Here is a guest post from Zubin Ajmera from Progress & Win (detailed bio at the end) .. He would like to share his insights on creating extra income while you are at job.. Over to him.

–

If I have to tell you the latest trends and fantasies of Indians these days, it would be 4 things :-

- Going on dating apps (“Forget Tinder, did you check out this new app?”)

- Trying a new restaurant (“We should really go to this new cafe opened last month, they serve the most delicious desserts”)

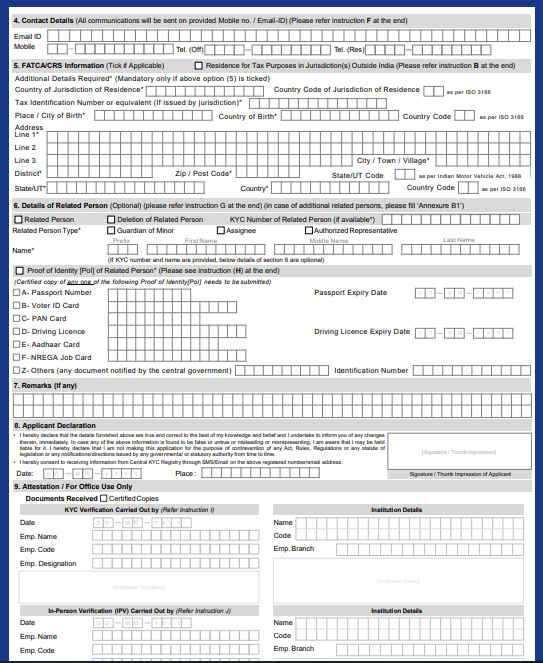

- Watching the latest movie (Robot 2.0?), or the new series on Netflix (“Did you watch Sacred Games, or Narcos?”). I mean, look at this craziness

- Starting a business (“Sometimes, I feel my manager doesn’t understand it! I just want to quit my job and start something of my own!”)

Today, I want to talk about the 4th — starting a side business. And it’s funny because the moment I tell this, the instant choleric reaction is:-

- “Uhh, I’m already occupied with so many things. I don’t have enough time”

- “Business?? I don’t even know where to start from”

- “Why will anyone pay me? I’m not an expert”

- “I’ve an idea in mind, but not sure if it will work!”

I call these Mental Scripts, these are some of the barriers you have in your head when starting anything new.

I don’t necessarily blame anyone for this. The fact is, we live in this “startup ecosystem” where you’ll come across hundreds of sites talking about technology, ecommerce, and mostly hear words like — “funding, investors, seed round A, renting office space, hiring”, etc.

I want to tell you that all of that is possible, but you CAN take a different route. A different route might mean –

- Starting a tiny business while still working at your day job (so eventually you’ve an option to quit your job)

- Working on something you’re interested in or deeply care about. For eg: I love to research and spend on perfumes. My weird dream is to start a business on it someday. Not kidding, just look at my enrapturing expression when I buy a new one online –

The expression after you order your favorite thing on Amazon

The expression after you order your favorite thing on Amazon

- Creating a second income stream

- Finding your first paying customer (Apple sold its first iPhone on 29th June, 2007 Flipkart got its first customer in October 2007. Moral for you — It all starts with ONE)

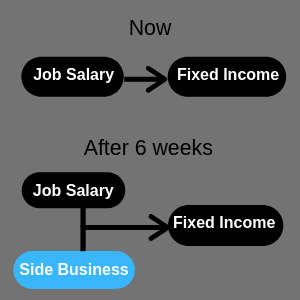

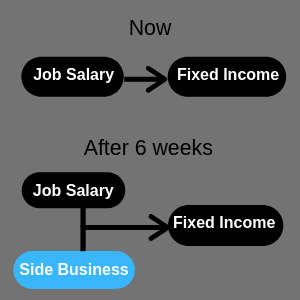

In fact, imagine how life looks like if you have 2 paychecks deposited in your bank account every month. A second income rolling in.

