What are pension plans and how do you identify the best pension plan in India? Is it the LIC pension plans or some pension plan policies from pvt companies or some unit linked plan from companies claiming to provide you with Rs. ‘X’ for ‘Y’ numbers of years once you retires? In this article we will see some of the disadvantages of pension plans in India and how they work.

A lot of investors think that retirement pension plans are the only way to go; and if they do not invest in these products today, then they will miss out on something. In this article let’s talk about pension products. Before I move ahead I would like to coin two terms used in Financial planning which are very easy to understand.

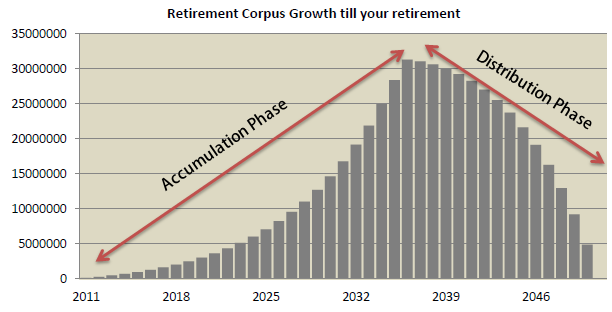

Accumulation Phase : Accumulation Phase is that period of your life, where you invest regularly each month and “accumulate” the Wealth. You start getting pension later in life. So when you invest your money in ULIP’s, Mutual funds, Direct Stocks or anything else you are into accumulation phase.

Distribution Phase : This phase refers to period when you start withdrawing money from your already accumulated wealth for consumption purpose. So at the time of your retirement or even before that, when you start taking out certain amount per month for next ‘N’ years, that’s called distribution phase.

Two major categories of Pension Plans

Let me start by taking about pension plans and their types. There are mainly two type of pension plans at broad level.

Deffered Annuity Plans : Most of the pension products in india are sold by LIC and all the private companies are deferred pension plans. These plans have accumulation phase inbuilt in itself and hence you first pay premiums for ‘X’ number of years. Once you retire, then you start getting pension income. You can see these types of plans all over the market. Some examples are LIC Jeevan Tarang, LIC Jeevan Nidhi, Bajaj Allianz Swarna Raksha ROC , New Pension Scheme (NPS)

Immediate Annuity Plans : These products are called immediate annuity plans because they start paying you the annuity right from day one once you make a lumpsum payment. So if a person wants a monthly pension and has huge lumpsum money, he can buy an immediate annuity plan and start getting pension. It’s a simple product which is not so much popular in India like deferred annuity plans. Some of the examples of immediate annuity plans are LIC Jeevan Akshay , ICICI Pru Immediate Annuity , HDFC Immediate Annuity .

4 reasons why you should not buy deffered annuity plans

Let me tell you 4 strong reasons why you should avoid buying pension plans in India .

