Do you want your children to be smart when it comes to Finance? Don’t you want them to learn all the things, which you’re learning today, from this blog & other resources? And that they don’t repeat the mistakes, we made in our lives?

Financial Education for Children is as important as their regular education. Sadly, we do not have in our school curriculum. However, you can start teaching your children, the basics of money, so that they become, more aware, more responsible and think in a better way about finance.

It’ll not just help your children, but even you as a parent in many ways. Here, I present 9 things to teach your children.

How to save money

Most kids today are indulged, like never before. All they do, is spend. The money mostly comes from one of the parents. The kid asks you for a 100 bucks to buy the latest thingamajig, you question them why, they answer you, and you give them the money.

This generally, makes them believe that once they give you a “good enough” reason, the money’s in the bank (or their grubby li’l hands) 🙂 . You need to make sure, that kids understand how you save money. This will happen only, when they themselves, understand how to save money.

Hence, encourage savings.

Let them save some money for their little goals (even big ones’). If your kid wants to buy something, which you think can wait, encourage them to save towards its purchase. Whenever you give them some money for anything, ask them to save 25% of it for that goal.

Apart from this, you can give them some small amount weekly to save for that goal directly. Please buy a piggy bank for your children. You can buy a fancy one or the clay one we had in our days 🙂 It works!

How to keep track of money

You should teach your kids where the money at home comes from, where it goes and how much is saved. I’d ask them to maintain a simple table where they can write how much money they received, & when, from whom, & where it was spent.

These 4–5 things are good enough for a small child to start with. If you have a computer at home, you can make an excel sheet and ask your kid to maintain the account, while making sure, that things are very simple for the kid to understand. Don’t over do it 🙂

Once they start doing this exercise, they’ll gain an awareness of where they spend their money & to what extent. You can sit with them each quarter, and review the sheet. Don’t try to point what’s right or wrong. Just gently point out facts; that’s all.

How to pay what its worth for something

Have you ever faced a situation when your kid bought something and they were cheated & charged exorbitantly? Or demanded something from you, but they thought that it’s wasn’t that expensive? Kids don’t always realize, just how much something costs. They just want it.

The best way to deal with this situation, would be to ask them upfront, what they think, is the price of something. If they demand a video game from you, they might not know how much it costs. So ask them, what they think is the price, & what is the maximum they’d like to pay for it.

Many times, you will find that the price is much more than they themselves think. In which case, they might want to reconsider buying it.

My experience:

I remember, when I was young, my brother & I demanded a video game from my dad. He fobbed us off a couple of times, but later he asked us, “Pata bhi hai kitne ka aata hai?” (“Do you know how much it costs”) . We were puzzled, as we really didn’t know the cost.

We assumed it’d cost us something like a 1000 bucks, but we later found, that it actually sold for more than 3,000 at that time. Once we knew the price and compared it to the value it delivered, it didn’t make sense to buy the game. We had much better, healthier entertainment options.

And guess what? Dad bought us the game, next year! 😛

How to spend money wisely

Ask them their priorities, what they need this year, what their wishes are, and help them sort out their desires and their requirements. Ask them, what is more important? What’s secondary? This way, you encourage them to think in the right direction.

You are giving them an opportunity to understand difference between needs and wants. This might not be true for small kids below 10, but will be more relevant for children in between the ages of 10 & 18. Kids often times speak or figure out amazing things, which we adults don’t think about. Do this exercise and you might find, that your kid has real smarts!

Please share examples from real life if any 🙂 .

How to think about money

You should make sure that your child’s attitude towards money is shipshape; that they respect money, understand that it takes an effort to earn, and also understand the fact that, while money is important, it’s only secondary, as far as happiness & a content life are concerned.

Talk about money in front of them in a way, which gives them an appropriate view. Make sure, you don’t give them an impression that the family’s happiness isn’t as important as your job or business. Read Personal Finance Mistakes

How to live on a budget

If you give your children pocket-money, make sure they live on it, the entire month and they do not come to you smack bang in the middle of month, asking for more, for things they could have managed with the same pocket-money.

This happens only when children deviate from their monthly needs and carelessly spend on what they don’t need. While, they may ask for more, because of some emergency need sometimes, over a long-term, you should make sure they stretch with that pocket-money.

Children will understand budgeting better, if you yourself practice it (ouch!). When they see how you allocate expenses each month, and stick to it, chances are, they will replicate it at their level. While, this whole thing can be tough initially, help them out, by giving them the extra money they need in first 2-3 months and then restricting gradually.

