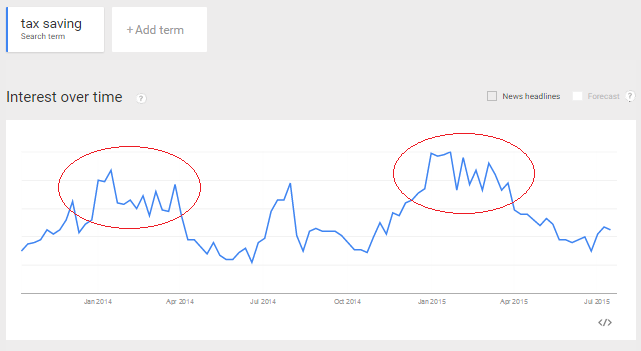

Have you ever bought the wrong financial product? Or it was mis-sold to you out of pressure from family/relative? Or because you trusted the seller too much? If not these reasons, maybe you wanted to do last minute tax saving and you jumped into buying that policy and gave yourself a life sentence of paying premiums which will not help you much in long run?

We are today going to discuss all sort of issues which arise when you get into a wrong financial product and why you should avoid it at any cost.

Background

Let me first give you some background on how I got started with this article. Here is what happened.

A few days back, I was once watching a TV show and there was a story of a woman who married a guy out of the pressure of family who wanted to get married as such as possible. She fell for the short term tricks and didn’t pay much attention to those points which matter in the long term.

Soon after the marriage, she started realizing that she made the mistake. It’s not what she wanted in life and its not a match which can sustain. Life was a mess. She was stuck in this relationship.

Coming out of it was not easy. She was in depression and all the time was going into regretting the decision. Almost 5 yrs had passed and by this time, a lot of her energy and time had got wasted.

Finally, she came out of that bad marriage. Often she wondered why she took such an impulsive decision? What if she had never got into that bad relationship? How would have her life shaped up?

Investors do the same thing with financial products

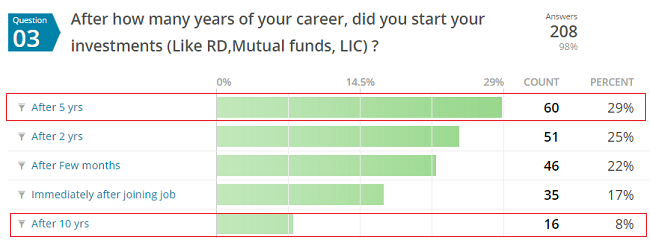

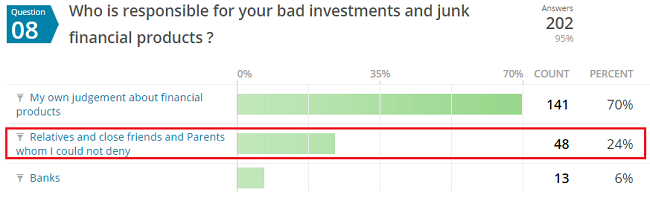

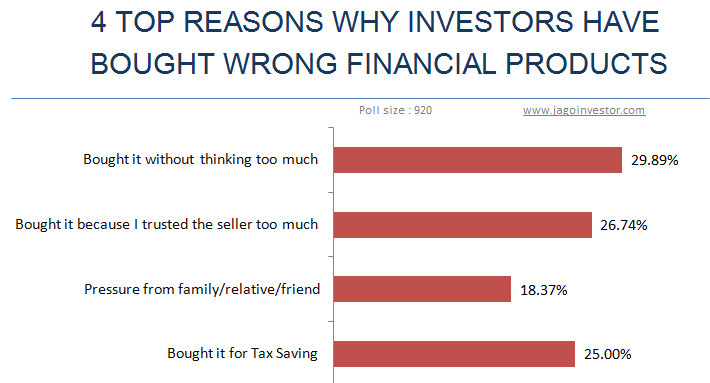

A lot of investors buy unsuitable or wrong financial products in their financial lives and it drains their money and valuable energy. It gives them unnecessary tension, which could have been avoided if they were a little more prudent in their financial life. Below are the top 4 reasons why most of the people have bad financial products in their life. I surveyed 920 people, the top most reason why because they were careless themselves and bought things without much thought. Where pressure from family/friends was not the major reason.

