Are you looking for Financial Planner? If you are, you should go through this article that talks about almost all the necessary information you need before hiring a financial planner. Most of the clients are confused on simple things like, where to find a good financial planner, what they should expect from financial planner and most importantly they do not understand the financial planning environment in India and how it operates. There are lots of myths and misunderstanding around the financial planning field and this article will give you most of the basic information you need to be aware of while hiring a Financial Planner.

What is a Financial Planner and what is the Certification for Financial Planning

A financial planner is a professional who helps his clients to deal with various personal finance issues through proper planning. Just like we have a doctor for our physical problems, we have Financial planners for our Financial problems. Just because you know “what is a Mutual fund” or some “Tax laws” or can buy and sell stocks on Stock market, it does not mean that you don’t need a Financial planner. Financial Planners are professionals who have done the certification, have learned strategies and have gone through in-depth knowledge to understand how to restructure a common man’s financial mess and come up with a sound long term plan which will help a client achieve his/her financial goals in future.

Just like CA, MBA, CS and other professional certifications, there exist a certification course for Financial Planning which is called CFP (Certified Financial Planner). Read more about CFP Here. CFP is regarded as the top most certification in Financial Planning and it is recognized worldwide in majority of the countries.

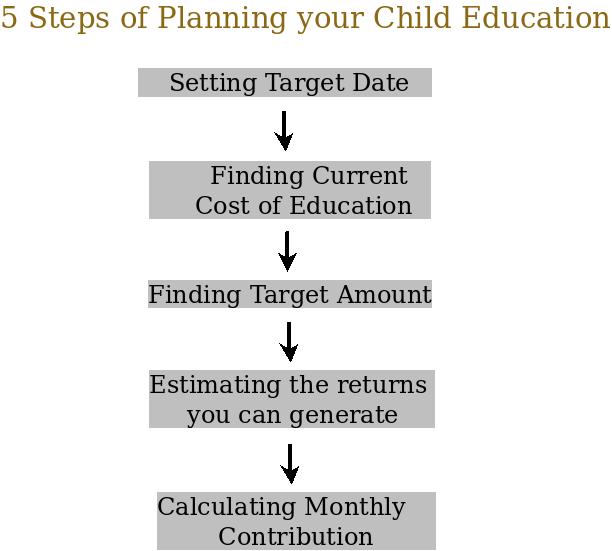

The 6 steps of Financial Planning which every Financial Planner has to go through are

- Step 1: Setting goals with the client

- Step 2: Gathering relevant information on the client

- Step 3: Analyzing the information

- Step 4: Constructing a financial plan

- Step 5: Implementing the strategies in the plan

- Step 6: Monitoring implementation and reviewing the plan

Who is not a Financial Planner:

A lot of CA’s, CS’s, MBA (finance), CFA, ICWA and other Finance related professionals feel that they are the right professionals to do Financial planning for individuals. Just because “Financial Planning” or “Personal Finance” has “finance” word associated with it; does not mean that any one from different finance field can be a Financial Planner. Financial Planning is very different from what CA, CFA or a MBA Finance does.

Financial planning deals with individual personal finance, his future financial goals, the risk taking appetite. Having CFA or MBA (finance) as qualification will definitely help at some level and may be some CA’s, CFA’s or MBA (Finance) have a great understanding of Financial Planning, but it’s not true for everyone in general. In the same way, any ULIP Agent, Insurance Adviser or Mutual funds agent, Wealth Manager, PMS guy is not a Financial Planner. These people are there to assist a Financial Planner to sell the products. In the analogy of Medicine field, Financial Planner is a Doctor and all these agents, Wealth managers etc. are like Compounders.

[ad#big-banner]

Where to find a Financial Planner (Important)

There are two ways of hiring a Financial Planner for your self:

1. Hiring a CFP

In case you want to hire a CFP (which is recommended) you can get a list of CFP’s in India at FPSB website link, Click here. You can find out CFP based on

- Name/Company

- City/State

- Nature of Employment

Tip: You should search for CFP’s who are “Independent Financial Planners” or “Self Employed”. Read further to understand the reason.

