We all know that Sushil kumar has won 5 crores from KBC few days back (actually 3.5 crores after tax) and now he is already being approached by wealth managers, relationships managers to advise him on how to “invest his money”. So I want to just discuss my thoughts with you all on how Sushil kumar should put his money at work ? Does he really need a Financial Plan ? Does he really need an advisor ?

Let us see what he can do with his money and how I think he should utilize his 3.5 crores. Given his background and education level and assuming that he listens to me, here is what I would suggest Sushil Kumar. Divide your money in 4 buckets A (1 crore) , B (1 crore) , C (1 crore) and D (50 lacs)

Bucket A (Security of future)

The first thing which I would tell Sushil Kumar is that he should just keep things simple and simply keep that 1 crore in a Fixed Deposit and let it accumulate there without any complication. This part of his wealth should be there incase THINGS GO HORRIBLY WRONG ever , he can just leave this part as it is for growth, even if its going to increase at a slower pace compared to equity or anything else.

Bucket B (Regular Income and Security of Capital)

I would suggest him to use the next bucket to generate a regular income along with his capital being secure, again there can be many ways of doing this , but considering his background and assuming that he might not be too sure about financial matters , again I would recommend him to put his next 1 crore into a fixed deposit with a monthly or a quarterly payout of interest . This will make sure that his initial capital of 1 crore is secure and he will start getting an income of Rs 65,000 – 70,000 per month (before tax) .

This income of 65,000 – 70,000 will be more than enough for him to live his regular life, thanks to him not very much addicted to junk foods , extravagance and other useless spendings which our generations have. He will surely be left with a lot of money each month or quarter and thats where he can put some money in equity on regular basis . No stocks , no mutual funds , just plain index funds, so that he does not have to bother about funds not performing every year and does not require a short-term review.

Bucket C (Assets creation , Education , Business)

Once his worst case is covered (bucket A) , his regular income is taken care , now he can use the next 1 crore for building a new house for himself and his family , he can also use some part of his money to fund his education and some part he can use to start a new business which can again open a new stream of income for him) . This purpose of this 1 crore is to take care of all the things which he wanted to do in his life. This part is not to save , but to utilize for his aspirations and his dreams.

Bucket D (Enjoying his Life)

I think he should use the last 50 lacs to just blow off and enjoy his life on regular basis which a lot of people just dream of . He should take a vacation abroad first using 10-12 lacs and then rest of the money he can use to go for a regular vacation each 6 month , with 35 lacs he can get a 2.8 lacs a year as interest income which would be enough for him to take 2 vacations a year with whole family 🙂 . The focus of this 50 lacs can be purely for enjoyment purpose because his other area’s in financial life are complete.

Other Suggestions

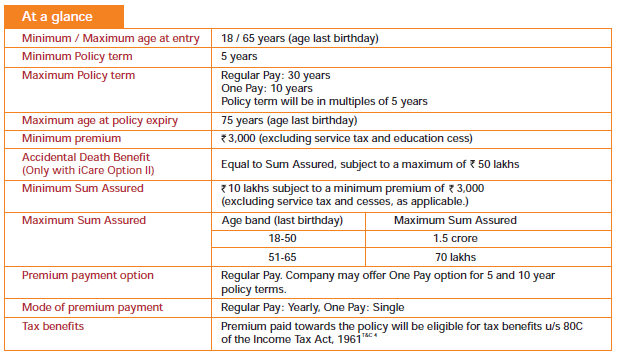

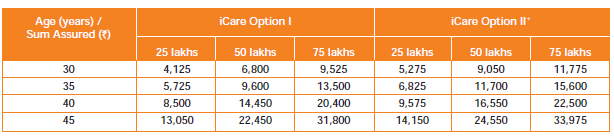

- Life Insurance is not required for Sushil Kumar because there is no requirement of Life Insurance, There is enough wealth with him and his family incase he is not around.

- Health Insurance would be something nice to have as it would come at a small cost compared to what he has in life, this would make sure that someday if something goes wrong , his wealth is protected against the unexpected expenses.

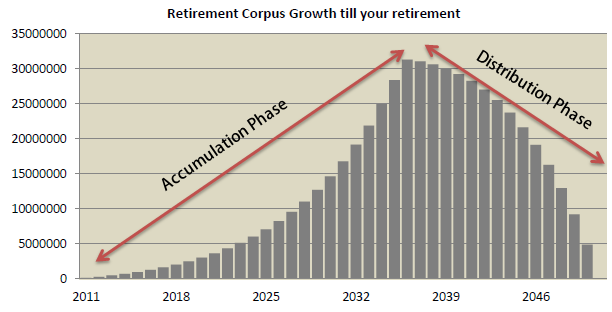

- He should stay away from any relationship manager , Agents or even Financial Planners as there is more for “Allocation” and less to “Plan” . He has already passed the Accumulation phase and only if he takes care of his existing wealth now, he should do good.

- Because of his less knowledge (assumption) about overall personal finance, he should keep things simple and be with simple products like Fixed Deposits which he understands properly.

Sushil kumar real enemy might not be inflation or ignorance about money, but his own relatives and Bihar goons ! . So what do you think about these suggestions to Sushil Kumar ,? Do you agree with it ? How would you allocate his 3.5 crores if you had to do it ?