This is the 4th and last part of the series on Stock Markets articles Newcomers. In other parts we discussed some important things which newcomers should know when they enter Markets.

In this article we will see how a new comer in stock market should start. Go through other 3 parts before this to get maximum out of this article .

Part 1 : Why Stock Markets Attract and Look Easy

Part 2 : Understanding What exactly you want to do in Stock Markets

Part 3 : 8 most Important Rules in Stock Market

“Small babies like Teddy Bears, and Market Bear likes Babies (newcomers) in Stock markets”

There are 5 things a new comer has to do , I will call it CLOPS model of starting in stock Markets .

- Calm Down

- Learn

- Observe

- Practice

- Start Small

This model of learning is totally obvious and logical and applies to all the areas of life. Stock Markets are no different. Lets see each of them separately and what they mean in Stock markets.

Calm Down

The first thing a newcomer has to do is to calm down and not rush. Just be where you are. Most of the people come in stock markets and its totally a new place for them and every thing looks like a great “get-quick-rich” opportunity to them and they want to make most of that once-in-a-lifetime opportunity.

They don’t know its every-day thing in stock markets. Markets are like a wonderland for them. Markets are not going anywhere and its more true for the opportunities they provide.

So the first thing is to just calm down and do-not rush to get in. There are other important things you have to do before you get-rich-quick. Most common mistakes which newcomers do is mainly because of excitement and getting in without preparation not because of lack of skill or because of there abilities.

When you calm down first and don’t get excited you are doing an important thing which is not jumping in without thinking and making yourself ready for another important things which are discussed below.

Learn

The next step is to Learn, Learning is an ongoing process which will never stop as far as Stock markets are concerned, but at the starting level you need to learn lots of basic stuff.

Read how Stock markets are structures, what are different indices, what is Nifty and Sensex? What are the factors affecting markets? How to analyse a company? what are important things to consider while investing?

Read books, Read blogs, Read anything you can get on the subject. Some of the good resources are:

Books for Value Investing (Thanks to Rohit Chauhan to provide the names)

- Intelligent investor by Benjamin Graham

- Common Stocks and Uncommon Profits by Phil Fischer

- Warren Buffett Way by Robert Hagstrom

Blogs for Value Investing

- Rohit Chauhan

- Shyam Pabbati

Books for Trading

- The Psychology of Trading by Brett Steenbarger

- Come into my Trading Room by Dr. Alexander Elder

- The Disciplined Trader by Mark Doglas

Blogs for Trading

- Brett Steenbarger Blog

- Sudarshan Sukhani Blog

- Timamo Blog

Watch this video for beginners to learn how to invest in share market:

Observe

After learning, the next thing is to Observe the markets. See market movements, watch how prices are behaving on each news or with volumes, see what kind of patterns are developing on charts and does it behave every time in almost same way?

