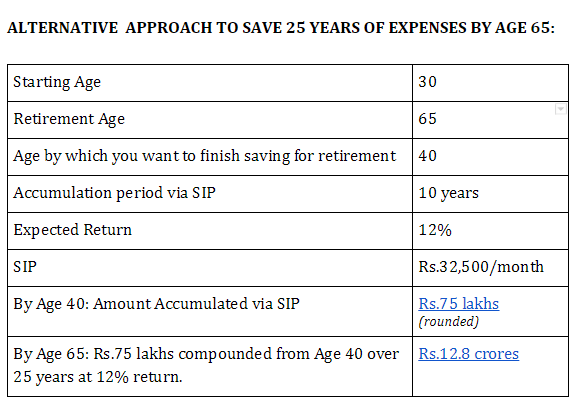

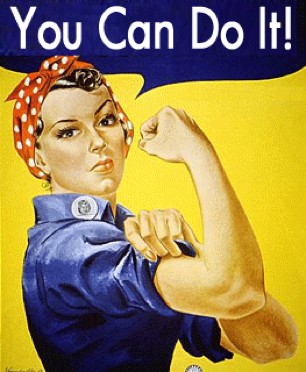

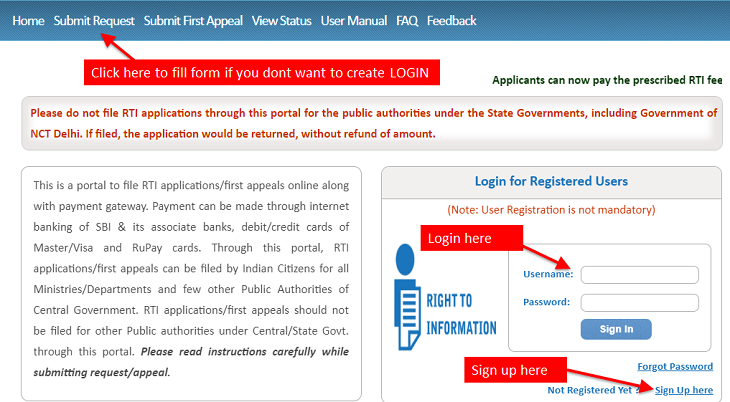

Today you will read one of the fascinating stories of one of our readers (Naren from SavingHabit.com) who has shared his personal journey on early retirement and also gave a step by step path on how to change your mindset about it. This is a long article, but quite deep on the topic of early retirement. I suggest you read till end.. Over to Naren

–

A few weeks back, I had shared my comments on early retirement on the “Myth of Early Retirement” article and Manish asked me to to elaborate on my comment and also do a guest post on this topic.

In this post I will go in detail on how to plan for early retirement and also share my personal early retirement journey.

Disclaimer : This article is purely the author’s personal opinion. The author is not a certified financial planner. Seek the help of a certified financial planner for your individual situation.

When mid-level IT employees in their 40s are being forced into early retirement anyway through layoffs, it has become a necessity for our generation to pro-actively plan for an early retirement. As early as 2011, JagoInvestor reader Ujjwal working in IT predicted this exact scenario and recommended planning for early financial freedom.

How I discovered Early Retirement?

- I graduated in computer science straight into a recession caused by the double whammy of the dot-com bust and the 9/11 attacks. My father had recently retired from his public sector job and I did not have any job offer on hand as campus hiring dried up completely. It felt like I was being tossed around by economic forces beyond my control.

- When I finally entered the workforce at a Big Company, I was soon frustrated by the usual job stress and job insecurity.

- I decided to end this “working for money” problem once and for all by joining an early-stage internet startup. Joining a startup was also my dream since college and I had plans to start my own later. The idea was when the startup will sell for millions, I would strike it rich and never have to work again. Well… 6 years later when the startup was sold, my services were no longer needed. I was out of a job without striking it rich 🙂

- Around this time, I discovered the early retirement community online that talked about focusing on the one thing I could control : my savings rate. All along I had focused on things outside my control and failed to solve the “working for money” problem. Out of all the options available to salaried employees to achieve early financial independence, early retirement offers the highest chance of success because its success or failure is under your control: how much you save each month.