For most of us, the bulk of our fixed income comes from our salary. What if you added one more stream to your income? That one stream might not be equivalent to your salary, but even an extra, say 25,000 — what do you think you can do with that?

- Pay for petrol or other bills

- Cover up for rent

- Buy that extra pair of clothes or shoes

- Take someone out for a lavish dinner

- Maybe take a short weekend trip to some new place?

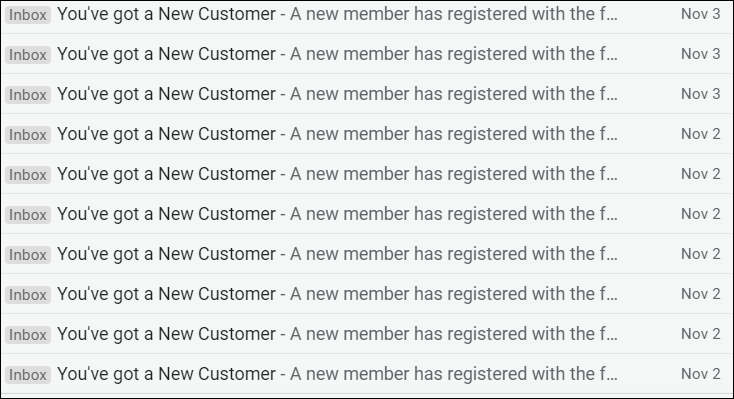

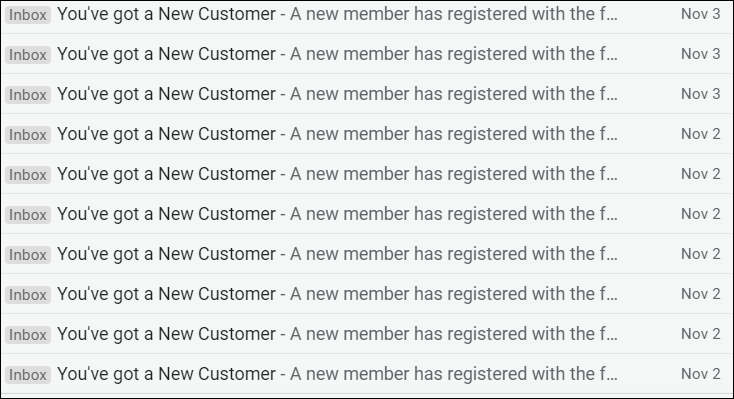

Here, I’ll show you what that second stream of income looks for me –

Here, I’ll show you what that second stream of income looks for me –

This was from November itself. Each customer worth $50

And let me show you what a business where you’re your own boss looks like for other ordinary people, who are just like you and me –

- Deepak Kanakaraju teaches digital marketing through his online courses and workshops

- Sandeep Singh sips a chocolate milkshake at a coffee shop, while he finds/reports online security loopholes for tech and ecommerce companies

- Karan Batra is a finance expert who provides various tax and finance saving services

- Ritika Tiwari is a writer, who provides content writing services for many websites and companies

Google all of them, and there are plenty of others who were working professionals and started as beginners. See more examples here.

Is this a dream “not possible”?

No! With a few simple steps, this is achievable. It’s not even a distant dream, you can start earning more in as little as 6 weeks and build a sustainable income — for life.

Let me show you how.

The simple framework to start a side business (in 6 weeks or less)

It boils down to 3 simple steps:-

Step 1: Find an idea

Step 2: Niche it down

Step 3: Get your first 1-3 paying clients

That’s it. I’m not going to throw 100 different things at you (“start a website, buy a domain, get the xyz discount”) to confuse you further.

I’m not even going to use complicated jargons you’ve never heard of, you really don’t need to when you start off.

It’s kind of like when you start working out at the gym. Your goal initially is not to lose 20 kgs, but maybe a tiny goal to lose 5 kgs first.