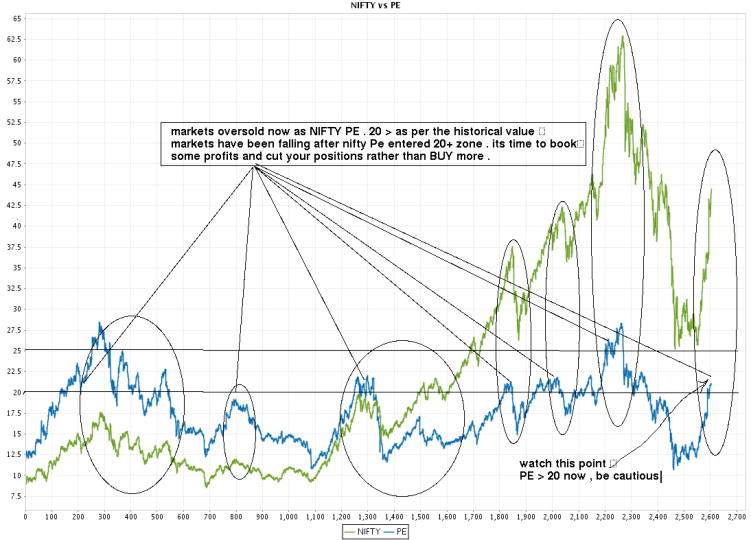

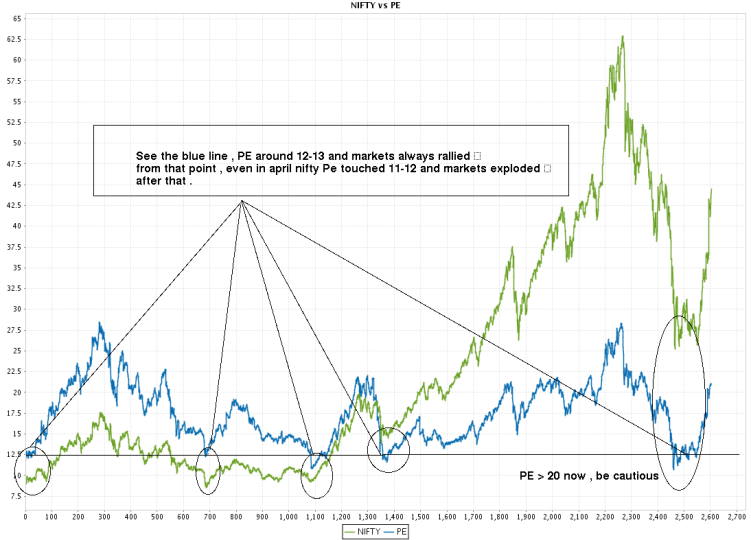

Look at how market behaves in relation with Nifty PE in this post.

When you observe these things, you will develop some understanding on relationship and you can validate those with what you have learned so far. A good amount of time should be given to this, markets have different faces and you need to see all the faces, just one good up move is not enough, see at least all different kind of moves.

Up-move, Down-move, trading in range. All of these in different time frame.

You can actually start this early and do it side by side your learning. Collect charts for each day for later reference so that you can see it later. If you know some programming , make a small program which can download the charts from yahoo customized to your purpose.

I have downloaded 15,000 daily and weekly charts for all the Nifty, Midcap stocks and Asian Indices. I can go back to them and test any of my strategy on those charts. Keep History to learn about the future 🙂 .

Practice

Now come the fun part and very important part, Practicing what you will do in real. So you have learned things and observed things, now is the time to practice. Before you try out anything in stock market with real money, just see if you able to make any money with practice or not.

I would recommend just have an excel sheet and put all the transactions there like

– Buy price

– Sell price

– Profit

– Profit percentage

– Time of holding the position

– Average Loss per trade

– Average Profit per trade

These are the statistics you should keep in mind and see how you are progressing each week, Don’t concentrate on each trade too much. It’s better to have a weekly target while you are practicing. I would recommend at least 2-3 months of practice.

This step is important because when you get into market to trade, its totally a different thing. Your reactions to markets movement will be too different than what you had thought. If you jump in markets without practice, you will do lots of mistakes.

Better practice before getting in real. Important thing here is that even with practice (without money). It wont help you a lot but will give you good idea of things. The fun part comes when you start with money then you truly get idea of your behavior 🙂 .

Anyways this is important.

Some people think practice is taking all the time and they are losing all the money, which they “could” have made. This is a wrong way of seeing things.

Though it looks like a opportunity lost, you are in learning mode and the best part is that you are not “losing” anything and getting ready for making money. There is a chapter on Practicing from a book “Enhancing Traders performance” on this post article by Brett Steenbarger, download it and read, its copyrighted material so i cant put it directly here.

Start Small

Now after you have learned things, Observed things and Practiced, here comes the last part, Starting Small, Start putting money in markets in small quantities, Grow gradually. View your self as a small baby who has just born, first start moving, then crawl, finally stand up one day and walk, once you can walk with speed then try Marathon. The same thing applies to Stock market.

But most of the new comers just want to win the marathon and start running fast without understanding that there body is not ready for marathons. they need to first know how to crawl and they want to win marathon.

You will fall a lot of times, you will have losses and will make money too. But if you don’t start small, one big loss will wipe you out of markets.

In the start it would be difficult for you to control your losses, you will need to have string of losses and the best way to tackle the situation is to start small and put little money in markets so that even a series of bad trades don’t hurt you much.

Many people may go slow and play small for learning and practicing part but when they start with real money, they start too big and that’s because of there over-confidence that are now ready to make money. First crawl baby, Marathon is long way to go. Make your legs healthy first, then dream of running.

Conclusion

Each and every newcomer in the market, should understand that Stock markets are places and from centuries people are trying to make money from it consistently but very few people are successful! This profession has very less success rate if your compare it with other professions like Medicine, Engineering, Computer Science etc.

There has to be some reason why you need to give time to it and learn things here. Take it as another professional course like any other and work hard on it. I think one should seriously give around 2 yrs for learning purpose.

See it as a career not just another place to get-quick-rich, that doesn’t happen in Stock Markets. Its a gradually getting rich place rather than get-quick-rich place. There is a famous quote in markets that “There are old traders and bold traders in stock markets, but not both”. that’s true!