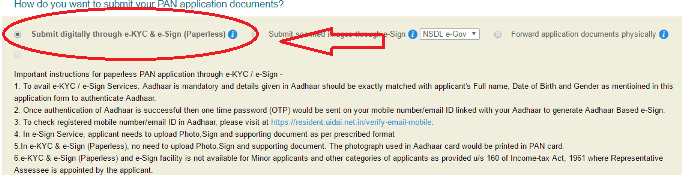

WHAT IS EARLY RETIREMENT?

Most of the Early Retirement literature online is from the U.S which is understandable because they have a longer history of regulated stock markets & mutual funds compared to India.

In this article I’ll do my best to translate Early Retirement for Indian conditions as we have our cultural differences when it comes to money like parents paying for child’s college expenses, joint families where children take care of parents in their old age etc and recent cultural changes mirroring the U.S like home loan EMI, SIP, credit card spending, low savings rate etc

Let me first start with what most people think when they hear the term “Early Retirement”:

- It is a stage by Age 40 when you are able to meet all your expenses through passive income from investments like Real Estate (rental income), Mutual Funds, Stocks (dividends) etc.

- So you don’t have to work anymore to meet your expenses.

- You can easily live on only investment returns post-inflation so your corpus will last forever beating inflation…theoretically.

While this is the “popular dream”, in reality Early Retirement simply means achieving financial independence early in life so you can focus on achieving your important goals in life. This is popularly abbreviated online as FIRE : financial independence/retiring early.

You can be employed at this stage, but in alignment with your life goals for example:

- To do something you love

- To spend more time with loved ones

- To earn money with less stress & more work-life balance

- To lead a healthy & active lifestyle

It is possible to retire early by age 40 but only if you aggressively save at least 50% of your income starting early in your earning life instead of doing a small monthly SIP with the goal of retiring in old age at 65.

Save 50% of my income??!! I can barely meet my expenses each month

Relax! You are already saving more than you realize. You already contribute 12% of your basic income mandatorily to your EPF and get another 12% employer match. That is a 24% savings rate on your basic income. So calm down and I’ll discuss some strategies for increasing your savings rate later in this article.

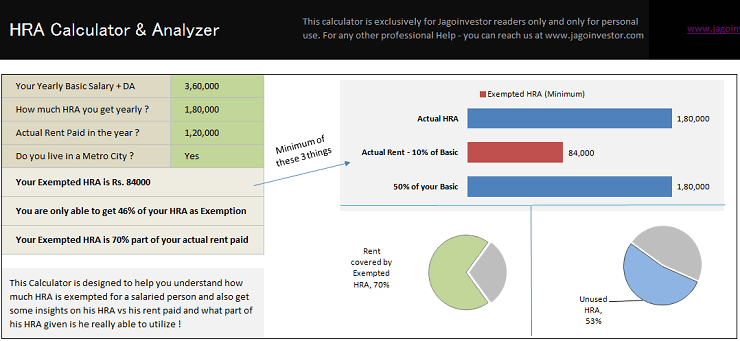

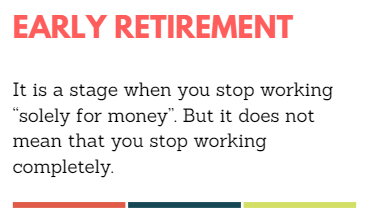

There is a reason behind the 50% savings rate

This is the simple idea behind Early Retirement before inflation & investment returns enter the picture. 50% savings rate may not be possible immediately for people whose income is low or expenses are high but early retirement is not possible unless you increase your savings rate to at least 50%

Here are some inspiring real-life people saving close to 50% :

– 1 income, EMI, 1 kid, private sector, Bengaluru. Income: 81K, Savings:43K

– Unmarried, private sector, Mumbai. Income: 65K. Savings: 30K

– 1 income, Government job, no kids, Rajasthan. Income: 70K, Savings: 42K

– Both working, 1 kid, private sector, Mumbai. Income: 1.05L, Savings: 45K

Here is the link to the “Family Finances” section from ET Wealth magazine. Make sure to look for households who fit your profile and are saving at least 50%. Ask yourself : If people similar to me can save so much, why shouldn’t I save more than my current rate?