That’s the goal here as well. To find an idea, test it, and get your initial clients. Do these 3 steps, and boom — you’ve a functioning business.

And the interesting part is all of this is possible while sitting in your office desk….doing your work…on the laptop…..or on a weekend….or coming home after work….or after dinner….just by spending 5-7 hours per week

Let’s go through the details of each.

Step 1: Find an Idea

Tool required: A pen and a paper (do not ask “what fancy tool should I use?” There isn’t)

Time required: 15-20 minutes

You’d be surprised when I tell you this — 80% of my readers face this challenge, which is coming up with an idea.

- “I don’t have any ideas”

- “Where should I start from?”

- “Zubin, I have an idea, but I am not sure if it will work”

It’s kind of like an “excuse” you make to cover up on not taking action. But you also make it sound “correct” in your head, so you think what you’re doing is right.

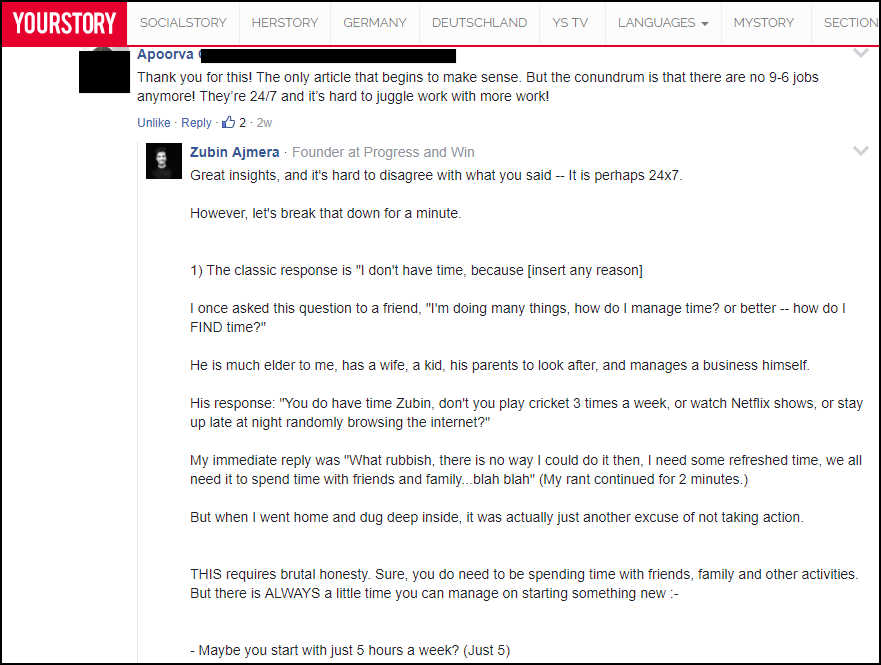

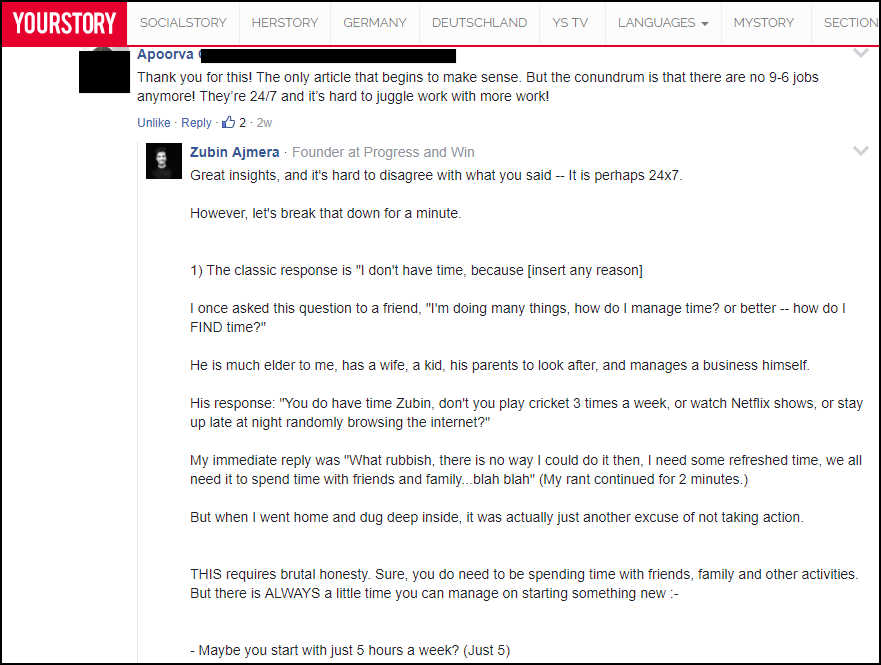

For eg: “I don’t have enough time” is the most common one you’ll find. Here’s an interesting comment on one of my articles for YourStory – (You can check my full response here btw.)

A big part of starting a side business is internalizing your inner psychology and mindset. (And it’s never about “which domain to pick”, or “what the name of your company should be”)

Let me show you 2 simple techniques to come up with atleast 10 different ideas in under 15 minutes. I’ve used them and I still do, many of my readers have, and it continues to work.

One quick caveat is to stop censoring yourself as you go through this process. No telling yourself “I can’t do this”, “I’ll do this some other day maybe”

Much of this is about creativity, testing, taking action, and eventually having fun with it.

Technique #1: The YUS Technique

I call it Your Unbeatable Superpowers (YUS). Each one of us is different. Our story is different — where we come from, experiences we’ve had, people we meet, places we travel, stories we know, food we eat, clothes we wear, etc. This is what makes you unique.