[ad#link_unit]

2. Hiring a non-CFP

You can also Hire a non-CFP but you have to be very careful while doing that. Before CFP certification came to India, we had excellent planners in the Industry who understood the financial planning process subconsciously and still practice that but without having the CFP certification. These people can be from various backgrounds but can have sound financial planning knowledge. They are rare species. Some of them who I can think of are people like P V Subramanyam.

The biggest problem one faces in hiring a Financial planner is the “Trust”. So you need to have some level of trust with Financial planner and for that you need to interact with him, spend time with him, get references from family and friends and once you are satisfied you can then hire him/her. A financial planner at the end is someone who is also interested in educating you and not just making money from you. Just imagine a doctor who gives you medicine, but does not tell you the preventive measures to take, so that you are not ill next time. Would you like to visit him again and again? He should be interested in educating you up to a level where you can take informed decisions yourself. Only then you can call him a good doctor, the same applies to a financial planner.

Current Status of Financial Planning Practice in India

There are two ways a Financial Planner makes money

- By pure consulting and advising (by making the financial plan)

- Through Commissions (from products sold to clients)

- Combination of 1 and 2

In India people dont value consulting and hence Financial planners are having a hard time getting clients whom they can charge on pure consulting basis. Therefore what has happened is most of them make money through commissions from selling the products. Based on this fact most of the agents, wealth managers etc have completed CFP certification just because they can get the tag of “Financial planner” and then make a financial plan and finally sell products to them and make good commissions, hence at present the current status is that 8 out of 10 CFP’s in India are associated with some mutual funds or Insurance company as either of

- Analyst

- Asset manager

- Branch manager

- Accountant

- Vice president

- Adviser

- Senior manager

- Wealth manager

They are still doing the same old work with a new certification in hand called “CFP” because they know that in coming days CFP’s is what everyone will prefer to hire for their Financial planning and similar services. These so called just for name sake CFP’s make the financial plan and when you buy the products, they will make majority of their money through commissions.

So what you have to look for while hiring a financial planner is that He/She should be independent Financial planner and should not be associated with some Mutual funds or Insurance company and has no compulsion of executing the plan through him. There should be freedom in Clients hand that he/she can execute the plan from anywhere he/she wants. As an additional service Financial planner can give an option to have financial plan executed through them, but it should never be compulsory because otherwise there will always be some level of biased attitude while recommending products to you.

The biggest problem with Financial Planning is that still “Financial Planning” is confused with “Investment Planning”. The moment I tell someone I am a Financial Planning writer, they start asking me stupid questions like

- What do you think Market will do tomorrow?

- Which is the best mutual fund?

- I have 5 lacs spare cash, how should I invest it so that I get maximum returns?

No one talks anything other than investment. Financial Planning is more than just investment planning, it’s much more than that. Read more to understand what is the goal of Financial planning.

Why to Hire an Independent Financial Planner

Do you know how a Financial Plan is made? No you don’t! Here are the problems with the Financial Plans:

1 No Personal Touch

What most of the Financial planning company or professionals do is that they have automated Financial Planning software in which they just stuff your data and create a Financial Plan automatically with a single click. This can take just minutes. While there is nothing wrong in creating the basic template of Financial Plan with help of a software but what really matters is how much of that is customized to a client’s needs personally? So a financial planner should give enough time to tweak the financial plan to suit a clients need, which is more though for Financial planners working for big organisations especially mutual funds and Insurance companies because they have to stick too much to the template they use and not to much of customization is done or recommended.

An Independent Financial Planner has more liberty and flexibility to make a financial plan which will be more suitable for you. So if he wants to add some extra part to financial plan or want to restructure something totally, it’s possible with independent financial planner but it’s rigid with non-independent financial planners.

