Today you are going to read “money story” of Priyanka Jadhao from Pune. She is 26 yrs of age and just started her career few months back.

She will be discussing about her life journey till date from the money perspective. I mean she will talk about her view about money, the incidents from her life which shaped her mindset about money. What she feels about money and how some incidents made her realise if money is important or not.

The special thing about her is that she is from Jagoinvestor Team 🙂

Few days back, when we were discussing on what kind of new writing we can do, we relised that we should start a series called “My money story” where a person jots down their journey of life from financial perspective and they felt about money all these years.

So I asked Priyanka to write her own money story. I think she has done an excellent job. This is the first post in the series we are going to call “My Money Story” where anyone can contribute with their stories.

Over to Priyanka from here.. I hope you will enjoy her money story.

Written by : Priyanka Jadhao, 26 yrs, Pune

My Story

I belong to a small town in Maharashtra, where most of the people are either government employees like teacher and regional officers or farmers. Other major businesses are very rare there, because most of the people have fear of taking risk, while others want to go on with the traditional ways of earning. In short, they want to play very safe game in life.

I was my parent’s first child, so it is obvious that everyone in my family had showered all their love on me. My family was not too rich, but it was financially stable enough, so I never faced any major hardships because of lack of money.

We should put limit on our needs

From my childhood, my parents taught me to put a limit on our needs, so that we can save for future. Everytime we needed something, the first thing we heard was to limit it or rethink about it before spending money on that.

This was the way of life and this had deep impact on my thinking. I slowly started beleiving that this is the absolute truth of life and it just got ingrained in my belief. Hence from childhood, I also started avoiding any extra spending, and always lived in limits.

Fortunately, I was never a spoiled child due to this mindset.

I can remember clearly, when I was a child, whatever things I needed like books or other study materials, my parents never gave me money directly in my hand. I had to ask for it and then only they used to buy those things for me.

People around me

I have seen people from my childhood considering money as a matter of pride, because of which they keep on collecting it and putting in their bank, rather than spend it on things. The focus was on just increasing wealth in numbers and not to make use of it for their happiness.

I grew up in an atmosphere, where earning money and saving it for future was the only motive. I have seen people who earned a lot, but never spent it to complete their dreams or for their hobbies because this was considered as a stupidity.

It was the way of life for them and they all thought that this is the “Right” way to live a life. They were satisfied and had no regrets about this. But that was because they had mastered the art of “controlling the need” and live with the most basic things.

My childhood experience with money

I was a shy child then, I never asked my parents more than what I actually needed. But when I used to see my friends buying dolls or fancy frocks, I always started thinking that ‘when I will grow up, I will earn lots of money and buy so many dolls and new dresses just like that friend of mine have’.

One incident I can still remember, I was in 5th std, one of my friend had a very beautiful lead pencil (lead pencils were very rare in those days, we were “Natraj Pencil” kids 🙂 ) having a beautiful less tied with eraser and two small Ghungroo’s on its cap. I wanted it so badly, but I didn’t have the courage of asking it to my parents.

Then I realized, that my birthday was coming in 2 months and my parents will definitely buy a new dress for me. So I waited for 2 months. And when my birthday came, I asked my parents to buy me that lead pencil instead of a dress. I can still remember its price, it was Rs.12.

Parents perspective about money

Both my parents are teacher. They earned a lot and invested it for only two goals, one is my brother and second one is me. I had never seen them spending money to complete their dreams or hobbies or even their basic wishes which were within their reach.

Whenever I asked them why do they work this much hard and can’t even take some time for themselves, the only answer I got was “Because we need to earn and save money, for both of your bright future”.

One more experience I would like to share. From my childhood I was fond of traveling. But as I told you earlier both of my parents were employed, we never had a family trip till date. My father had his own passion of farming.

Every day after job he used to go our farm (even today) and returned home late night. Whenever I asked him to plan a family trip, he always had his own reasons. He never said – “NO”, but he just always used to postpone it for next vacation.

When I was in school, one day I stared asking my father to plan a trip now. I was literally annoying him. So finally he said Yes, but I knew my father very well.

So, I took a page from my notebook make it look like an agreement paper by sticking a Rs.10 note on it (because I had seen picture of Rupee on some agreement papers before) and I wrote down on that paper – “We are going on a trip this time, papa already has approved it and so papa will now sign this paper” and then I actually took my father’s signature on it.

This time I was sure that the trip is going to happen as there was a written “agreement”.

But, that trip didnt happen till date.

This may look like a very small funny incident to you, but I was kind of shaken because of this. Even after an “agreement” was there, the event didnt happen. The focus was still on making more and more money and not on the trip.

And this incident made my belief stronger that earning money is more important than everything and everyone else.

All these circumstances made my mindset that I should also go on the same path, earn a lot of money, keep it in my bank account or invest all of it into some property like land or real estate so that one day I can had over it to my kids.