So, how can you monetize these experiences? How do you turn your unique experiences into profit viable ideas?

Answer the key elements below:-

- Experiences you’ve gained — like learning algebra or studying architecture, finance or consulting, traveling by spending less, doing interior designing

- Skills you’ve developed — like playing a guitar, working on excel, taking better photos, coding in java

- Challenges you’ve faced and overcome — like treating foot pain, getting the perfect muscular body, losing weight, learnt to write better

- Achievements you’ve been awarded for — maybe you got a promotion, or a high MBA score, or bought a car from your own pocket, or stood first in a swimming competition

Write down as many you can think of.

Technique #2: The Detective Hat Technique

I want you to answer these questions –

What would you do on a Sunday morning after your morning breakfast?

You wake up at 10 am (hey, it’s SUNDAY!), spend another 10 minutes on your bed. Brush your teeth. Take a bath. Have your breakfast.

Now after all this, what do you usually do?

Will you go to the gym? Read business websites? Watch cooking videos? Go to a networking event? Arrange your next travel trip?

Write it all down!

What do your friends/family struggle with and ask your help for?

Do they come to you for design advice? Or ask you about finances? Or they need help with planning an event? Learning how to create excel spreadsheets? Advise on what phone/laptop to buy?

Remember, no idea is a bad idea at this stage. I want you to list down EVERYTHING you can think of when using the techniques. You’re not allowed to

- Chalk out any idea

- Think “this idea isn’t possible” (How do you know?)

- Critic yourself (“I am not an expert”)

We’ll remove some of these ideas, don’t worry. I’ll show you how to identify and eliminate the bad ones. But, we’ll address all of these concerns later.

Right now, just put everything on the page.