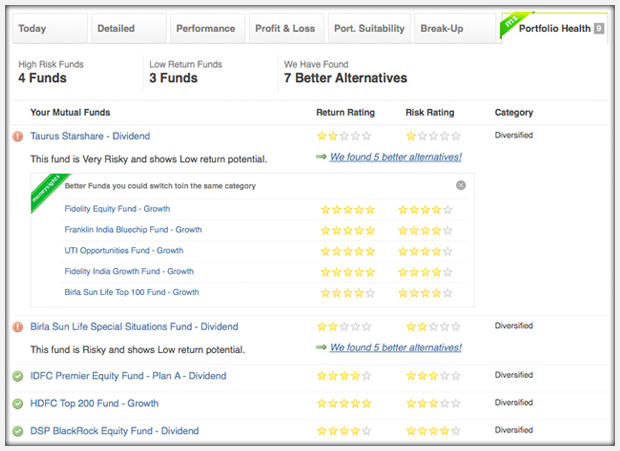

1. There are better options for growth of your wealth

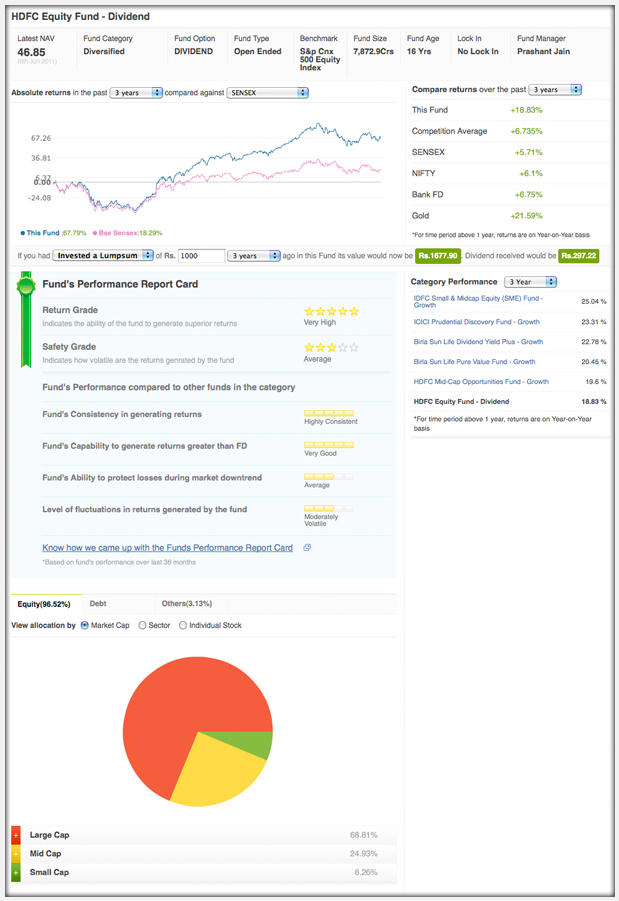

The accumulation of your wealth happens in a pension plan for many years, but it’s not the best way your money can grow, ultimately if you had to invest your money in equity (underlying asset class), you have simple and no-cost options like mutual funds, index funds. Also you can choose to put money in real estate. A regular SIP in an equity diversified mutual funds should give much better returns then accumulation in a pension plan (read unit linked products).

2. No predictable returns for annuity

The core function of a pension plan is to give you pension. But do you know how much returns you will get out of your pension plans when time comes for retirement? A lot of pension products do not give a clear idea on how much will you get at the end. What is the return earned is around mere 4%? What will you do? The same is true for NPS.

One major (I mean MAJOR) DRAWBACK is you have no clue what will happen once you finish the accumulation stage and go on to the withdrawal stage. Let us say you have accumulated Rs. 500 lakhs in a NPS account. They allow you to withdraw say 50% of the amount and the balance has to be invested BACK in an annuity. Let us say you ARE FORCED to invest Rs. 250 lakhs in an annuity which pays Rs. 11,000 per month as a pension…looks good? Well depends on what you are capable of doing with your own money!