Watch this video to know how to raise a smart child about money:

How to invest

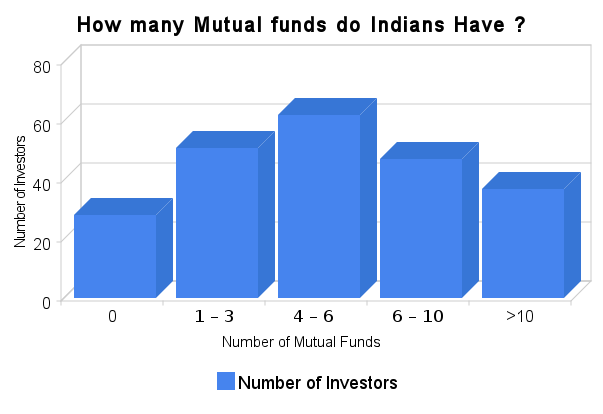

Start teaching your child, the different ways of investing. Teach them basic banking, how banks operate and what it means to earn interest on an amount. You can also buy them some games which teach investing. Ask them to deposit some amount with you and you can pay them interest per month.

When you give them pocket-money, say Rs.500 per month, ask them to deposit back Rs.250 with you, with the assurance that next month you will pay them 10% interest on that amount, i.e : Rs.275. Though you might be out-of-pocket by Rs 25, the knowledge you impart to them is priceless !

This Rs.25 gives them the important message, that saving their money and investing regularly can increase their money many times over.

When they start earning later in life, this gyan will be something, they respect you for! Also, don’t forget to open a bank account for your child as soon as they turn 12-13 yrs.

How to exercise the entrepreneurial spirit

Don’t tell me you want your children to do regular 9-5 jobs! Don’t you want to instill some entrepreneurial skills in your children right from start, so that they know what they want to do in life and take an initiative to work along those lines?

The first step:

First step is to talk about different ideas your children have. When they are small, they can have weird ideas, but listen to them, & ask them how they can make money from some idea. Ask them questions like “Can you think of some idea, using which, you can make money?”

My own brother who is 13 yrs old makes weird stuff out of junk which can act like a toy gun! He once said, that if he can make 10 of those and sell at Rs 20 each, there will be many friends of his who will be ready to buy it. Though he didn’t do it, he surely has the right attitude.

You can encourage your child to do some random / different / creative stuff for a few hours every day (during vacations at least) and pay them extra money for it. This will help them earn some money and also help you do some work for which you wanted to pay someone!

If you have a garden, you can ask your child and his friends to do some random things for which you wanted to hire a guy anyway. This has some advantages; First – your children will understand, it’s not that easy to earn money and they have to work for it.

The second step:

Here, you will help your kids to spend some time constructively, which they would have spent playing or roaming around or playing video games. And finally, your money stays at home 🙂

Thinking a bit bigger, maybe you can really involve your child and his friends and work on some month-long project… one, that has a whole business plan, revenue model and which then earns money for 1 month (may be this can be done in summer holidays). Wow… this seems exciting, talk to your child about this today and see the response.

Ideas? Anyone?

How to handle credit

You should also start teaching your child, to handle credit.

If you pay them Rs 500 pocket-money and in the same month they demand Rs 200 extra, you can give them that money, but now introduce them a concept of “credit”. Tell them that it’s not going to be free and you are cutting Rs 50 for next 4 months from their pocket-money and paying them just Rs 450.

If you want to add some horror and suspense, make it 5 months (charge interest). This will make sure they ask for extra, only if they need to. Stick to this with discipline, and don’t fall for emotional atyachaar from your children,(they are really good at it, especially girls!)

The previous point’s example can also be used here. If you are making some small project for them from which they can earn money, loan them some seed money like Rs 1000-2000 (as a venture capitalist) and then demand the money back after 1 month with interest. (I come up with crazy thoughts at times 🙂 )

Conclusion

Teach your children basics of money from the very start. These tips will act as a foundation for your child’s financial education and they can build upon these learnings in the future. Most of these tips are for children, but can be used for your spouse, who may not be that good at personal finance. What say?

Comments, Can you also share your tips ? Do you think these tips will be helpful to your children? If no, then what are the obstacles?

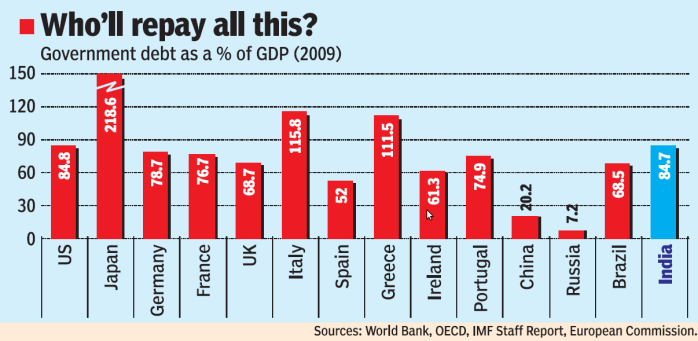

Source : DNA

Source : DNA