There are two types of investors.

- Category 1 – Those who invest their money manually at the end of each month

- Category 2 – Those who auto-invest at the start of each month.

Today we will discuss which option is better than others and what are the benefits of choosing the auto investment mode at the start of the month

While investing at the end of the month manually is very intuitive and sounds comfortable to most of the investors, we think that investing in the auto mode at the start of the month is much better and beneficial for an average investor.

Most people adopt the “Save whatever money is left at the end of the month” approach in their financial life, but there is enough research and proof that it does not work for the larger masses. The best option is to put your investments in auto mode and let it happen automatically each month.

Now let’s looks at the benefits of investing in auto mode at the starting of each month

Benefit #1 – You can manage your lack of discipline

Can you trust yourself in investing each month manually for the next 5-10 yrs?

If you decide to invest Rs 10,000 on the 25th of every month for the next 10 yrs, will you be able to do it consistently for the next 120 months (10 yrs X 12 months)?

Trust me, it’s a lot of work and very hard to act in a robotic fashion.

- Sometimes, you will postpone it

- Sometimes, you will feel – “Let’s do it next week”

- Sometimes, you will skip it for the sake of other expenses

- Sometimes, you will just be involved in some other tasks

- Sometimes, you will actually follow it

- And most of the times, you will just forget it

Compare this will an auto mode, where you have set up your SIP (automatic monthly deduction in mutual funds) or a recurring deposit (for those who don’t think mutual funds are their cup of tea), and the money automatically gets deducted from your bank account (considering you have the balance) and then gets invested without your intervention.

Which one of these options do you feel will be in your interest?

Most people think that each month of a certain date they will invest some X amount on a regular basis, but they are not able to do it on a consistent basis. They either lack in discipline or they are so consumed in other areas of life, that they are not able to follow what they promised themselves.

Due to this, their financial life suffers. The money does not get transferred from the bank to the investments and eventually gets spent.

Trust me, even if you are the KING of indiscipline, the auto investing will create wealth for you!

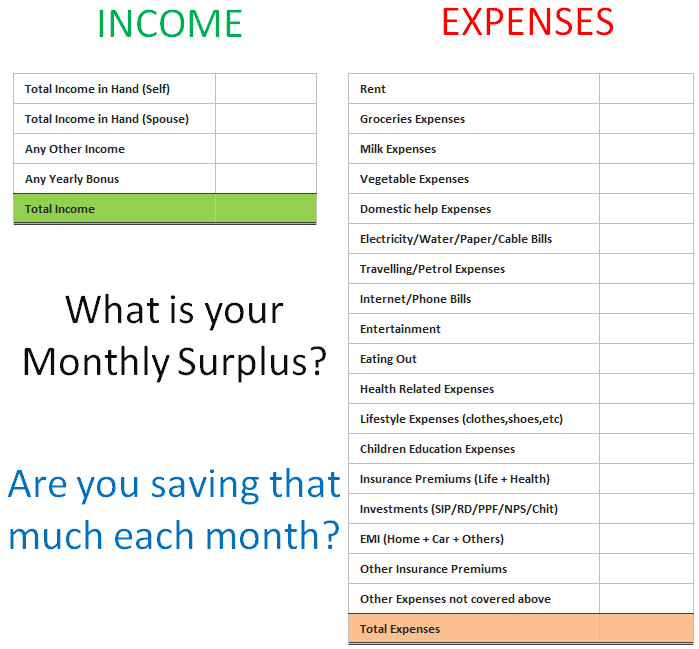

Benefit #2 – You avoid unwanted expenses

“Supply creates its own demand” – a classic principle of economics. If you have money lying available in your bank account, you will find enough reasons for spending that money.

Hence, if you think – “Let me first spend, if anything is left, I can always save/invest it at the end of the month” , it’s almost guaranteed that you will not find any money at the end (unless your income is very high compared to your expenses)

This is the reason why you should create a structure that takes away some part of your salary from your savings bank account to somewhere else which is not easily visible to you (like PPF, RD, or mutual funds).

