellers. One of the things proposed is that all professionals who want to call themselves ‘advisors’ should not take commissions from financial product manufacturers and their income should come from the fee that they charge their clients i.e. investor.

If advisors will have no commissions to earn, their advice will remain unbiased and they would represent the interest of their clients and not of the product manufacturer. This is termed as a fiduciary relationship. Clients would then have to pay advisory fees to the advisor based on the value received. Financial product distributors or sellers who offer transaction execution and related service can earn commissions, but then they will not be able to call themselves as advisors.

So for a common man, differentiating between a financial advisor and distributor will be made easier. Here are a couple of related articles in the financial media: Sebi to come out with guidelines for investment advisory space and SEBI certificate must for investment advisors

Fees v/s Commission – does it make a big difference?

I think many individual investors resist paying fees and don’t really bother about how much commission their financial advisor or agent earns because they feel that “It is the financial product company (e.g. mutual fund or insurance) that is paying commission to the agents/advisors, so why should I care?” Well, actually it is the investor’s money from which the commission is paid! To understand this better, have a look at these two presentations on Why did SEBI Abolish Entry Loads in Mutual Funds? and How to evaluate your financial advisor.

There have been some anxiety and concerns amongst an existing lot of financial distributors and advisors. Their biggest fear against this regulation is that “consumers are not ready to pay a fee for advice, so we have to live on commissions.” Some of these concerns are valid and hence the new regulation has to be supported with adequate efforts on investor education and awareness.

What is the way forward?

Some really important developments are going to happen in the near future that will significantly impact financial advisors as well as individual investors.

In my personal opinion, regulating financial advisors will be beneficial for both – investor community and the financial services industry. However, it will be very important to implement the regulations in a consistent and phased manner with adequate investor education. By consistent, I mean that coordinated regulations should come across all products i.e. mutual funds, insurance, pension products, etc. So it should regulate financial advisor and not just investment advisor, thus encouraging holistic financial planning. The good news is that multiple financial regulators are collaborating on this effort of regulating advisors and we can hope for a comprehensive regulation.

Along with regulations of financial advisors, it will be very critical to conduct an awareness drive to make people sensitive to the fact that paying fees to a financial advisor/planner are more transparent. This shift in perception is very important otherwise many honest financial advisors will have a tough time running their practice and many consumers will be deprived of good financial advice.

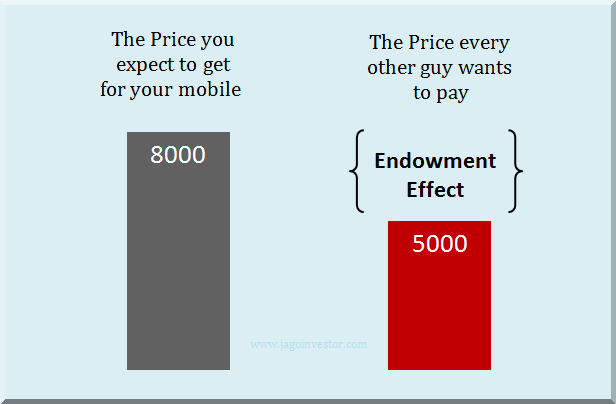

Also, I’m not saying that paying fees for advice is any guarantee for getting good advice, you may even get very valuable advice for free from a friend or you can educate yourself enough to be your own financial advisor. But if financial advisor as a profession has to grow and mature, then I think a consumer paying fees for advice is much more transparent than the commission-based model which has an inherent conflict of interest.

Are investors fully aware of this critical issue?

In my professional experience spanning over 14 years, I have had the privilege to work closely with various banks, asset management companies, stockbroking and distribution houses, independent financial advisors, insurance companies, media houses and financial regulators in India. So when SEBI made the concept paper for regulating investment advisors open for public comments in October 2011, I interacted with various stakeholders on this issue to get their opinion.

And I realized that while the financial industry is abuzz with discussions these developments, there was hardly any discussion happening amongst the investors and consumers of financial products. Most of them are not much bothered about this issue of fees and commission. So I thought it was important to write about this issue with an objective to give individual investors a viewpoint that would help them in working with their financial advisors. Many good, honest financial advisors are today facing a lot of challenges in sustaining their business and convincing their clients to pay fees for advice, service, etc.