2. Lack of quality

Everyone like beautiful pictures, we are attracted to beautiful people no matter what crap they are from inside. Some of the best looking things in the world are totally shit. Same is true for Financial Plans, that most of the financial plans I have seen has beautiful pictures, amazing color schemes, beautifully designed tables and great back ground but when it comes to content and the quality of Financial plan they suck big time! There is nothing great about them. But clients like them because we are visual animals and we assume a clean and beautiful thing literally at face value. I do not say that all clean and beautiful financial plans are crap but most of them really are. A simple analogy is a dish you get at 5 star hotels and some authentic but not so well known eating place, the food you get at 5 star hotel will look great and there will be too much time spent on making it beautiful but at the end it can taste very average or some time even foul, but the food you get at home or some less known place may taste better and may be more healthier but then it might just look okay and not “beautiful”.

A financial planner who is independent and takes limited clients does not have time and energy to work on beautification of financial plan, he mainly works on making financial plan better and not the looks of financial plan. So if you watch a financial plan from an Independent financial planner, it might not look as beautiful as from other planners.

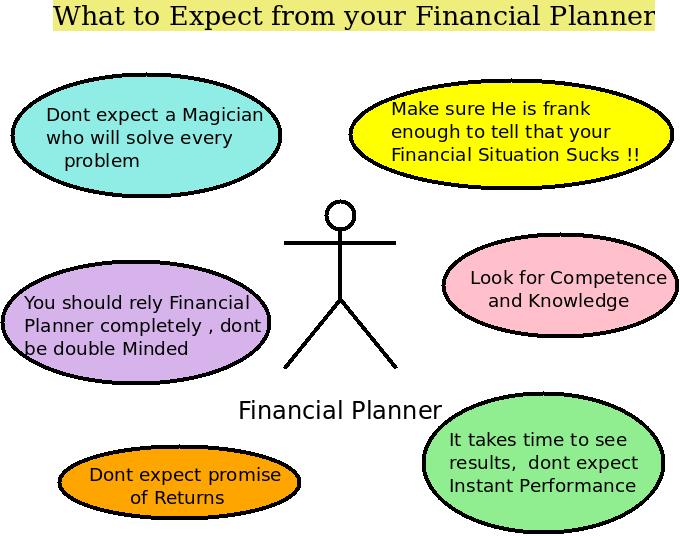

What to Look into a Financial Planner

You should watch out for following things in Preference

- Competence or Knowledge

- Confidence

- Your level of Trust and comfort with Financial Planner

- Frankness

What to not look into a Financial Planner

- Promise of Returns

- Magic (financial planner is not some magician who will fix all your problems and will make a financial plan which will try to achieve all you want)

- Instant Performance

How much to Pay to a Financial Planner

This is a debatable topic, still let’s try to understand and find out how much do Financial Planners deserve.

Financial Planners in US and Australia gets as much as $150 to $200 per hour. (that’s close to 7.5k – 10k per hour). Financial Planners in India cannot and should not ask for that kind of money for two reasons:

- They will not get it 🙂

- FP is new in India and there is still not standard procedure or standards to create a financial plan. So what they can expect is not more than $30-$40 max per hour.

Now in India people will literally laugh if a Financial planner asks money in per hour basis, it’s just not what Indians can imagine. Imagine doctors asking per hour fees here or lawyers or anyone. We Indians like to pay one time fees or lump sum fees, that’s the model India runs on. A good financial plan takes around at least 10-12 working hours (strongly focused and distributed across several days). From that stand point a price in range of 10k – 25k looks reasonable for a Financial plan. Anyone who is charging less than Rs 10,000 is undervaluing it and working more for less money. Other point is, you have to understand that all financial planners differ from each other and the amount of detail and care they take while creating it.

Comments, Please share your views on what are the other issues you guys face/ will face while choosing a financial planner. In case you know of a good Financial Planner, feel free to share here.

Check my latest trip Pictures at Netrani Islands . I did Scubadiving , snorkeling and Tent Camping .