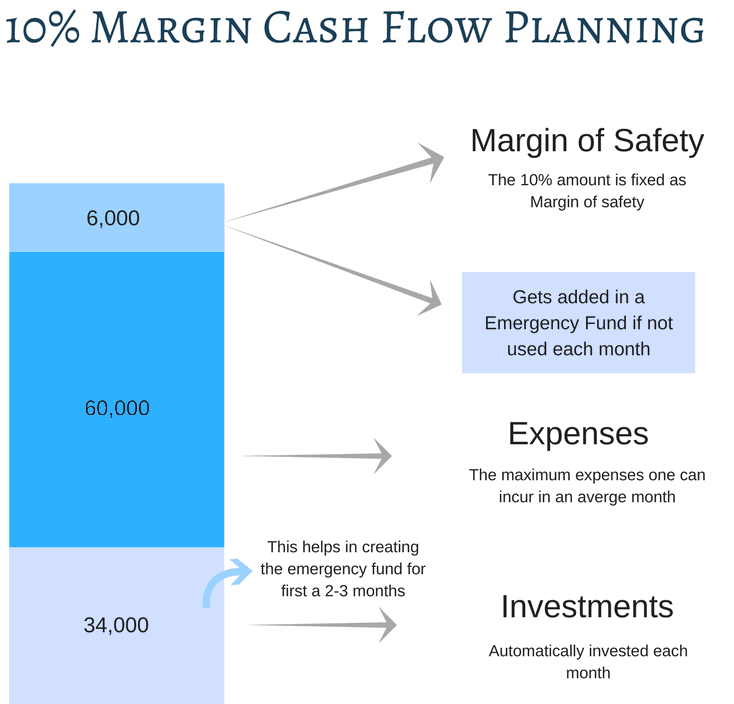

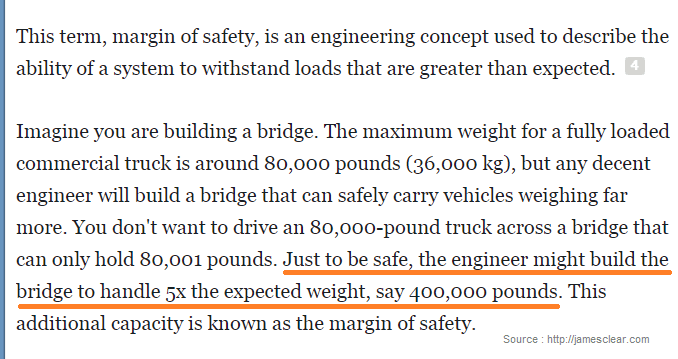

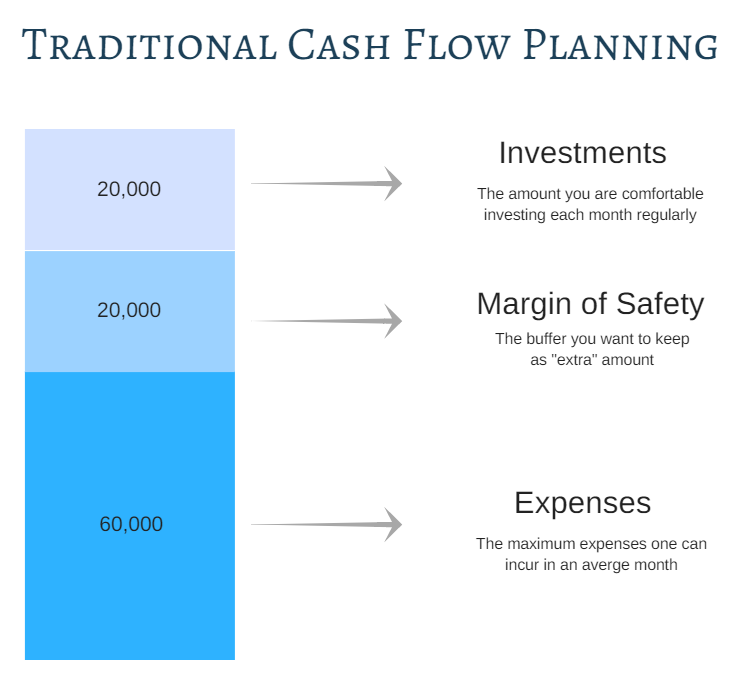

I have devised something called a “10% margin system”, which can truly transform the way you manage your cash flow. It’s one trick that will help you save more money each month.

