Can you name a billionaire who didn’t start a company?

Or a $ millionaire for that case?

In this article, we are going to talk about various ways people become RICH. No, it’s not a tutorial on how to become rich, but just a conversation on are various ways using which people have become rich. Maybe you will get some idea of which path you want to take or try for yourself.

#1 – Starting a successful business

One of the ways, most people become rich is owning a successful business. Yes, think of any rich person and chances are that they own a business. It can be a tech company, a big store or some kind of traditional business, but it’s BUSINESS.

A job gives you linear income and growth. The business gives you exponential growth and income over time, along with the huge risk of losing the money. That’s the primary reason why most of the people are into jobs and not business.

My point is simple. If your goal is to be in the middle class or higher middle class, you can continue doing your job. However if your dream is to own that exotic villa, or to drive the most amazing cars and never worry about money all your life, you need to own a business, otherwise, it’s going to be really tough to get rich (apart from other 9 points)

You might want to read this article called Indian Entrepreneurs Success Stories – Who Started With Nothing to some inspiration.

#2 – Let someone else run business and get a share

A lot of people have become extremely wealthy by investing money in other business and just holding the shares for long. No, this is not stock investing.

I am talking about funding others’ businesses and keeping a share of ownership to cash on in the future. This is definitely not very common or an easy thing to do. The failure rate is very high, but many people have become very rich through this method.

Paytm Founder sold 40% equity for 8 lacs many years back

For example, you have heard about PAYTM. Right?

You know it’s now a multibillion company and its owner is already a billionaire. But did you know that years ago, there was a guy who helped paytm founder with Rs 8 lacs and in exchange took 40% of the company and exited the company with a couple of 100 crores?

Watch the interview with Paytm founder Vijay Shekar Sharma, where he shares about his journey and this incident (Just click the video and watch the next 1 min)

It’s not always the case that you have to start the business, the main point is to be part of a business and contribute in the journey of the business since the start when it was not successful.

Most of the people who joined large companies as employees got equity in the company (ESOP’s and stocks) and years later when the company becomes big, they all became rich.

Take Infosys for example, It was a business owned by a few people, but those who stayed with Infosys and contributed for its growth over years were rewarded and now they are quite RICH.

At Infosys, drivers, electricians are millionaires

The Infosys management has over the years rewarded selected staff belonging to the C, D and E grades with shares for faithful service and excellence in work. By the time Infy began skyrocketing in value, 67 of these people including eight drivers, owned enough stock to make them very rich men indeed. Kannan’s portfolio of 2,000 shares when multiplied by the latest share value makes for a huge value statement

#3 – By Inheritance

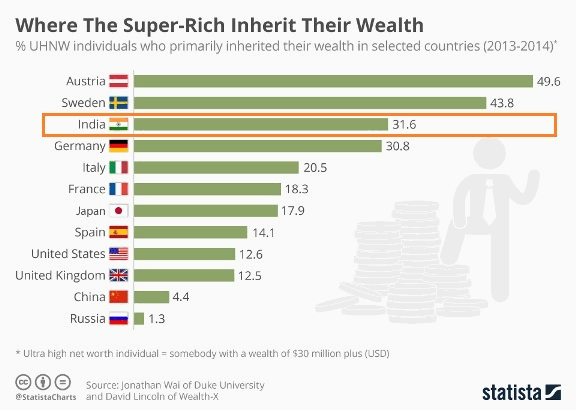

Another way a lot of people become rich is when they inherit a lot of money from their parents or some relative. As per this report, around 31% of ultra-rich people in India have inherited their wealth, which is quite a good number. Every 1 out of 3 people in an ultra-rich category is rich through inheritance.

However, this option is not applicable to most people like us.