And many myopic financial advisors are going around finding newer ways to misguide their clients under the garb of being their trusted financial advisors or ‘relationship managers’. Hence it is important to take an informed and balanced view on this. We have also created a website – http://wikipaisa.com to spread more information on this issue of Free v/s Fee for financial advice.

I’d like to take this opportunity to know your views as an individual. Do you currently pay a fee for advice? And if not, do you think it makes more sense to pay fees? Or do you think the current model of the commission structure is fine? If you are an advisor, do share your feedback too, but please mention in the comments that you are an advisor. So do share your views and also answer this poll question.

This is a guest post by Deven Shah, who works as a Consultant with the National Institute of Securities Markets (an educational institution established by SEBI) and has played a key role in initiatives like InvestorFirst.in, The Pocket Money Program and CPFA Examination. All views expressed in this article are his personal opinions and do not represent the views of any organization he is associated with. He also leads WikiPaisa – a collaborative effort to make money simple and live happier. He can be reached on [email protected]

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was

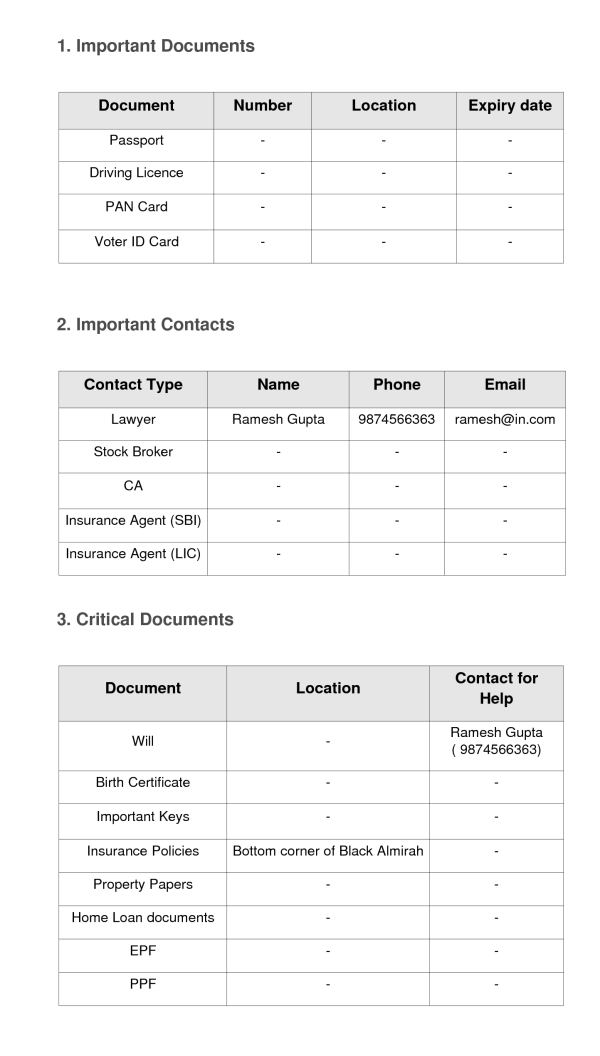

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was  I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a

I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a  Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan.

Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan. Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me

Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me  Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s

Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s  Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take

Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take  Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” (

Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” ( Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! .

Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! . Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their

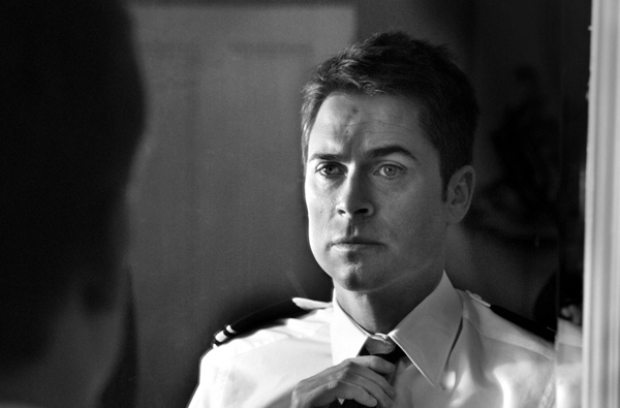

Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their  No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever!

No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever! Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!