The biggest tool an investor has is knowledge on his side. But when it comes to real estate, we can see a lot of investors do not pay a lot of attention to smaller details which can create big problems for them. Today I want to hand over to you a real estate terminologies toolkit, which will explain various things to you in most simple and shortest way. When you go out to buy your home next, you will not need anyone on your side to have conversation with the builder and you will give him the feeling that you know more than him. It should help in someway.

18 terms which will super charge your Real Estate knowledge

Here are those 18 terms and terminologies.

1. Carpet Area – When you buy a flat, you actually area on which you can lay carpet is called as “carpet area”. Note that builders advertise the property based on other parameters, but as a buyer this is what you are going to actually use for next many decades. Higher the Carpet area, better space you get.

2. Built up area – Built up area is the area which covers Carpet Area and the Walls and doors . A good 15-20% of space goes into walls and doors and your super built up area is generally 20% higher than carpet area. Ideally the rate quoted by builders is based on “built up area”.

3. Super Built up Area – A lot of times you will come across a term “Super Build Up area” , which is nothing but built up area along with all the space common to all the residents of society like Corridors, staircases, parking area etc . So Super Built up area is higher than Built up area. A lot of builders also use “super built up area” to advertise the projects which gives an artificial picture of property. Never rely on that

4. Sub-Registrar Office – For Registrations of Properties, there is an official department called “sub registrar office” , you can visit it to get your properties registered and also obtain any legal documents related to properties and land. If any officer tells you to “pay for Chai Pani” there, tell him you are filing a RTI and putting his name in the application for the “request” he made to you and ideally he behave properly with you. Note that you can get sub registrar office address online. Example – for Delhi its here

5. Capital Gains – When you sell a property after 3 yrs, the amount of profit you make is called “Capital Gains” . Tax will be applied on this Capital gains after applying Indexation. Also you can avoid paying this tax if divert the profits part in another property or another way of saving tax on that amount is investing in NHAI or REC bonds.

6. Encumbrance Certificate – Encumbrance Certificate is an evidence of free title or ownership of property. This document clearly tells you if there is any legal or monitory dues on property. So if you are going to take a home loan against a flat, bank will need Encumbrance Certificate to be sure that there is no other loan going on for the same property. You can get the Encumbrance Certificate from the Sub-Registrar Office (where registration of properties take place). You can ask for upto 30 yrs of data (if available) . It takes around 15-20 days at times to get it after you have put a request to get encumbrance certificate . Read more about Emcumbrance certificate here

7. Title Deed – A title deed is a legal document used to prove ownership of a piece of property. So if you are buying property from Mr. Manish Chauhan, make sure you check the title deed. Title deed is something which you can get from Registry office of the concerned jurisdiction. Title deed is something which one must always obtain and check if you are buying an old property, because at times land and property is owned by some one old and children claim that its in their name just to speed up the process, but at times it gets ugly later. Important Tip – Never rely on Xerox Copies of the Title Deed, get it examined in original because sometimes the seller might have taken a loan and given in the original deed to lender (and does not tell you about this) .

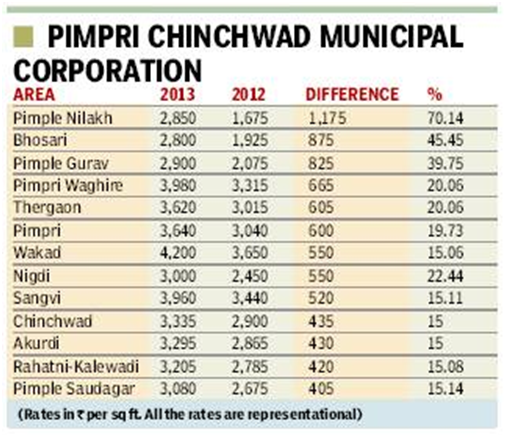

8. Stamp Duty – Real Estate Stamp Duty is the tax collected by Govt . The stamp duty payable differs from one state to another. In some states its 3-4% and some has it at 8% also. The Stamp duty is payable on Agreement Value. So a lot of times buyers and sellers do the property agreement at lesser value and involve black money in the transaction. Its important to factor in stamp duty cost as per of your home purchase plan, because its quite a huge amount . For a Rs 50 lacs property, it can be in range of Rs 2-3 lacs. Important point is that women in many states have to pay lesser stamp duty compared to men. For instance, in Delhi, a women need to pay a stamp duty of 4% compared with 6% for men. Thats 2% saving and for a 50 lacs house, its a saving of Rs 1 lacs” .

9. Franking Charges – When you go for home loan, there is a small charge called as “franking charges” paid you buyer to Bank . Franking (incase of real estate transaction) is actually the activity to stamping a document which proves that the Stamp duty has been paid to govt. Its an official seal kind of thing which is to be done in sub-registrar office for a small fees (Few Hundreds), this is done by the bank and they collect those charges from buyer.

10. Registration Charges – Just like you pay Stamp Duty, you also pay Registration Charges when you register the property in your name and the charges again depends from state to state . In Maharashtra, the registration charges are 1% of property or Rs 30,000

whichever is lower.

