Today, we’ll talk about Women’s involvement in Personal finance, especially in the Indian context. How many of us remember when our ladies at home took any decisions regarding banking, Insurance or Investments?

Their role has been always limited to household work and as caretakers of our homes & hearths, for decades and centuries now. Even in today’s world, when women are at par or even above par with men in all areas, they fall behind in this one.

Decisions (as far as finances go) are primarily made by men, & not women in general. In this article, we’ll see why it’s important for women, to know about Personal finance .

Women not accepting their Responsibility in Personal Finance

One of the big problems, with women, is that they do not treat Personal Finance as something that’s important for them. For ages, they have not participated in Personal finance, regarding it as the man’s domain, just as they felt cooking was theirs.

Obviously, this isn’t true now, in this day & age. Cooking is as much a guy’s activity as Personal Finance ought to be a woman’s. Women, in general, don’t show real eagerness for these activities, for some reasons like

Women treating their earning as time pass activity : The biggest reason for this, is that, since the dawn of time, Man has been the main provider and the primary bread-winner of the Family .

He was responsible for earning and managing money and taking care of financial goals, Women, on the other hand, were mainly responsible for raising children and taking care of household activities and to a big extent, maintaining relationships outside the house and in the community.

Many women in spite of being qualified enough, and having skills to earn money, view their earning as secondary compared to men. They “feel” that they are not at the same level, even though its not true; most of this is psychological.

Everyone handling her money but her: From centuries women’s financial decisions were taken care of, by their fathers, then their husbands and then their sons. They never got involved & were never encouraged to do so, because they were not considered smart enough!

Men have always shown dominance over women in this space. One reason, which could be responsible for this, is that women, hardly ever ventured outside house for these activities and never got time enough from their household chores.

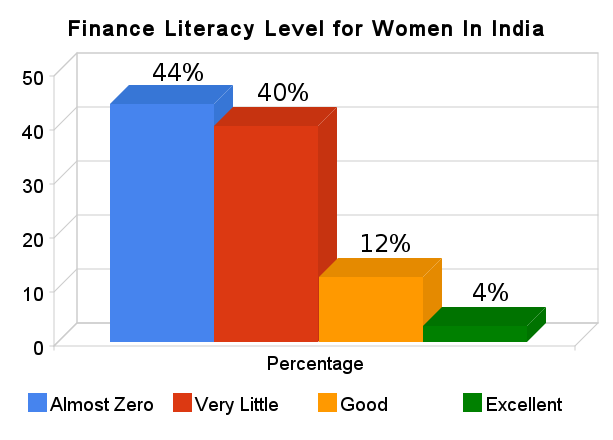

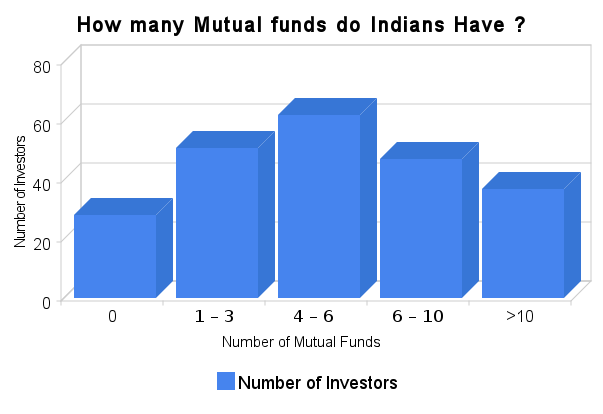

Current Situation Women Knowledge in Personal Finance [ Statistics ]

Why It can be trouble for Women to not Know Personal Finance

Sudden responsibility

A lot of women never learn about Banking , Insurance, Investments , how to grow money well and related topics throughout their lives .

They are smart, have a good job, high earning , but they never learn about Money and some day when sadly, things go wrong eg., they lose their husband because of accident or some other reason; apart from emotional pain, there comes bigger pains in life , i.e. taking care of your children and overall finances, that day she has no idea on how to invest money for making sure of child education , her retirement , her Insurance etc .

She suddenly finds herself in very tough situation and will have to rely on others, (relatives , friends etc.) This is not a good situation. Girls! Ladies! please learn about money, even if you don’t like it… Learn a bit, at least up to a level, where you can take charge of things and no one is able to take advantage of your situation .

More Divorce rates

Gone are the days in India when Women would keep compromising in a relationship! Women these days, are independent, and have a say in every decision. Because of this, they have more flexibility to move out of a marriage, if things don’t work out. Divorce rates are on rise in cities from last decade.

Women who get divorces, have to, at some point in life, look after themselves and take charge of their finances. So learning about money is important from start.

Women live longer so need a better Retirement Planning

Think Long Term! What does’t seem to be important today, might be very important tomorrow. Women worldwide, have a higher life expectancy than men, and hence have to live more than their male counterparts .

Women generally rely on their children, but they should be better planned and hence learn about things .

“On average, Women live 4-5 years longer than their husbands and over three-quarters of all women are widowed at an average age of 56. Women comprise a horrifying 87% of the impoverished elderly”.