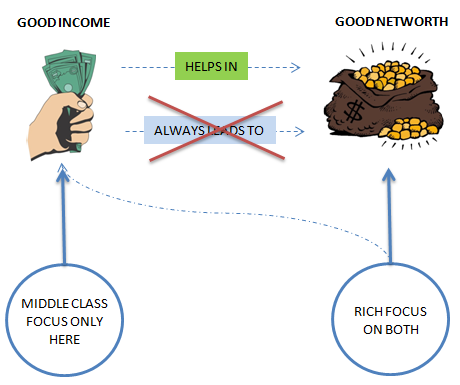

The careless attitude costs them too much trouble. I have worked with more than a thousand investor now, and I can tell you most of the good financial lives which we see are not because of making good decisions, but by avoiding bad decisions. Most of the people who have high net worth or powerful financial lives are those who have not wasted their valuable time and money in wrong financial products and concentrated on simple things.

One bad move can nullify 2-3 good decisions.

Today I want to talk about 4 core problems that arise out of buying the wrong financial product. Let’s look at them one by one.

[su_table responsive=”yes” alternate=”no”]

| Problem #1

Waste of money |

Problem #2

You feel “stuck” and waste your time and energy |

| Problem #3

The opportunity Cost |

Problem #4

You lose trust and everyone looks like a “cheater” |

[/su_table]

1. Waste of Money

Nothing hurts investors more than losing their hard earned money. When you buy a wrong financial product, most of the times, you lose money or do not get the returns your hard earned money deserves. A few years back ULIP’s were one of the most mis-sold financial products. Millions of investors have lost their hard-earned money in these products. The charges in the first year were huge at that time which ate away all the returns one got. On top of it, the returns of the ULIP were linked to the stock market and most of the investors never knew this.

Because of this, a lot of investors lost a big chunk of their money in these products.

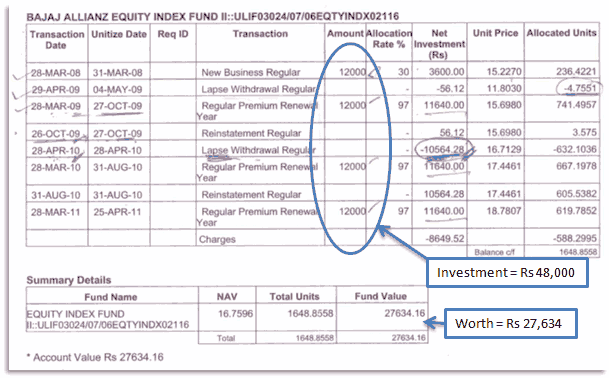

Below is a snapshot of one of our readers who bought a ULIP in 2008, and he paid a total of Rs 48,000 in the ULIP, however when he checked his statement after a year, his fund worth was just close to Rs 27,000.

The value of the fund had come down due to market movements and commissions structure, but the main point is that the investor never expected it. He didn’t know that it could happen because, at the time of selling, there was no communication of the risk part. This is what happens when one buys a financial product without understanding it.

Then there are other kinds of products like endowment insurance policies which does not pay you back your full money if you surrender them in between or very early. Its the product design. If you pay Rs 50,000 per year premium, then in 4 yrs you must have paid Rs 2 lacs in total. Do you know much would you get back, if you wanted to close the policy and take your money back? On average it would be just 40%-45 %, which means only Rs 1 lac you will get back.

Forget financial products, some time back I bought a sim card which was available on purchase of an internet connection and there were some attractive benefits associated. I fell for it and bought it without giving much thought. I spend a good amount of time and energy behind it, paid bills without using it and finally ran around to close the connection. I could have avoided a lot of pain, had I just ignored it. The same is true for various credit cards, unwanted memberships, etc.

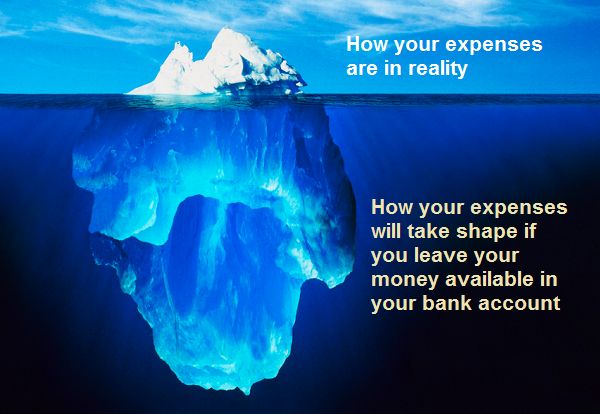

2. You feel “stuck” and waste your time and energy

Forget money, what about the time and energy you waste? Once you are stuck with the wrong financial product, you will keep thinking about it. You will keep regretting your decision. The financial product will be part of your life and you will often wonder why you invested in it?