Let’s step back here for a minute

First, you need to be very determined to retire early.

When you truly want something you will come up with solutions rather than excuses and you’ll get inspired instead of finding faults. Imagine in your mind’s eye for a moment all the positive reasons why you want to retire early like Family-time, Freedom, Health, Low-Stress, Travel, Security etc.

Now get yourself into an optimistic “can-do” frame of mind before reading further.

(Source)

Early Retirement is an improved version of Conventional Retirement

Around 100 years back even conventional retirement at age 65 was not possible for everyone. What was once a fantasy is a reality now. Now everyone believes it is perfectly normal to retire at age 65.

Similarly, for the first time in history, due to innovations like regulated stock markets, mutual funds & SIP, even the salaried middle-class can now retire early which was previously possible only for high-earning executives or businessmen. So if you try and understand Early Retirement you too can take advantage of it and enjoy a better quality of life.

Be ready to take some tough decisions on what is important to YOU in life rather than just going with the flow of what everybody else is doing with their life.

Can I just retire early and never have to work ever?

The typical dream of Early Retirement is to “sit and eat” from the retirement corpus without having to work for money from age 40 to age 90 which is a long span of 50 years which no one can predict.

It is a difficult feat to pull off as Life has a habit of springing surprises especially when you have kids and elderly parents. But it is possible if key variables outside your control like the stock market returns work in your favor and there are real-life success stories like Mr.MoneyMustache.

Two big problems with this “I never want to work again” Early Retirement thinking:

- UNCERTAINTY:

- If a family member has a major health expense not covered by health insurance, how will you meet that expense if you are not earning any additional income?

- If you cannot find a tenant for your rental income house for more than a year, how will you meet household expenses if you are not earning any additional income?

- If the stock market crashes by 15% and goes into a 5-year recession, will you have the stomach to withdraw money for monthly expenses from an already depleted corpus?

- What if all of the above happen simultaneously in your life like the expression “When it rains, it pours” ?

- STRESS: you’ll replace the stress of a job with the stress of obsessing over running out of money every single day of your early retirement.

My Alternative Early Retirement Plan for Indian conditions

Stop working for “money” but don’t stop working

- By Age 40: Finish saving up for retirement by saving at least 50% of your income in retirement SIP.

- After Age 40: Stop your retirement SIP & switch to work that you truly enjoy in order to cover monthly expenses.

- From Age 40: Let compounding double your retirement corpus every 6 years until age 65!

The idea is to permanently secure your comfortable lifestyle by age 40 so you can follow your dreams without fear. Even in the worst case scenario you’ll always be guaranteed to enjoy the comfortable lifestyle of your 30s.

The benefits of this alternative approach

FREEDOM: Free by Age 40 to do work you truly enjoy

While saving up for retirement your monthly budget at 50% savings rate will look like this:

Income Rs.1 lakh = Rs. 50K Expenses + Rs.50K Retirement SIP

By age 40 once you finish saving up for retirement, you don’t need the retirement SIP anymore and your budget will look like this

Income Rs.1 lakh = Rs.50K Expenses + Rs.50K Surplus

After age 40, you can work for a 50% lesser salary at jobs that are more fulfilling and less stressful but fully pays for your monthly expenses including support for kids & elderly parents:

Income Rs.50K = Rs.50K Expenses

Most people who want to retire early simply are tired of the job stress and deep down are not averse to working if there is work-life balance and they are working on something they truly enjoy.

SECURITY: Your retirement fund is actually a 25-year emergency fund!

If you ever lose your job before age 65 like the TCS/Cognizant/Infosys mid-level managers in the headlines : you can use a small portion of your retirement fund to fund monthly expenses for even 3-4 years while you re-skill and find another job after which you can replenish the amount you took out during the jobless period.