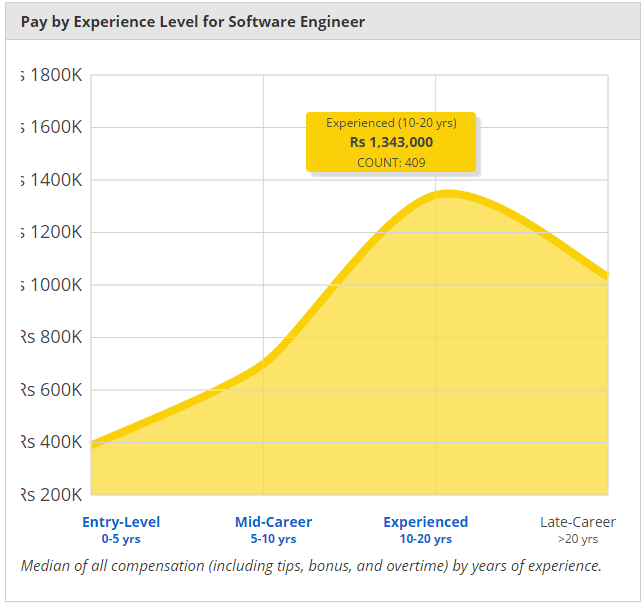

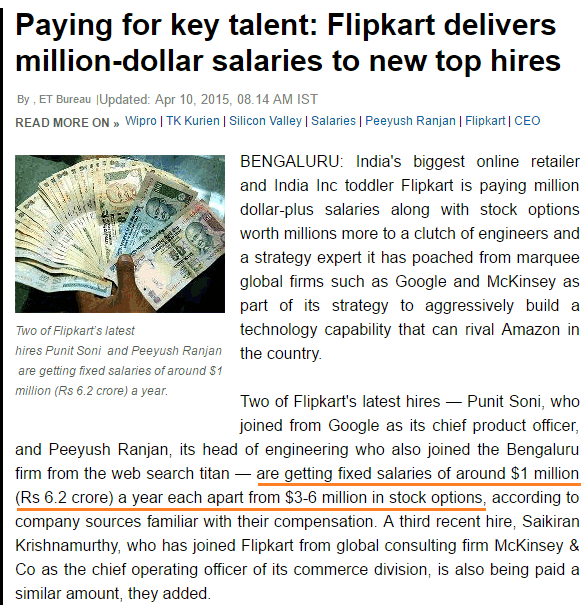

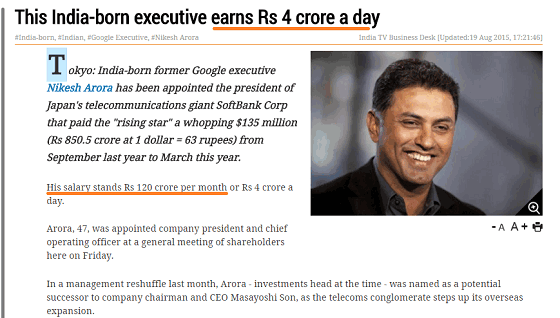

#4 – Become a highly paid top executive

If you are very clear that you do want to own a business and will keep continuing doing the job, then your salary is the most important factor which can make you rich. No, we are not talking about packaged of Rs 10 lacs or 20 lacs here.

We are talking about packages which some top executives earn at important positions in the company. They are people like

- CEO

- Managing Directors

- Vice Presidents

- Top Managerial Positions

- Top-Level Professionals (Doctors, Lawyers)

It comes only when you are really out of the class in what you do. If you have skills to manage the company or help a company excel at something, you can reach these top positions, but it takes quite an amount of hard work, smart moves and a bit of luck too. Many professionals earn very high salaries like examples below.

Here is another example of a high salary –

It’s not always the case that you own a business to earn high income. To run a company or business many skills are required and if you have that in you, you can help someone else to build and manage the company in exchange for your skills.

As per this report, around 42,800 have reported an income of Rs 1 crore per annum in India. You now have to set yourself to be in that club

#5 – Speculation or Gambling

This is not a recommendation, but a lot of people become rich by speculation or gambling. This has more to do with Luck and smart thinking at times, but not with hard work.