Most of the people anyways take a lot of time to take financial decisions and just imagine what happens if one of those decisions is wrong or bad for you? You will keep cursing the agent, your financial planner, yourself, the system, SEBI, IRDA and every other person (even yourself).

You feel STUCK …

Nothing is more frustrating than feeling stuck and not being able to do anything fruitful. There are millions of investors who are stuck with their endowment policies, ULIP’s, bad credit cards, wrong advisors, other products. They want to get rid of it, but they DON’T.

Also, the world is cruel, you as investors are taken for granted. See how one of the readers, when tried to surrender his LIC policy, was treated.

Hello – I approached the branch manager on cancellation – it’s not even 7 days – he is asking me to get the agent to the branch! is this correct ? I have a question : If I want to surrender the policy or retrieve the maturity amount , is the agent required , this is weird stuff , If this is not true, please help me how this can be escalated and resolved .

Over-analysis leads to more delay

Investors also over analyze what they need to do once they realize that they bought something bad? How to minimize their losses and how to come out clean. But in that process more and more time passes and the situation gets messier compared to the past. Most of the people keep delaying their policy surrendering for years and the damage keeps compounding.

It’s like you bought a bad stock and you didn’t sell it off when you had a 10% loss. You wanted to get out of it at the right time and then it will send down by another 10% and then another 20% and finally out of frustration you sell it at 50% loss wondering why you didn’t take 10% loss itself at the first place.

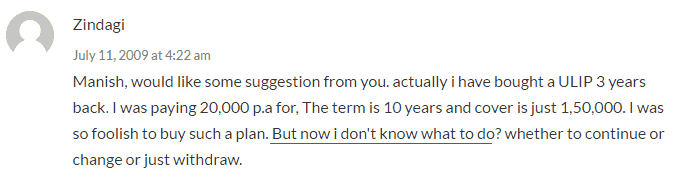

In the same way, most of the investors keep thinking about the loss they are going to make if they get out of the bad financial product and keep postponing their decision. Here is one comment from our blog where an investor shares his state of mind. You can see that he feels so stuck. This is a very common problem

Our lives are very busy these days and if one pending item gets added to our list, it takes months and years to complete it, even if it’s just a few hours of work!.

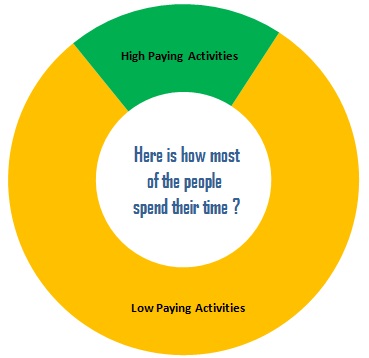

So the big problem which happens when you buy a wrong financial product is that you waste your valuable energy trying to fix the issue. That precious time should have gone into earning more money and managing it well.

3. The opportunity Cost

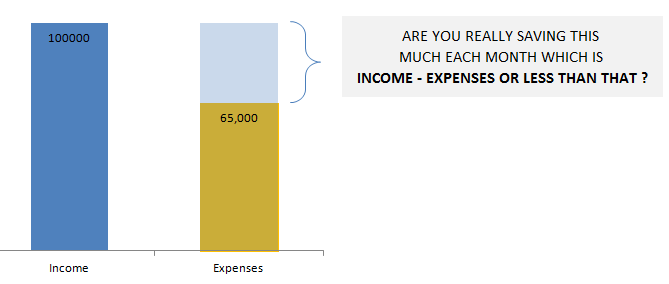

Opportunity cost here means what is the other thing an investor could have done had he not got into a bad financial product. This is a very important thing to understand for financial success. Imagine a bad decision, where you invest Rs 5 lacs and after 2 yrs, your money worth is just Rs 4 lacs. You are in a loss of Rs 1 lac ?

