Budget 2020 was a big event.

For last so many days before the budget, there was this noise and expectations around raising 80C limits, change in tax slabs, and reversal of Long term capital gains tax on equity or at least giving the benefit of Indexation in equity taxation.

However, nothing like that happened.

Infact, things have become more complicated for investors while I think the govt intention was to make it simple. So let me jot down all the relevant points and important news items.

Here is my audio commentary for 15 min on Budget 2020

1. New Tax Slabs vs Old Tax Slabs

A new (and optional) tax slab is introduced now which has lower tax rates compared to old one. The investor will have choice of either staying with the old slabs along with various exemptions and deductions they used to enjoy, or they can shift to new slabs without any exemptions/deductions.

New Income tax slab rates

[su_table responsive=”yes”]

Tax Slab |

Tax Rate |

| Below 2.5 Lacs | No Tax |

| 2.5 Lacs- 5.0 Lacs | 5% |

| 5.0 Lacs- 7.5 Lacs | 10% |

| 7.5 Lacs – 10.0 Lacs | 15% |

| 10.0 Lacs – 12.5 Lacs | 20% |

| 12.5 Lacs – 15.0 Lacs | 25% |

| Above 15 Lacs | 30% |

[/su_table]

- Education cess @4% on the tax amount

- Surcharge of 10% applicable if income > 50 Lacs and 15% if income > 1 Cr

Old Income tax slab rates (for those below 60 yrs.)

[su_table responsive=”yes”]

Tax Slab |

Tax Rate |

| Below 2.5 Lacs | No Tax |

| 2.5 Lacs- 5.0 Lacs | 5% |

| 5.0 Lacs- 10 Lacs | 20% |

| Above 10 Lacs | 30% |

[/su_table]

Which tax slab is better?

Basically the new tax slabs are of not much to those who take benefit of various deductions and benefits anyways, because they are able to bring down their taxable income by some decent margin. Only those who have income range of 6-9 lacs and do not take benefit of any exemption/deduction will benefit from the new slabs.

Example 1 – Let’s see an example here and calculate the tax to be paid under old and new system.

- Income : Rs 15,00,000

- 80C – Rs 1,50,000

- Home Loan Interest – Rs 2,00,000

- Medical Insurance – Rs 20,000

- Standard Deduction – Rs 50,000

Calculation of Tax under OLD SLABS

You can see that here, the taxable income will come down by 4.2 lacs directly. So under the old slab system, the taxable income will be Rs 10.8 Lacs (15 lacs – 4.2 lacs)

Let’s see tax calculations

[su_table responsive=”yes”]

| Slab | Slab Higher Amount | Income Tax Rate | Taxable Income under Slab | Tax |

| 0 – 2.5 Lacs | 250000 | 0% | 250000 | 0 |

| 2.5 – 5 lacs | 500000 | 5% | 250000 | 12500 |

| 5 – 10 Lacs | 1000000 | 20% | 500000 | 100000 |

| Above 10 lacs | No Limit | 30% | 80000 | 24000 |

| Income Tax | 136500 | |||

| Education Cess @4% | 5460 | |||

| Surcharge | 0 | |||

| Total Tax | 141960 |

[/su_table]

Calculation of Tax under NEW SLABS

In new slab, there is no way of getting any deductions/benefits , so let’s directly jump into the tax calculations

[su_table responsive=”yes”]

| Slab | Slab Higher Amount | Income Tax Rate | Taxable Income under Slab | Tax |

| 0 – 2.5 lacs | 250000 | 0% | 250000 | 0 |

| 2.5 – 5 lacs | 500000 | 5% | 250000 | 12500 |

| 5 – 7.5 Lacs | 750000 | 10% | 250000 | 25000 |

| 7.5 – 10 lacs | 1000000 | 15% | 250000 | 37500 |

| 10 – 12.5 Lacs | 1250000 | 20% | 250000 | 50000 |

| 12.5 – 15 Lacs | 1500000 | 25% | 250000 | 62500 |

| Above 15 lacs | No Limit | 30% | 0 | 0 |

| Income Tax | 187500 | |||

| Education Cess @4% | 7500 | |||

| Surcharge | 0 | |||

| Total Tax | 195000 |

[/su_table]

Which tax system is better – Old or New?

