Spending more than you should

Sometimes, people spend impulsively, on things which they do not really need. Just because, your plastic card is in your wallet and you “might” need it in future makes you believe that you need to get it right now. A brand new camera, with a 100 megapixel sensor and a 2000 x zoom is available at an EMI of just 1999 per month — and suddenly you’re interested in Photography! An EMI of 2500 a month, for that magical million colour, anorexic Flat Screen TV creates a magical belief in you that your normal TV at home is now really blurry these days (not to mention really fat!)

Is there a need, to splurge on Movies and eat out, every weekend? A regular meal at home, with a movie on tv is also a good weekend, at times. With many people, savings occur, only if they are left with any money at the end of the month. This needs to change – start saving first, then spend on what’s necessary and then spend on your desires – last. Financial planning does not mean compromising your dreams or what you love to splurge on; it’s all about knowing what you need and what you don’t, & knowing it well! . Read : Can you live with 90% of your Salary

No Financial Education to Spouse and Kids

Most people are more comfortable talking about SEX rather than FINANCE to kids (just kidding.) They dont feel the need to tell their children that they have bought life insurance for them (the kids) should they be hit by a bus tomorrow (the parents, not the kids 🙂 ). Once children reach an age of maturity like 16 or 17; when they can understand things & reason well and can take on responsibilities to some extent… Please start telling them about money and finances. Once you are gone, you can’t even regret.

Kids should know what your work is & how much you earn. They should be clear on how you are saving money to fund their education, bike , trips etc. Once they know about life t it, chances are they will be a lot more supportive, would be realistic in their demands & stay well within their limits. Kids don’t know sometimes, how much pain you take in earning money. Most of the times, kids know your salary and your designation at company and assume the family to be a “higher middle class” one. Once you tell them about Home loan EMI, Car Loan, other liabilities, Retirement Savings, Education Expenses, Marriage expenses and the medical emergencies for which you are saving, they will have a better idea about the current situation and they will act responsibly.

Parents feel a little uncomfortable, telling their kids these things, as they feel children are still young and such information will create unneccessary psychological pressure and they would not talk about their demands and be unhappy. Parents feel that children should start learning about finance and applying that knowledge, once they are in a job and start earning. I say, if your finances and spending habits are messed up today, a big reason could be that, your parents never talked about finance with you openly. The same applies to spouses. Imagine, if you had all the knowledge and best practices you have learned on this blog, 10 years ago; or when you started earning? The situation would have been very different today, wouldn’t it?

Dont let this happen to your kids: Teach them!

Imbalanced Asset Allocation

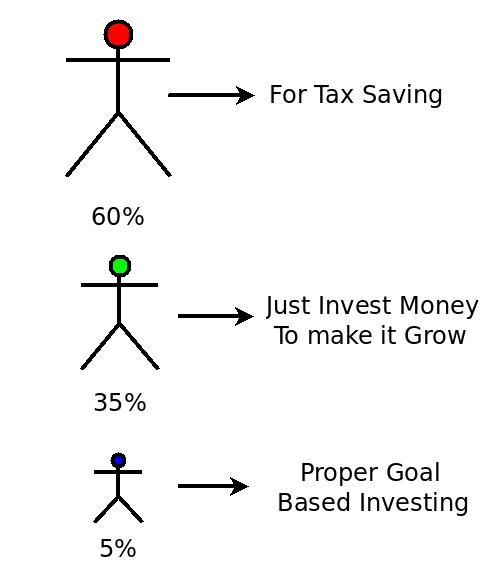

A lot of people have a tendency to start working and then never look at, or review their finances. Tax Planning is nothing more, than a “signature” on some form for them. Initiatives from their side are limited to just calling an “agent” and nothing more. When they finally look back at their finances, they find that they have 40 Lacs in FD’s and 25 lacs lying in Bank. This happens a lot with NRI’s working outside the country. These are 35 yrs old who have 90% in debt or Cash, and 3-4 mutual funds and shares bought in recent years just for “trying”. This category misses a huge amount of returns which they could have made with just 4-5 hours of planning or hiring a proper investment consultant.

On the other hand, there are investors who have no PPF, no FD, no Debt Funds, no bonds; they just do share trading, buy direct stocks, invest in just Mutual funds (pure equity). Their imbalanced Asset allocation is responsible for the huge ups and downs their portfolio takes. One year the worth of their portfolio will be 10 lacs, the next year it will be 7, then suddenly it will be 14 lacs the next year. The numbers dance with huge fluctuations, but at the end of let’s say, a decade, they look back & find they are nowhere better than their “High debt Instrument” kind of Investor brothers .

Buying products from Close One’s

Will you sell a junk product to yourself if there’s a 35% commission and it will be a burden to you all your life ? I don’t think so, but if you had to sell it to your friend, colleague, brother-in-law, sister-in-law, father’s friend etc, you’d consider it, wouldn’t you? That’s what happens in real life too.

Most times, the “Best plan” comes from one of your relatives or some one known. STOP IT PLEASE! A simple NO might hurt your relations with said person, but it will save you, your hard-earned money, rather than waste it on idiotic products, which you’ll regret for life 🙂 It’s just common sense that there are better advisors and consultants than your relatives or a close ones, unless they themselves are known and respected in the field (of finance). Read : “Papa Kehte Hain” problem in Personal Finance

Most of the readers here, have shared their bitter personal experiences, where they bought products because it came from their relatives, Uncle’s et al. This happens a lot with young guys yet to start working, and their fathers have bought policies for them and then delegated the premium paying responsibility to them once they start earning, it’s a real “burden of legacy” .

Read Part 2 of Common Mistakes in Personal Finance

Comments please , Any other mistakes you can think of ?