NO, it’s not just Rs 1 lac.

Why?

Because you could have taken the right decision and could have made a profit which you lost in addition to the real loss. In that same example I gave above, you could have invested Rs 5 lacs in such a way that it would have become 6 lacs in 2 yrs. So your opportunity cost is Rs 1 lacs which you didn’t make here. Instead, you are sitting on a loss of Rs 1 lac.

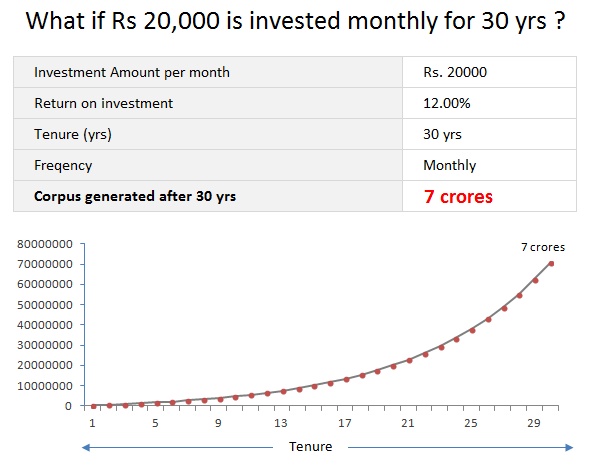

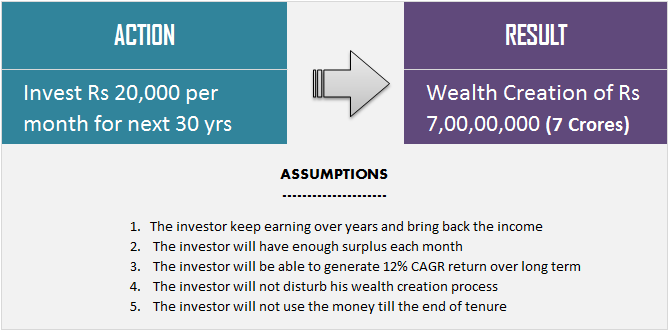

Another example is of a young investor who wants to create a big corpus in the long term, but he/she is maximizing the PPF by investing Rs 1.5 lacs per year in that.

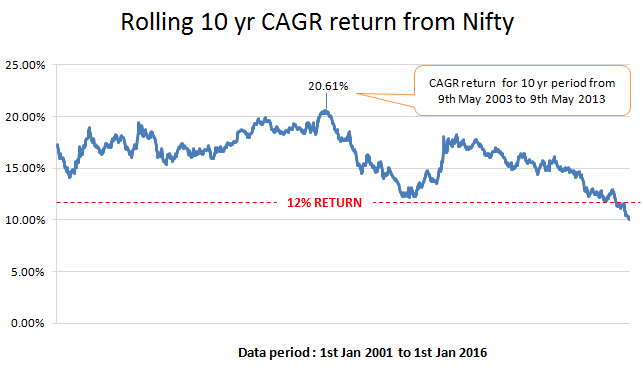

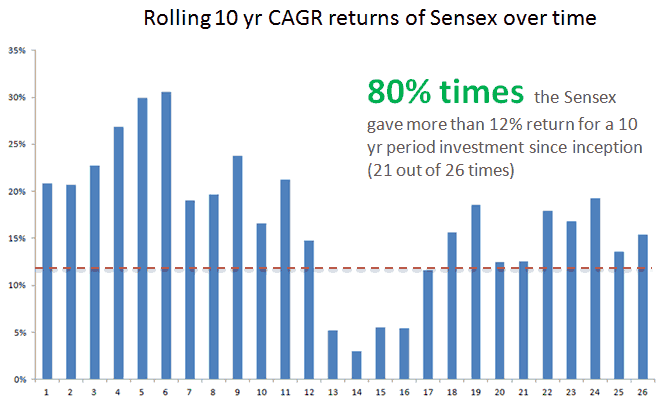

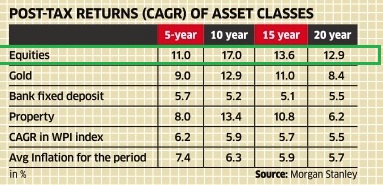

After 15 yrs, they will get a near inflation return only. I consider even that as a bad decision looking at the goal of wealth creation. The same 1.5 lacs can be invested in an equity product and a better inflation-adjusted return can be earned. The final wealth different in case of equity vs. PPF will be quite a big amount. The difference between 8.5% return compared to a 12% return is huge.