- Old slab tax is Rs. 1,41,960

- New slab tax is Rs. 1,95,000

- Difference of Rs. 53,040

We can clearly see that the tax is lesser in the older system, compared to the newer system.

Important Points

- You can choose each year which tax system you want to choose from – New vs Old. However this choice is only those, who do not have a BUSINESS INCOME. For those who have any kind of business income, will not be able to switch back to the other system once they have done it.

- Remember, that there is a tax rebate under sec 87A in both new and old tax slabs where a person earning up to Rs 5 lacs gets a tax rebate of Rs 12,500, which technically means that if someone’s taxable income is less than 5 lacs, then they will have to not pay any tax.

2. No Deductions or Exemptions under New Tax Regime

I have already mentioned this, but if one chooses the new tax regime, they will not be able to take benefit of following things

- 80C investments (PPF, ELSS, EPF, Life Insurance Premium)

- Medical Insurance Premium

- Home Loan Interest

- HRA

- LTA

- Standard Deduction of Rs 50,000

- Extra 50,000 deduction for NPS (apart from 80C limit)

- Donations under 80G

- Education Loan Interest

Note that you can still put your money in all those 80C investment products and medical insurance etc., but you will not be able to take tax benefits (not for those who stick with old system)

However, the employer contribution to NPS and EPF is still tax free up to 7.5 lacs per year. So you can ask your employer to contribute more on your behalf in these two things.

3. NRI definition change + Taxation Rule

There was too much confusion around new rules for NRI’s for the whole day and twitter saw many people debating if many NRI’s especially from Middle east will have to pay taxes in India or not.

Here is what the new rule says –

“If a person is not resident of any country, then they are deemed to be a resident of India and they will be taxed on their global income”

There are a lot of citizens of India, who stay in different countries for small period of time and technically are not resident of any country and hence don’t pay any taxes. Those investors will not have to pay the TAX in India for their global income.

This is different than those investors who are living in countries like UAE etc. where there is ZERO tax. Because they are a “tax resident” of these countries. They are just not paying tax because the law is like that. So these kinds of investors don’t have to worry at all, and nothing changes for them. Check out the video clarification from officials

Now as per the new rule, a person has to stay out of India for more than 240 days to qualify as an NRI, against the old limit of 182 days.

4. Dividends will be taxable in the hands of investors

The DDT (dividend distribution tax) is now abolished and the dividends will now be taxed in the hands of investors as per their slab rates.

Till now the DDT rates for companies was 20.35%. So every investor who got any kind of dividend took that kind of hit indirectly (even thought it was tax free in investors hands).

This is not great news for those who are in higher tax bracket, because they will pay higher tax now compared to what they paid earlier and now there will be additional headache to track and mention all dividend income while filing tax returns.

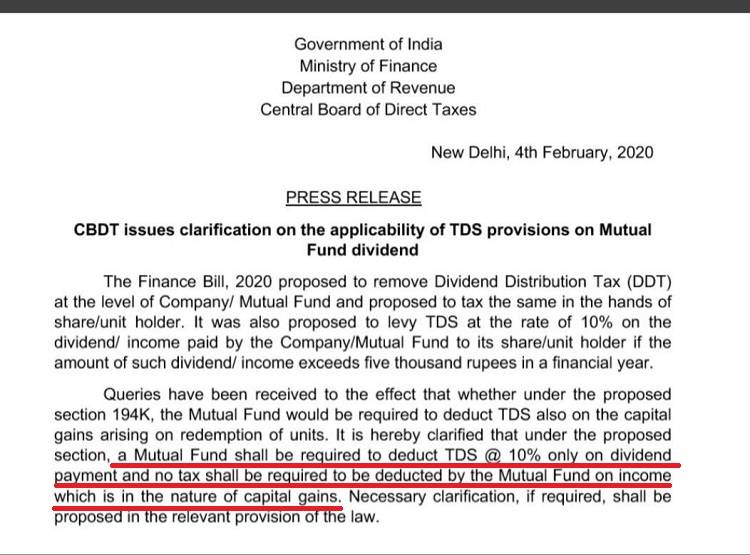

There will be TDS @10% deducted by mutual funds, if the dividend to be given is more than Rs 5,000 in a financial year to an investor.