Under this system, you only keep your monthly expenses + 10% more in your bank account and invest everything else at the start of each month. Click here to read more on this 10% margin system.

So if you invest at the start of this month, you will shop only limited to your needs, you will not overeat outside, and to a great extent, you save on the unwanted expenses.

The whole idea is to “cut” the excess supply of money to yourself by investing it at the start of the month itself.

[su_button size=”6″ radius=”square” background=”#306bf1″ url=”https://www.jagoinvestor.com/mutual-funds#account”]Start your FREE Mutual Funds Account with Jagoinvestor[/su_button]

Benefit #3 – It develops the Habit of Saving

One of the biggest challenges for new investors is to develop the “habit of saving” in them.

The world these days is such that it’s very easy to SPEND money on things you don’t really need. You spend on mobiles, gadgets, parties, traveling and consuming various things (nothing wrong in these things). However, beyond a point, you start crossing the limits and you start “wasting” money at the cost of the future.

Most of the investors find themselves not saving any money and living paycheck to paycheck for the simple reason that they never develop the saving habit and eventually end up in the never-ending cycle of earn -> spend -> earn -> spend

You should check this excellent simple video by Brain Tracy on why you should save at least 10% of your salary if you are a beginner investor.

Some time back, I had written an article for beginner investors and how they should manage their financial life. Please go through it.

If a person sets up the auto investing at the start of the month, then at some level the habit of saving starts. If one is able to continue that for a few months, the overall expenses will get adjusted with the leftover money in the bank account. If you are a new investor, the primary reason to start your SIP or RD is not to save money, but to develop the habit of saving.

Benefit #4 – You reduce the risk of investments

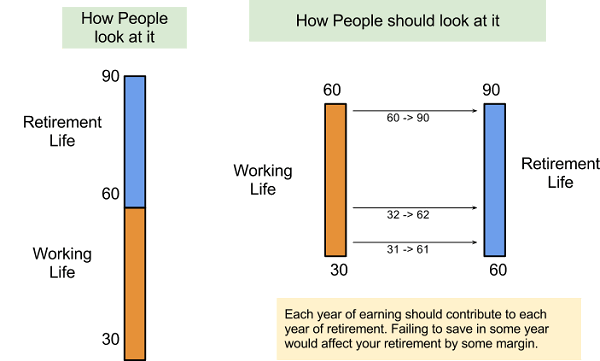

If you do not spread your investments across months, then there are good chances that if the markets fall suddenly, its impact will be high on your wealth. In the same way, the upside potential is also high. But let’s focus on the risk part here.

If your investments are happening each month on a regular basis, then your investments are spread over all kind of markets like bull and bear market (assuming your investments are happening in mutual funds SIP)

So if you want to control the risk part, it’s a good idea to let your investments happen on a monthly basis and not a one-time basis. A good example of this is SIP in ELSS vs. One time investment in ELSS for 80C.

For example, consider two friends Ramesh and Dinesh

Case 1 : Ramesh invests Rs 1.5 lacs in one go for tax saving during the month of Feb, but the markets in next one year go up and down and eventually go down by 10% . In this case, the investment done will be having high risk, because all money was invested in one go (which also means that potential returns can also be high if markets do well) and all the ups and downs impact will be on the total money.

Case 2 : However, Dinesh does a SIP of Rs 12,500 per month in ELSS, and in 12 months he invests total of Rs 1.5 lacs. In this approach, the investments are spread over 12 different months and risk (and returns) will be more controlled. If markets go down in the first few months, then it’s only for the amount invested before that event.

Benefit #5 – Guilt-free Spending

This is one benefit that is often not appreciated enough.