Instead of trying to live off the retirement fund for life from age 40, you strategically use the retirement fund to build a safety net for uncertain times and take calculated risks like starting a business or a new career.

LESS STRESS: Not having to worry about money running out

It is an open secret that even the pioneers of early retirement that I hero-worship like MMM & ERE bring in active income in their “early retirement” from working on their passions like building houses by hand or working as a quant trader/researcher leaving their retirement corpus to compound meaning they are not solely living off of their early retirement corpus themselves.

So if the early retirement gurus are bringing in active income why shouldn’t you factor in the active income from your dream-job in your early retirement plans? Why assume that working on something you enjoy won’t cover monthly expenses even after working at it for 3-4 years?

You’ll be sitting on a 25-year emergency fund in the form of your early retirement corpus for God’s sake! If you are still unsure, you can start working on your dream-job as a side-project while you are still working at your day-job to give yourself enough runway and confidence that it will make money by the time you quit your day-job.

PRACTICE: Great Training for “full retirement”

Scaling down your work by 50% by age 40 is a great way to get a preview of what “full retirement” will look like at age 65. You will get a lot of wake-up calls mostly around the state of your health, investment returns , wasteful expenses and whether you really have any true passions in life or were you just lying to yourself about “dreams & passions” to mentally escape from job stress 😉 So while planning for Early Retirement also work on your passion on the side to prepare yourself for the post-40 life.

4 STRATEGIES TO INCREASE YOUR SAVINGS RATE

Strategy #1 – Lower your expenses: This is the only thing under your control so tackle this first. Analyze your lifestyle using apps like Spendee to cut down wasteful spending without being “penny wise and pound foolish”.

For example: In our house we use the internet for entertainment so no T.V or cable expenses, we mainly eat home-cooked food so our eating-out expenses are low, we do yoga at home so no gym fees, we own high-quality phones & laptops that are expensive but we maintain them carefully for years so they work out cheaper in the long run.

It took us almost 3 years to systematically reduce our spending without feeling deprived. In your household, what are the top 3 categories where you could get the same value but for way less money?

Strategy #2 – Increase your income: If you’ve cut all wasteful expenses and are still not saving enough then your only option is to increase your income. Your early retirement goal gives you the clarity and urgency to do what is necessary to get that promotion or better-paying job. It will not happen overnight but you can work towards it purposefully now that you have a time-bound reason.

Strategy #3 – Get out of Debt: If you’ve made the mistake of buying a house on exorbitant EMI at an early age, you need to first crush your EMI or education loan before attempting early retirement. You need to simultaneously lower expenses and increase income. Read : Is home loan EMI jeopardising your other financial goals? Here’s what to do

Strategy #4 – Work as a team with your spouse: By age 30 you are probably married and both of you are earning. Get your spouse on board and work together as a team. If all you want is a couple of years freedom to try your hand at a new career or business, try a mini-retirement instead.

If you are debt-free and your spouse’s income can take care of expenses, you can quit your job with the safety net of your spouse’s income. If you succeed in your venture and are able to cover expenses then your spouse too can quit their job to follow their dreams. This way both of you can make money doing what you like. Even if you fail in your venture, you can re-join the workforce & try again later.