11. Gift Deed – Generally you “sell” the property in exchange of money. But when you have to transfer the property rights to some one without taking the money like what happens in families, then you should to pass it on as GIFT and a Gift Deed should be prepared to document the process. Note that Stamp duty is to be paid even if the property is transferred through Gift Deed. Learn more about income tax on gifts here

12. Power of Attorney – A lot of times you will find that someone is trying to sell you land or a flat, based on power of attorney, which is a legal way of transferring your rights to someone else. But Supreme court has now banned all the real estate transactions based on power of attorney. So next time someone tells you that the owner of land is outside India and hence assigned him power to sell the flat, do not get fooled, only deal with someone with clear title deed.

13. Sale Deed – A sale deed is one of the most important legal documents in a purchase or sale of a property. Once its signed by the seller and buyer only then the sale is assumed to happen legally. The registration of property and stamp duty payable is based on sale deed only. A sale deed will also contain property details , measurements and other important details.

14. Service Tax and VAT – Service tax needs to be paid only for under construction properties untill complition certificate has been obtained by builder. Because till the flat is under construction, its regarded as “service”, so service tax is applicable (3.09% at the moment). But once the construction is over and complition certificate has been obtained by Builder, then the property like “goods” , where the service tax is not applicable. In the To be Paid for Under Construction Flats. VAT again is applicable for under construction properties, but only in those states where state govt has asked for VAT. Not all states have VAT applicable.

15. Conveyance Deed – Conveyence Deed is a legal document which a builder executes in order to transfer the land title to Housing socities formed. This is generally done once all the flats are sold in a project. This step is extremelly important because if this is not done, the title of land still remains with Builder and incase in future something happens, there is unnecessary legal battles. So make sure that once the society is formed, the conveyance deed is executed.

16. Completion Certificate – Once the project is completed, the local authority visits the site and inspects the construction and various things and awards completion certificate to Builder. so Completion Certificate is kind of certificate from local authority, that now the work is complete. This is the moment a builder can officially declare about the project completion. There still can be few last minute things which might need to be addressed.

17. Possession certificate – Possession letter is issued by the Builder which is actually the official permission to take possession of property. Generally its given to those who booked property during under construction. If its a ready to move in flat, the sale deed is enough and will work just like possession certificate. Note that a builder can give possession certificate only after he has obtained completion certificate.

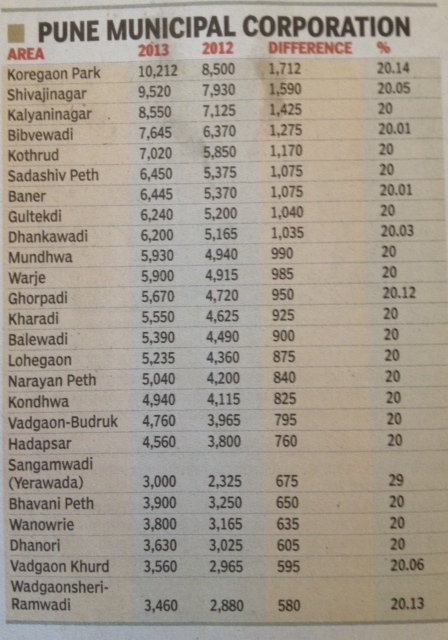

18. Ready Reckoner Rates or Guidelines Value – For each area, there is a official govt defined rates for property which acts like the base price. The minimum registration and stamp duty charges has to be on those guidelines value. Builders generally charge premium over these guideline values . Read more here

19. FSI (Floor Space Index) – It is the ratio specified by local authority (generally municipal corporation or urban development authority) which governs how much area one can build over a specific plot of land. i. e. if FSI for an area is 2 and you have a 1000 sq ft plot, you can build (2 X 1000) 2000 sq ft building over it. Generally, common areas like staircase, lift, passage leading to the flat door, service ducts outside toilets and kitchens, etc. are not considered in this 2000 sq ft FSI area, which means, you can construct these areas over and above the permitted FSI area. At macro level, this magic ratio called FSI determines how much construction will come up in a city.

20 – OC (Occupancy Certificate) – Well, generally CCs (Completion Certificates) are issued by municipal corporation in stages. i. e. a 25 floors high building may be issued CC for every 5 floors depending on its design. However, building is considered to be ready-for-occupation after builder has not only completed the construction but has also made it habitable by bringing in all services like electricity, water supply, drainage connection and fire fighting facilities. The corporation, after receiving NOCs from all concerned dept. will issue OC. Ideally, builder should / can issue Possession Letter only after receiving the OC. In reality though, several (not few) buildings have OC even after years of completion and being occupied. Buildings not having OC have higher outgo towards water bill, electricity charges and property tax.

Thanks Mehul for adding last 2 points as contribution

Please add more terms

If you are aware about some other thing which you have come across or feel can be added here, please add it in comments section.

Also let us know if you feel like a “pro” now in real estate terminologies or not ?