My belief become more stronger during my college days

In my college days, when I was completing my post-graduation, I always had to hear one common sentence from everyone – “Study hard beta, you should get good scores otherwise you will not get job and will have to spread your hands in-front of others for money”.

I was very afraid of this statement because of my over imagination, I was actually imagining myself begging for money and only started working hard because of this.

I started relating everything with money. I started seeing everything around me though the lens of “money”.

I started realizing on every point of my life, that without money there is no life. If I wanted to live a happy life, we need money.. and it became my behavior that I actually could not live without money. Whenever the money in my wallet was approaching ZERO, I become uncomfortable. I start feeling like “Oh My God.. What should I do.. ?”

I could not see my existance without money. If money is there, I am there. If money is not there, I thought I will not be able to live life.

I started feeling like if money is this much important then how can I ask for it to anyone? Including my parents!

And this feeling increased my hesitation in asking for monthly pocket-money to my parents.

I started feeling so helpless without money. But fortunately, I never had lack of money in my bank account and was satisfied with whatever I had.

How I turned a money minded person?

I was post graduate and still jobless. I had less money compared to my friends. I want to be on par with me. I wanted to have same lifestyle like them.

So getting a high class and well paid job was my dream just like every other youngster.

Now looking at my friends who had already started working and here I am still unemployed was quiet frustrating. I started feeling awkward, while asking for pocket money to my parents and a cycle got started in my mind asking same question repeatedly – “How to earn more and more money?”

One of the funniest moment which happened with me, is when my mother took me to a numerologist, who was suggested by my father’s friend.

That person asked for my details like date of birth, education etc. and then while predicting about my career and personal life he said – “She does not have dreams like a common girl, She is totally a money minded person and wanted to live just for earning money”.

I started smiling and thinking in my mind “Isko kaise pata chala?”

I used to get lots of free advise from people (Our uninvited financial advisers) that money is not everything, dont run after money, money is evil and things like that.

Which made me confused. If money is not everything, then why all these people are running behind it?

When I lost all my pocket money

5th September 2013, it was my first week in college – Modern college, Pune. I was new in Pune at that time and hardly knew anyone. On that day, all students including me were busy in the arrangements for the event of teacher’s day. I placed my bag on one of the bench.

Meanwhile I got a call from my mother. I went out to receive the call and came back to class finishing the conversation very shortly.

After that event and one lecture, I went to a snack center which was on my way to home to buy some food. I realized that my wallet was missing. I called a friend of mine and asked him to take me back to college, because I didn’t even have money for buying a bus ticket or for lunch.

I searched for it a lot, asked all my friends if they had seen it, but I was not able to trace the money. I couldn’t find it back.

I had a bad habit of carrying cash all the time instead of using card.

I lost all my pocket-money of that month and some other important things in one moment. But luckily my cousin was also living in Pune, so he came and helped me in that situation.

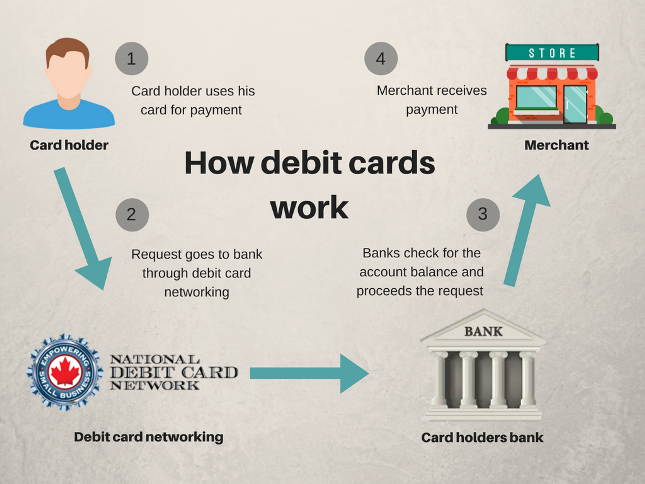

Since then, I used to carry less cash and started using card as much as possible. I learned that I should keep my money in various forms and at different places.

I started earning and my perspective changed towards money

A year after completing my PG, I started earning as a freelancer and I was little bit relaxed as I was not dependent on others for money. But my earning was not much, whatever I earned used to get spent.

Every month, money came in bank account and it just vanished in my expenses. Though, I was happy because of the feeling of independence, but still something was missing.

I wanted to earn more and more money, so that I can save for future.

Then, I joined Jagoinvestor Team

Before I joined Jagoinvestor team, I saw money as something which is to be earned and invested, and not for spending it for enjoying life.

But then my life changed and my perspective about money totally shifted. I came across various dimentions of money.

I used to hear my teammates talking to clients about their investments for their goals. At first I was completely unaware about goal based investing, which is what is practiced at Jagoinvestor (click here to get help from our team). I even created an audio related to goal based investing which you can hear below.