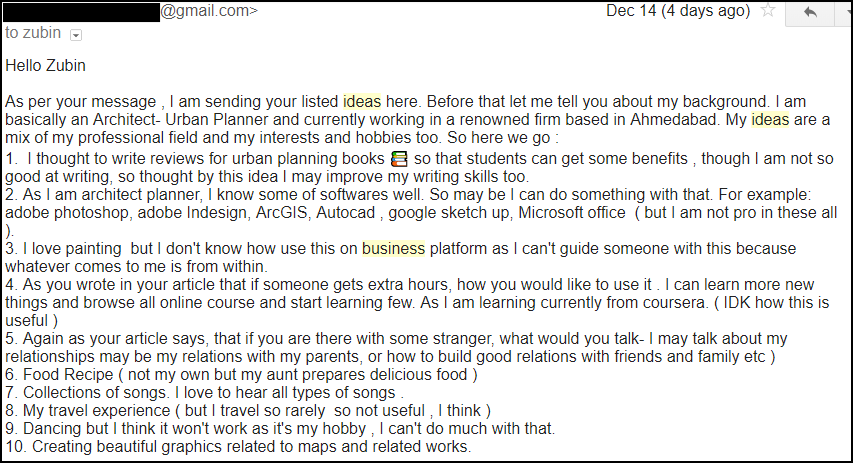

Great! With using just these 2 techniques, you now have a list of 10-15 potential ideas. (If you also want to see the Book Shelf and The Flight technique to come up with more ideas, check below here.)

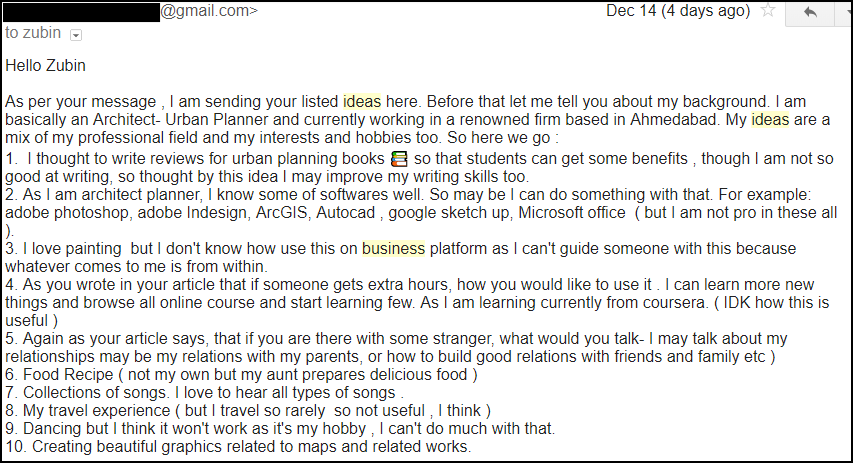

Here’s how your list might look like –

This is from one of my readers. A simple exercise, and you already have so many ideas

Awesome! Pat yourself.

Now, I want you to pick one idea. Do not obsess over this. Pick one idea. Do inky-pinky, or something that interests you, or what idea catches your eye when you look at the list, or just ask your mom (she gives the best advice sometimes trust me) — that’s not the point.

The point is to pick 1 idea to test and validate, and move to the next step. A lot of people get stuck at this step alone. Treat this as a system. You simply follow the steps, trust the process — and you will see results.

Step 2: Niche it Down

Tool required: Just your creativity

So, you’ve an idea. Now, let’s determine who can be your potential customer/client.

In marketing, there is a golden rule penned by author Tim Ferris in his book, which goes — “if everyone is your market, then nobody is your market”

Once you have a rough idea, the next step is to identify the person who will pay you. Don’t go after each and every individual you can think of.

Ask yourself – Who is my ideal client?

Bad answer: My ideal client is 18-35 year-old men

Really? An 18-year old college “dude” has almost nothing in common with a 35-year old professional. They are at different stages in their lives, have different goals, their lifestyle is different, and they have completely different mindsets.

GET REALLY SPECIFIC! I cannot emphasize the power of getting super-specific.

Good answer: 30-35 year-old men who are working professionals

Amazing answer: 27-35 year-old men who are working professionals, in the IT industry, living in Mumbai. They typically work in IT, Banking, Finance companies. They are either middle or senior level professionals in their career. They work largely on these xyz softwares, excel spreadsheets, and emails. Most of them are married. They commute either by train or a bus. They spend most of their time on social media (Facebook and LinkedIn.)