When you save your money at the start of the month, then the rest of the money is available for your expenses. Now you can spend it freely, without any guilt.

Most of the people who do not save enough or save at the end of the month, keep worrying and thinking while spending their money. They keep feeling “Bahut Kharcha ho Gaya is Baar” while going for outings or movies etc. This is because they have not allocated money for the future.

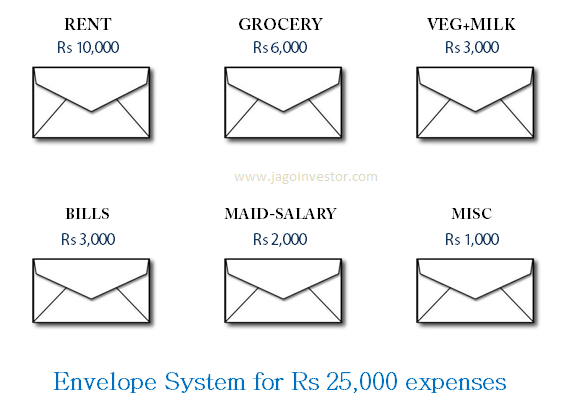

So you should start your auto investing (SIP is one of the best way of doing that) and once you have done that, I suggest you adopt the envelope style of expenses where you create few envelopes for each expenses category and put the cash in the envelope and use only that till the end of the month.

However once you setup your automatic investments at the start of the month, you then just have one agenda – “Spend rest of the money” guilt-free.

Are you starting your investments in Auto mode Now?

So what are you waiting for?

If you have not yet started your investments in auto debit mode, you should immediately start your investments. You can either start your SIP with our team or reach out to your trusted advisor who can guide you on this.

[su_button size=”6″ radius=”square” background=”#D8180A” url=”https://www.jagoinvestor.com/mutual-funds#account”]Start your FREE Mutual Funds Account with Jagoinvestor[/su_button]