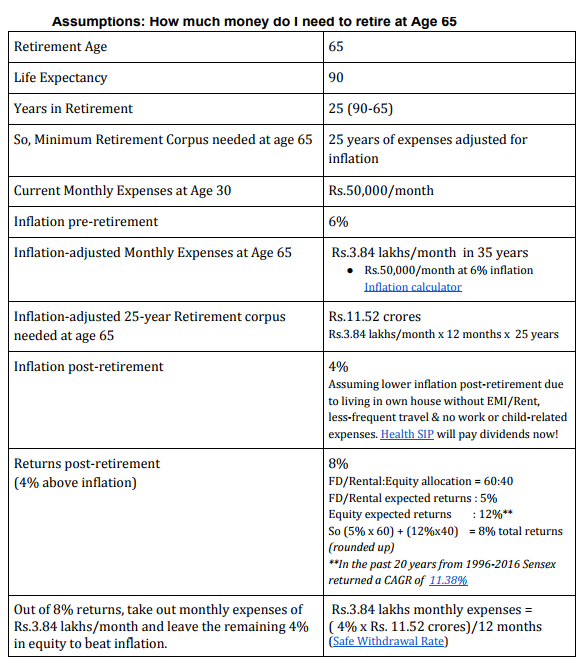

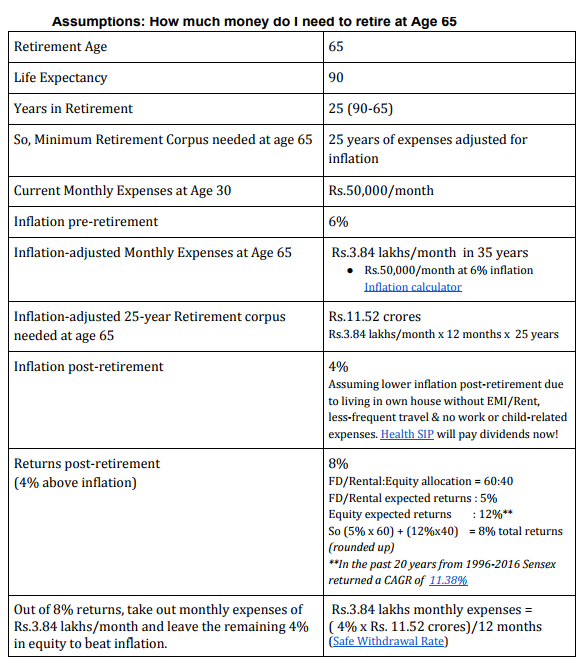

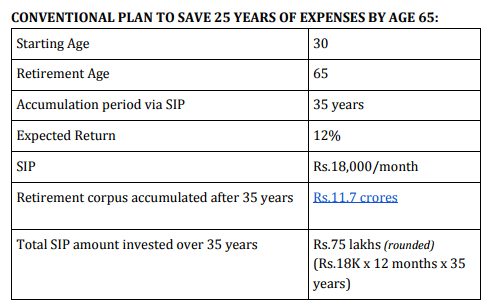

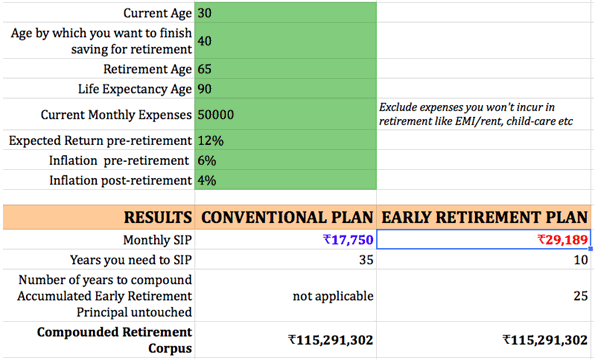

Wow! An investment of Rs.75 lakhs in SIP over 35 years has given a retirement corpus of Rs.11.7 crores

But look closer and you’ll notice that this is a bad bargain for the number of years this person has to save. Why should you take 35 years to accumulate 75 lakhs?