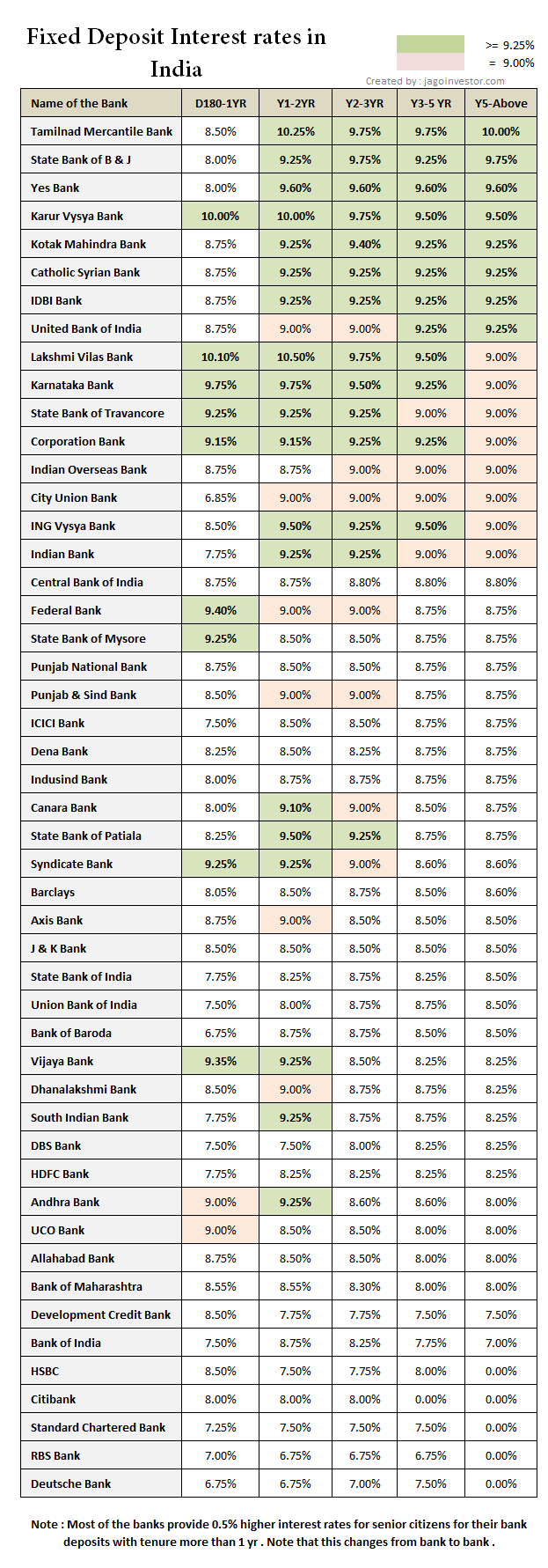

At this point of time, the better alternatives would be old fashioned products like Post office monthly schemes , Fixed deposits with monthly payouts or even senior citizen savings scheme. these all give near inflation returns atleast .

3. Rigidness and no flexibiity

Almost all the pension products are rigid in taxation and what you can do with your money at the end. Under current laws you can withdraw only 1/3rd of your accumulated money tax-free, where as there is long term capital gains at the moment is 100% tax-free. Also it’s compulsory to buy annuity for the remaining money. What if I want all my money for some reason at the end? What if I don’t have a requirement for income later?

These problems won’t be there if you accumulate your money in plain vanilla mutual funds or PPF or other simple investment products.

4. High charges

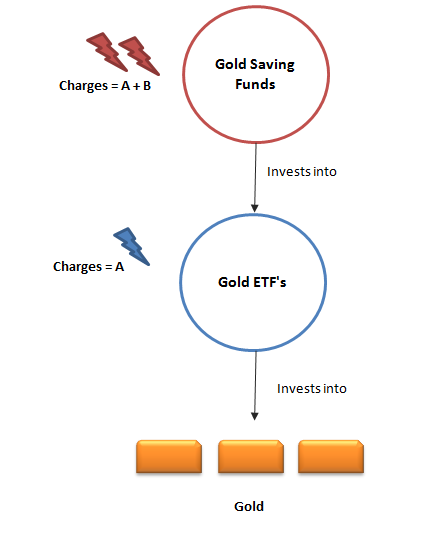

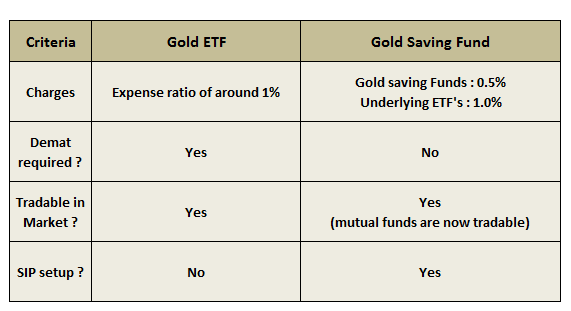

Who does not know how ULIP’s and other similar products have charged so high costs for initial years without giving clarity to customers. These annuity plans also have high allocation charges many times and customers do not know about it and can’t do much later when he acknowledges it! So why do you want to pay high fees for these products?

Conclusion

It’s suggested that you invest in some instrument which does not have any rigidness on what can be done with your investments at some later stage, like Mutual funds, Direct Equity, PPF, Index Funds, Real estate or even old fashioned products like FD, NSC, KVP… You can create your own accumulation stage and when the time comes for “distribution phase” (pension), you can always buy some immediate annuity plans or create your monthly income through ways of renting out property, getting FD interest or plain dividends from stocks or any combination of these. I hope you have got a fair understanding of what are pension plans in India.