To create wealth, you have to first get in touch with the power of compounding. I am not just talking about the mathematical concept here but making the “compounding” your way of life. You will understand what I am talking about as you move forward.

Today’s write-up is close to my heart.

It is not just an article, it is about someone experiencing a breakthrough in his overall life. I thought of sharing some of the conversations we exchanged with one of our clients because there is something important to learn from it and it has the power to strengthen your journey as an investor.

Power of Compounding in your life

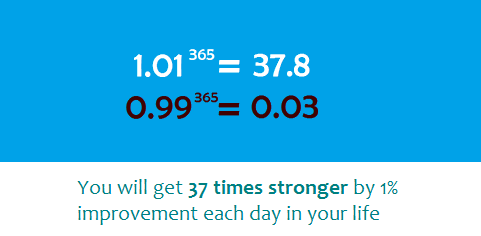

What happens if you just improve by 1%?

Nothing!

Yes, nothing will happen to you if you improve your skills, attitude, salary, net worth, relationship by 1%, but when you improve it constantly by a small margin for a very long time? What happens if you do that for 365 days?

Then?

Here is what happens!

You bring a drastic change in any area because you are allowing the compounding to work there. See the image below …

Let me share an incident with a client where he emailed me about himself and how he wanted to improve. Below is the conversation. Please go through the full conversation until the end.

Here is the first email, which hit my mailbox

Dear Nandish,

I am one of your financial planning clients and I would like you to coach me in the area of money. I am a competent person, have a solid work experience and also earn decent money each month but still my financial life is a mess”. Can you please help me find the solution to my problem?

I tried hard to get the answer but failed to crack this issue.

Thanks

XXXXXXX

And here was my Reply

Dear Client,

Thanks for writing to me and for showing trust in me. I may not have a readymade solution for your problem but I can surely help you to see your situation under a different light.

Before I suggest you anything I have a simple question to ask:

Question: Tell me how many areas in your life you have you been consistent with from last 5-10 years time?

In Service,

Nandish

To this, the client replies back …

Dear Nandish,

I really can’t figure out any such area from my life where I have been consistent from last 5 – 7 years.

Let me know what I need to do now.

XXXXX

My Reply

Dear Client,

I invite you to look into your life and check for yourself, maybe what is missing in your life is the power of compounding, compounding as a way of life and not just mere as a concept. The majority of people know compounding only as a concept. There are very few who experience the real power of it.

The Situation you are into may sound like a mystery to you but in reality it is not.

Now, getting this insight is not enough and so I have an assignment for you for the Next 1 year.

Assignment:

If you really want to experience the power of compounding you will have to take-up 3 more areas along with the area of money. Compounding is all about expanding your capacity as a person and so it is important to pick some more areas. Pick any four areas in your life which are new to you and engaging with them will help you to practice the power of compounding for the Next 1 year.

I would like to hear back from your experience exactly after a year from now and not before that.

If you are game for this assignment let me know.

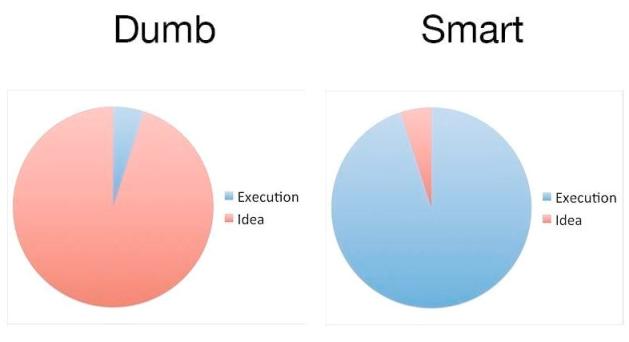

I want you to just not have amazing ideas but also focus on the action part and execute what you are thinking because only that action will bring the compounding into action, Check the image below and you will get what I am trying to say.

Reply from client

Dear Nandish,

Thank you, coach. I am a game for this assignment.

My 4 areas

- Health: Will join gym and work with my trainer

- Music: I always wanted to learn Guitar but never started

- Quit Smoking: I would like to get rid of my smoking habit

- Money Management: Complete actions as per the plan and start my sip of 25k pm for next 1 year

Thanks, Nandish. Thanks for coaching me and for giving a sense of direction to my life. I will let you know my experience exactly after a year.

Thanks once again. Thanks a lot.

Excited Client

XXXXX

I then received his reply, exactly after a year.

Dear Nandish,

I am one of your most excited and enlightened Financial planning clients, remember you gave me an assignment 1 year back to practice the power of compounding.

Here is the assignment you gave me

Assignment:

If you really want to experience the power of compounding you will have to take-up 3 more areas along with the area of money. Compounding is all about expanding your capacity. Pick any four areas in your life which are new to you and engaging with them will help you to practice power of compounding for the Next 1 year

My Life has completely changed the day I started doing the assignment. I created a journal for all four areas and started to capture my experiences. Before I share about my assignment I just want to say I am extremely happy as an investor and in each and every area of my life.