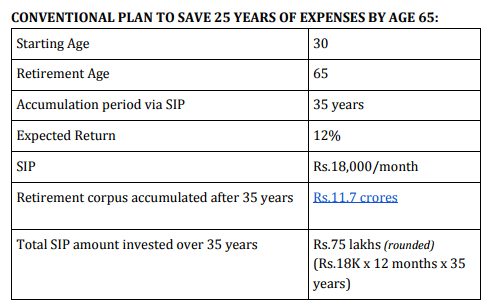

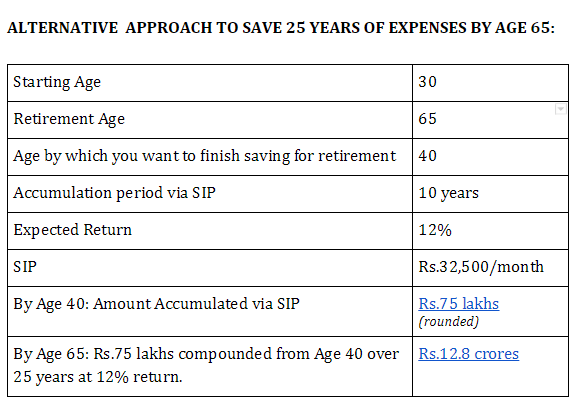

Let’s see what happens if you try and accumulate the same Rs.75 lakhs within 10 years and then stop your SIPs but let the Rs.75 lakhs compound untouched for another 25 years.

WHAAAAT???!!! How did you end up with Rs.12.8 crores at age 65 even though you stopped SIPs at age 40!!!

THE SECRET : Compounding really works its magic on large numbers

SIP does not do the compounding by itself…only when you finish saving up a large corpus does meaningful and substantial compounding gets started. That is why you should accumulate your retirement corpus as early as possible for compounding to start doing its job.

See here, here and here for others who’ve illustrated how saving up early then stopping and letting the money compound untouched grows the money like crazy meeting or even exceeding your goals as compared to doing a small monthly SIP for decades.

ILLUSTRATION OF THE TWO APPROACHES VIA EXCEL CALCULATON

Download Early Retirement Calculator

MATHEMATICAL PROOF

THE RULE OF 72 a.k.a What they did not teach you in school

Question 1: How long will it take for Rs.75 lakhs to double @ 12% annual return?

You don’t need a calculator to answer this. Use The Rule of 72.

This handy thumb-rule derived from the compound interest formula says that to find the number of years required to double your money at a given return %, you just divide 72 by the return %

So 72/12 = 6 years.

Answer: Rs.75 lakhs @ 12% annual return will double in 6 years

Question 2: How many times will Rs.75 lakhs double @12% annual return over 25 years?

Answer: 25/6 = 4 times

Rs. 75 lakhs @ 12% return will double 4 times over 25 years

Question 3: What’ll be the final value of Rs.75 lakhs after doubling 4 times at the end of 25 years?

Answer:

Doubles first after 6 years : Rs.75 lakhs x 2 = Rs.1.50 crores

Doubles again after 12 years : Rs.1.50 crores x 2 = Rs.3 crores

Doubles again after 18 years : Rs.3 crores x 2 = Rs.6 crores

Doubles again after 24 years : Rs.6 crores x 2 = Rs.12 crores

Total doubling : 4 times

Final corpus : Rs.12 crores

- Now refer back to the alternative accumulation plan’s final retirement corpus of Rs.12.8 crores to verify that the Rule of 72 produces a result remarkably accurate to the result from a lumpsum investment Calculator.

- Also verify using CAGR calculator that the initial lumpsum invested and future compounded corpus works out to a 12% annual return.

