Everyone is concern when it comes to investment. But lot of investors does the mistake of focusing on investments only and not on their portfolio. Having a good financial portfolio is also as important as an investment.

This article will talk about 5 things every financial portfolio must have and we will see that it should be good for almost every type of investor . We will try to judge it over the important parameters discussed in my one of the earlier Article : Pillars of Success

What is mean by a financial portfolio?

Financial portfolio is a road-map which you can use to achieve your future financial goals. It is build up by considering your risk appetite and investment objectives. You can handle your own financial portfolio or you can also take help of the professional financial managers which will make it easier for you to reach your financial destination.

Your investments alone can not help you to build a healthy portfolio, there are some other elements also which are important as much as your investments.

Let’s see the Five most important and must have things that each and every financial portfolio must have:

1. Life Insurance

Each and every person who has financial dependents must have a good Life cover through Term Insurance. This must be taken at an early stage of life for the longest term possible.

For India :

- Aegon Religare Life Insurance

- SBI Life Insurance

- Max New York Life Insurance

- LIC (Jeevan Amulya)

For Other countries :

Please search for your respective countries and find out which term insurance is the best one.

2. Health Insurance

This is extremely important to have a health insurance now a days, because of rising health-care expenses. A Family must be covered with a Family Floater plan for a good amount (Rs 5 lacs/$10,000) depending on your budget .

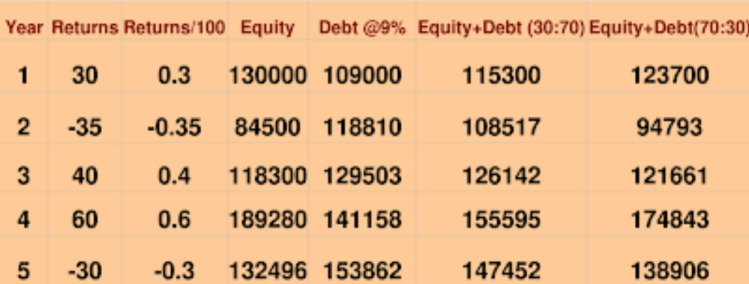

3. PPF

Each and every financial portfolio much have debt exposure and PPF (for India) is an excellent investment product for anyone, backed by government , its 100% safe and one of the most efficient and tax efficient products available , with post-tax returns of 8% , its a must have in each portfolio .

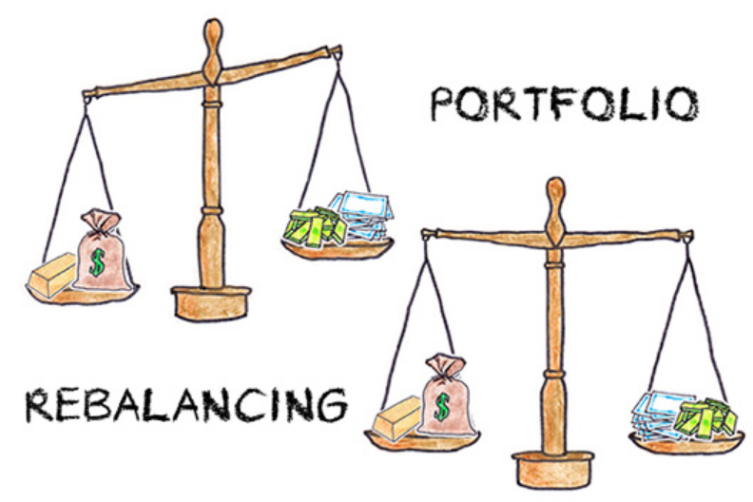

4. SIP in Mutual Funds (for long term)

For long term investments, its hard to beat this . For long term investments Equity must be the route and for systematic and disciplined investing , SIP is the best way to channelize your money . Considering the undebatable growth for Indian economy , no can afford to miss Equities for long term investments.

5. Contingent/Emergency Fund (Cash + Liquid Funds)

Each and every financial portfolio must have good amount of cash and liquidity to meet unforeseen and emergency expenses. Other wise you will have to liquidate and break you investment products which may attract penalties and may not give you enough cash at the time of requirement which can create problem .

Better to have money equivalent to 3-4 months of expenses in emergency fund . You can also put 1-2 months expenses as Cash and rest into Liquid funds which may also provide you some returns .

Analysis

Understand that these 5 things are a list of things one would have for sure , but its not an exhaustive list . Depending on your profile and requirements you should have other products as well. but i would say this will solve 90% of the problem . Let looks how a finanacial portfolio consisting of this 5 things passes on 4 parameters called Pillars of Success ?

1. Capital Appreciation :

With SIP in mutual funds and PPF , the capital appreciation should happen to a great extent , PPF would provide stability and assurity or returns , where as Equity will gives exceptional returns .

2. Liquidity :

We have already covered that Contingent fund should be able to provide good Liquidity.

3. Risk Management :

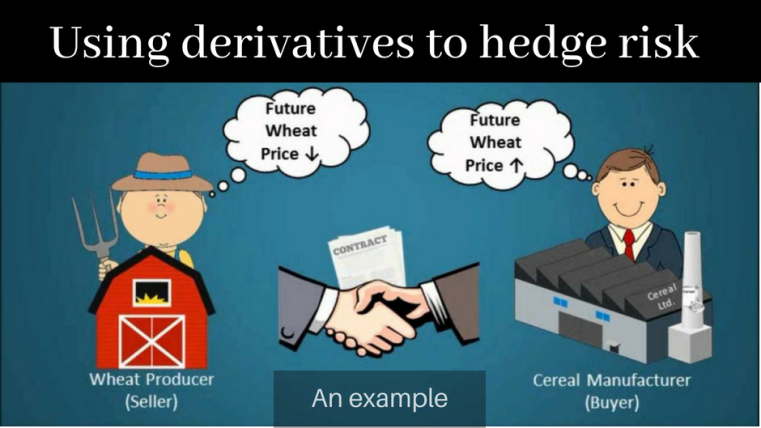

Term Insurance and Health Insurance will take good care . SIP will take care of the market volatility. some other techniques like Hedging using Derivatives and being well informed will manage extra level of risk .

4. Goal Oriented :

Each and every product is for a specific and important goal , as described above .

For Non-Indian Readers

Hi all , the article is specifically with Indian context , but article is helpful for each of you , please find the similar products in your country .

Conclusion

Each and every financial portfolio can be different and should match the requirement of the investor , But these 5 things are such that it can be for any kind of investor . Just like we have master key for any kind of lock , we have these products for any kind of investor.

If you have an query ask us in the comment section.