Some Psychological Myths Women Face

- Somebody will manage my money for me : Yes, but only up to a certain age… If there is no well-wisher, don’t rely on relatives or friends! When it comes to money, no one is truly yours, and even if they are, you better learn things and manage things on your own. It’s not that tough!

- I don’t know enough to do this myself : This is patently false! If you can be an Engineer, Doctor, House Manager, then you can definitely understand and learn anything you set your mind to! There might be some topics which might scare you away, but there are always blogs like this and people like me to help you with doubts.

- I will make too many mistakes : So what? Everybody does! We make mistakes to learn in life. I would encourage you to make mistakes and learn from them, because, “Making mistakes is a privilege unsuccessful people don’t get in their life” . Computers can never become more intelligent then human beings , because computers never make mistakes, only humans do .

- I don’t have money to invest : There can be two things here… One is that you might not be saving enough. Do review your income and expenses, and find out where can you save without compromising your lifestyle. Try to live with 90% of your salary .The second point is that you have little money which is ok! Doing investments, does not mean you have to invest lots of money; every body starts small, & slowly we progress! So what, if it’s only Rs 500? Make a start, at least! Develop self-discipline and start learning things. Tomorrow, when you have more money, you will already be way ahead of the curve .

- I don’t have time to plan my money : This could be due to lack of interest. Review your monthly schedule and manage your time well. Even if you take out, couple of hours each month, to learn about money, its enough. Once you start learning things, you will enjoy it. If you make yourself believe that you don’t have time today, then you will never have it ever 😉

Women’s Personal Financial Dreams

For time immemorial, women have been dependent on their father or husband for money and to fulfill their dreams. If they want to go for some trip or buy some jewelry or anything else, for that matter, they have to ask (or demand) their husband for money.

Many times women have their own dreams, which they want to fulfill on their own, but they cannot . Women are good savers, but never good investors like men (even men are not for that matter.) Women diligently save money at home, but do not make best use of those savings.

That money is mostly lying idle, in the bank or at home. By learning about investments and how to invest well, women can grow their money and reach their goals. There is no need to always rely on men for everything.

I know many women readers on this blog who are excellent thinkers; they ask questions, get involved in discussions and given a chance, they’d give serious competition to their male counterparts in financial planning!

They have learned lot and can beat many women outside this space on Personal finance. Credit goes to their willingness to learn, and the time they take out in order to learn things . Here is a excellent Short Video from Manish Thakor , Personal Finance Expert for Women .

Even though its made for American Audience , everything applies to India Women .

Extra Benefits for Women

There are many Women only benefits like :

- Generally Lower Education loan by 0.5-1% for Women

- Lower Income tax for Women compared to Men

- Premium for Insurance Policies is lower compared to Men : Compare at Apnainsurance .com

- Lower Stamp Duty for Real Estate Registration in Some States

Role of Women in Personal Finance at Home

There are many men who do not involve ladies at home in the decisions regarding Insurance, investments , retirement planning, banking , budgeting etc , and it’s not a right. Women have better understanding most of the times, about the future goals of the family, especially child education related expenses.

We men, sometimes can not understand, long-term expenses like how our expenses will be at retirement and what kind of situation we would be living in. However smart we feel we are, there are many things that women outsmart us at. We should involve them in every decision we want to take in our life.

So next time when you think about insurance, talk to her about her needs after you are gone. Don’t shy away, feeling that this is taboo in this country. You have to plan things well and understand her needs.

Also while planning for retirement, take her advice and her views on what your standard of living would look like at retirement, what are your (and hers) post retirement plans are. She will give you many suggestions and it will help in planning.

Women are the queens of Budgeting and they are the real help in making the budget and what is needed and what is not . So you can’t do without her. They also save lot of money compared to men. When we men, go out to buy vegetables and if the Vendor tells us Rs 20/KG price, we buy it!

Whereas women, tend to bargain and bring the same stuff at a much lower cost. So whatever we bring for Rs 100 , the same thing Women bring at Rs 90 or Rs 85 .

Respect and Confidence

We men, have to make sure that we encourage our Wife / Mother / Sister / Daughter to learn about money. If they understand money well, your children will also learn about money from early life!

Just imagine how many mistakes you’ve made financially… Your children, will at least not make stupid mistakes, (hopefully) you have been doing all these years before learning better. An educated Woman means an educated Family. We have to make them confident that they can learn things very well, and involve them.

When you learn about something on this blog or anyplace else, try to teach them those lessons. Ask them questions, and see if they can answer them, and if they fail, then guide them gently.

I see a day, when one of the major reasons India will outpace other countries in, is financial literacy among women of this country. Also if women learn about money they can share the financial work of men and also do it themselves. We have to respect our ladies in this field .

There are many great women personalities, like Suze Orman and Monika Halan Personal Finance Space and each of our ladies can get there to that place, at least up to that level.

So if you are a Man and a true Jago Reader, make sure your Wife / Sister / Female friends / Girl Friend read this article and get motivated to learn about Personal finance. If you are a Woman, make sure more and more women friends of yours get to read this article .

Comments , Please suggest other tips to help Women increase their Financial Literacy levels , Any good links , websites for them ?