Important Update : There was a big confusion around investors and advisors community that TDS of 10% will also be applicable on redemption from mutual funds or not? But the govt has already clarified that the TDS is only applicable on mutual funds dividend and nothing else. Any redemptions you do from mutual funds, that will not attract any TDS for residents (for NRI’s , the TDS is already there since long time)

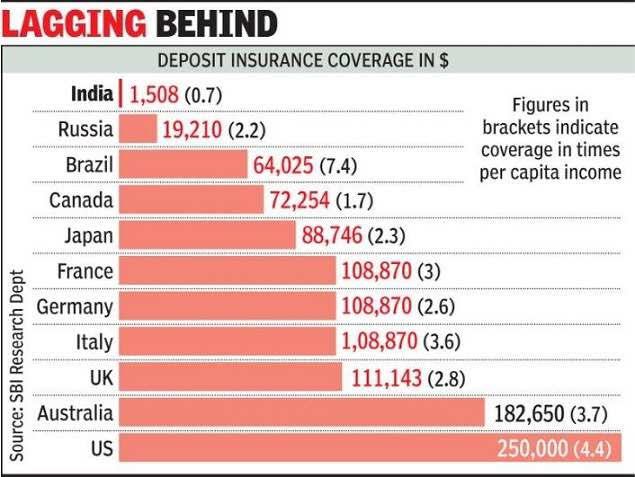

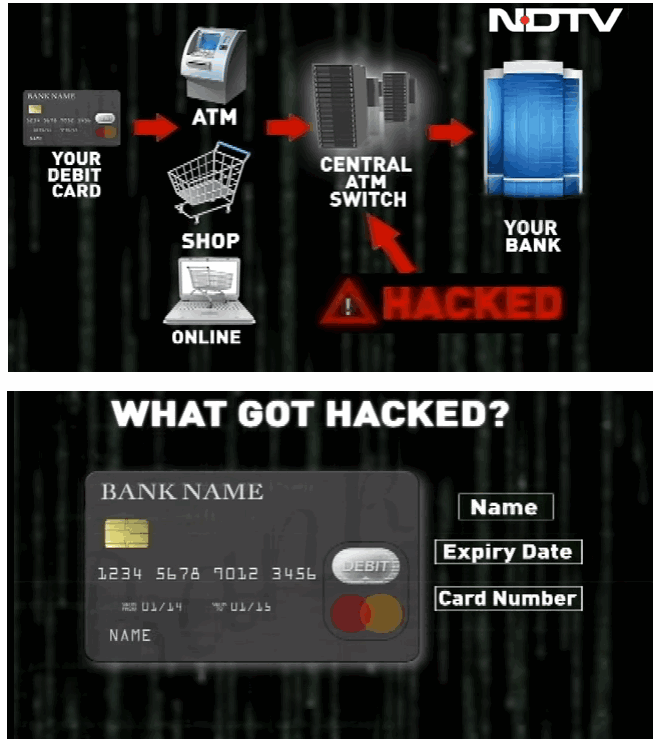

5. Banks Deposit Insurance raised from 1 lacs to Rs 5 lacs

The insurance on your bank deposits have gone up from Rs 1 lacs to Rs 5 lacs. This was much needed change and finally it’s done. Recently we saw the problems in PMC bank (the bank is not yet closed or shut, hence the insurance will still not apply there)

Conclusion

As govt said, they want to simplify taxation rules in long run and I feel over next 5-6 yrs, they will slowly try to remove the old system of deductions and exemptions with lesser tax rates coming in.

However I feel, most of the investors needs that carrot of “tax saving” for investments otherwise they don’t do it.

While, its correct that one should invest anyways whether there is tax benefit or not, but when you go to ground level and see, the reality is that people need that nudge to invest. We need to trick them for their own benefit, else they will not think of investments.

From that point, it might be a bad news.

Also, for some years, we will see this confusion of old vs new tax rules and which one should we be choosing, but this can’t continue forever and eventually we will have a single tax system and you guess it right, it will be the new one.

Let me know what are your comments on this budget and how do you see it?