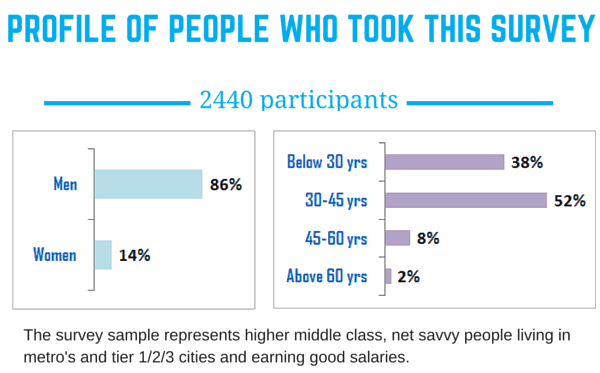

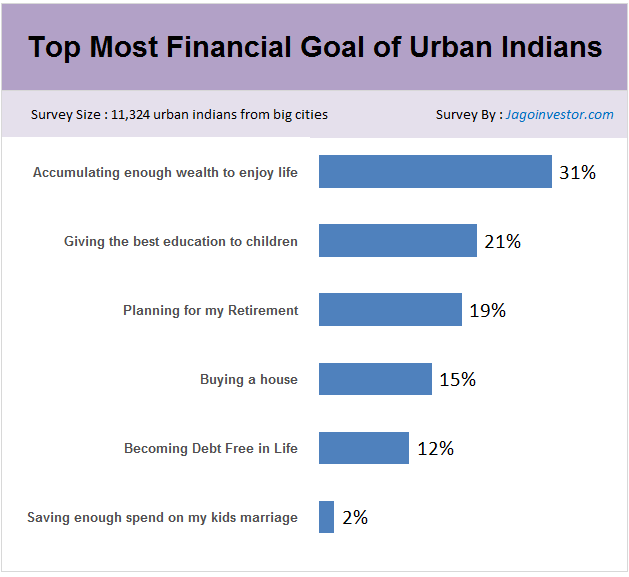

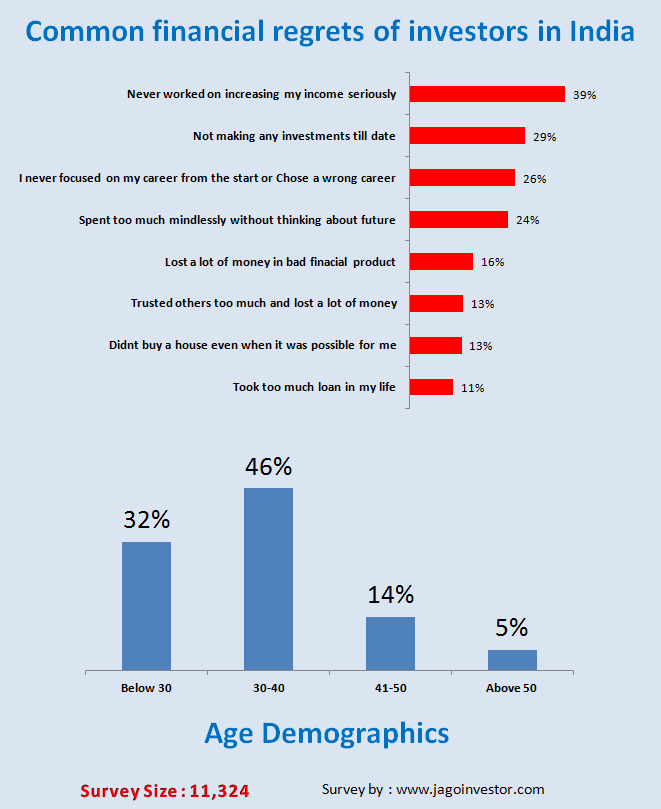

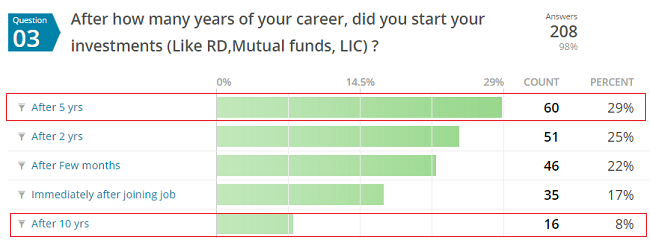

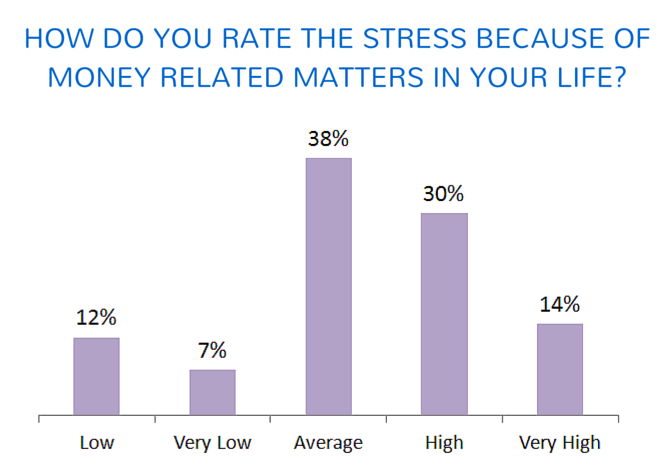

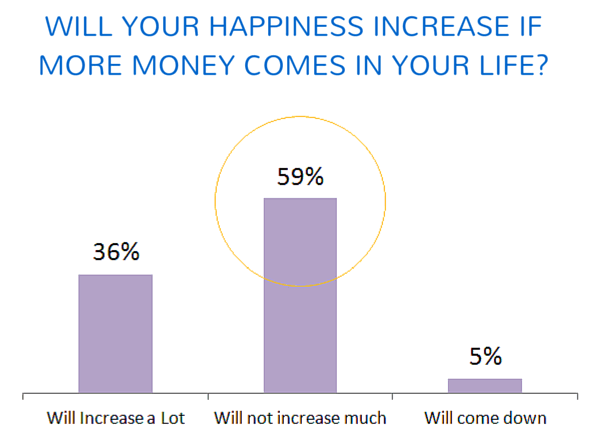

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.