I mean, look at that amazing answer above. I love you already!

The more specific you get, better your chances of early success. When thinking of your ideal client, you want to deeply understand :-

- Age

- Location

- Demographics

- Where do they hang out often?

- What do they read, watch, listen?

- Where do they go to solve their problems?

- Type of industry they are in

- etc.

Let me walk you through an actual example. Say our idea is — “content writing”

Who is my ideal client? Maybe we come up with –

- Marketing agencies who require content writers on a part-time basis

- Authors or bloggers who require for their website or a new book

- Small scale companies who need for regularly putting out new content for their blog and social media channels

Say we pick the first one — marketing agencies, since the demand for content writers might be more there. Agencies need content writers everyday!

Again, the point I want to emphasize is do not obsess over and over again. Pick one and move to the next step. With a little testing and refinement, you will learn a lot more, than to simply sit and daydream on it.

So, where are we? You’ve an idea — you’ve narrowed it down for a specific market, you know EXACTLY who would be a good target audience for your idea.

Alright, great then, this is a good start!

Step 3: Getting Your First 1-3 Paying Clients

Back in the day, getting a client meant doing some grilling work — months and months of waiting, no response, following up repeatedly, all a dreadful process. Oh, and by the way, how can we forget there was less internet access and penetration!

Today, finding your first paying customers is pretty quick, cheap and easy. Let me show you the cheapest and a free way of getting a client.

Go Direct!

Yes, just go direct — send an email, or meet in-person, or do a direct cold call.

My recommendation: Start with 5-10 emails a week. Can you do that? Don’t answer that, since the answer to that question is “Yes, you can!” So, you better not give me the “I don’t have time excuse!”

With about 30 minutes per day, you should be able to send 10-12 emails (even while watching Netflix on your laptop, OK?).