Here are some of the highlights from each area:

- Health: I joined the gym the very next day and the first thing I did was hired a personal trainer. I shared with him about my assignment and he chalked out a well designed 1-year exercise plan for me. We decided to exercise 5 Days a week along with a specific diet plan. The first month was tough to follow but I slowly daily exercise started to become an integral part of my life. My strength , stamina, and overall fitness have gone to a whole level in last 1 year. I would like to thank you and my personal trainer for getting me started.

- Music: I joined the music school; again the first month was difficult. In the start, I could not even hold the guitar. I was not comfortable with the guitar and even the guitar was not comfortable with me. My Music sir always emphasizes on one word “PRACTICE”. My sir kept reminding me that practice leads to compounding and eventually it leads to mastery. I slowly started playing songs and now music really relaxes me from all the noise out in the world. I am so happy I got connected to music, it has taught me many things in last 1 year.

- Quit Smoking: This was the hardest of the all. Initially, it looked impossible for me to quit smoking but I really wanted to get rid of my smoking habit and I started putting efforts. I decided not to hold the cigarette between my two fingers, no matter what. I also shared about my project with my friends and family members and they really supported me a lot in this area. My commitment to fitness and music also helped me a lot to get rid of my habit. I can now call myself a non-smoker. I am free, completely free from my habit of smoking and it feels great.

- Personal finance: Happy to share all the personal finance actions that you suggested in the plan are complete. I took help of your team and completed all the required actions. I also started my sip as per the commitment I made. Today, my financial life is in sync with my dreams, goals, and aspirations. Thanks to you and your team for all the support and guidance. I realized that personal finance is all about actions; it is not about worrying about future or regretting about the past. I can say in this area things have shifted and things are moving in the right direction. I am happy in the area of money.

Thank you for assigning a wonderful project to me, I keep sharing with my team and other about the power of compounding and I keep getting people coming and sharing their results with me. Thank you for bringing the magic back into my life.

Conclusion

Can you see the real power that resides in the word “compounding”? It is not about how your money grows but how you grow as a person. Pick any 4 areas in your life and start engaging with them. The more you engage, the more you will grow in those areas. Don’t take only one area because one single area takes a back seat very easily.

Now tell me which area you want to improve and start working on improving it by 1% each day or even a week. Watch out this video below to get a more detailed idea on this

Many of you may be new to investing or equities do not get scared try out this assignment and see what happens after 1 year. Make the power of compounding your way of life and don’t just know it as a concept. Do share your views in the comment section; most importantly I would like to hear about your 1-year project which will help you to practice the power of compounding.

This article is written by Nandish Desai…

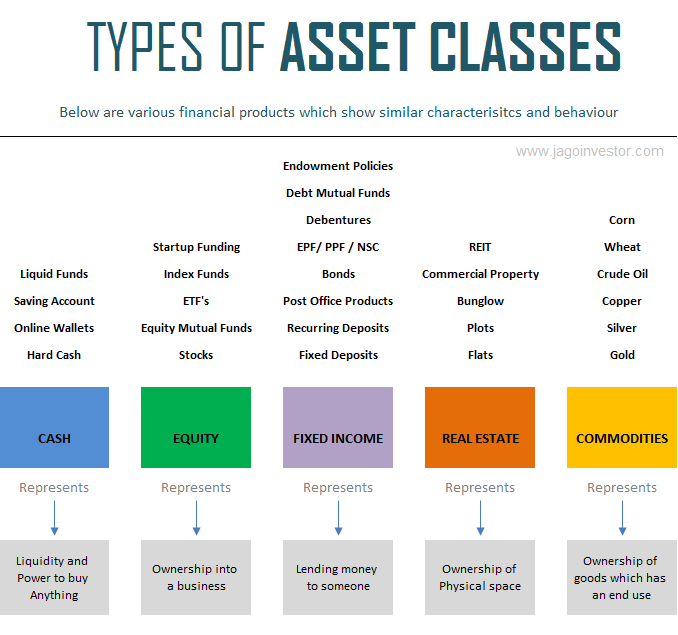

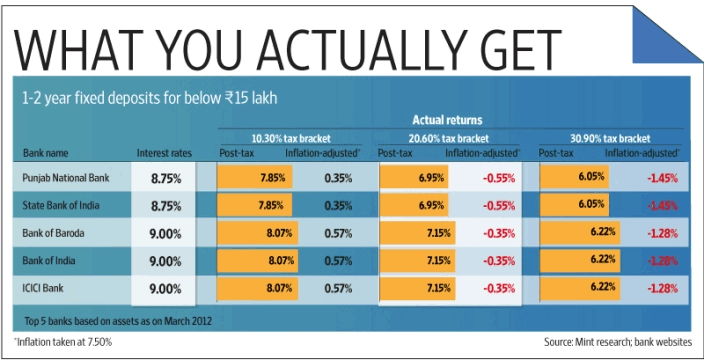

![asset class-] comparison](https://www.jagoinvestor.com/wp-content/uploads/files/asset-class-comparision.png)