I do not want to label speculation as BAD, because speculation takes guts and courage and those who take that route also get lucky at times and make a lot of money. There are two kinds of speculation

- Blind Speculation – A speculation where you are just shooting in the dark. Things like buying lottery, horse race etc is pure speculation and unless you get lucky, you will lose your time and money. A lot of people are into these speculative and gambling activities

- Calculation Speculation – Then there are many situations where you have to take a very calculated risk, where the risk is still high, but then the return potential is huge and clear at times. These are high risk, high return situations where if you take a chance, you can get really lucky.

One can get lucky, only when you take a risk and speculate. Speculation is seen as a bad word, but one can’t deny that it also has a brighter side to it. If you want to innovate something, you need to speculate on the fact that it will become successful.

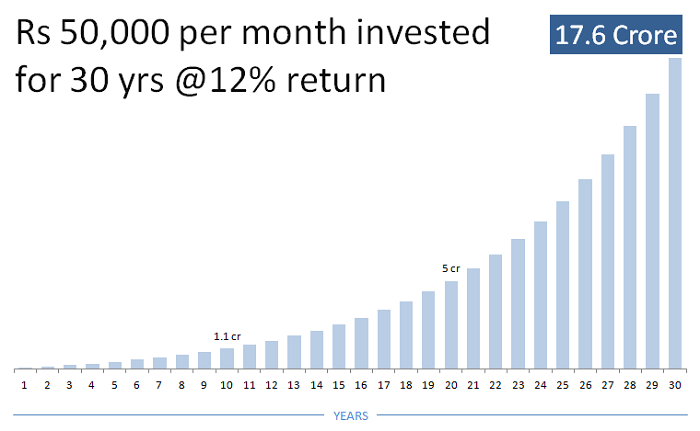

#6 – By Investing money regularly – the boring & long route

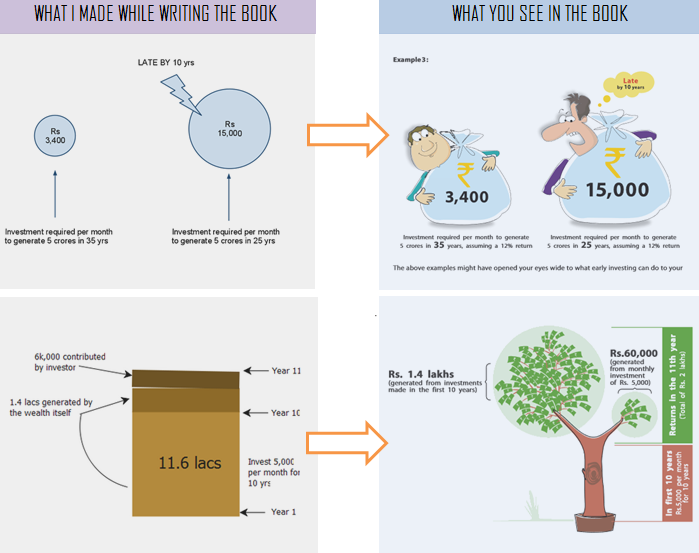

In the end, if you feel you are not made for the above 5 points, then the only way to get rich is to invest your surplus money on regular basis and that too in high return instruments like equity mutual funds or stocks and wait for a long time to become rich.

The big problem is that there is too much-delayed gratification here. If you start your investments today, you can’t expect to get rich in just a few years which is possible in other ways mentioned above.

You need to have time on your side and extreme discipline. On top of that, you need to invest a good amount of money. You can’t expect to become rich by doing just Rs 4,000 SIP in an equity fund. You need to invest a good amount like Rs 20,000 or Rs 50,000 per month (at times Rs 1 lacs per month too) to accumulate a good amount of wealth.

So, the only option left for most of people to become rich (that too in future) is only by investing their money and that will happen only if you earn a good income because only then you will be able to invest a good chunk left out of it.

Let us know what do you think about the points mentioned above?