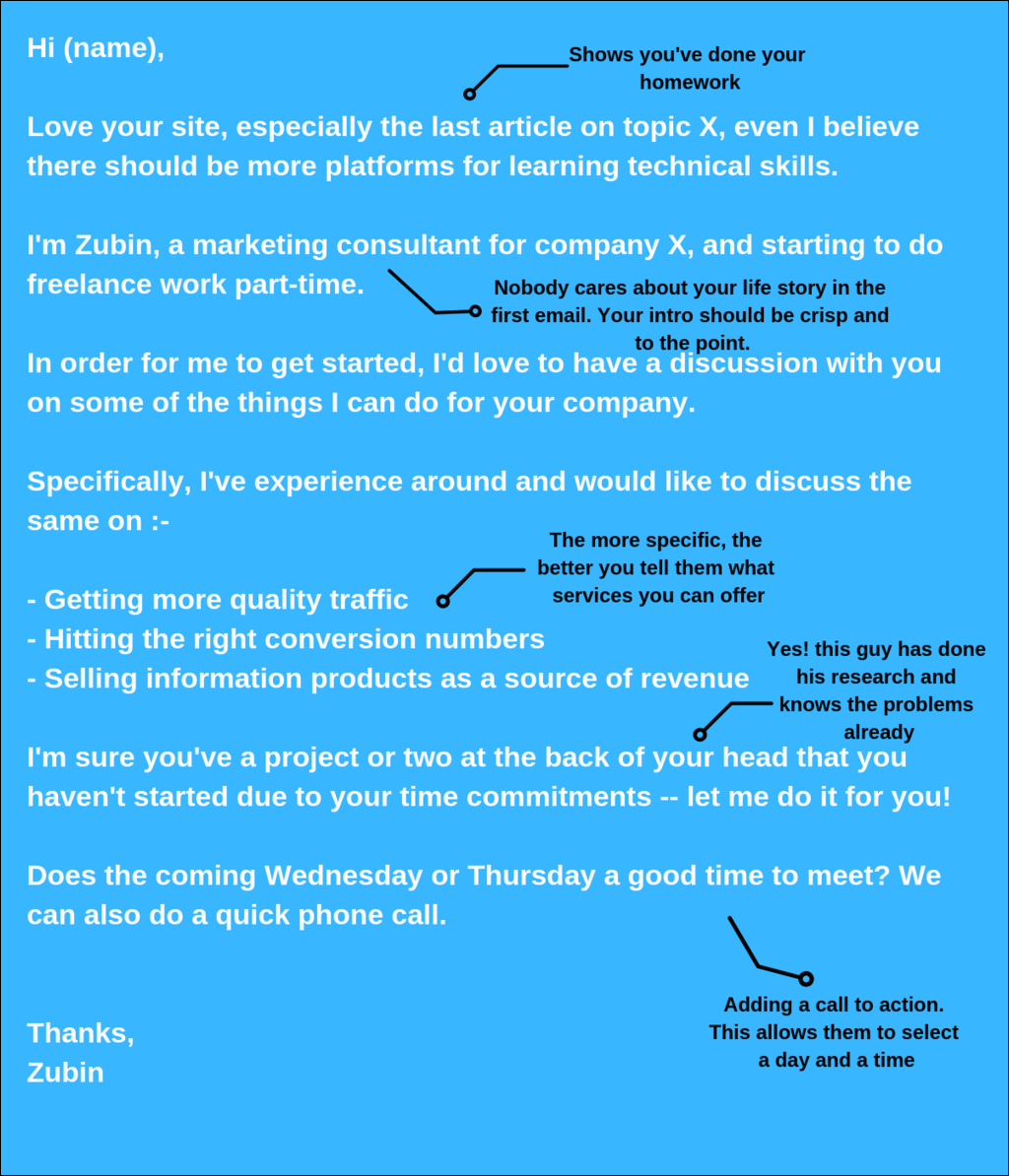

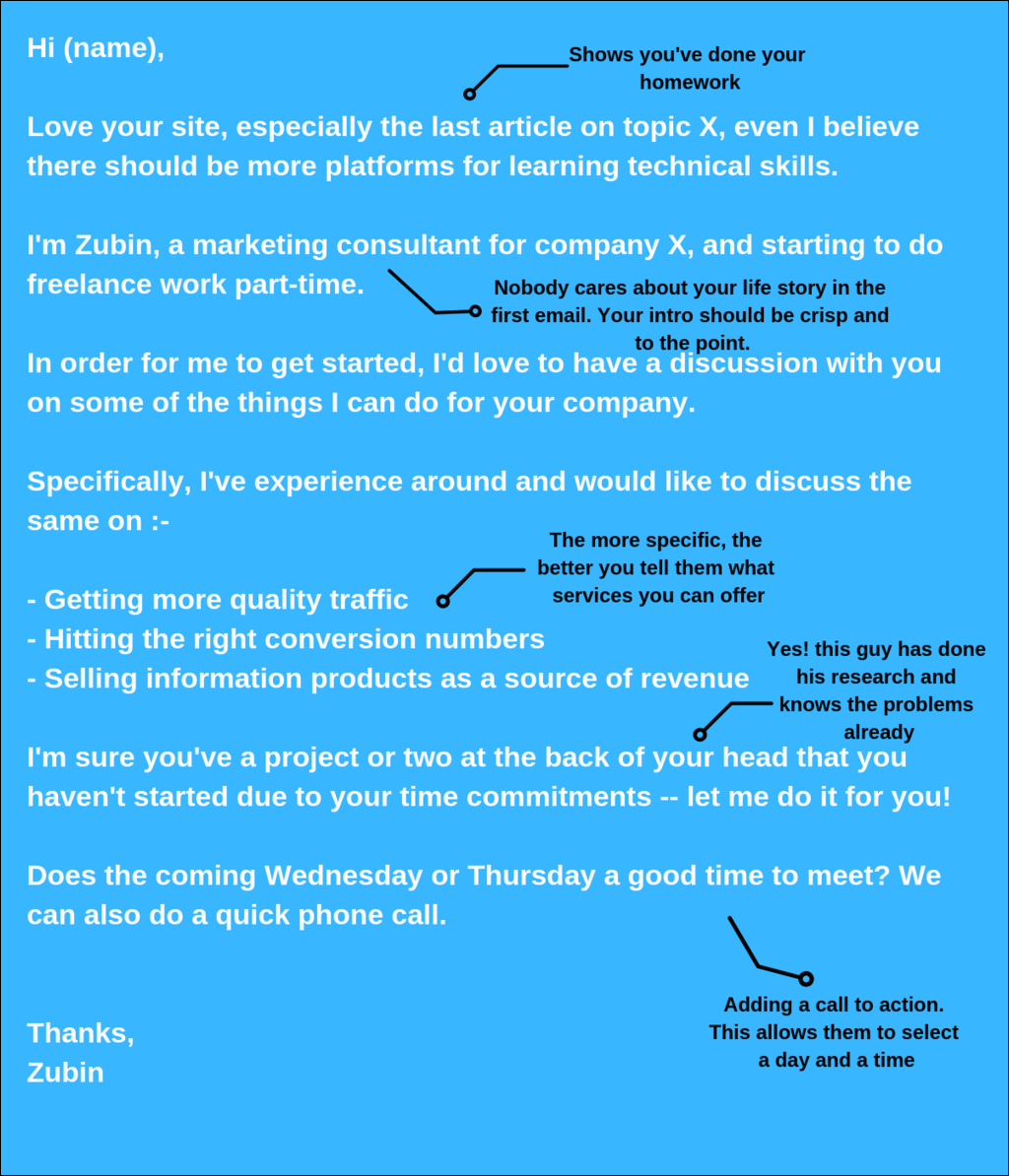

Let me go one step further and show you an exact word-for-word script to send.

The 5-Point Formula Email Script to Get your First Paying Client

Few things which make this deceptively simple email work like magic –

- It’s simple and casual (you feel you’re talking to this person friendly. No “sir”, nothing formal)

- It’s not too short, and not too long, yet it covers all important points —

- a quick intro

- services you can offer

- problems he has

- benefits to him

- a call to action

- Not all of your recipients will respond, but a few will, and that is your road to turning those into paying customers

Once you set the foundation of getting your first client correct (i.e. you know your idea is validated, there is demand for it, you’re getting responses to your emails, etc.) — you can then scale. You can get your next 10 or even 100 clients pretty easily.

Conclusion, and Your Next Step

Unlike other “digital marketing” gurus, who preach overwhelming stuff –

- “You NEED a website. Here is the 50% discount on the hosting provider”

- “Just do affiliate marketing” (Blunt truth: you will not see any results for the first 6 months alteast!)

- “You must have a Facebook page!”

These are the same advises I got, and which you will get too.

Instead, without setting up a website or a facebook page or any fancy bells and whistles, which is all for later, start with this simple 3-step system. I’ve used it, many have, and the best thing about it? IT WORKS!

Forget Black Friday, here’s my “give-me-a-slap-if-it-doesn’t-work” guarantee offer: Apply this proven system, and you WILL see results. If you don’t, I’m open to get slapped (just don’t hit me hard, please!)

About the Author: Zubin Ajmera

After his 5-year stint in USA, Zubin returned back to India. He’s a Content Marketer, Founder of 2 online businesses, and started Progress and Win, a site where he helps working professionals and beginner bloggers start an online side business from scratch, using tested techniques and strategies.

He believes in a strict “no-B.S” approach, has been covered on Entrepreneur India, YourStory, directly worked with 2 authors, 4 CEOs, and featured on multiple other brands.