Only after creating that audio, I really understood why linking your money with goals is important and how it gives real meaning to your money and investments.

I had never looked at my money from this point of view.

We started having conversations at tea time and lunch time which made my ideas more clear about money. I started looking at money with a completely new perspective and in a more healthy way..

After that, when I looked at my bank balance it was looking like meaningless money, which was just lying in my account without any purpose, because of which it just got spent here and there without any planning, this this resulted into increasing my monthly expenses.

But now I have understood that the money is to be used for my important goals and has to be spent in a meaningful way.

I decided to give a purpose to that money.

My previous perspective about money have changed and I now realize that money is not just for earning or investing for future, but also to spend it for things we love and desire. Just accumulating money into bank account without any planning is meaningless.

There has to be healthy balance between spending and investing both.

We should keep a part of it for ourselves apart from our routine expenses and savings, so that we can live the life which we dream about.

How money is related with happiness?

Last week Manish Sir, gave me a 30 min video to watch and asked me to watch it till end, as it will give some new ideas around money.

I watched this video from Mr. Nilesh Shah about money, investment and Mutual funds. In that video one statement he made which took my attention was

“Money is not important – Make this statement once you earn enough money to spend your life smoothly”.

I strongly suggest you to watch this 30 min video below.

Happiness does not come just from accumulating more and more money, but how you make use of it. If you think of it logically then you will realize that money has become an inseparable part of our life. We cannot buy happiness directly with money, but still we depend on money at some point to be happy.

Writing, traveling, designing various crafts are the things that I want to do more than anything else. It’s my passion. But if I think of following any of these things, I can’t do that without money. Also, I need to have enough money with me, so that I dont have to worry about my basic needs and desires in life, so that I can find time to do things I love.

In short, money has has its own place and value in our lives.

My current opinion about money

I saw everyone around me just earning and passing on to future generation by compromising on their desires and wishes.

I think thats not the correct way to deal with money. If everyone will pass their own wealth to next generation, then who will use it?

If I earn a lot of money just like my parents did and in future my future generation (my child) also choose to earn his own money then what will happen with my investments or savings?

I now want to save for future, but at the same time, I also want to spend it wisely so that I do not regret fulfilling my hobbies and dreams. If I earn Rs 100, I will use Rs 30 for my basic needs, spend another Rs 30 for my wishes and desires (like travelling, shopping, eating out, entertainment) and save Rs 40 for future, which can be used by me only or can be passed to my children.

How I feel after sharing my story

When I took this post to write on, at first I thought I may not be able to write much on this topic. But once I actually started writing, it became more exciting than I thought about it.

I started realizing, how different I was earlier and what have I became now. Meaning and importance of money has changed completely for me throughout all these years and I didn’t even realize it.

Now when I read this article myself, I feel like I was completely a different person before. All these changes happened because of the experiences in different situations and the environment where we live.

This was my experience about money throughout my life.

What is your money story?

If you want to write your money story, Leave your details here and we will get in touch with you with next actions.

What do you think about my money story? Did you enjoy it? Can you share your views about money and how it changed over the years?

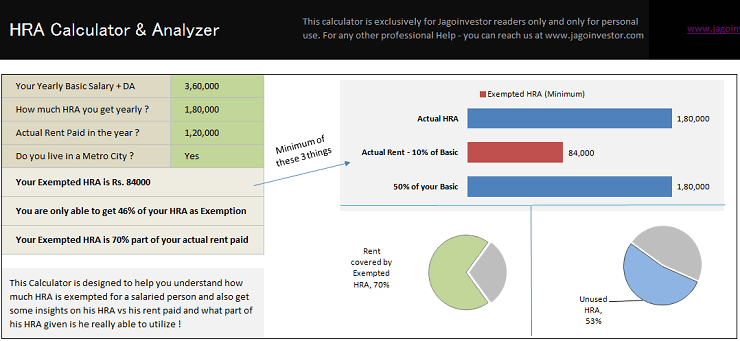

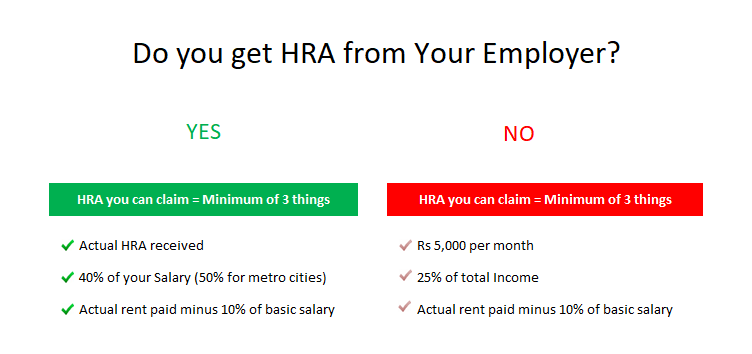

Important points regarding HRA?

Important points regarding HRA?