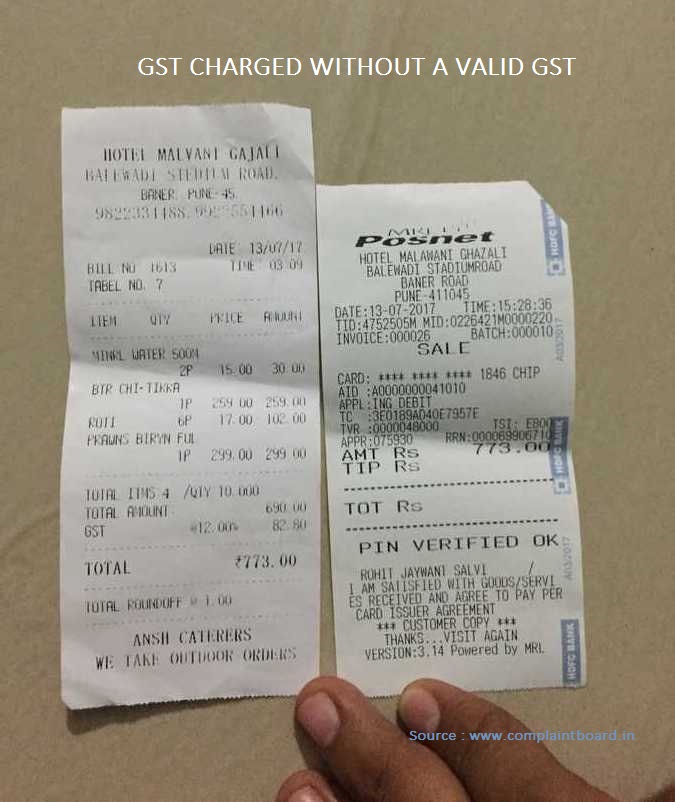

A word of caution on debt: Compounding works against you when you have outstanding debt. For example: Say you have a 36% annual interest Credit Card and an outstanding balance of Rs.1 lakh on it. If you don’t pay back the debt for 2 years then the credit card balance will double to Rs.2 lakhs.

How? Rule of 72: 72/36 =2. So your debt will double in 2 years!

(Source)

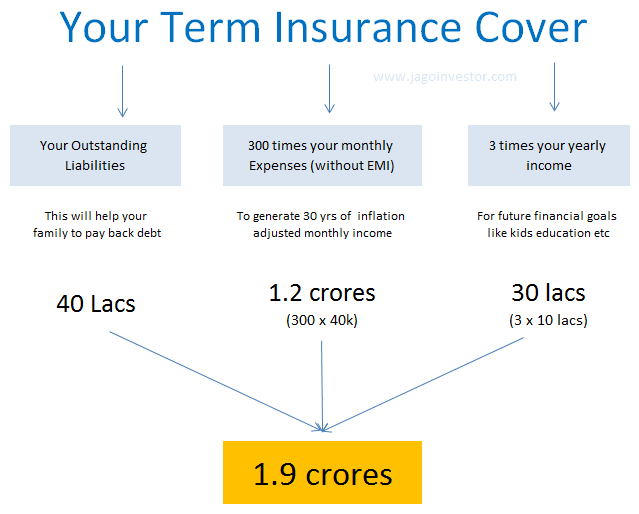

FAQ 1: If I’m saving first for my retirement what about saving for my child’s college expenses?

Use the same Early Saving strategy to save for child’s college expenses:

At the time of the child’s birth itself, invest the prevailing cost of college into mutual funds and let it compound for 18 years to beat education inflation. For example: 4-year engineering course at IIT currently costs Rs.8 lakhs. Say your kid was just born this year. If education inflation is 12% y-o-y the same course will cost Rs.60 lakhs in 18 years. To beat this education inflation: Invest prevailing cost of Rs.8 lakhs in mutual funds at the time of the child’s birth itself and let it compound over 18 years to Rs.60 lakhs @ 12% annual return by the time your child is ready to enter college. Your child can take out an education loan for any shortfall over and above your savings.

If you don’t have Rs.8 lakhs to invest in mutual funds at the time of your child’s birth:

- Finish saving for your retirement first by age 40 so you don’t have to worry about losing your job or sacrificing your dreams.

- Then start SIP for your kid’s future expenses like higher education or wedding

- To bridge any shortfall between your SIP savings & the education or wedding expenses, your child can take out an education loan or scholarship for college and a personal loan for their own wedding.

- Since you’ll be earning while your child is in college, you can help out with whatever college expenses you can afford. Your child may also earn income through internships or side-projects while still in college.

Take care of your own retirement first before you save for your child because the child has other viable options like education loans, scholarships, low-cost weddings etc. No bank will give you any “retirement loan” if you’ve not saved enough for your retirement!!!

Plus you can be a role-model to your child by balancing your dreams & your reasonable duty towards your child. You will be giving them the inheritance of them not having to worry about your retirement also when they make their own retirement plans

Like how the air hostess tells us in the safety precautions before every flight…..

Image Source

I highly recommend that you read Manish’s article on how not to stress too much about the inflation in higher education expenses.

FAQ 2 : What about buying our own house?

