PPF interest rates was increased to 8.6% by govt recently. This is good news for all the investors who are primarily debt instruments investors. The Public Providend Fund interest rate was 8% from very long time and the investment limit for PPF is increased to 1 lac from old 70,000 . This will be applicable from 1-12-2011 (source) . There are some other changes which were done in other investment products , which are

- The Maturity tenure for National Saving Certificate (NSC) has been reduced to 5 yrs (earlier it was 6 yrs) and interest rates increased to 8.4% from 8%

- A new National Savings Certificate (NSC) would be launched with a 10-year maturity with an annual interest rate of 8.7 per cent.

- Post office savings account interest is increased from 3.5% to 4 per cent.

- Interest on loans obtained from PPF will be increased to 2% p.a. from existing 1% p.a

- Kisan Vikas Patra has been discontinued from now onwards . The committee had said that the KVP was a bearer-like certificate with a regulated premature closure facility and was open to abuse by tax dodgers. They can be bought or sold without going to the post offices.

- Maturity period for Post Office Montly Savings Scheme (POMIS) has been reduced to 5 yrs and interest rate has been increased from 8% to 8.2%. Also the 5% bonus on maturity has been scrapped.

- Commission for agents on PPF and Senior Citizens Savings Schemes are scrapped. For any other instruments, agents commission will now be 0.5% against 1% earliar . According to the Gopinath Committee, the agents were paid around Rs 2,400 crore commission in 2010-11.

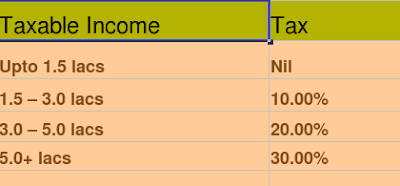

- The interest rates of varios tenures fixed deposits in Post Office is increased , for example for 1 yrs Fixed deposit , the new interest rates is 7.7% against 6.25% earliar . There are changes in other tenure fixed deposits also (See image above) . This has happened because interest rates on small saving instruments have been aligned with G-sec rates of similar maturity, with a spread of 25 basis points.

These measures are in sync with the recommendations of former RBI deputy governor Shayamala Gopinath committee that submitted its report to finance minister Pranab Mukherjee on June 7 this year.

Jayant Pai has an interesting comment on ppfas blog which goes like this

By now you must be aware that the interest rates on Government Small Savings Schemes (SSS) have been increased. Newspapers are going around town proclaiming that this is a bonanza for small investors. Well, it is true that soon (Most probably from December 1, 2011) you will be earning more by investing in these instruments but in a way this move is similar to the recent deregulation of bank savings account rates by the Reserve Bank of India .

You may be earning more today but this could change in the future. In other words, interest rates on all SSS will be dynamic and linked to the yield for comparable Government Securities although the rate changes will occur only once in a year and the relevant announcement will be made on April 1 each year. The Government will however ensure that a spread ranging from 25 to 50 basis points over the relevant benchmark security will be maintained.

Note that the news of PPF interest hike was published on Jagoinvestor news blog within few minutes of govt decision .