Do you know that your health insurance premium may depend on your city? Yes, there is something called “Zone-based premium” in the health insurance industry which I will share in this article today.

For instance, the premium amount for a person aged 30 years, living in Delhi, might be higher than the person of the same age living in Pune. So, apart from age, the sum insured & health conditions, even the city which you mention at the time of health insurance purchase also impacts your premium amount.

Zone-based pricing in Health Insurance

Here is how zone-based pricing works in health insurance premium calculation. Various cities in India are divided into 3 zones at a high level which defines Metro/Tier-1, Tier-2 cities and other rest of the cities (tier 3/4). Here is an indicative list of zones (may vary from insurer to insurer)

[su_table responsive=”yes” alternate=”no”]

| Zone 1 | Metro cities like Delhi, Mumbai including thane |

| Zone 2 | Tier-II cities like Chennai, Pune, Bangalore, Hyderabad |

| Zone 3 | Rest of India excluding areas falling under Zone 1 and Zone 2 |

[/su_table]

List of companies which provide zoned based insurance pricing

Given below is the name of health insurance companies which use zoned based pricing model-

- Max Bupa Health Insurance

- L&T Health Insurance

- Star Health Insurance

- New India Assurance

- SBI General Insurance

Why health insurance companies adopt zoned based pricing?

You will agree that the overall expenses in a metro or tier-1 city are usually higher than a tier-4 city or a comparatively smaller city. Imagine if someone gets treatment for a big illness in Mumbai/Delhi compared to a smaller city like Meerut or Akola. There are various reasons why this happens

- Higher Room rent charges

- Higher charges for diagnostic tests

- Higher doctors fees

- Higher stress levels

- More prone to lifestyle illness

- Higher consultation charges pre/post-hospitalization

The point is that a policyholder living in a smaller city will claim less amount compared to a policyholder living in a bigger city, even if they both have the same amount of sum assured and claimed for the same thing.

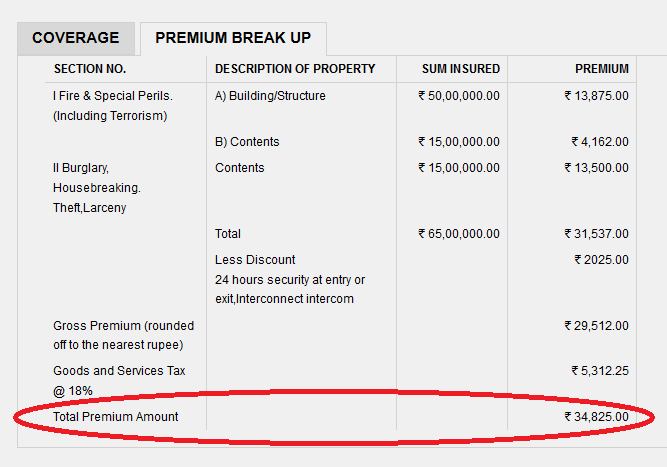

Check an example below where we checked the yearly premium for a 30 yr old person for sum assured of Rs 10 lacs for 3 different cities from each zone. You can see how the premium reduces by approx 10% each time for zone 2 and zone 3 cities.

So you can see above that the premiums were as follows

- Zone 1 (Delhi) – Rs 9862

- Zone 2 (Pune) – Rs 9041 (9% less than zone 1)

- Zone 3 (Varanasi) – Rs 8201 (17% less than zone 1)

So you can expect zone 2 pricing to be approx 10% lesser and zone 3 pricing to be approx. 20% lesser than zone 1. This is just approximations, for exact difference refer to policy documents.

Hence the zone-based premium pricing comes into picture. This is exactly the reason why companies charge a lesser premium if you are from a smaller city and vice versa.

What if, a policyholder of a small city wants to avail of treatment in the metro city?

Note that, there is no restriction on the city where one wants to avail of the treatment. In some cases, it may happen that the policyholder might want to go for a better hospital in a bigger city. In those cases there might be some extra amount policyholder has to pay from their own pocket. Like in some policies, if a policyholder of zone 3 (smaller city) avails treatment in zone 1 or zone 2 city, then there will be a clause of co-payment.

It means that the claim amount will not get settled 100% by the insurance company. For eg. If a person of zone 3 claimed Rs. 50,000 for getting medical treatment at Delhi, he will be paid Rs. 40,000 (80% of the claim amount) and balance 20% has to be borne by insured.

This clause changes from company to company and on a zone to zone basis. Please go through the policy document of the health insurance policy to know the exact rules and clauses applicable.

So in case, you do not want that co-pay applicable to you, then you can choose the city as any metro or bigger city of your choice so that you pay the premiums for zone 1 cities, but at the time of providing the address proof, you can give any address.

Important points regarding Zone-based premiums

- In case you shift your city in the future, you can always inform the company at the time of renewal, and the premiums as per new zone will apply

- In case you port your policy from one insurer to another, it might happen that your premium changes depending on the pricing model of the old/new company.

- In zone-based pricing only premium changes depending on the city of residence. It will not change any benefits or other features of the policy.

- Note that very few companies follow the zone-based premium pricing model, so please inquire about it.

Conclusion

As you are now aware of the zoning concept, see if there is any scope of using this to your advantage, provided the insurer of your choice provides it for your policies.

Please share what you think about zone-based premium pricing? Do you feel if its the right thing to do or not? Is it useful or not?