4. You lose trust and everyone looks like a “cheater”

Do you know how does it feel when you take some financial decision by trusting someone and you lose money? The tweet below was done by Kalpen Parekh, CEO Of IDFC Mutual funds.

When investors hear us say, it’s cheap so buy more, this is what Dharmendra will say! pic.twitter.com/UIHLdhpzAC

— Kalpen Parekh (@KalpenParekh) February 27, 2016

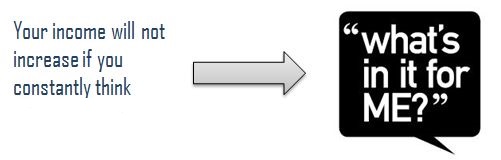

Money is a very private matter and most of people are very very attached to it. When an investor gets a bad experience once, they carry it with them for a very long term. Every other person starts looking like a cheater to them. Everyone seems to be behind their money and it’s tough to trust others.

It’s a very natural reaction, but the problem is that it also damages the investor’s chances to get into a good association too. There are many investors who contact us for their financial planning and many of those who have faced bad experiences in the past never move ahead because it’s difficult for them to trust someone now.

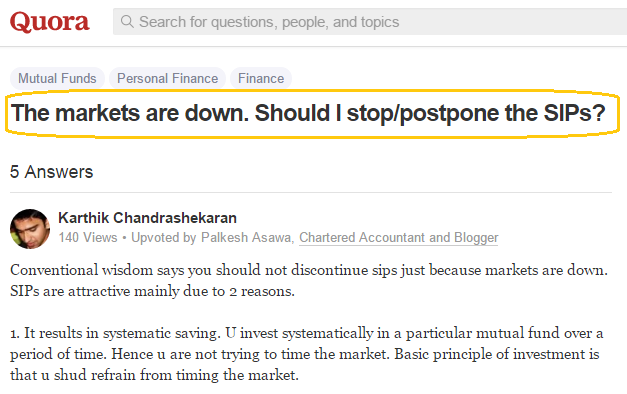

Imagine a guy who has had a bad experience with ULIP, someone who has lost his money due to market movements, will find it very tough to start his SIP’s in mutual funds for his long term wealth creation. This is a big loss for himself based on his past experience.

I know few investors who have vouched to never buy any other financial product other than a fixed deposit because they felt cheated in the past.

So what is the point I am making? If you take the wrong financial product, then it affects the way you think about financial products and advisors in the future.

How to buy financial products?

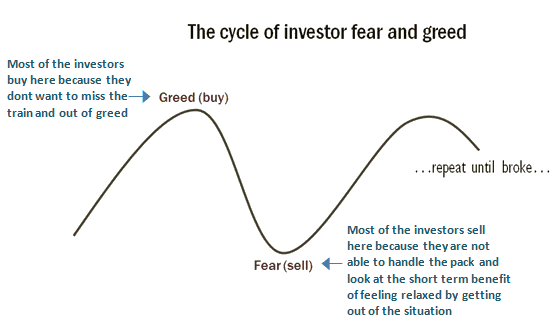

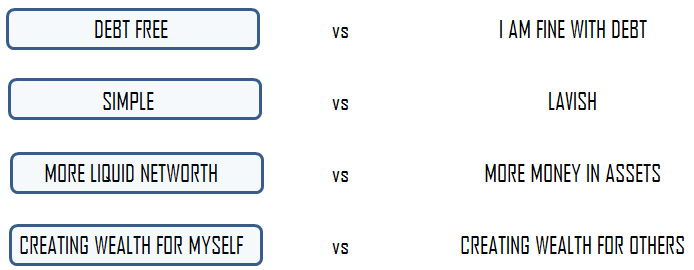

I am not going into detail here, but one thing is clear. You have to take out the emotions out of it. No greed, no fear, no pressure, no over trust on others. Make sure you understand what you are buying, why you are buying, for which goal are you buying, what are the risk factors, etc.

If you spend just 1 hour before you get into a financial product, I think 95% of the investor’s woes will be solved.

What do you feel about this article? Do you have more points to add?