I recommend from personal experience: Don’t buy a house on EMI at a young age in your 20s or 30s when you don’t know where you’ll settle down permanently. We move to other cities and even countries for work these days and there is no knowing ahead of time where you will settle down in old age.

Instead save SIP in mutual funds towards buying a house until you have 100% clarity closer to retirement in your 50s or 60s and then build or buy a brand new house or flat fully in cash without EMI. The SIP returns should be able to match the real estate inflation. Until your retirement it is cheaper to rent in India at 4% rental yield even at 10% annual rent increase instead of paying EMI at 10-12% and also property tax, water tax, maintenance, repairs, association dues etc. only to end up with an “old flat” after 25 years!

A couple we know are doing exactly this: after traveling all over India for work & renting throughout they are now building a house in their hometown for retirement in their mid-fifties. Subramoney also recommends the same approach: See point #9 of his article.

Recommended reading: Why large investment in property at young age could be risky

FAQ 3: But we want to do extended travel frequently. That’s why we want to retire early and stop working!

Think win-win: Once you achieve financial independence you can quit your job and travel for say a year. After a year of travel, you can recharge both yourself and your bank accounts by returning to the job market for a couple of years to work on something you enjoy (maybe something related to travel!). Then travel again. Repeat the process until your 60s by which time hopefully you would have traveled everywhere you wanted to and your compounded retirement fund will be waiting for you!

My Personal Journey so far

- Age 36. Married. No kids yet.

- We’ve saved up 30% of our retirement target so far

- By age 45, we’ll finish saving up 100% of our retirement target & then let it compound untouched over the next 20 years

- Own a flat bought with savings & no EMI in a city where we don’t live 🙂 Although it gives us a modest rent that we SIP, I consider it a poor decision as we could have reached financial independence already by renting instead of owning.

- 3 years in Big Co IT dept : paid off student loan & credit card debt so savings rate was low : around 25%. Debt-Free so I work at Internet Startup for 6 years : Saved little over 40% of my salary!

- 3 years back, wife and I took a calculated risk to start own business when we had a savings runway of 6-7 years. 3 years later business income now covers monthly expenses and savings rate is climbing slowly towards 50%

- Once we reach our retirement target by age 45, I may take up a job at a non-profit working for a better India at a much lower salary but only if it fully covers our already low expenses.

- We exercise 30 mins to 1 hour daily towards our Health SIP & maintain a healthy diet. We plan to be be fit and healthy in our 60s when no health insurance will cover us.

- We’ll save what we can for our future child using the Rule of 72 since the child has age on their side for compounding to work until age 18. But we’ll definitely teach the child to be financially independent in their 30s itself and follow their dreams without needing money from us 🙂

This is our story in brief. We took calculated risks and re-invented ourselves with the safety net of savings that would have lasted for only 6-7 years. Imagine how you too can work on your dreams stress-free with the safety net of savings that’ll last for 25 years.

We are a regular couple with middle-class values. If we can do it so can you. Good luck!

Special Thanks: My wife & I are forever grateful to Mr.MoneyMustache for demonstrating that you can simply save your salary to freedom 25 years ahead of schedule!

I want to end with a well-written poem about “A Man with Savings” that makes the point much better than I ever could with all the math & personal stories.

Please share your thoughts about early retirement under comments section. I would be happy to read them and also discuss more on this topic.

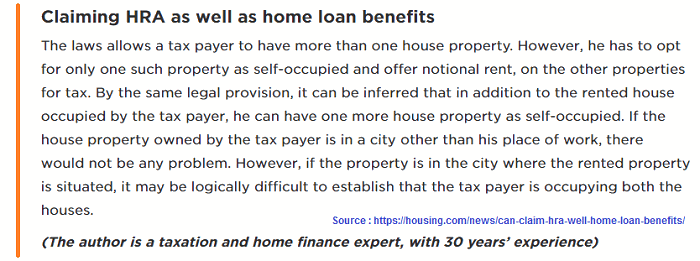

Important points regarding HRA?

Important points regarding HRA?